How to Convert Digital Gold to Physical Gold in India: Delivery, Charges, and Timelines

Digital Gold to Physical Gold: The Short Answer (and What You Can Redeem)

Can you convert digital gold to physical gold in India?

-

Yes. You can redeem your digital gold for 24K coins/bars (most common) and, on some platforms, select jewellery via partner jewellers. This is the simplest way to turn a gold purchase into a physical gold buy without visiting a store.

“UPI digital gold purchases in India rose from ₹8 billion in January 2025 to ₹21 billion in December 2025 – nearly tripling in one year.” – Source

What you can redeem

-

24K 999/995 coins and bars in popular denominations (1g, 2g, 5g, 10g, 20g, 50g)

-

Limited jewellery options through authorised partners (making charges apply)

Quick at-a-glance: steps

-

Check KYC and address match your account

-

Choose denomination (coin/bar) and quantity

-

Review making/minting + delivery/insurance charges + GST

-

Pick delivery method (doorstep vs pickup, if offered)

-

Pay applicable charges and confirm

-

Track shipment; receive in tamper-evident pack with assay card

When does redeeming make sense vs selling?

-

Redeem if you want long-term holding/gifting or festive needs

-

Sell if you only want cash returns and wish to avoid making charges

Ready to redeem digital gold to physical gold – or start your first gold purchase from ₹1 and earn free Bitcoin rewards? Download the OroPocket app now: https://oropocket.com/app

How Redemption Works: Step-by-Step for India (KYC, Address, Payment, Delivery)

Turning your digital gold to physical gold is straightforward when you follow the right steps. Here’s the complete flow for a smooth physical gold buy via redemption – KYC, address, charges, delivery, and timelines.

“The World Gold Council’s Retail Gold Investment Principles call for transparent disclosure on purity, custody (vaulting/insurance), pricing, and delivery to protect retail investors.” – Source

Pre-checks before you hit ‘Redeem’

-

KYC status: PAN/Aadhaar verified; name must match

-

Address: current and serviceable for secure delivery

-

Minimum grams: ensure you meet platform’s minimum redemption quantity

Step 1: Pick product and denomination

-

Choose 24K coin/bar (1–50g typical); check purity (999/995) and hallmark/assay

Step 2: Review charges transparently

-

Making/minting, packaging, logistics/insurance, and 3% GST where applicable

Step 3: Choose delivery method

-

Doorstep delivery with secure logistics; in-store pickup (if offered by partners)

Step 4: Pay and confirm

-

Pay balance charges via UPI/cards/net banking; receive order ID and invoice

Step 5: Processing and T+ timelines

-

Minting/packing (T+0–T+2), dispatch, shipment tracking, delivery attempt

Step 6: On delivery

-

Inspect tamper-evident pack; verify weight, purity, and assay card; store invoice safely

Pro tips

-

Redeem in standard coin weights to reduce making charges

-

Align delivery dates away from peak festive congestion

-

Keep an eye on live prices to choose a favourable window

Start your redemption the smart way – or make your first gold purchase from ₹1 and earn free Bitcoin on every buy. Download the OroPocket app: https://oropocket.com/app

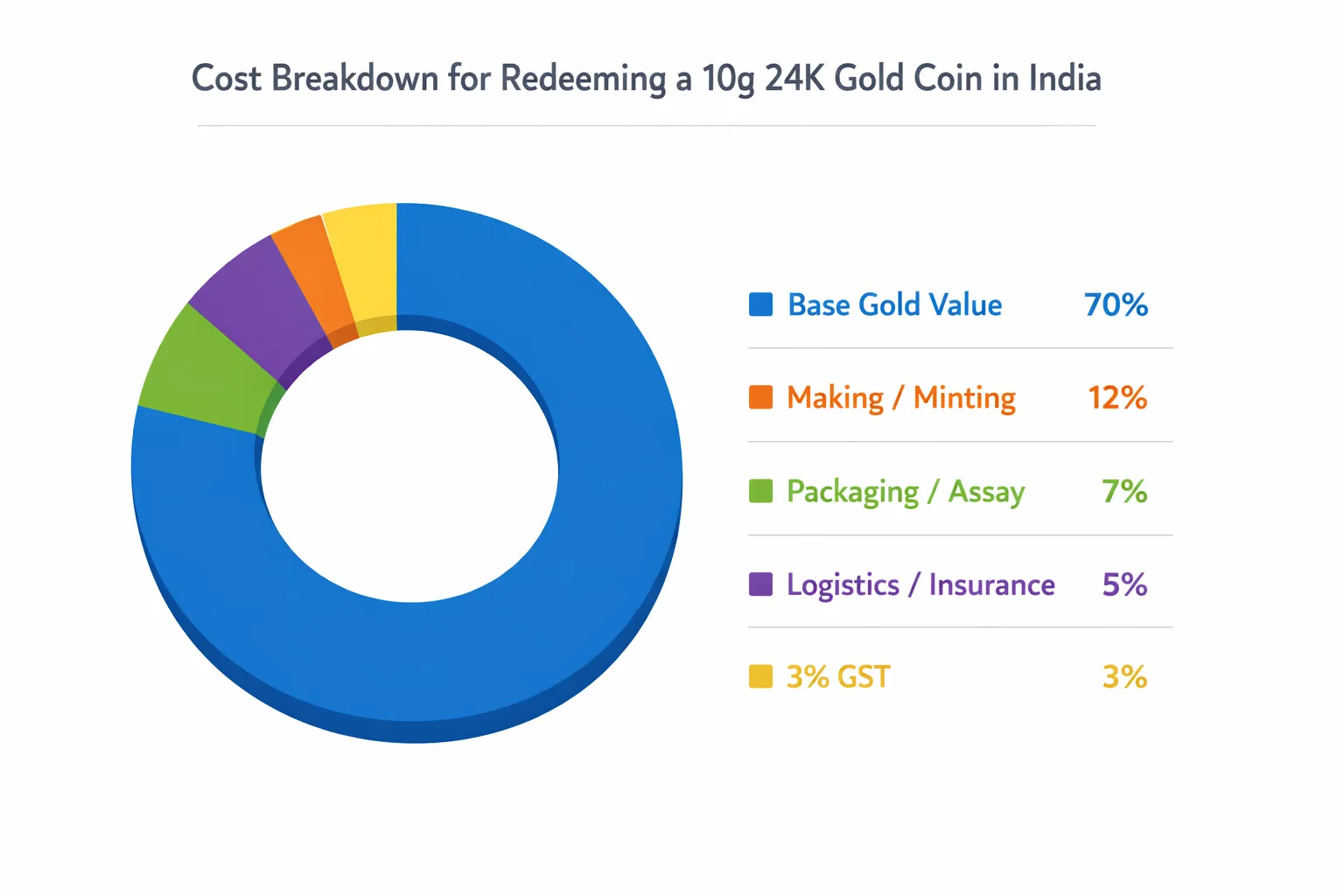

Charges and Fees Explained: Making, Delivery, Insurance, GST

What you pay for when converting digital gold to physical gold

-

Making/minting charges: fabrication and finishing of coins/bars

-

Packaging and assay: tamper-proof pack and certification

-

Logistics + insurance: secure shipment with cover

-

Taxes: 3% GST component where applicable

How to minimise fees (smart redemption)

-

Prefer standard coin sizes (5g/10g) for better making-charge efficiency

-

Doorstep vs pickup: check if pickup saves fees (if available)

-

Group redemptions to reduce per-gram delivery impact

Hidden costs to watch

-

Festive surge in making charges

-

Remote-area delivery surcharges

-

Re-delivery/return-to-origin fees if address is incorrect

Example fee stack explained (coins vs jewellery)

-

Coins/bars: largely minting + logistics; transparent

-

Jewellery: higher making + wastage, design premiums

Fee breakdown matrix (illustrative ranges)

|

Product |

Base Gold Value |

Making/Minting |

Packaging/Assay |

Logistics/Insurance |

GST |

Total |

|---|---|---|---|---|---|---|

|

1g coin (24K 999) |

Live gold price × 1g |

Higher per gram vs larger coins (small format) |

Included/nominal |

Flat fee; highest per gram impact |

3% on eligible components |

Sum of all components |

|

5g coin (24K 999) |

Live gold price × 5g |

Moderate per gram |

Included/nominal |

Flat/zone-based, better efficiency |

3% on eligible components |

Sum of all components |

|

10g coin (24K 999) |

Live gold price × 10g |

Best efficiency per gram |

Included/nominal |

Flat/zone-based, efficient |

3% on eligible components |

Sum of all components |

|

10g bar (24K 995/999) |

Live gold price × 10g |

Similar or slightly lower than coin |

Included/nominal |

Flat/zone-based |

3% on eligible components |

Sum of all components |

|

Simple jewellery (~10g, 22K/24K) |

Live gold price × net weight |

High: making + possible wastage |

Box + hallmark/assay card |

Flat/zone-based |

3% on eligible components |

Sum of all components |

Keep your redemption costs lean and your outcomes smarter. Buy from ₹1 and earn free Bitcoin on every gold purchase – download OroPocket: https://oropocket.com/app

Delivery Timelines (T+): Minting, Processing, Shipping, and What to Expect

“Standard bullion shipments in India typically arrive within 2–7 business days, depending on location and logistics.” – Source

Typical end-to-end timeline

-

T+0–T+2: minting/quality checks/packing

-

T+1–T+5: dispatch and in-transit movement

-

T+2–T+7: final delivery; metro vs non-metro variance

Factors that affect timelines

-

Denomination availability and mint load

-

Festive seasons (Dhanteras/Diwali/Akshaya Tritiya)

-

Pincode serviceability and weather/logistics constraints

Tracking and communication

-

Real-time tracking link; SMS/Email/WhatsApp alerts

-

What to do if tracking stalls or delivery is reattempted

If delayed or lost in transit

-

Insurance coverage scope; how claims are initiated

-

Support channels, documentation, and replacement SLAs

Timeline matrix by location and product (illustrative)

|

Stage |

Expected Days |

Notes |

|---|---|---|

|

Minting (Metro/Tier-1, 1–10g coins) |

T+0–T+1 |

Smaller coins typically ready stock; quick QC and pack |

|

Dispatch (Metro/Tier-1, 1–10g coins) |

T+1–T+2 |

Labeling and handover to secure courier |

|

Transit (Metro/Tier-1, 1–10g coins) |

T+1–T+3 |

Ground/air line-haul; real-time scans |

|

Delivery (Metro/Tier-1, 1–10g coins) |

T+2–T+4 |

Signature required; reattempts if recipient unavailable |

|

Minting (Metro/Tier-1, 20–50g bars) |

T+0–T+2 |

Bars may need fresh minting; extended QC |

|

Dispatch (Metro/Tier-1, 20–50g bars) |

T+1–T+3 |

Extra checks for high-value parcels |

|

Transit (Metro/Tier-1, 20–50g bars) |

T+1–T+3 |

Insured movement; restricted route windows |

|

Delivery (Metro/Tier-1, 20–50g bars) |

T+2–T+5 |

May require ID verification on delivery |

|

Minting (Tier-2/3, 1–10g coins) |

T+0–T+2 |

Production aligned to demand; possible batching |

|

Dispatch (Tier-2/3, 1–10g coins) |

T+1–T+3 |

Handover to partner hub serving your pincode |

|

Transit (Tier-2/3, 1–10g coins) |

T+2–T+5 |

Hub-and-spoke routing; weather/pincode variability |

|

Delivery (Tier-2/3, 1–10g coins) |

T+3–T+6 |

Attempt windows vary by local courier capacity |

|

Minting (Tier-2/3, 20–50g bars) |

T+1–T+2 |

Higher denomination; additional verification |

|

Dispatch (Tier-2/3, 20–50g bars) |

T+2–T+4 |

Secure bagging and custody transfer |

|

Transit (Tier-2/3, 20–50g bars) |

T+2–T+5 |

May include line-haul + last-mile handoff |

|

Delivery (Tier-2/3, 20–50g bars) |

T+4–T+7 |

Longer last-mile; recipient availability critical |

Plan your redemption around festivals and local logistics to avoid delays – and keep your KYC and address spotless for first-attempt delivery success. Ready to redeem or start your first gold purchase from ₹1 and earn free Bitcoin on every gold buy? Download OroPocket: https://oropocket.com/app

Eligibility, Denominations, and Limits (KYC and Address Requirements)

Minimums and maximums

-

Typical minimum redemption: 1g; some platforms 0.5g/2g for specific SKUs

-

Per-order and daily caps may apply; check app limits

KYC must-haves

-

PAN/Aadhaar; name match; date of birth; mobile-linked OTP

-

PEP/sanctions screening as part of compliance

Address and identity alignment

-

Address proof examples: Aadhaar, Passport, DL, utility bill

-

Name and address must match account to avoid RTO (return to origin)

Updating details

-

How to update KYC/address within the app; expected verification time

-

Why consistent mobile number matters for OTP and delivery

Stay compliant and ready to redeem without hiccups. Start building gold from ₹1 and earn free Bitcoin on every buy – download OroPocket: https://oropocket.com/app

Packaging, Insurance, and Chain of Custody

What arrives at your door

-

Tamper-evident packaging; sealed assay card for coins/bars

-

Product details: weight, fineness (999/995), hallmark/serial (if applicable)

Insurance 101

-

Coverage from vault to your doorstep; when coverage starts/ends

-

What’s typically excluded; steps if the pack is tampered on arrival

“The World Gold Council’s Retail Gold Investment Principles require providers to protect client assets via secure, insured storage with transparent oversight.” – Source

Who handles your gold behind the scenes

-

Authorized bullion partners, RBI-compliant processes, security trustees

-

Vaulting with 100% insurance and periodic audits

Best practices upon delivery

-

Record unboxing; verify seal and assay; store invoice and certificate safely

Convert digital gold to physical gold with confidence – secure packaging, insured delivery, and full traceability. Ready to redeem or start your first gold purchase from ₹1 and earn free Bitcoin on every buy? Download OroPocket: https://oropocket.com/app

Common Redemption Mistakes (and How to Avoid Them)

Top mistakes

-

Address/KYC mismatch causing delivery failure and extra charges

-

Underestimating making charges (especially for jewellery redemptions)

-

Choosing non-standard denominations that raise per-gram costs

-

Ordering right before festivals; expect longer timelines and higher fees

-

Ignoring OTP/registered mobile mismatch; payment declines

-

Not inspecting tamper-evident seal at delivery

The fix

-

Pre-validate KYC and address; redeem standard coin sizes

-

Budget for fees; check fee breakdown before paying

-

Track shipment; keep someone home to receive

-

Record unboxing; contact support immediately if tampered

Quick checklist before you redeem

-

KYC verified, address current, mobile active

-

Standard denomination selected (5g/10g) unless you need smaller

-

Charges reviewed: making, delivery, insurance, GST

-

Delivery window chosen outside peak rush

Avoid these pitfalls to keep your digital gold to physical gold redemption smooth, cost-efficient, and secure. Ready to make a physical gold buy – or start your first gold purchase from ₹1 and earn free Bitcoin on every buy? Download OroPocket: https://oropocket.com/app

Real-World Cost Scenarios: 1g, 5g, 10g Coins (Worked Examples)

Understanding the full landed cost helps you choose the most efficient denomination when converting digital gold to physical gold. Here’s how the numbers typically stack up.

How the math works (illustrative)

-

1g coin: Higher per-gram costs due to fixed making, packaging, and delivery components.

-

5g coin: Balanced choice; popular for gifting with better per-gram efficiency than 1g.

-

10g coin: Best efficiency per gram; fixed costs spread across more gold.

Example walkthroughs (placeholders you can update)

Assumption for illustration only: Live 24K gold price = ₹6,500/g. Actual fees vary by platform, product, and location.

Formula: Total payable = (Live gold price × grams) + Making/Minting + Packaging/Assay + Logistics/Insurance + GST (on eligible components)

-

1g coin (24K 999/995)

-

Base gold value: ₹6,500 × 1g = ₹6,500

-

Making/Minting: ₹350

-

Packaging/Assay: ₹75

-

Logistics/Insurance (doorstep): ₹200

-

GST (3% on eligible components, e.g., base + making): 3% of (₹6,500 + ₹350) = ₹206 (approx.)

-

Total payable: ₹6,500 + ₹350 + ₹75 + ₹200 + ₹206 ≈ ₹7,331

-

5g coin (24K 999/995)

-

Base gold value: ₹6,500 × 5g = ₹32,500

-

Making/Minting: ₹1,200

-

Packaging/Assay: ₹100

-

Logistics/Insurance: ₹250

-

GST (3% on eligible components): 3% of (₹32,500 + ₹1,200) = ₹1,011 (approx.)

-

Total payable: ₹32,500 + ₹1,200 + ₹100 + ₹250 + ₹1,011 ≈ ₹35,061

-

Effective per gram: ~₹7,012

-

10g coin (24K 999/995)

-

Base gold value: ₹6,500 × 10g = ₹65,000

-

Making/Minting: ₹1,800

-

Packaging/Assay: ₹120

-

Logistics/Insurance: ₹300

-

GST (3% on eligible components): 3% of (₹65,000 + ₹1,800) = ₹2,004 (approx.)

-

Total payable: ₹65,000 + ₹1,800 + ₹120 + ₹300 + ₹2,004 ≈ ₹69,224

-

Effective per gram: ~₹6,922

Takeaway: As denomination increases, fixed costs (making, packaging, logistics) get distributed across more grams, improving per-gram efficiency – useful when planning a physical gold buy.

Optimising your redemption

-

Group orders; redeem in standard sizes (5g/10g coins or a 10g bar) to reduce per-gram costs.

-

Avoid peak festive surges; plan 10–15 days ahead to sidestep higher making charges and courier congestion.

-

Prefer coins/bars over jewellery for lower making/wastage premiums and a more transparent gold purchase.

Bonus with OroPocket

-

Your gold purchases on OroPocket earn Bitcoin rewards (Satoshis). Over time, these rewards can partially offset redemption costs – making your digital gold to physical gold journey even smarter.

Ready to run your own numbers or start with just ₹1? Convert digital gold to physical gold the smart way – and earn free Bitcoin on every purchase. Download OroPocket: https://oropocket.com/app

Why Choose OroPocket for Digital-to-Physical Gold in India

What makes OroPocket different

-

Start at ₹1; build your stack without minimum thresholds

-

Earn free Bitcoin (Satoshi) on every gold/silver purchase – two assets for one action

-

24K pure, 100% insured, securely vaulted; RBI-compliant processes with authorised bullion partners

-

Transparent pricing for every gold purchase with no hidden charges

Fast, modern, and rewarding

-

Instant UPI payments; buy gold in under 30 seconds

-

Daily streaks, Spin-to-Win, and tiered rewards keep you motivated

-

Send gold to friends/family; easy gifting before you redeem

-

Referral rewards: invite friends, earn Satoshis and bonus spins

Redemption on your terms

-

Coins and bars in popular denominations (1g, 2g, 5g, 10g, 20g, 50g)

-

Transparent fee breakdown; track delivery end-to-end

-

Responsive support when you need help – no running around showrooms

-

Simple, secure chain of custody from vault to your doorstep

Smart way to prepare for physical gold buy

-

Accumulate digitally with micro-purchases, earn Bitcoin rewards, then convert to coins/bars when ready

-

Ideal for festivals (Dhanteras/Diwali), weddings, and milestone gifting

-

Optimise costs by redeeming standard sizes for a more efficient physical gold buy

-

Perfect for anyone asking how to invest in physical gold without large upfront amounts

OroPocket is the modern, trustworthy way to go from digital gold to physical gold – fast, transparent, and rewarding. Start with just ₹1, earn free Bitcoin on every purchase, and redeem into 24K coins/bars when it suits you. Download the OroPocket app: https://oropocket.com/app

Conclusion: Redeem With Confidence – Start on OroPocket Today

The bottom line

-

Converting digital gold to physical gold in India is straightforward when you know the steps, fees, and timelines

-

Redeem coins/bars for lower fees, verify KYC/address, and plan around festive surges

-

Keep packaging, insurance, and tracking top of mind to ensure a smooth experience

Next step

-

Start small, grow consistently, redeem when it suits you – and earn free Bitcoin along the way with OroPocket

Call to action

-

Download the OroPocket app to buy, stack, and redeem gold the modern way: https://oropocket.com/app