How to Buy Gold from Banks in India: Pros, Cons, and Hidden Costs

Bank Gold in India 101: What You Really Buy (and Why)

Bank gold sounds simple: walk into a bank, buy a coin, done. But what you’re actually buying – and why it costs what it costs – matters if you care about purity, resale, and overall returns.

“India was the world’s second-largest gold consumer in 2024, with investment demand at 239.4 tonnes (+29% YoY).” – Source

What “bank gold” actually means today

- Most banks don’t mint their own coins; they sell branded 24K (999/995) coins/biscuits via authorized bullion partners at select branches.

- Denominations are limited and standardized: 1g, 2g, 5g, 8g, 10g, 20g, 50g, 100g.

- Availability is patchy. Not all branches/regions carry stock; festive periods (Dhanteras/Diwali/Akshaya Tritiya) see higher availability – but also higher footfall and, often, higher premiums.

- Expect tamper-proof packaging, purity certificates, and clean provenance – this is the main reason people gravitate to bank counters.

Bank gold vs jeweller vs online platforms at a glance

- Purity and packaging: Banks and top jewellers both offer 24K with hallmarking/tamper-proof packs. Online platforms selling coins via reputed refiners also meet 999/995 standards.

- Price competitiveness: Banks typically charge higher premiums over live market rates versus reputed jewellers or online platforms. You pay for the “bank trust” plus brand packaging.

- Liquidity and buyback: Banks usually do not buy back coins. For resale, you’ll rely on jewellers/bullion dealers, who may deduct for melting/testing. Well-known jewellers and online marketplaces often offer clearer buyback routes.

- Expectation vs reality: Many buyers assume “bank = best price.” In reality, you’re paying extra for perceived security and branding, not necessarily for better resale outcomes.

Search intent match: how to buy gold from bank in India

If you’re figuring out how to buy gold from bank counters (how to buy gold from a bank / how to purchase gold from bank), check these before you step in:

- Availability: Call the branch to confirm if they stock coins/biscuits, the denominations available today, and if you need to pre-book during peak seasons.

- Purity: Ask for 24K 999/995 purity, hallmarking details, and tamper-proof packaging with serial number/certificate.

- Denominations and packaging: Confirm the exact weights (1g to 100g) and any packaging differences that influence price.

- Final price breakdown: Request the all-in price per gram, including GST (3%), packaging/handling premiums, and any branch-specific charges. Compare with jewellers and online platforms the same day.

- Payment and KYC: Check accepted modes (UPI/card/NEFT/cash limits) and what KYC is needed (PAN for higher-value purchases).

- Buyback/resale: Clarify the bank’s policy – most banks won’t repurchase coins. Understand where you’ll sell later (jeweller/bullion dealer) and expected deductions for purity testing/melting.

Set the right expectations on after-sales:

- After-sales support from banks is limited to purchase documentation. Resale support is typically not provided.

- For liquidity, plan your exit route upfront – know which jeweller/dealer will buy and at what deduction.

Prefer transparent pricing, instant liquidity, and zero store visits? Buy 24K digital gold starting at ₹1 on OroPocket – and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

How to Buy Gold from a Bank in India (Step-by-Step)

Buying gold from a bank feels trustworthy – but to avoid overpaying and to keep resale simple, follow these steps. They’ll help you compare prices, check purity, and set clear expectations on buyback.

Step 1: Confirm availability and purity

- Call the branch or check the bank’s website to confirm if they currently sell gold coins/biscuits and which sizes are in stock.

- Ask purity upfront: 24K 999 vs 995. Verify hallmarking, refiner/brand, and that an assay certificate or sealed pack is provided.

Step 2: Compare prices before you pay

- Understand the live market rate vs the bank’s selling price. Banks typically add a premium (minting/packaging/brand) plus 3% GST.

- Shortlist 2–3 quotes (banks, reputed jewellers, and online platforms) on the same day to benchmark your all-in cost.

Step 3: Documentation and payment

- PAN may be required above certain thresholds; cash limits apply by law. Most branches accept UPI/card/NEFT.

- Ask for a tax invoice with a clear breakdown: purity, weight, per-gram rate, premium, and GST.

Step 4: Inspect packaging and certificate

- Check tamper-proof packaging, a unique serial/HUID, brand/refiner stamp, weight, fineness (999/995), and assay details.

- Keep both the invoice and the certificate intact for future resale; avoid opening the pack.

Step 5: Storage and insurance

- Home safe: immediate access, but ensure a sturdy safe and consider insurance.

- Bank locker: recurring annual cost and access during banking hours; useful for larger values.

Step 6: Exit strategy

- Banks typically do not repurchase coins. Plan resale with a reputed jeweller or bullion dealer and ask about testing/melting deductions in advance.

“State Bank of India does not offer a buyback facility for gold coins sold by the bank.” – Source

Popular Indian banks’ gold offerings (at a glance)

| Bank | Purity (24K 999/995) | Common denominations | Indicative premium range (qualitative) | Buyback policy | Where to purchase | Notes |

|---|---|---|---|---|---|---|

| State Bank of India (SBI) | 999/995 | 2g, 5g, 8g, 10g, 20g, 50g | Medium–High | No | Select branches/authorized partners | Festive availability spikes; confirm stock |

| HDFC Bank | 999/995 | 1g, 5g, 10g, 20g, 50g | Medium–High | No | Select branches/authorized partners | Check current denominations and pricing |

| ICICI Bank | 999/995 | 2g, 5g, 8g, 10g, 20g, 50g | Medium–High | No | Select branches/authorized partners | Ask for assay card and sealed pack |

| Axis Bank | 999/995 | 5g, 10g, 20g, 50g | Medium–High | No | Select branches/authorized partners | Policies vary by branch; call ahead |

| Kotak Mahindra Bank | 999/995 | 5g, 10g, 20g, 50g, 100g | Medium–High | No | Select branches/authorized partners | Festive-only availability in many locations |

| Punjab National Bank (PNB) | 999/995 | 2g, 5g, 8g, 10g, 20g | Medium–High | No | Select branches/authorized partners | Confirm purity and denominations before visit |

Pro tip: Before you purchase, compare the bank’s all-in price with a reputed jeweller and a trusted online platform on the same day. Many buyers discover banks charge the highest premiums for the same purity and packaging.

Want lower minimums, transparent pricing, and instant liquidity with zero store visits? Buy 24K digital gold from just ₹1 and earn free Bitcoin on every purchase with OroPocket. Download the app: https://oropocket.com/app

Pros and Cons of Buying Gold from Banks

Advantages

- Brand trust and perceived safety

- Purity assurance (24K, tamper-proof, assay certificate)

- Ideal for gifting and ceremonial buys

- Transparent invoicing; no jewellery-style making charges

Disadvantages

- Higher premiums vs jewellers/online quotes

- No buyback from banks; liquidity depends on third parties

- Limited denominations and stock

- Potentially slower checkout vs app-based purchases

- Storage costs shift to you (locker/home safe)

Key takeaway for first-time buyers

- Bank gold works for trust and gifting; investors must weigh costs and resale

Hidden Costs and Gotchas (Premiums, GST, Storage, Resale)

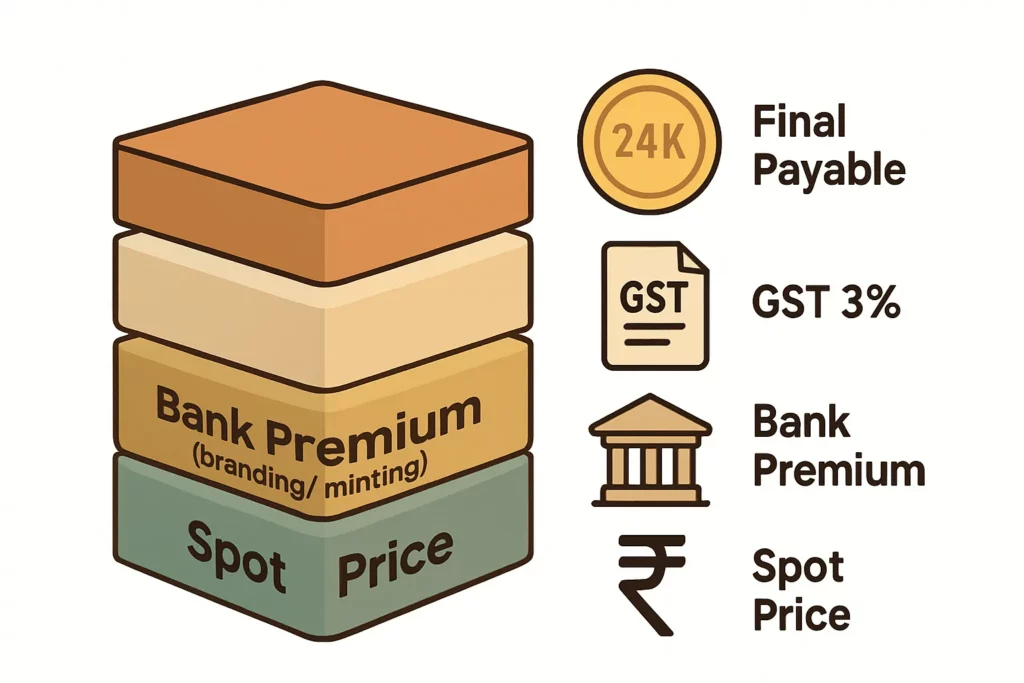

When you buy gold from a bank, you’re paying for purity, branding, and peace of mind. Here’s the full cost stack so you don’t overpay – and so you can benchmark banks vs jewellers vs apps with clarity.

1) Premiums over spot

- Why banks charge more: minting, sealed/tamper-proof packaging, brand markup, logistics, and branch handling.

- How to benchmark: check the live market rate per gram (24K) and compare the bank’s per-gram selling price. The gap = premium. Cross-check with two quotes: a reputed jeweller and a trusted online platform, same day.

2) 3% GST on gold

- GST is charged on the invoice value of gold purchases. If the bank bundles premium into the coin price, GST applies on the full amount.”GST on gold in India is 3%.” – Source

3) Packaging/assay and delivery fees (where applicable)

- Many banks include packaging and assay in the premium; some itemize handling separately.

- If you opt for doorstep delivery (rare for bank coins), expect delivery/logistics fees.

4) Storage costs

- Bank locker: annual fee + access limited to banking hours.

- Home safe: one-time purchase + recommended insurance; recurring premium depends on coverage.

5) Resale realities

- Banks typically do not buy back coins. You’ll sell to jewellers or bullion dealers – expect deductions for testing/melting and a margin off the spot rate.

- Keep the coin sealed, with the invoice and assay card intact to reduce deductions.

Worked example: 10g coin cost stack (illustrative)

- Assumption: live gold = ₹6,600 per gram → ₹66,000 for 10g

| Line item | Amount (₹) |

|---|---|

| Live gold value (10g x ₹6,600) | 66,000 |

| Bank premium (illustrative 5%) | 3,300 |

| Subtotal | 69,300 |

| GST @3% (on subtotal) | 2,079 |

| Final payable | 71,379 |

Notes:

- Effective cost per gram = ₹71,379 / 10g = ₹7,137.90 (≈8.2% above spot in this example).

- Your actual premium may be higher/lower. Always compare bank vs jeweller vs trusted app quotes on the same day.

Want transparent pricing, zero store visits, and instant liquidity? Buy 24K digital gold from ₹1 on OroPocket – and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

Bank Gold vs Digital Gold vs SGB vs Gold ETF: Which One Should You Choose?

Decision criteria

- Goal: gifting/ceremonial vs investing/wealth-building

- Time horizon: days–months (short) vs years (long)

- Liquidity: need instant exit vs okay with trading hours/lock-ins

- Budget size: ₹1–₹5,000 micro-buys vs lumpsum

- Pricing sensitivity: okay paying premiums vs want tight spreads

- Taxation: understand CGT, indexation, and exemptions

Quick comparisons

- Liquidity

- Bank coin: resale via jewellers/bullion dealers; banks typically don’t buy back

- Digital gold: instant sell in-app, 24/7 at live rates

- Gold ETF: exchange liquidity during market hours; depends on fund liquidity/spreads

- SGB: exit on exchange post lock-in; early redemption windows from year 5; full redemption at maturity

- Costs

- Bank coin: higher premiums + 3% GST

- Digital gold: small spreads; 3% GST on buys

- Gold ETF: brokerage + expense ratio; no GST on units; STT may apply as per exchange norms

- SGB: no GST on purchase; priced near market; no annual expense; may face brokerage if bought on exchange

- Storage

- Bank coin: physical custody (locker/home)

- Digital gold: vaulted and insured by partners

- Gold ETF: demat custody via DP

- SGB: held in demat or certificate form (RBI-issued)

- Tax

- Physical/digital gold: CGT – short term as per slab; long term 20% with indexation (as per prevailing rules)

- SGB: capital gains on redemption at maturity are tax-exempt; 2.5% annual interest taxable

- Gold ETF: capital gains taxation similar to other mutual fund units per prevailing tax laws

Suggested use-cases

- Bank coin: perfect for gifting/ceremonies where brand packaging and perceived trust matter more than price efficiency.

- Digital gold: best for small-ticket, instant, goal-based micro-investing with UPI convenience and 24/7 liquidity.

- SGB: ideal for long-term holders who want sovereign backing, periodic interest, and tax-exempt maturity gains.

- Gold ETF: suited to market-linked exposure in portfolios, SIPs via demat, and investors comfortable with exchange trading.

Prefer the modern route? Build gold savings from just ₹1, sell instantly any time, and earn free Bitcoin on every purchase with OroPocket. Download the app: https://oropocket.com/app

Purity, Hallmarking, and Authenticity Checks

Buying a coin/biscuit from a bank or anywhere else? A two-minute purity check saves you money at resale. Here’s exactly what to verify so you don’t get short-changed later – whether you buy gold from bank counters or plan to go digital.

What to look for on the coin/biscuit

- Purity: 24K with fineness clearly marked as 999 (99.9%) or 995 (99.5%).

- Weight: Stated in grams (e.g., 1g/5g/10g/20g/50g/100g). Ensure the printed weight matches the invoice and any assay card.

- Refiner/brand: Look for a reputed, authorized refiner stamp (e.g., MMTC-PAMP/Augmont/SafeGold partner). Prefer LBMA Good Delivery–accredited refiners where available.

- Serial number/HUID: A unique number laser-marked on the piece or on the packaging; it must match the certificate/pack details.

- Assay/certificate: Tamper-evident assay card or certificate with fineness, weight, refiner, and serial number.

BIS hallmarking basics

- What hallmarking does: Confirms the purity/fineness inspected by a BIS-recognized Assaying & Hallmarking Centre.

- Where you’ll see it: On jewellery, hallmarking with HUID is the norm. Many coins/biscuits also carry BIS hallmarking and/or a refiner assay card. If BIS hallmark is present, you’ll typically see:

- BIS logo

- Purity/fineness (e.g., 999 or 995)

- HUID (Hallmark Unique Identification) laser-marked code

- Identifiers for the jeweller/refiner and A&H centre (where applicable)

- 995 vs 999: 999 = 99.9% pure, 995 = 99.5% pure. The difference is small, but 999 may fetch marginally better acceptability with some dealers due to higher fineness and reduced testing doubts.

Pro tip: If a BIS HUID is present, use the BIS Care app to verify the hallmark details instantly.

Packaging hygiene

- Accept only sealed, tamper-proof packs (assay cards). Check for scratches, tears, fogging, or reseal attempts.

- Match all serial numbers: coin/biscuit, pack, and certificate must align.

- Keep the invoice safe and legible (shows purity, weight, price, GST). Store the pack in a protective sleeve to avoid scratches on the seal.

If you plan to resell later

- Keep the pack intact. Once opened or damaged, most buyers treat the coin like open bullion and may:

- Levy assay/testing charges (XRF/fire assay)

- Deduct a higher margin off spot

- Carry the original invoice and certificate. Popular refiner brands and 999 fineness often see smoother buy quotes.

Want to skip the packaging and resale uncertainty altogether? Buy 24K vaulted digital gold from just ₹1 on OroPocket, sell instantly when you need to, and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

Documentation, Limits, and Taxes You Should Know

Buying gold from a bank is straightforward – until you hit thresholds, cash limits, or tax rules. Here’s what to know so you don’t run into compliance or tax surprises later.

KYC and payment norms

- PAN requirement: Quoting PAN is mandatory for purchase/sale of goods/services exceeding ₹2 lakh per transaction (Rule 114B). See official rule: https://incometaxindia.gov.in/Rules/Income-Tax%20Rules/103120000000007197.htm

- Payment modes: Most branches accept UPI/card/NEFT; confirm before visiting to buy gold from bank.

- Cash restrictions: Avoid large cash. Section 269ST restricts receiving ₹2 lakh or more in cash in a day/single transaction/one event from one person – penalty equals the amount received.

“Section 269ST prohibits receipt of ₹2 lakh or more in cash (per day, per transaction, or per event from a person); violations attract a penalty equal to the amount received.” – Source

Taxation on sale

- Physical/digital gold: Short-term capital gains (STCG) if held ≤36 months and taxed at your slab; long-term capital gains (LTCG) if held >36 months, typically at 20% with indexation (as per prevailing rules). Keep your invoice to establish cost basis.

- Cost basis records: Preserve purchase invoice, refiner/serial details, and any fees (making/premium) that form part of acquisition cost.

SGB tax angle (for comparison)

- Interest: 2.5% p.a. (taxable as income).

- Maturity: Capital gains on redemption at maturity are exempt (per RBI/SGB scheme rules). Early sales on exchange are taxable per holding period.

Practical checklist

- Always collect a tax invoice with purity, weight, rate, premium, and GST.

- Record serial numbers/HUID and refiner/brand for audit/resale clarity.

- Plan storage (locker vs home safe with insurance) and document where bills/certificates are stored.

- Track your cost basis and holding period for future tax filing.

Prefer a paperless, low-friction route with instant liquidity? Start with ₹1 on OroPocket, buy/sell 24K gold in seconds via UPI, and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

When Buying from Banks Makes Sense – And When It Doesn’t

Not all gold buys are equal. Here’s when purchasing gold from a bank works – and when you’re better off choosing digital or market-linked options.

Good fit

- Cultural gifting where brand trust and presentation matter

- Tamper-proof packs, reputed refinery branding, and clean invoices make bank coins ideal for weddings, Dhanteras, housewarmings, and corporate gifts.

- One-time ceremonial purchases where premium is acceptable

- If you’re buying a single 5g/10g coin and value the “bank seal of trust” over price efficiency, paying a higher premium can be fine.

Not ideal

- Price-sensitive investors seeking low spreads and easy liquidity

- Banks tend to price coins above live market with premiums; resale is typically through jewellers/bullion dealers with deductions.

- Frequent accumulators (SIPs) and small-ticket buyers

- For regular investing (₹1–₹2,000 at a time), branch visits, stock uncertainty, and higher premiums reduce compounding efficiency.

What savvy buyers do

- Compare final-to-final price with jewellers and digital platforms

- Don’t compare just “spot rate.” Compare the all-in per-gram price including premium and GST across 2–3 sources on the same day.

- Plan exit before you enter (who will buy back, at what deduction)

- Assume banks won’t buy back. Call a jeweller/bullion dealer to confirm testing charges and margin deductions. Keep coin sealed and invoice intact.

Want low spreads, instant liquidity, and the flexibility to start with ₹1? Buy 24K digital gold on OroPocket – and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

A Smarter Alternative: Buy 24K Gold from ₹1 on OroPocket (+ Free Bitcoin Rewards)

Why OroPocket beats bank gold for investing

- Start from ₹1; instant UPI checkout

- Tiered Bitcoin (Satoshi) cashback on every gold/silver purchase

- Gamified habits: daily streaks, spin-to-win, referral rewards

- 24K pure gold, 100% insured vaults; RBI-compliant partners

How it works (30 seconds)

- Download the app (iOS/Android), complete quick KYC

- Enter ₹ or grams, pay via UPI

- Earn instant Bitcoin rewards; track holdings in real time

- Send/gift gold to friends; redeem anytime

Trust and transparency

- Authorized bullion partners, fully insured vaults, audit-ready records

- Clear pricing, no jewellery-style making charges

For whom it’s perfect

- First-time investors, salaried professionals, Bitcoin-curious but cautious, festival buyers, gifters

Ready to build your gold stack the modern way – and get free Bitcoin on every purchase? Download OroPocket now: https://oropocket.com/app

Conclusion: Bank Gold vs Better Value – Start with OroPocket Today

The bottom line

- Banks offer purity and trust, but premiums over spot, 3% GST on the full ticket, lack of buyback, and storage costs chip away at returns.

- For investors, lower-cost, liquid, and goal-friendly options generally win – especially digital gold for flexibility and SGBs for long-term, tax-efficient holding.

Next step

- Try OroPocket to buy 24K gold from ₹1, earn free Bitcoin on every purchase, and build a consistent habit with daily streaks and rewards.

- Download the OroPocket app now: https://oropocket.com/app

![Best App for Investing in Gold in India [2026]: Fees, Rewards, and Safety Compared 6 Best20App20for20Investing20in20Gold20in20India205B20265D 20Fees20Rewards20and20Safety20Compared cover](https://blog.oropocket.com/wp-content/uploads/2026/01/Best20App20for20Investing20in20Gold20in20India205B20265D-20Fees20Rewards20and20Safety20Compared-cover-300x200.webp)