How to buy silver online in India safely: complete 2025 guide

Is it safe to buy silver online in India in 2025? What it really means

Short answer: yes – if you follow a clear safety checklist. “Safe” means you verify purity, trust the platform, pay the right price (spot + premium + taxes), use secure payments (UPI, cards, net banking), and decide how you’ll hold it (home delivery vs vaulted storage) with a clear exit plan.

The short answer

- Yes – if you follow a clear safety checklist covering purity, platform reputation, real-time pricing, secure payment, and how you take possession (delivery vs vaulting).

“Approximately 59% of global silver demand in 2024 came from industrial applications.” – Source

What this guide covers (and what you’ll get out of it)

- A step-by-step playbook to purchase silver online safely, avoid fakes, and minimize fees.

- Clear comparison of physical bars/coins, digital (vaulted) silver, and Silver ETFs.

- Exactly what to check on certificates, invoices, and packaging before you pay.

- How to use UPI securely and what red flags to walk away from.

Three ways to own silver online

- Digital/vaulted silver (buy fractional grams, stored in insured vaults; redeem/sell anytime).

- Physical silver (coins/bars delivered to your door, with tamper-evident packaging).

- Silver ETFs (market-listed units backed by silver; requires demat/trading account).

Safety pillars to remember

- Purity & certification

- Platform/dealer verification

- Transparent pricing (spot + premium + taxes)

- Payment & invoice security

- Possession & storage (home delivery vs vaulted storage)

- Exit plan (liquidity, buyback, resale)

If you’re comparing how to buy silver online or where to purchase silver online, keep these pillars front and center. They’re your filter for safe silver investment online in 2025.

Digital silver vs physical bars/coins vs Silver ETFs: which is right for you?

Quick take

- Physical bars/coins = tangible control, higher logistics.

- Digital (vaulted) silver = low minimums, instant UPI, insured vaults, easy liquidity.

- Silver ETFs = exchange-traded, demat-based, transparent NAV/prices.

How to choose based on your goal

- First-time investors or small-ticket SIPs: digital silver (₹1–₹500 start) to build a habit.

- Bulk buyers and gifters: physical bars/coins (100 g–1 kg) for long-term holding.

- Market-savvy investors with demat: Silver ETFs for exchange liquidity and transparency.

Key decision factors

- Minimum investment, purity assurance, liquidity and spreads, regulation/audit, storage cost, redemption/delivery, tax treatment, and rewards/benefits (e.g., Bitcoin cashback with OroPocket).

| Factor | Digital/Vaulted Silver | Physical Bars/Coins | Silver ETF |

|---|---|---|---|

| Minimum Investment | Ultra-low (start from ₹1–₹500 via UPI; SIP-friendly) | Higher (typically 10 g–1 kg, full-ticket purchase) | One unit price on exchange; as low as 1 unit + brokerage |

| Purity Assurance | Platform-certified, 999 fineness, backed by vaulted bullion | Verify BIS hallmark, mint/refiner, COA, serial numbers | Mandated 99.9% purity LBMA Good Delivery bars |

| Storage | Custodian vaults, fully insured; no home storage needed | Self-storage (home safe/bank locker) or third-party vault | Custodian vaults held by the ETF; no user storage |

| Liquidity/Exit | Sell back in-app at live prices; quick settlement | Resale via dealer/jeweller; spreads vary by city/brand | Exchange-traded during market hours; market liquidity |

| Regulation/Audit | Varies by provider; check custody, audit, insurance | Unregulated product; rely on dealer reputation | SEBI-regulated; daily NAV, statutory audits, disclosures |

| Fees & Taxes | Premium over spot, platform spread; 3% GST on redemption delivery; capital gains per tax rules | Premium + making/packaging; 3% GST on purchase; capital gains | Expense ratio, brokerage/STT as applicable; capital gains |

| Delivery | Optional redemption into coins/bars with tamper-evident packaging | Doorstep delivery from dealer; insured shipping recommended | No delivery (financial security). Some FoFs allow SIPs |

| Ideal For | First-time/small-ticket investors, UPI-native users, goal-based SIPs; perks like Bitcoin rewards with OroPocket | Bulk buyers, gifters, those who want tangible assets at home | Demat users seeking transparent pricing and exchange liquidity |

“SEBI permitted Silver ETFs in November 2021 and requires funds to hold 30 kg bars of 99.9% purity conforming to LBMA Good Delivery standards.” – Source

Pro tip: If you’re asking how to buy silver online or where you can purchase silver online with the least friction, start with digital silver on a trusted app that supports instant UPI, shows transparent spot + premium + taxes, and offers extras like Bitcoin cashback (OroPocket) for smarter silver investment online.

How to vet a platform or dealer before you purchase silver online

Reputation and compliance checks

- RBI/SEBI/NITI Aayog-aligned practices; authorized bullion/refinery partners.

- Transparent About/FAQ pages naming vaulting partners, insurers, auditors.

- Real reviews on Google/Play Store/App Store; beware of only-perfect ratings.

Product transparency

- Live spot-linked pricing with visible premium, GST, shipping/insurance charges.

- Clear purity stamps (e.g., 999/99.9), refiner/mint mark, serial number (for bars), assay.

- Tamper-evident packaging and documented buyback policy.

Website/app safety

- HTTPS, payment gateway logos you recognize, no forced screen-share for support.

- Proper invoice with GSTIN, HSN code (e.g., 7106 for silver), and your PAN when required.

Red flags – walk away if you see

- “Too-cheap” deals, no certificates, missing return/buyback policy, unlisted phone numbers, demand for full advance via unknown bank account, pushy sales urgency.

Purity, hallmarks and simple tests: how to avoid fakes

What to see on the bar/coin

- Purity marking (e.g., 999/99.9 fine), refiner/mint logo, serial number (bars), weight.

- Assay card or certificate; tamper-evident packaging intact.

BIS hallmarking basics (for jewellery/artefacts)

- HUID-based hallmarking on jewellery/artefacts; understand what the marks mean.

“BIS hallmarking now uses a three-part mark – BIS logo, purity/fineness grade, and a unique HUID code for traceability; sale without HUID is prohibited from April 1, 2023.” – Source

At-home non-destructive checks (basic)

- Magnet test (silver is non-magnetic), ice test (high thermal conductivity), sound/ping test.

- Avoid abrasive/acid tests that void packaging or resale value; opt for a certified assayer if in doubt.

Pro move

- Buy brands listed by reputed refineries/mints; verify LBMA/ISO credentials where applicable; keep all documents for resale.

Price, premium, GST and spreads: calculate the true cost before you buy

Spot vs premium (and why bar size matters)

- Spot is the live market price per gram. Premium is what you pay above spot for minting, logistics, packaging, and brand.

- Smaller bars/coins usually have higher per-gram premiums than 1 kg bars because production and handling costs don’t scale linearly.

Taxes and fees to account for

- GST on silver bullion, shipping/insurance, platform fees (if any), and buy/sell spreads when you exit.

“GST on silver bullion in India is 3%.” – Source (Editor: verify via CBIC/GST rate schedule for HSN 7106.)

How to keep costs low

- Compare 2–3 reputed platforms before you purchase silver online.

- Choose optimal bar sizes (e.g., 1 kg often cheaper per gram vs 100 g).

- Buy during calm markets to avoid wide spreads; avoid impulse buys during spikes.

- Consider digital silver for micro-buys (low minimums) and Silver ETFs for demat-based efficiency.

Cost components to track

| Component | What it covers | Typical range | How to minimize |

|---|---|---|---|

| Spot price | Live market rate per gram | Moves daily with global/INR factors | Use trusted live price feeds; avoid panic buying on spikes |

| Premium | Minting, logistics, packaging, brand margins | ~1–3% for 1 kg; ~3–10% for 10–100 g | Prefer larger bars; compare multiple platforms; consider vaulted silver |

| GST on bullion | Tax on bullion value (HSN 7106) | 3% | Plan purchases; note ETFs don’t charge GST at purchase (but have expense ratios) |

| Shipping/Insurance | Door delivery and transit cover | Often ₹0–₹600 or slab-based | Consolidate orders; look for insured shipping offers/thresholds |

| Platform fee | App/portal convenience or processing fee | 0–1% (varies by provider) | Choose low/zero-fee platforms; offset via rewards (e.g., Bitcoin cashback on OroPocket) |

| Buy/Sell spread | Difference between buy and sell quotes | Physical: ~2–6%; Digital: ~0.5–3%; ETFs: market bid-ask + expense ratio | Use liquid products; trade in normal hours; compare quotes before selling |

Worked example (illustrative only)

Assume live spot = ₹90/g.

- Option A: 100 g silver bar

- Spot value: 100 g x ₹90 = ₹9,000

- Premium (5%): ₹450 → Subtotal = ₹9,450

- GST (3% on subtotal): ₹283.50

- Shipping/insurance: ₹200

- All-in = ₹9,450 + ₹283.50 + ₹200 = ₹9,933.50

- All-in per gram ≈ ₹99.34/g

- Option B: 1 kg (1,000 g) silver bar

- Spot value: 1,000 g x ₹90 = ₹90,000

- Premium (2%): ₹1,800 → Subtotal = ₹91,800

- GST (3% on subtotal): ₹2,754

- Shipping/insurance: ₹500

- All-in = ₹91,800 + ₹2,754 + ₹500 = ₹95,054

- All-in per gram ≈ ₹95.05/g

Takeaway: larger bars can reduce the premium burden, significantly lowering your all-in per-gram cost. If you’re figuring out how to buy silver online cost-effectively, run this math before you purchase silver online – especially when comparing silver investment online across platforms.

Payment and checkout safety (UPI, cards, netbanking)

Best-practice checkout flow

- Use UPI or trusted payment gateways; avoid direct transfers to unknown bank accounts.

- Confirm you’re on HTTPS (lock icon), and check the payment gateway name before proceeding.

- Never share OTPs, CVV, or PINs with anyone; avoid “remote support” apps during checkout.

- Enable 2FA on your bank/app; set per-transaction limits for extra safety.

- If you’re figuring out how to buy silver online or where you can purchase silver online, stick to platforms with verified payment partners and clear refund policies.

What your invoice must include

- Your full name and PAN (when required), seller GSTIN, and business name/address.

- HSN code (e.g., 7106 for silver), item description (purity like 999/99.9 and weight), and quantity.

- Price breakup: spot-linked base, premium, GST, shipping/insurance, and any platform fee.

- Order ID, date/time, and payment reference (UPI Ref No./Txn ID or card auth code).

Post-payment hygiene

- Save the e-invoice, payment confirmation, and courier tracking ID immediately.

- Verify that shipping is insured and note the declared value.

- On delivery, inspect tamper-evident packaging; record an unboxing video (avoid showing personal data).

- If anything looks off (weight mismatch, damaged seal), raise a ticket with photos/video within the stated window.

UPI-specific safety

- Verify the UPI ID handle and confirm the beneficiary name matches the seller before paying.

- Avoid scanning QR codes sent over social media or chat without verifying the source.

- Never approve “collect requests” you didn’t initiate; check the amount and merchant name carefully.

- Do not screen-share during payment. Enter UPI PIN only inside your UPI app’s secure screen.

- For recurring silver investment online (SIPs), set up autopay mandates only with trusted, RBI-compliant platforms.

Smart move: Prefer platforms that show a transparent spot + premium + taxes breakdown at checkout and provide instant UPI receipts – this keeps your purchase silver online trail clean for audits and resale.

Delivery vs vaulted storage: pick how you want to hold silver

Insured home delivery (physical possession)

- Tamper-evident packaging, inspect on arrival, store in a dry safe or bank locker.

- Ideal if you want tangible control or to gift.

Vaulted storage (digital silver)

- Fully insured, audited vaults; instant buy/sell; no storage logistics; redeem later if needed.

- Ideal for SIPs, small-ticket, or frequent rebalancing.

What to ask the provider

- Who is the vaulting partner? Is insurance 100% of value? Audit frequency? Buyback policy and spreads?

Buying silver safely with OroPocket: 30‑second walkthrough + rewards

Why OroPocket for silver investment online

- Start from ₹1 via UPI – no minimums.

- Earn free Bitcoin (Satoshis) cashback on every silver purchase.

- Gamified investing: daily streak bonuses, spin-to-win, and referral rewards.

- RBI-compliant operations, authorized bullion partners, 100% insured vaults.

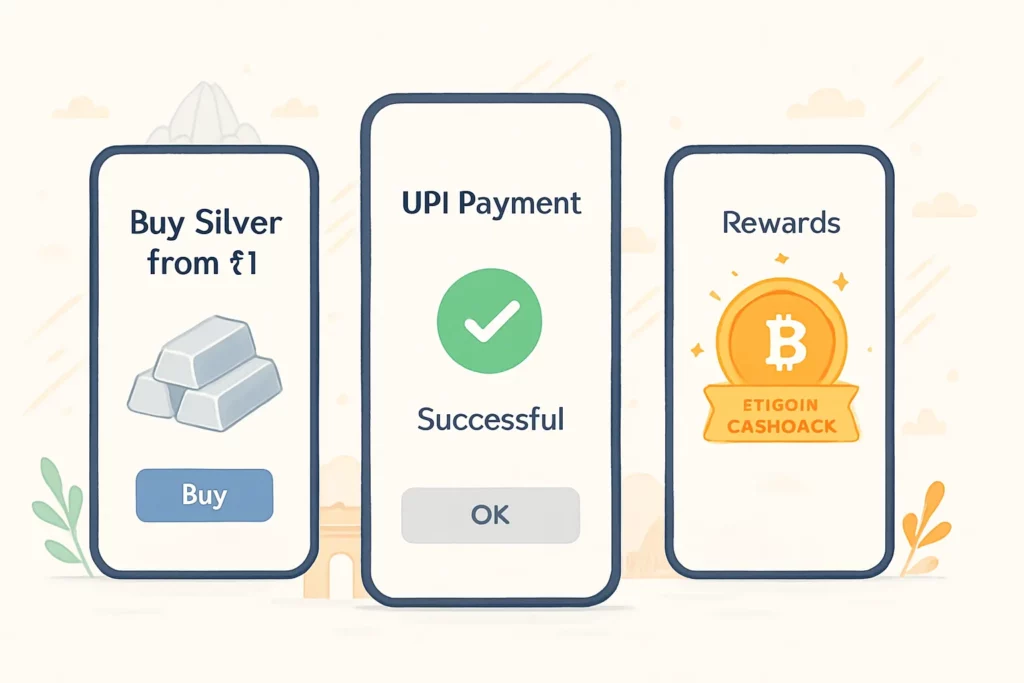

30-second flow to purchase silver online

- Download OroPocket (iOS/Android) and complete quick KYC.

- Add funds via UPI or pay directly at checkout.

- Choose silver, enter amount (from ₹1), confirm live price.

- Get instant allocation in insured vaults; view holdings in the app.

Extra superpowers

- Sell anytime at live rates; gift silver to friends; redeem to bank; track price alerts.

- Build a habit: set SIP reminders, maintain streaks for bonus rewards.

Transparency and safety

- See live spot-linked prices and exact fees before you confirm.

- All holdings are real, fully insured, and audited.

Tip to maximize rewards

- Maintain 5-day streaks and refer friends to stack Satoshis faster while you invest.

Ready to start? Download the OroPocket app now: https://oropocket.com/app

Taxes, records and exit strategy

Taxes at purchase

- GST on bullion purchases applies; check your invoice’s tax breakdown and HSN (e.g., 7106 for silver).

- For Silver ETFs, no GST on the fund unit purchase, but brokerage, exchange/SEBI charges, stamp duty, and GST on brokerage may apply.

Capital gains overview (general guidance)

- Physical/digital silver sold at a profit is subject to capital gains tax per prevailing income tax rules.

- Holding period, rate, indexation treatment, and set-off rules can change. Silver ETFs and fund-of-funds may be taxed differently from physical/digital silver.

- Track acquisition and sale dates, apply FIFO where relevant, and consult a qualified tax advisor for the latest treatment before selling.

Documentation to preserve

- Purchase invoice with seller GSTIN, HSN, purity/weight, and full tax breakup.

- Certificates/assay cards, serial numbers, and tamper-evident packaging details (photos help).

- Delivery acknowledgements, courier tracking/proof of insured shipping.

- Vault statements and monthly/annual summaries (for digital/vaulted silver).

- Contract notes/account statements (for ETFs).

Planning your exit

- Know the platform’s buyback spread and settlement timelines; wider spreads can eat returns.

- Keep bars sealed and assay intact to preserve resale value; breaking packaging can reduce offers.

- For ETFs, monitor NAV, bid-ask spreads, brokerage, and expense ratios; trade during liquid hours.

- For vaulted silver, review redemption/delivery fees and minimums; compare in-app sell vs physical redemption.

Smart habit

- Use staggered selling (tranches) and goal-based exits (education fund, down payment, festive gifting) to reduce timing risk.

- Set alert thresholds (price targets, premium/spread levels) and review taxes before placing the sell order.

Common scams and red flags when you purchase silver online

Tactics to watch for

- Deep-discount bait with hidden fees or fakes.

- Fake “certificates” without verifiable mint/refiner info.

- Social media-only sellers, no GST invoice, no physical address.

- Pressure to pay instantly to a private account or via obscure wallets.

How to protect yourself

- Buy only from reputed platforms; verify domain, support number, and CIN/GSTIN.

- Cross-check purity/weight/serials; insist on tamper-evident packaging and insured shipping.

- Never share OTPs; avoid remote-access apps; use official app stores only.

If something feels off

- Stop, compare prices on two other reputed sites; ask for documentation; walk away if answers are vague.

Conclusion: Start building your silver stack – safely – with OroPocket

The bottom line

- Buying silver online in India is safe when you verify purity, pick trusted platforms, understand the full cost (spot + premium + GST), pay securely via UPI, and choose the right holding method (delivery or vaulting).

- Whether you prefer physical bars/coins, digital silver, or Silver ETFs, follow the safety pillars: certification, transparent pricing, secure payment, clear invoices, and an exit plan.

- If you’re wondering how to buy silver online or where you can purchase silver online with minimal friction, start with a platform that offers price transparency, insured storage, and fast liquidity.

Why start with OroPocket today

- Invest from ₹1 via UPI – no minimums, perfect for SIP-style silver investment online.

- Earn free Bitcoin (Satoshis) cashback on every silver purchase – build two assets at once.

- 100% insured, audited vaults with authorized bullion partners; live spot-linked pricing and no hidden charges.

- Instant liquidity: buy/sell at live rates, redeem to bank, or gift silver – right inside the app.

- Gamified rewards: daily streaks, spin-to-win, and referral bonuses to keep you consistent.

Next step

- Download the OroPocket app now and make your first silver purchase in under a minute: https://oropocket.com/app

![10 best places to buy digital silver online in India [2026] 9 1020best20places20to20buy20digital20silver20online20in20India205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/1020best20places20to20buy20digital20silver20online20in20India205B20265D-cover-300x200.webp)