How to Invest in Gold and Silver Together in India: Smart Allocation Guide

Why invest in gold and silver together in India (2026–27): quick answer and expectations

Inflation vs savings: why idle cash loses value in India

-

Savings rates often trail inflation, creating negative real returns.

-

Metals don’t replace your equity–debt core; they hedge shocks while your long-term assets compound.

“Dec 2024 CPI ~5.22% while typical savings rates were ~2.5–3.5% – negative real returns for savers.” – Source

Gold hedge + silver growth: clear roles, not guesses

-

Gold = core hedge (low equity correlation, INR cushion in risk-off).

-

Silver = higher-beta satellite (industrial demand: EVs, solar, electronics).

-

Answer to “should I invest in gold and silver?”: yes – together, gold-heavy with a smaller silver sleeve.

-

Answer to “which is better to invest, gold or silver?”: neither alone – combine both with rules.

How this guide helps (what you’ll learn)

-

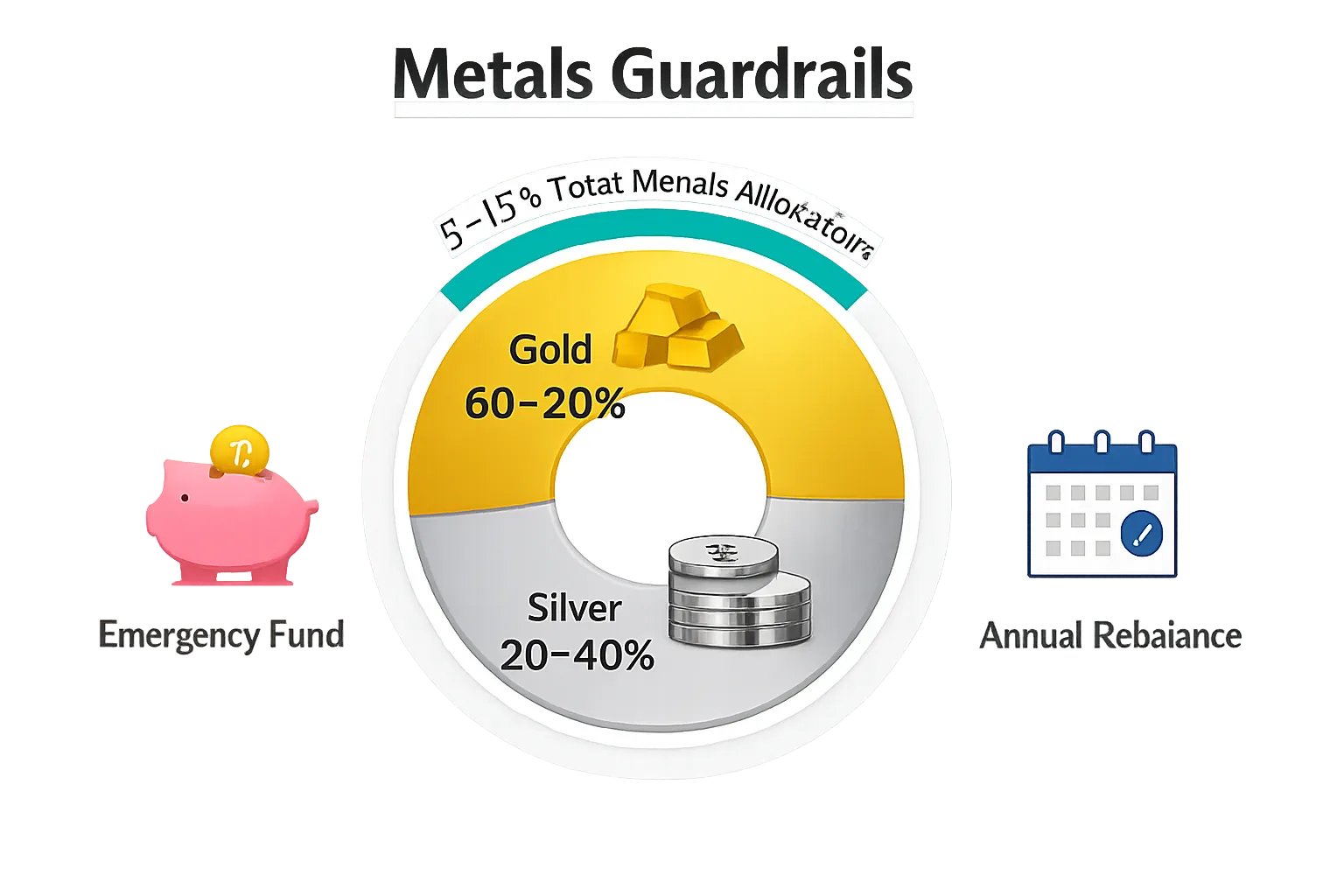

Allocations (5–15% total metals) and within-metals splits (e.g., 70% gold / 30% silver) for 2026–27.

-

SIP plans from ₹1 to ₹5,000+ per week and simple rebalance rules (annual or ±25% drift).

-

Best routes to invest (digital gold/silver, ETFs, SGBs, physical), with cost and tax pointers.

-

Fast start on OroPocket: ₹1 entry via UPI, insured 24K vaulting, free Bitcoin rewards on every purchase.

Ready to start with ₹1 and earn free Bitcoin on every gold/silver purchase? Download OroPocket: https://oropocket.com/app

Gold vs silver in Indian portfolios: roles, correlation, and volatility

Gold: the shock absorber

-

Tends to zig when equities zag; reduces drawdowns in stress.

-

INR cushion: often rises in INR terms during global risk-off.

-

Treat gold as the core of your metals sleeve.

“Indian portfolios historically improved risk-adjusted returns with a 7.5–15% gold allocation.” – Source

Silver: dual engines, higher torque

-

Precious + industrial demand (PV/EV/electronics) drives higher upside – and higher volatility.

-

Keep as a smaller satellite.

What to expect month-to-month (2026–27 mindset)

-

Stress regimes: gold leads; silver can lag or chop.

-

Growth regimes: silver catches tailwinds; gold steadies.

-

Keep rules simple: SIP to average prices; rebalance on schedule.

Ready to build a gold‑heavy, silver‑light sleeve from ₹1 and earn free Bitcoin on every purchase? Download OroPocket: https://oropocket.com/app

Smart allocation for 2026–27: exact splits, SIP plans, and rebalancing

Suggested within-metals splits by risk level

-

Conservative: 80% gold / 20% silver; total metals = 5–7% of portfolio.

-

Moderate: 70% gold / 30% silver; total metals = 7–12%.

-

Aggressive: 60% gold / 40% silver (cap silver at 40%); total metals = 10–15%.

SIP rhythm that sticks (₹1 to ₹5,000+)

-

Two fixed buy days (e.g., Mon/Thu) to reduce timing stress; scale SIP 10–20% after every 4-week streak.

Rebalancing, made simple

-

Annual calendar rebalance + threshold rule (rebalance if gold–silver drift hits ±25%).

-

Use Diwali/Dhanteras top-ups as mini-rebalances to the underweight metal.

“PV silver demand rose from ~118.1 Moz (2022) to ~193.5 Moz (2023) with a further ~20% rise forecast for 2024, cementing solar as a key silver driver into 2026.” – Source

Allocation planner

|

Risk Level |

Gold % |

Silver % |

Total Metals % of Portfolio |

Suggested Weekly SIP (₹) |

Rebalance Rule |

|---|---|---|---|---|---|

|

Conservative |

80% |

20% |

5–7% |

100–500 |

Annual / ±25% drift |

|

Moderate |

70% |

30% |

7–12% |

250–1,000 |

Annual / ±25% drift |

|

Aggressive |

60% |

40% |

10–15% |

500–5,000+ |

Annual / ±25% drift |

Ready to automate your plan from ₹1 and earn free Bitcoin on every gold/silver purchase? Download OroPocket: https://oropocket.com/app

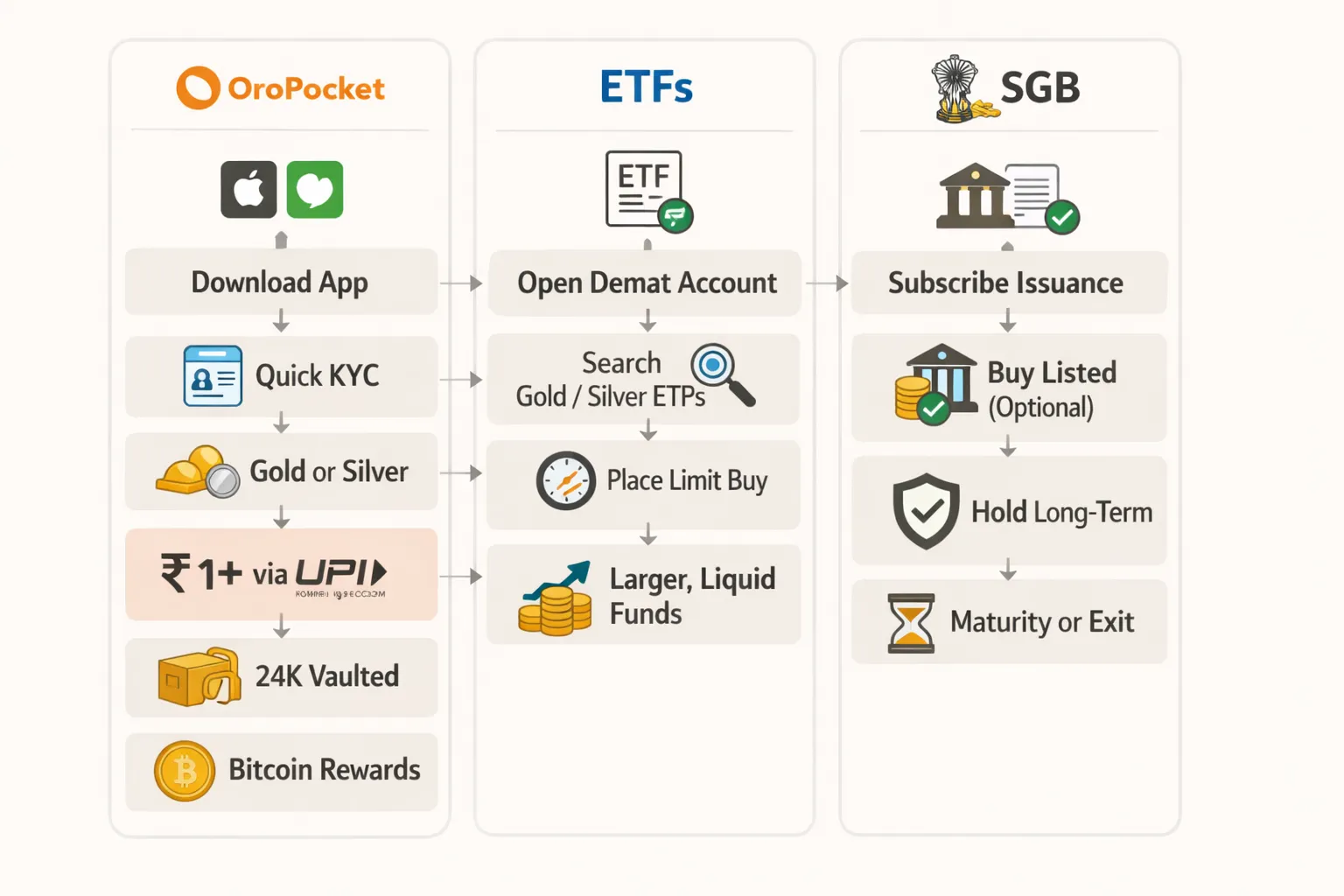

Where to invest: digital gold/silver vs ETFs vs SGB vs physical (choose the right tool)

Fit the tool to your goal, horizon, and liquidity

-

Digital (OroPocket): ₹1 entry via UPI, 24/7 in-app liquidity, Bitcoin rewards.

-

ETFs: demat + broker; market-hour liquidity; regulated; expense ratio + bid–ask.

-

SGB: gold-only, sovereign-backed, interest; long tenor; best for hold-to-maturity.

-

Physical: cultural/usage value; less efficient for pure investing.

Practical blends

-

Gold core via Digital/ETF/SGB; silver via Digital or Silver ETF.

-

Keep silver as the smaller sleeve; rebalance annually/±25% drift.

Comparison at a glance

|

Option |

Metals |

Minimums/Entry |

Liquidity |

Costs/Fees |

Rewards/Interest |

Regulation/Safety |

Best For |

|---|---|---|---|---|---|---|---|

|

Digital (OroPocket) |

Gold + Silver (24K) |

From ₹1 via UPI |

24/7 in-app buy/sell; instant partial exits |

Buy–sell spread |

Bitcoin (Satoshi) cashback; streaks; spin-to-win; referrals |

RBI-compliant partners; 100% insured vaults |

How to invest in gold and silver in India with micro-SIPs; first-time investors; instant liquidity |

|

Gold ETF |

Gold |

1 unit (via broker/demat) |

Market hours; exchange-driven |

Expense ratio + bid–ask; tracking error |

None |

SEBI-regulated ETF |

Regulated, exchange-based exposure; tactical trims; SIP via broker |

|

Silver ETF |

Silver |

1 unit (via broker/demat) |

Market hours; exchange-driven |

Expense ratio + bid–ask; tracking error |

None |

SEBI-regulated ETF |

Adding silver sleeve alongside gold; regulated structure |

|

SGB |

Gold |

Gram-denominations in tranches |

Long tenor; early-exit windows (post year 5); exchange liquidity varies |

No storage cost; issue/redemption norms |

Semi-annual interest; capital gains exempt at maturity |

Sovereign-backed |

Long-horizon gold holders comfortable with lock-ins |

|

Physical |

Gold/Silver (coins, bars, jewellery) |

Retail purchase amounts |

Sellable but with friction (purity checks, making charges) |

Making charges; storage/security |

None |

Self-custody risk; purity verification |

Cultural/usage needs (gifting, jewellery); not optimal for pure investing |

Ready to act? Start with ₹1 on OroPocket and earn free Bitcoin on every gold/silver purchase: https://oropocket.com/app

How to invest step-by-step: OroPocket, Gold ETF, Silver ETF, and SGB

OroPocket (gold + silver, ₹1 via UPI)

-

Download app (iOS/Android) → quick KYC → choose Gold or Silver → enter ₹1+ → pay via UPI.

-

Turn on weekly micro-SIPs; enable streaks/spin; refer friends for Satoshi rewards.

Gold/Silver ETFs

-

Open demat + trading account → search symbols → place limit orders during market hours.

-

Optional: broker SIP; prefer larger, more liquid funds.

SGB (RBI sovereign gold bond)

-

Subscribe during issuance windows (bank/broker) or buy listed series on exchange.

-

Plan to hold to maturity/early exit window to realize full benefits.

Ready to start with ₹1 and earn free Bitcoin on every gold/silver purchase? Download OroPocket: https://oropocket.com/app

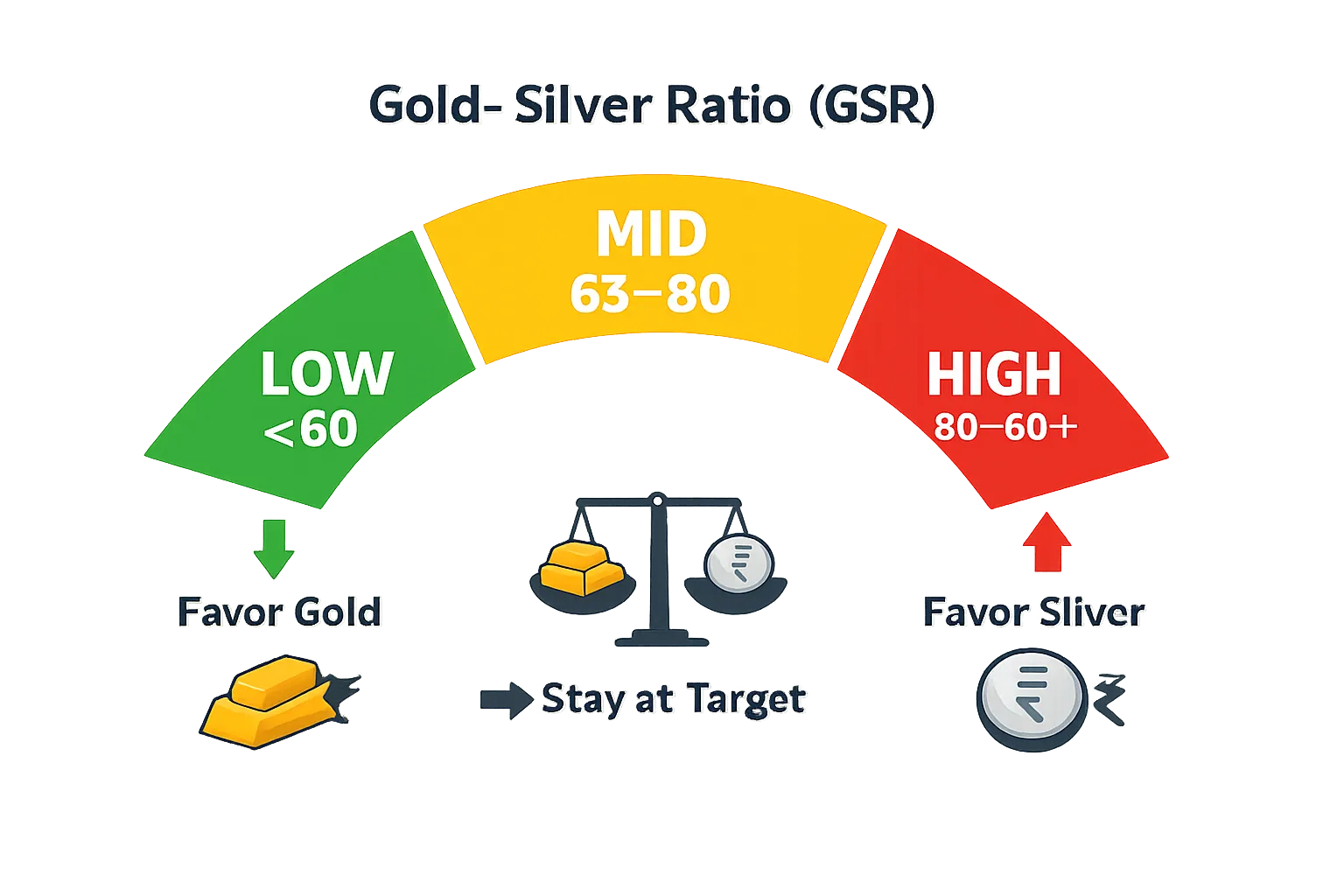

Rebalancing and the Gold–Silver Ratio (GSR): rules that prevent overtrading

Two-rule framework

-

Time-based: annual rebalance.

-

Threshold-based: rebalance if gold–silver split drifts ±25% from target.

Use GSR for gentle tilts only

-

High GSR (80–90+): tilt new buys slightly toward silver (respect silver cap).

-

Mid GSR (65–80): stay at target weights; keep averaging via SIP.

-

Low GSR (<60): tilt new buys back toward gold.

Discipline over tinkering

-

Apply tilts only to new contributions; evaluate monthly at a fixed window (e.g., first Monday) to avoid overtrading.

Ready to set your rules and stick to them? Start a gold‑heavy, silver‑light SIP from ₹1 and earn free Bitcoin on every purchase: https://oropocket.com/app

Costs, taxes, and liquidity (India 2026): minimize drag, stay flexible

Control costs in practice

-

Batch tiny buys into 1–2 weekly purchases to reduce spread impact.

-

Let OroPocket rewards (Satoshi cashback, streaks, spin-to-win) offset net costs over time.

-

For ETFs, use limit orders; prefer larger, liquid funds to reduce tracking error and bid–ask.

Taxes (illustrative; verify latest rules)

-

Gold/silver assets: STCG at slab; many LTCG cases at a flat rate after a defined holding period (indexation removed across categories; verify specifics before acting).

-

SGB: interest taxable; capital gains at maturity exempt under the scheme; early exits follow capital gains rules by holding period.

“Budget 2024 moved many gold/silver LTCG to a flat ~12.5% after 24 months (indexation removed); SGB interest remains taxable while gains at maturity are exempt.” – Source

Liquidity checklist

-

Need T+instant: digital in-app sells (OroPocket).

-

Need market-hour execution: ETFs.

-

Comfortable with long hold + interest: SGB.

Ready to keep costs low and access high? Start with ₹1 and earn free Bitcoin on every gold/silver purchase: https://oropocket.com/app

Risk controls and common mistakes to avoid

Guardrails that keep you safe

-

Cap silver at 40% within your metals sleeve; total metals 5–15% of your overall portfolio.

-

Maintain a 3–6 month emergency fund so you don’t raid metals for cash needs.

-

Document your target split and rebalance date to avoid emotional decisions.

Do / Don’t

-

Do automate weekly SIPs; don’t chase headlines.

-

Do one annual review; don’t overtrade every dip.

-

Do use large, liquid ETFs (if using exchanges); don’t ignore bid–ask and tracking error.

Behavioral edge

-

Fix two buy days (e.g., Mon/Thu) to reduce timing anxiety.

-

Use OroPocket streaks and rewards to reinforce consistency.

Ready to put rules over emotions? Start a gold‑heavy, silver‑light SIP from ₹1 and earn free Bitcoin on every purchase: https://oropocket.com/app

Copy-ready India portfolios you can start today (2026–27)

Student/first-jobber (₹500/week)

-

Metals sleeve ~7%; within metals 70% gold / 30% silver.

-

Flow: ₹350 gold (Mon) + ₹150 silver (Thu); annual + ±25% drift rebalance.

Salaried professional (₹5,000/month)

-

Metals sleeve ~10%; within metals 70% gold / 30% silver.

-

Flow: ₹3,500 gold + ₹1,500 silver (monthly or weekly cadence).

Long-horizon gold accumulator

-

Metals sleeve 8–10%; within metals 80% gold / 20% silver.

-

Tools: Core via SGB; top-ups via OroPocket; silver adjustments via Silver ETF; annual rebalance.

Festival-focused gifter

-

Six festival buys per year; each top-up acts as a mini-rebalance to the underweight metal.

-

Use OroPocket “Send Gold” for instant, no-making-charge gifting.

Ready to start from ₹1 and earn free Bitcoin on every gold/silver purchase? Download OroPocket: https://oropocket.com/app

Conclusion: Start your gold + silver plan now with OroPocket

Bottom line

-

Gold is your hedge; silver is your torque. Combine both, keep silver smaller, rebalance annually or on ±25% drift.

Why OroPocket for beginners in India

-

Start from ₹1 via UPI; 24K purity; insured vaults; RBI-compliant partners.

-

Unique edge: free Bitcoin (Satoshi) on every gold/silver purchase; streaks and spin-to-win that reward consistency.

Next step (30 seconds)

-

Download OroPocket, set a weekly micro-SIP, and pick your 2026–27 split (e.g., 70% gold / 30% silver).

-

Not investment advice; invest per your risk profile.

-

Call to action: Download now – https://oropocket.com/app