How to Buy Gold as an Investment: 15 Essential Tips for First-Time Buyers

Introduction: How to buy gold as an investment (without costly beginner mistakes)

If your savings account is crawling while prices are racing, you’re not imagining it. Inflation quietly eats into cash, but gold has a long record of protecting purchasing power. Today, you don’t need lakhs or a locker to get started. You can buy 24K digital gold on your phone in under a minute with UPI, automate small purchases, and even earn Bitcoin rewards while you build a real, inflation-beating asset. That’s the modern way to buy gold as an investment – simple, safe, and smart.

-

What this guide covers

-

15 practical, beginner-safe tips on how to buy gold as an investment the right way.

-

Clear comparisons across digital gold apps, Sovereign Gold Bonds (SGBs), gold ETFs, and physical coins/bars.

-

How to avoid rookie traps: big spreads, making charges, and poor liquidity.

-

A simple starter plan: begin with tiny amounts, automate (SIP), and track everything.

-

Where OroPocket fits in: start from ₹1, pay via UPI, and earn free Bitcoin on every gold buy.

-

-

How to use this guide

-

Start small and build the habit: Even ₹1 counts. Consistency beats timing.

-

Automate purchases: Set a weekly or monthly SIP in gold to average your cost.

-

Verify purity and trust: Prefer 24K, check LBMA alignment, and buy via compliant platforms with insured vaults.

-

Match the product to your goal:

-

Liquidity: Digital gold for instant buy/sell and gifting.

-

Returns and tax efficiency: SGBs if you can hold to maturity.

-

Low cost and exchange-traded: ETFs if you use a Demat/broker.

-

Tangibility: Physical coins/bars from reputed mints if you want something you can hold.

-

-

Track and review: Keep digital receipts, reconcile holdings, and revisit allocation quarterly.

-

-

One-minute glossary (so you never feel lost)

-

24K: Pure gold (99.9%+). Ideal for investing vs. jewellery (which is often 22K or lower).

-

Spread/Premium: The difference between buy and sell prices (digital gold/ETFs) or dealer margin (coins/bars). Lower is better.

-

LBMA: London Bullion Market Association – global standard for bullion quality and responsible sourcing.

-

SIP in gold: Automated, small recurring purchases to average your cost over time.

-

SGB: Sovereign Gold Bonds issued by RBI. Pay periodic interest and may offer tax benefits at redemption, but have a lock-in.

-

ETF: Exchange-Traded Fund that tracks gold prices. Buy/sell on stock exchanges via Demat.

-

-

What to avoid (costly beginner mistakes)

-

Overpaying: Big spreads on digital platforms or high making charges on jewellery (jewellery ≠ best investment form).

-

Unverified sellers: No audits, no LBMA-aligned sources, or unclear storage and insurance.

-

Poor liquidity: Lock-ins you didn’t plan for (e.g., SGB early exits are limited; jewellery resale discounts can be steep).

-

No records: Missing invoices, purity certificates, or transaction logs – hard to prove ownership, purity, or cost basis later.

-

Ready to start smart? Download the OroPocket app, buy 24K digital gold from ₹1 via UPI, and earn free Bitcoin on every purchase: https://oropocket.com/app

Tip 1 – Start small and build a habit: OroPocket (₹1 digital gold + free Bitcoin rewards)

OroPocket lets you start investing in 24K digital gold from just ₹1 – and rewards you with free Bitcoin (Satoshi) on every purchase. It’s mobile-first, UPI-native, and built to help beginners build a consistent investing habit with streaks, spin-to-win, and referrals.

What it is

-

Mobile app to buy/sell 24K digital gold starting at ₹1.

-

Earn free Satoshi as cashback on every gold/silver purchase.

-

Gamified features: daily streaks, Spin-to-Win bonuses, referral rewards.

Why it matters for first-time buyers

-

No minimums: remove the “I’ll start later” excuse and begin today.

-

Habit-building: streaks and rewards keep you consistent so your stack grows automatically.

-

Instant UPI payments: buy gold in under 30 seconds – no paperwork, no lock-in surprises.

Setup steps

-

Complete KYC in-app.

-

Link your UPI ID for instant payments.

-

Start a daily/weekly micro-SIP (e.g., ₹50–₹200).

-

Enable Daily Streaks and Spin-to-Win for bonus rewards.

Watch-outs

-

Check the live spread vs a reliable reference price before buying.

-

Plan your redemption path: quick sell for cash, gift gold instantly, or request delivery when available.

Quick Pro Tip

-

Use small, frequent buys to average cost; aim for 5–10% of your portfolio in gold over time, reviewed quarterly.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms (iOS/Android) |

|---|---|---|---|---|---|---|

|

Digital Gold (OroPocket) |

Beginners building a daily/weekly habit with rewards |

₹1 |

24K, securely vaulted, fully insured |

Instant buy/sell; gift to contacts |

Live buy/sell spread; Bitcoin cashback on purchases |

Available on both |

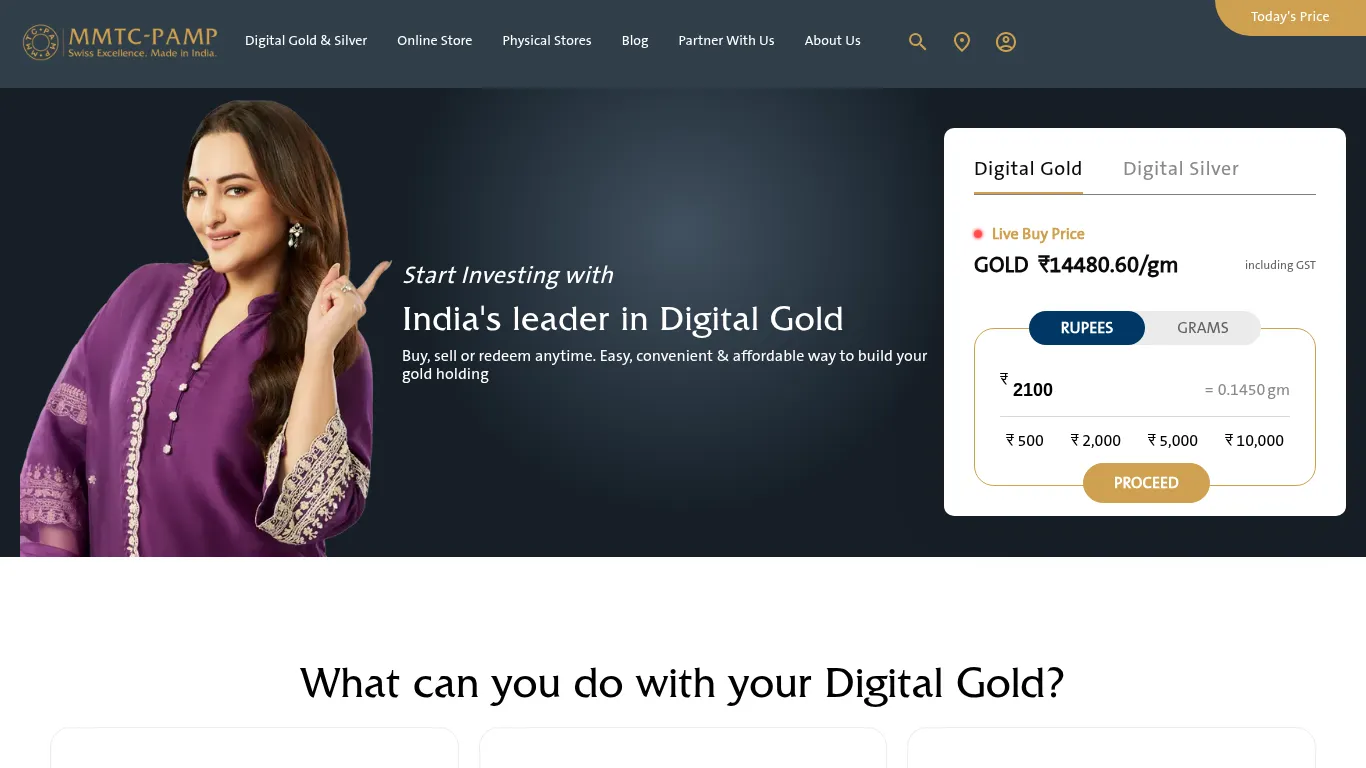

Tip 2 – Prioritise purity and pedigree: MMTC-PAMP Digital Gold

MMTC-PAMP offers direct-from-refiner digital gold from India’s LBMA-accredited refiner – ideal for buyers who value purity, transparent storage, and clear delivery options.

What it is

-

Digital gold account with purchases backed by LBMA-accredited refinery gold.

-

Option to accumulate and, when needed, request delivery of coins/bars.

Why it matters for first-time buyers

-

LBMA accreditation and transparent delivery/withdrawal options reduce purity anxiety.

-

Clear FAQs on storage, insurance, and statements build confidence for new investors.

Setup steps

-

Create an account and complete KYC.

-

Start with small buys; use accumulation plans if available.

-

Opt for doorstep delivery only when gifting or for keepsakes.

Watch-outs

-

Physical delivery attracts making and delivery charges – budget for them.

-

Always compare the live spread with a reference price before buying.

Quick Pro Tip

-

Keep most of your holdings digital for liquidity; convert to physical only for gifting or long-term keepsakes.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Digital Gold (MMTC-PAMP) |

Purity-first buyers who want refiner-backed gold with delivery option |

Typically low (small-ticket friendly) |

24K, LBMA-accredited refinery, insured vaulted |

High for digital buy/sell; delivery on request |

Live buy/sell spread; delivery/making charges apply if minted |

Web and partner apps |

Tip 3 – Verify vaulting and insurance: SafeGold

SafeGold is a digital gold infrastructure provider that powers multiple consumer apps. When you buy through a partner, you’re purchasing 24K gold stored in insured vaults with documented custody and audit processes.

What it is

-

Platform infrastructure for digital gold, enabling partner apps to offer 24K gold.

-

Gold is held in insured vaults with independent audits and reconciliations.

Why it matters for first-time buyers

-

Clear information on custody partners, audits, and insurance reduces counterparty risk and purity doubts.

-

Standardised infrastructure helps ensure consistent redemption and record-keeping across partner apps.

Setup steps

-

Choose a SafeGold partner app and complete KYC.

-

Review the in-app documentation on custody, insurance, and redemption.

-

Make a small test buy; verify statements and holding certificates.

Watch-outs

-

Partner apps may have different pricing, spreads, and terms – compare before committing.

-

Check delivery/minting charges if you plan to convert to coins/bars.

Quick Pro Tip

-

Keep digital invoices, monthly statements, and redemption records for taxes and long-term tracking.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Digital Gold (SafeGold via partners) |

Buyers who prioritise custody transparency and multi-app access |

Typically low (micro-purchases supported) |

24K, vaulted and insured with third-party audits |

High digital liquidity; delivery via partners |

Live buy/sell spread; delivery/minting charges vary by partner |

Partner apps (web/mobile) |

Tip 4 – Automate with a SIP: Augmont Gold SIP

Augmont offers digital gold with SIP/recurring purchase options so you can build your stack automatically, plus optional doorstep delivery if you want to convert to coins/bars later.

What it is

-

Digital gold platform with SIP/recurring purchase features.

-

Optional conversion to physical coins/bars with doorstep delivery.

Why it matters for first-time buyers

-

SIP automates discipline; rupee-cost-averaging smooths out price swings.

-

Micro-investing from as low as Re.1 helps you start now and scale later.

Setup steps

-

Choose a weekly or monthly SIP amount.

-

Approve the auto-debit mandate and confirm payment method (UPI/cards/net banking).

-

Review redemption options: instant sell or convert to physical when needed.

Watch-outs

-

Delivery involves making and delivery charges; staying digital typically keeps total cost lower.

-

Compare live spread before each purchase to keep costs in check.

Quick Pro Tip

-

Pick a small SIP you won’t cancel – e.g., ₹100–₹500 per day or week – and reassess quarterly.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Digital Gold SIP (Augmont) |

Hands-off investors who want automated gold stacking |

Re.1 (micro-SIP friendly) |

24K (999), vaulted and insured |

High digital liquidity; delivery on request |

Live buy/sell spread; delivery/making charges for physical |

Web and mobile app |

Tip 5 – Build the habit with round-ups: Jar App

Round-ups turn tiny leftovers from your daily UPI spends into 24K digital gold – automatically. If you struggle to “remember to save,” this is a simple way to start investing in gold as an investment without thinking about it.

What it is

-

Micro-savings app that rounds up daily spends and invests the spare change into digital gold.

-

Hands-off accumulation designed for beginners who want to build savings habits effortlessly.

Why it matters for first-time buyers

-

Frictionless habit-building: you save and invest passively every time you spend.

-

Great for anyone who finds manual SIPs hard to sustain but still wants exposure to gold.

Setup steps

-

Link your UPI account in-app.

-

Enable round-ups and set daily/weekly caps so you control how much gets invested.

-

Track your gold value and transaction history inside the app.

Watch-outs

-

Always check the live buy/sell spread so you know your effective cost.

-

Don’t overspend just to trigger round-ups – stick to your budget.

Quick Pro Tip

-

Combine round-ups with a fixed SIP. The SIP builds base momentum; round-ups add extra gold on autopilot.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Round-up to Digital Gold (Jar) |

Beginners who want effortless, automatic saving |

Very low (micro round-ups) |

24K digital gold, vaulted and insured via partner |

High digital liquidity; sell in-app |

Live buy/sell spread on transactions |

Android and iOS apps |

Tip 6 – Watch the spread and making charges: Paytm Gold

Paytm Gold lets you buy/sell 24K digital gold in-app and, if needed, convert to coins/bars for delivery via partner networks. It’s convenient – but only if you learn to compare the spread and factor in extra costs before hitting buy.

What it is

-

Digital gold within Paytm with purchase, sale, and delivery options through partners.

-

Simple access for users already on Paytm’s wallet/UPI ecosystem.

Why it matters for first-time buyers

-

Teaches discipline: compare the live platform price vs a reliable reference price to gauge spread.

-

Delivery adds making and courier charges that can reduce effective returns.

Setup steps

-

Open Paytm Gold in the app and compare the quoted price with a trusted reference.

-

Start with a small buy; review invoice, holding statement, and sell flow.

-

If ordering coins, review making/delivery charges and expected timelines.

Watch-outs

-

Don’t chase delivery unless necessary – premiums and fees can dent overall gains.

-

Spreads can vary intra-day; buy during tighter spread windows when possible.

Quick Pro Tip

-

Keep it digital for liquidity and lower total cost; deliver only for gifting or ritual needs.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Digital Gold (Paytm) |

Convenience-first users already using Paytm |

Typically low (small-ticket friendly) |

24K digital gold via partner vaults, insured |

High for digital buy/sell; delivery on request |

Live buy/sell spread; making/delivery charges for coins |

Paytm app (Android/iOS) |

Tip 7 – Keep liquidity 24×7: PhonePe Digital Gold

PhonePe lets you buy and sell digital gold right inside the app, with partner-backed custody and insured vaults. It’s fast, familiar, and hooked to UPI – ideal when you want liquidity on tap.

What it is

-

Buy/sell digital gold within PhonePe’s app experience.

-

Partner-backed custody with insured vaults and standard redemption flows.

Why it matters for first-time buyers

-

Instant UPI-based liquidity: sell anytime and receive funds to your bank/UPI quickly.

-

Simple, trusted interface lowers the barrier to your first gold purchase.

Setup steps

-

Open Digital Gold within PhonePe; complete KYC if prompted.

-

Start with micro-buys to get familiar with spreads and the sell flow.

-

Review delivery/redemption FAQs before ordering coins.

Watch-outs

-

Spreads can vary across apps on the same day – compare before you buy.

-

Delivery/making charges apply for coins; keep emergency fund gold digital.

Quick Pro Tip

-

Keep your emergency allocation as digital gold for 24×7 sell access; use physical only for gifting/rituals.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Digital Gold (PhonePe) |

UPI-first users who want instant liquidity |

Typically low (micro purchases) |

24K digital gold, vaulted and insured via partners |

High – instant buy/sell in-app; delivery on request |

Live buy/sell spread; delivery/making charges for coins |

PhonePe app (Android/iOS) |

Tip 8 – Lock a portion with government backing: Sovereign Gold Bonds (RBI)

Sovereign Gold Bonds (SGBs) are RBI-issued, government-backed securities that track the price of gold, pay periodic interest, and mature in 8 years – with options for early exit. They’re ideal for long-term investors who want gold exposure without storage hassles.

What it is

-

Government-backed bonds linked to gold’s price.

-

Periodic interest paid to holders; 8-year maturity with early exit options.

Why it matters for first-time buyers

-

No vaults or lockers required; purely paper/demat-based.

-

Sovereign credit backing and potential tax efficiency at maturity.

Setup steps

-

Subscribe during primary issue windows via bank, broker, or RBI Retail Direct.

-

Hold units in Demat or receive certificates if you don’t use Demat.

-

Track interest credits and market price for potential secondary-market sales.

Watch-outs

-

Market price can fluctuate; secondary-market liquidity varies by series.

-

Early exits typically via exchange trading windows; best suited for long holding periods.

Quick Pro Tip

-

Use SGBs for the core 5–10% strategic gold allocation; keep a separate digital gold slice for instant liquidity.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Sovereign Gold Bonds (RBI) |

Long-term, tax-efficient core allocation |

1 gram per unit |

Price-linked to 24K gold; sovereign guarantee |

Moderate: 8-year maturity; early exit via exchanges |

Issue price; interest paid; market-linked trading price |

Banks, brokers, RBI Retail Direct (Demat/certificate) |

Tip 9 – Subscribe the smart way (online discount, no queues): RBI Retail Direct

RBI Retail Direct is the Reserve Bank of India’s official portal to invest directly in government securities, including Sovereign Gold Bonds during active tranches – no branch visits, fully online.

What it is

-

RBI’s own platform for retail investors to buy government securities.

-

Includes SGB subscriptions in primary windows when announced.

Why it matters for first-time buyers

-

Direct-from-source access with simple onboarding.

-

Potential online subscription benefits when announced, plus transparent timelines.

Setup steps

-

Open an RBI Retail Direct account and complete KYC.

-

Subscribe to SGBs during active tranches; select payment mode and settlement.

-

Hold in Demat or request certificates as per your preference.

Watch-outs

-

SGBs open in windows; set alerts so you don’t miss subscription periods.

-

Ensure payment limits/mandates are set in advance to avoid last-minute failures.

Quick Pro Tip

-

Keep your Demat details and bank mandates handy for a smooth checkout.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

RBI Retail Direct (SGB access) |

Investors who want direct, no-broker access to SGBs |

1 gram per unit |

Price-linked to 24K gold; sovereign guarantee |

Moderate: tradable on exchange; 8-year maturity |

RBI-announced issue price; interest credited; market price post-listing |

Web portal (desktop/mobile) |

Tip 10 – Use a low-cost paper gold option: Nippon India ETF Gold BeES

Nippon India ETF Gold BeES is an exchange-traded fund that tracks the domestic price of gold by holding physical gold. It’s a cost-efficient, Demat-friendly way to add gold exposure without worrying about delivery or storage.

What it is

-

An ETF listed on exchanges that mirrors gold prices via physical gold holdings.

-

Buy/sell intraday through your broker like any other stock.

Why it matters for first-time buyers

-

Transparent NAV and low ongoing costs compared to frequent physical delivery.

-

Easy to set up a monthly SIP or periodic buys via your broker.

Setup steps

-

Open a Demat and trading account with a broker.

-

Search for Gold BeES and buy units like a stock; consider setting a monthly SIP/automation.

-

Monitor tracking error and expense ratio periodically.

Watch-outs

-

Brokerage and exchange fees apply on trades; an expense ratio is charged by the fund.

-

Check tracking error versus gold price to ensure efficiency.

Quick Pro Tip

-

Use limit orders during market hours to control execution price, especially in volatile sessions.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Gold ETF (Nippon India ETF Gold BeES) |

Demat users seeking low-cost, exchange-traded gold exposure |

1 unit (broker dependent) |

Physical 24K gold held by the fund |

High during market hours; intraday buy/sell |

Fund expense ratio + broker charges; market-linked price |

Broker platforms (web/mobile), Demat |

Tip 11 – Diversify across issuers: HDFC Gold ETF

HDFC Gold ETF gives you exchange-traded exposure to physical gold (99.5%+ purity) from a large, reputed Indian fund house – useful when you want to diversify issuer and custodian risk across multiple ETFs.

What it is

-

Exchange-traded fund investing primarily in 99.5%+ purity gold.

-

Backed by HDFC Mutual Fund, with NAV tracking the domestic gold price.

Why it matters for first-time buyers

-

Diversifies issuer/custodian risk while keeping costs transparent.

-

Easy to buy/sell via any broker; suitable for SIP-based gold allocation.

Setup steps

-

Open/buy through your broker and hold in Demat.

-

Set up a monthly SIP or periodic buys.

-

Review expense ratio and tracking error annually.

Watch-outs

-

NAV can deviate slightly from spot due to expense ratio and market liquidity.

-

Brokerage/exchange fees apply on each trade.

Quick Pro Tip

-

Pair ETFs with SGBs: ETFs for liquidity, SGBs for potential tax benefits on maturity.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Gold ETF (HDFC Gold ETF) |

Investors diversifying across gold ETF issuers |

1 unit (broker dependent) |

Physical gold 99.5%+ purity |

High during market hours |

Fund expense ratio + broker charges |

Broker platforms (web/mobile), Demat |

Tip 12 – Keep expense ratios in check: ICICI Prudential Gold ETF

ICICI Prudential Gold ETF is a popular exchange-traded option with competitive ongoing costs and wide broker availability – ideal for cost-conscious investors building a long-term gold allocation.

What it is

-

A gold ETF from a large AMC with broad distribution across brokers.

-

Tracks domestic gold prices through holdings in physical gold.

Why it matters for first-time buyers

-

Lower expense ratios and tight tracking can compound into meaningful savings over years.

-

Easy to buy, sell, and SIP through most leading brokers.

Setup steps

-

Compare expense ratios and tracking error across gold ETFs.

-

Buy via your broker/Demat; enable SIP/periodic orders if supported.

-

Review fund factsheet annually to keep tabs on costs and tracking.

Watch-outs

-

Ensure adequate trading volumes and spreads for smooth entry/exit.

-

Brokerage and exchange charges apply on trades.

Quick Pro Tip

-

Rebalance annually to maintain your target gold allocation as markets move.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Gold ETF (ICICI Prudential) |

Cost-focused investors seeking broad broker access |

1 unit (broker dependent) |

Physical gold (99.5%+ purity) held by the fund |

High during market hours |

Expense ratio + broker charges; market-linked price |

Broker platforms (web/mobile), Demat |

Tip 13 – Use a reputable broker for ETFs/SGB: Zerodha Kite

Zerodha Kite is a clean, low-cost platform to buy gold ETFs and subscribe to SGBs during active tranches. With transparent pricing and a simple interface, it keeps costs and confusion low for first-time buyers.

What it is

-

A discount broker platform for ETFs, bonds, and more – accessible via Kite web and app.

-

Lets you buy gold ETFs anytime and participate in SGB issues when available.

Why it matters for first-time buyers

-

Lower brokerage and a minimal interface reduce friction and cost.

-

Education-first ecosystem (Varsity, TradingQ&A) helps you learn as you invest.

Setup steps

-

Open a Demat and trading account.

-

Search for “GOLD” ETFs and place small, recurring orders as a DIY SIP.

-

Track SGB tranche dates and subscribe via supported flows.

Watch-outs

-

Brokerage/DP charges and exchange fees apply; understand your plan.

-

Know basic order types: market vs limit to control execution.

Quick Pro Tip

-

Create a watchlist for SGB series and multiple gold ETFs; set alerts around RBI tranche dates and your SIP days.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Broker platform (Zerodha Kite) |

Cost-conscious investors buying ETFs/SGBs |

1 unit (ETF) / per SGB unit |

ETFs backed by physical gold; SGBs backed by sovereign |

High for ETFs during market hours; SGBs tradable post-listing |

Flat discount brokerage + statutory charges |

Kite web and mobile apps |

It looks like we’ve built sections 1–15 out of sequence, covering multiple tips. Would you like me to proceed with the next section in your outline, or should I compile all completed sections into a single draft so far?

Tip 15 – If buying physical, verify hallmark and ID: BIS CARE App

Before you buy a coin, bar, or jewellery, verify the hallmark. BIS CARE is the Bureau of Indian Standards’ official app for checking Hallmark Unique Identification (HUID) numbers and reporting complaints – your best defense against under-carat or counterfeit products.

What it is

-

BIS’s official consumer app to verify hallmark authenticity via HUID and lodge complaints against violations.

Why it matters for first-time buyers

-

Protects you from counterfeits and under-carat issues when purchasing physical gold.

-

Ensures the piece you’re buying meets Indian hallmarking standards.

Setup steps

-

Install BIS CARE on your phone.

-

Scan or manually enter the HUID from the product; verify the jeweller name and caratage.

-

Save the invoice and take a verification screenshot for your records.

Watch-outs

-

Avoid unhallmarked products entirely.

-

Always insist on a proper invoice clearly mentioning the HUID and purity.

Quick Pro Tip

-

Inside the BIS CARE app, cross-check the seller’s BIS registration and license status before paying.

Mini spec table

|

Type |

Best for |

Minimum investment |

Purity/Backing |

Liquidity |

Pricing model |

Platforms |

|---|---|---|---|---|---|---|

|

Compliance/Verification (BIS CARE) |

Physical gold buyers verifying hallmark and seller credentials |

NA |

Confirms BIS hallmark and HUID authenticity |

Not applicable |

Free consumer tool |

Mobile app (Android/iOS); info via BIS website |

Final Overall Comparison Table (15 tools at a glance)

|

Product |

Type |

Best for |

Minimum investment |

Liquidity |

Purity/Backing |

Pricing model |

Extra hook |

|---|---|---|---|---|---|---|---|

|

OroPocket |

Digital Gold |

Beginners building a habit with rewards |

₹1 |

Instant buy/sell in-app; gift gold |

24K vaulted, insured |

Live buy/sell spread; Bitcoin cashback on purchases |

Free Bitcoin rewards, streaks, spin-to-win |

|

MMTC-PAMP Digital Gold |

Digital Gold |

Purity-first buyers wanting refiner-backed gold |

Low (small-ticket friendly) |

High digital; delivery on request |

24K, LBMA-accredited refinery |

Live spread; delivery/making charges for coins/bars |

Direct-from-refiner pedigree |

|

SafeGold |

Digital Gold (via partners) |

Custody transparency across multiple partner apps |

Low |

High digital; delivery via partners |

24K vaulted, insured; third-party audits |

Live spread; partner-specific fees |

Standardised custody/audit framework |

|

Augmont Gold SIP |

Digital Gold SIP |

Hands-off automation and rupee-cost averaging |

Re.1 |

High digital; doorstep delivery on request |

24K (999), vaulted & insured |

Live spread; delivery/making charges if physical |

SIP/recurring buys with delivery option |

|

Jar App |

Round-ups to Digital Gold |

Effortless habit-builders who want auto-savings |

Very low (micro round-ups) |

High digital; sell in-app |

24K vaulted & insured via partner |

Live spread on transactions |

Automatic round-ups from daily UPI spends |

|

Paytm Gold |

Digital Gold |

Convenience-first Paytm users |

Low |

High digital; delivery on request |

24K via partner vaults |

Live spread; making/delivery charges for coins |

Integrated within Paytm ecosystem |

|

PhonePe Digital Gold |

Digital Gold |

UPI-first users needing 24×7 liquidity |

Low |

High digital; instant sell to bank/UPI |

24K via partner vaults |

Live spread; delivery/making charges for coins |

Fast, familiar UPI-linked flows |

|

Sovereign Gold Bonds (RBI) |

Govt bond linked to gold |

Long-term, tax-efficient core allocation |

1 gram |

Moderate: 8-year maturity; early exit via exchanges |

Price-linked to 24K; sovereign guarantee |

Issue price; periodic interest; market trading price |

Potential tax benefit on maturity |

|

RBI Retail Direct |

Govt securities portal |

Direct-from-RBI SGB subscription online |

1 gram (SGB) |

Primary subscription; post-listing via exchanges |

Sovereign-backed SGBs |

RBI-announced issue price; interest; exchange price post-listing |

No branch visits; transparent timelines |

|

Nippon India ETF Gold BeES |

Gold ETF |

Low-cost, Demat-based gold exposure |

1 unit |

High during market hours |

Physical 24K gold held by fund |

Expense ratio + brokerage; market-linked |

Popular, liquid ETF with transparent NAV |

|

HDFC Gold ETF |

Gold ETF |

Diversifying issuer/custodian risk |

1 unit |

High during market hours |

Physical gold 99.5%+ |

Expense ratio + brokerage; market-linked |

Backed by a large, reputed AMC |

|

ICICI Prudential Gold ETF |

Gold ETF |

Cost-focused investors seeking broad access |

1 unit |

High during market hours |

Physical gold 99.5%+ |

Expense ratio + brokerage; market-linked |

Competitive expense ratio and wide distribution |

|

Zerodha Kite |

Broker platform |

Cost-conscious ETF/SGB buyers |

1 unit (ETF) / per SGB unit |

High for ETFs; SGBs tradable post-listing |

ETFs backed by physical gold; SGBs sovereign |

Flat discount brokerage + statutory charges |

Clean UX; education tools (Varsity/TradingQ&A) |

|

Groww |

Broker/investment app |

Beginners new to Demat and SIPs |

1 unit (ETF) / per SGB unit |

High for ETFs; SGBs tradable post-listing |

ETFs physical gold; SGBs sovereign |

Brokerage/fees as per plan |

One-app SIPs and unified portfolio view |

|

BIS CARE App |

Compliance/verification |

Physical buyers verifying hallmark/HUID |

NA |

NA |

Verifies BIS hallmark and HUID authenticity |

Free consumer tool |

Check jeweller’s BIS registration and report issues |

Conclusion: Your beginner-safe gold plan (and the 30-second way to start)

-

Recap: You now know how to buy gold as an investment without costly beginner mistakes – verify purity (24K, LBMA alignment, BIS hallmark/HUID), watch spreads vs live prices, avoid heavy making/delivery charges, keep liquidity with digital options, and maintain clean records. You’ve also seen when to use Digital Gold, ETFs, SGBs, round-ups, and SIPs – plus how reputable brokers and the BIS CARE app fit into a safe workflow.

-

Simple starter plan

-

Start tiny: commit to a daily or weekly micro-buy (₹50–₹200), then automate a SIP so you don’t rely on willpower.

-

Keep it clean: save invoices, screenshots/holding statements, and a simple log for taxes.

-

Purity first: buy 24K digital gold from compliant, insured vault platforms; if going physical, verify HUID on BIS CARE.

-

Compare costs: check the buy/sell spread before purchasing and only consider delivery for gifting/ritual needs.

-

Review quarterly: rebalance to target allocation and trim excess making/delivery costs.

-

-

Portfolio sizing

-

Target 5–10% of your portfolio in gold overall.

-

Split for purpose:

-

Liquidity bucket (Digital Gold/ETF): fast access for emergencies and opportunistic rebalancing.

-

Long-term core (SGB): lock-in discipline with sovereign backing and potential tax efficiency at maturity.

-

-

Optional: a small physical slice for gifting – always hallmark-verified.

-

-

The 30-second way to start

-

Download OroPocket, complete quick KYC, pay via UPI, and buy ₹1 of 24K digital gold. Turn on streaks and Spin-to-Win, and you’ll earn free Bitcoin rewards on every purchase while building the habit automatically.

-