How to invest in gold and silver together: smart allocation and rebalancing for Indians

Introduction: Invest in gold and silver together (2026–27, India) – quick answer + comparison at a glance

Why combine gold + silver now

-

Inflation erodes idle cash; metals can hedge shocks while equities drive growth. If you’re asking “should I invest in gold or silver” in 2026, the smarter move is both – used as a diversification sleeve alongside equities and debt.

-

Pair gold’s stability with silver’s industrial upside; rebalance on a schedule. This barbell approach answers “which is the better investment, silver or gold” by assigning roles: gold = core hedge, silver = higher-beta satellite.

-

Micro-investing + UPI + rewards make execution easy for first-time investors. With ₹1 buys and SIPs, you can implement the best way to invest in gold and silver – without timing the market.

What we compare in this guide (head-to-head)

-

OroPocket (digital gold + silver, ₹1 entry, UPI-native, Bitcoin rewards)

-

Gold ETF (ICICI Prudential Gold ETF) – regulated, exchange-traded

-

Silver ETF (ICICI Prudential Silver ETF) – regulated, exchange-traded

-

Sovereign Gold Bonds (RBI SGB) – sovereign-backed long-term gold

At-a-glance: which option fits which need

|

Option |

Metals Covered |

Minimums |

Liquidity |

Costs/Fees Nature |

Rewards/Interest |

Regulation |

Best For |

|---|---|---|---|---|---|---|---|

|

OroPocket (digital) |

Gold + Silver |

From ₹1 |

Instant in-app buy/sell |

Buy–sell spread (no demat) |

Bitcoin rewards on every purchase; streaks/spins/referrals |

RBI-compliant partners; insured vaults |

Micro-investing via UPI; first-time investors; habit building |

|

Gold ETF (ICICI Prudential Gold ETF) |

Gold |

1 unit (broker rules apply) |

Exchange hours; depends on ETF liquidity |

Expense ratio + bid–ask spread |

None |

SEBI-regulated ETF |

Regulated, liquid exposure; SIP via broker |

|

Silver ETF (ICICI Prudential Silver ETF) |

Silver |

1 unit (broker rules apply) |

Exchange hours; depends on ETF liquidity |

Expense ratio + bid–ask spread |

None |

SEBI-regulated ETF |

Silver allocation in a regulated wrapper |

|

Sovereign Gold Bonds (RBI SGB) |

Gold |

Small gram-denominations via tranches |

8-year tenor; early exit windows; exchange liquidity varies |

No expense ratio; issue/redemption norms apply |

Fixed interest p.a. + gold price linkage |

Sovereign-backed |

Long-term gold holders comfortable with lock-ins |

Key insight to set expectations

“Indian portfolios achieved better risk-adjusted returns and lower drawdowns with 7.5–15% gold allocations.” – Source

Diversification sweet spot: A gold-heavy sleeve with a smaller silver allocation tends to offer a smoother ride. Silver is higher beta – keep it as the kicker, not the core.

How to use this guide

-

Pick the instrument(s) that fit your goal and liquidity needs (digital for ₹1 micro-buys via UPI, ETFs for regulated exchange exposure, SGB for long-term holders).

-

Follow the allocation splits by risk level, then rebalance annually or on ±25% drift.

-

Fast-start steps for each option are included in later sections to help you implement the best way to invest in gold and silver – without guesswork.

Ready to start with ₹1 and earn free Bitcoin on every gold/silver purchase? Download the OroPocket app: https://oropocket.com/app

Who should choose what: the right tool for your goal, time horizon, and liquidity

If you want to start tiny and stay consistent

-

OroPocket: ₹1 entry via UPI in 30 seconds; no demat, no market hours.

-

Earn free Bitcoin on every gold/silver purchase; streaks and spins help build a weekly SIP habit.

-

Best way to invest in gold and silver for first‑timers who value convenience and visibility.

-

Tip: Automate a small weekly micro‑SIP and rebalance annually or on ±25% drift within your metals sleeve.

If you want regulated, intraday liquidity without lock-ins

-

Gold ETF + Silver ETF (ICICI Prudential): buy/sell through your broker during market hours.

-

Suitable for tactical trims/additions and for investors who prefer exchange execution.

-

Good fit if you already run SIPs in mutual funds/ETFs and want a regulated metals sleeve.

-

Tip: Use limit orders to manage bid–ask, and review allocation quarterly.

If you can lock in for the long term and want sovereign comfort

-

RBI SGB: gold‑only, 8‑year tenor with early exit windows after year 5; pays interest in addition to gold price linkage.

-

Ideal for hold‑to‑maturity gold exposure and long‑horizon goals (5+ years).

-

Not suited for frequent rebalancing or liquidity needs.

-

Tip: Keep SGB as your core gold; use a liquid route (ETF/digital) for topping up or rebalancing.

If you need both gold and silver in one routine

-

Blend OroPocket (for both metals, micro‑SIP + rewards) with a Silver ETF (for regulated silver exposure) if you prefer exchange execution for silver.

-

Practical answer to “should I invest in gold or silver?” – do both: gold as ballast, silver as higher‑beta.

-

Tip: Keep silver a smaller satellite sleeve; rebalance annually or on drift.

If you prefer a single app experience with gamified habit-building

-

OroPocket: daily streaks, spin‑to‑win, and referral Satoshi reinforce consistent buying.

-

Great for beginners asking “which is the better investment, silver or gold?” – start gold‑heavy, add silver slowly.

-

Tip: Begin 70/30 (gold/silver) within your metals sleeve; review weights every quarter.

Ready to act? Start your metals SIP from ₹1 and earn free Bitcoin on every purchase with OroPocket: https://oropocket.com/app

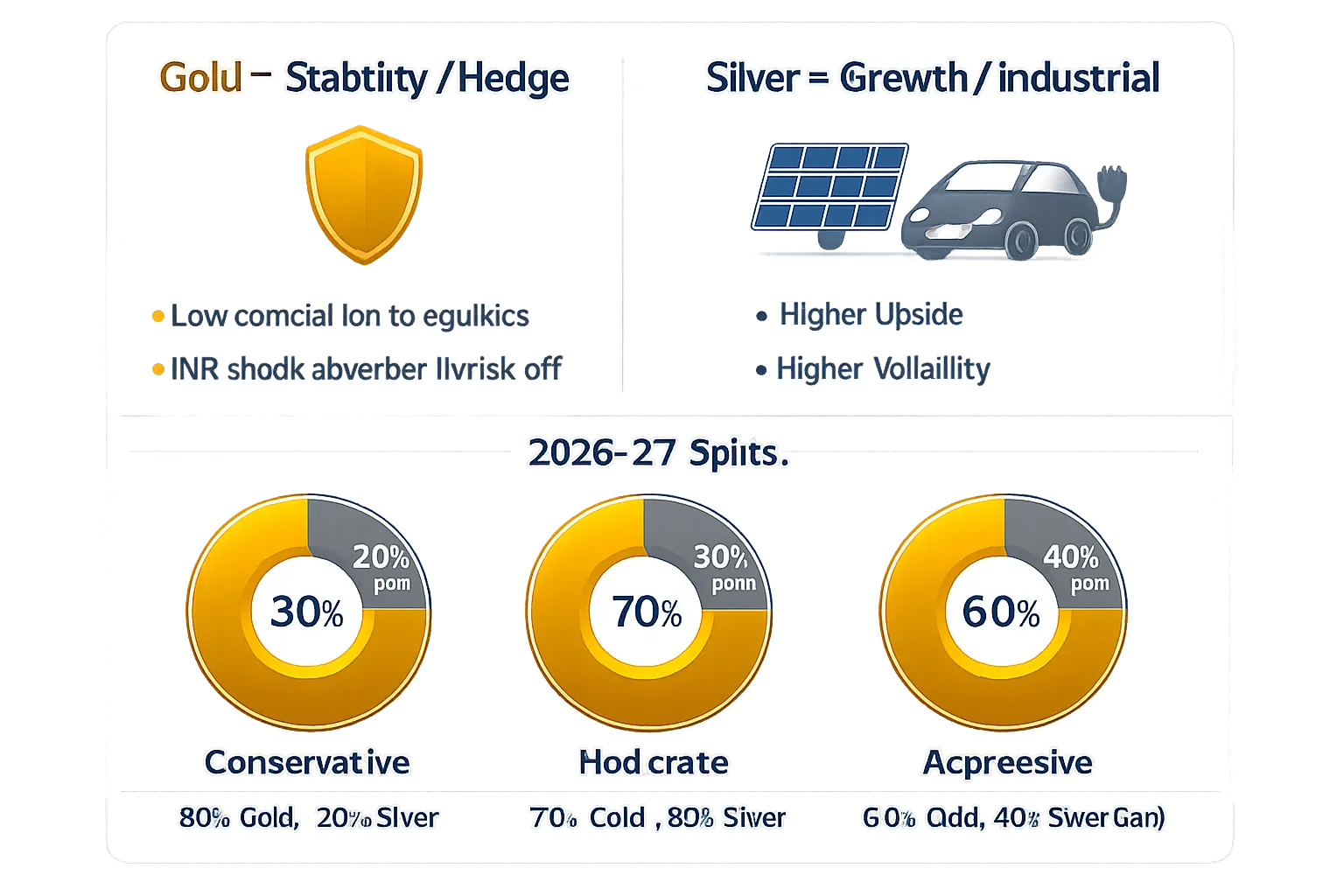

Gold vs silver roles in your portfolio (India lens) + 2026 splits

How each metal behaves

-

Gold: low equity correlation and an INR shock-absorber in global risk-off phases; use it as the core hedge in your metals sleeve.

-

Silver: dual precious + industrial demand (EVs, solar, electronics); higher upside potential with higher volatility – treat as a smaller satellite.

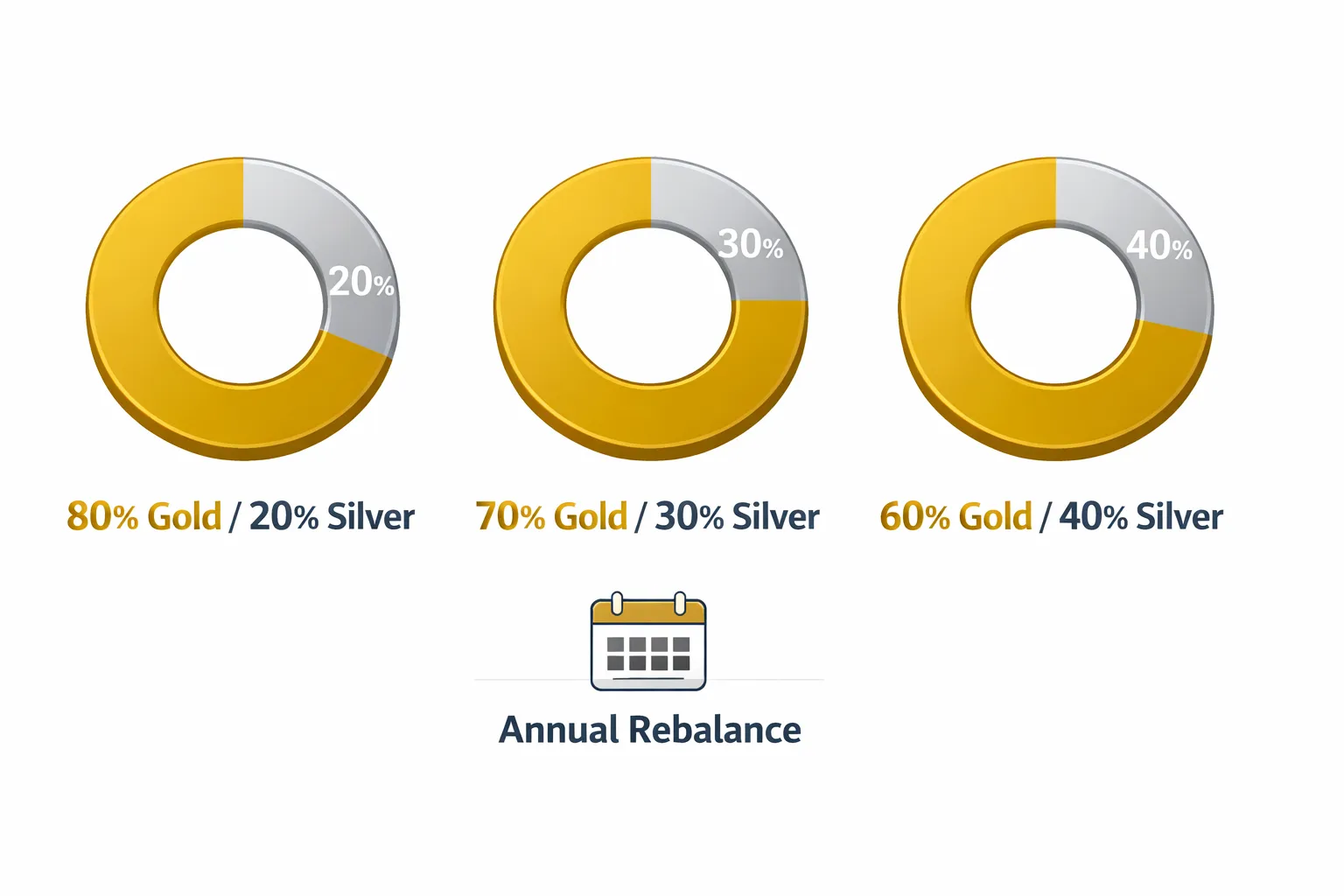

Suggested within-metals splits for 2026–27

-

Conservative: 80% gold / 20% silver (metals sleeve = 5–7% of total portfolio)

-

Moderate: 70% gold / 30% silver (metals sleeve = 7–12%)

-

Aggressive: 60% gold / 40% silver (metals sleeve = 10–15%, cap silver at 40%)

When each shines

-

Macro stress, inflation, rupee wobble: gold usually leads and cushions drawdowns.

-

Expansion and clean-tech buildout: silver can catch strong tailwinds from PV/EV cycles.

Practical barbell for beginners

-

Build a gold‑heavy anchor with silver‑light torque; rebalance annually or on ±25% drift.

“World Gold Council: A 7.5–15% gold allocation has historically improved risk-adjusted returns for Indian portfolios.” – Source

Deep-dive comparison: features, costs, liquidity, regulation, and unique benefits

What you can buy and how

-

OroPocket: digital 24K gold and silver; ₹1 entry; UPI-native; Bitcoin rewards; insured vaulting; in-app gifting.

-

Gold ETF (ICICI): gold exposure via exchange; requires demat + broker; expense ratio + bid–ask spread.

-

Silver ETF (ICICI): regulated silver exposure; similar mechanics to gold ETF.

-

RBI SGB: gold-only, sovereign-backed, interest paid semi-annually; tenor ~8 years with early exit windows.

Liquidity and access

-

OroPocket: buy/sell any time in-app; instant partial redemptions.

-

ETFs: buy/sell during market hours; depends on ETF liquidity.

-

SGB: primary issuance windows; exchange liquidity varies by series; best held to maturity or to early exit windows.

Costs and offsets

-

OroPocket: spread applies; effective cost can be offset by Bitcoin cashback, streak bonuses, spin rewards.

-

ETFs: expense ratio + tracking error + bid–ask; no rewards, but regulated structure.

-

SGB: no storage cost; interest income; potential premiums/discounts if trading on exchange.

Regulation and safety lens

-

ETFs/SGB: regulated market/securities framework; sovereign backing for SGB.

-

Digital gold: platform + vault partner model; evaluate custody, audits, insurance, and transparency; OroPocket works with authorized bullion partners, RBI-compliant processes, 100% insured vaults.

|

Option |

Metals |

Entry & How to Buy |

Liquidity & Access |

Costs/Fees |

Rewards/Interest |

Regulation & Safety |

Unique Benefits / Best For |

|---|---|---|---|---|---|---|---|

|

OroPocket (digital) |

Gold + Silver (24K) |

Start from ₹1 via UPI; no demat; in-app gifting |

24/7 in-app buy/sell; instant partial redemptions |

Buy–sell spread; no expense ratio |

Bitcoin cashback on every purchase; daily streak bonuses; spin-to-win; referral Satoshi |

RBI-compliant processes; authorized bullion partners; 100% insured vaults |

Best way to invest in gold and silver for first-timers; micro-SIPs; habit-building with rewards |

|

Gold ETF (ICICI) |

Gold |

Buy through broker/demat; exchange-traded |

Market hours; subject to ETF liquidity |

Expense ratio; bid–ask spread; tracking error |

None |

SEBI-regulated ETF structure |

Regulated, liquid gold sleeve; tactical trims/additions; SIP via broker |

|

Silver ETF (ICICI) |

Silver |

Buy through broker/demat; exchange-traded |

Market hours; subject to ETF liquidity |

Expense ratio; bid–ask spread; tracking error |

None |

SEBI-regulated ETF structure |

Regulated silver exposure; complements gold-heavy allocation |

|

RBI SGB |

Gold |

Primary issuance/tranches; can buy/sell listed series on exchange |

8-year tenor; early exit windows after year 5; exchange liquidity varies by series |

No storage cost; issue/redemption mechanics; possible exchange premium/discount |

Fixed interest paid semi-annually + gold price linkage |

Sovereign-backed |

Long-term, hold-to-maturity gold exposure; goal-linked planning without frequent rebalancing |

Costs, taxes, and liquidity (India 2026): what to expect and how to minimize drag

Cost control, the practical way

-

Batch tiny buys into 1–2 weekly purchases to reduce spread impact.

-

Use rewards: OroPocket Satoshi cashback, daily streak bonuses, and spin-to-win can lower your effective net cost over time – especially with consistent SIPs.

-

ETFs: prefer larger, liquid funds to keep bid–ask spreads and tracking error in check; place limit orders where possible.

Taxes, high level (illustrative; verify latest rules before investing)

-

Many gold/silver capital assets: short-term gains taxed per slab; long-term gains generally taxed at a flat rate without indexation beyond a specific holding period – confirm instrument-specific rules and current law before acting.

-

SGB: interest is taxable; capital gains at maturity are exempt under the scheme. Early exits follow standard capital gains rules based on holding period.

-

Keep records: save invoices, contract notes, demat statements, and app exports to simplify filing and accurate cost-basis tracking.

“From July 23, 2024, long-term gains on many gold/silver holdings are taxed at a flat 12.5% after 24 months, replacing the earlier 20% with indexation; SGB interest is taxable, while gains at maturity are exempt.” – Source

Liquidity checklist

-

Need T+instant: OroPocket in-app sells.

-

Need market-hour execution: ETFs.

-

Comfortable with long hold and interest: SGB.

Start small, stay systematic, and let rewards offset costs. Begin with ₹1 and earn free Bitcoin on every gold/silver purchase on OroPocket: https://oropocket.com/app

How to start (step-by-step): OroPocket, Gold ETF, Silver ETF, and SGB

OroPocket (gold + silver, ₹1 via UPI)

-

Download app (iOS/Android) and complete quick KYC.

-

Tap Gold or Silver, enter ₹1+, pay via UPI; holdings are instantly vaulted and insured.

-

Turn on weekly micro-SIPs; activate streaks and spins; refer friends for Satoshi bonuses.

ICICI Prudential Gold ETF

-

Open demat + trading account with your broker.

-

Search for the ETF symbol; place buy order during market hours.

-

Optional: set up SIP via broker if supported; review expense ratio and tracking error.

ICICI Prudential Silver ETF

-

Same as gold ETF steps; add as your silver sleeve.

-

Keep silver capped (e.g., ≤40% within metals) to manage volatility.

RBI SGB

-

Subscribe during issuance windows via bank/broker; or buy listed series on exchange (liquidity varies).

-

Plan to hold to maturity/early exit window to realize the scheme’s full benefits.

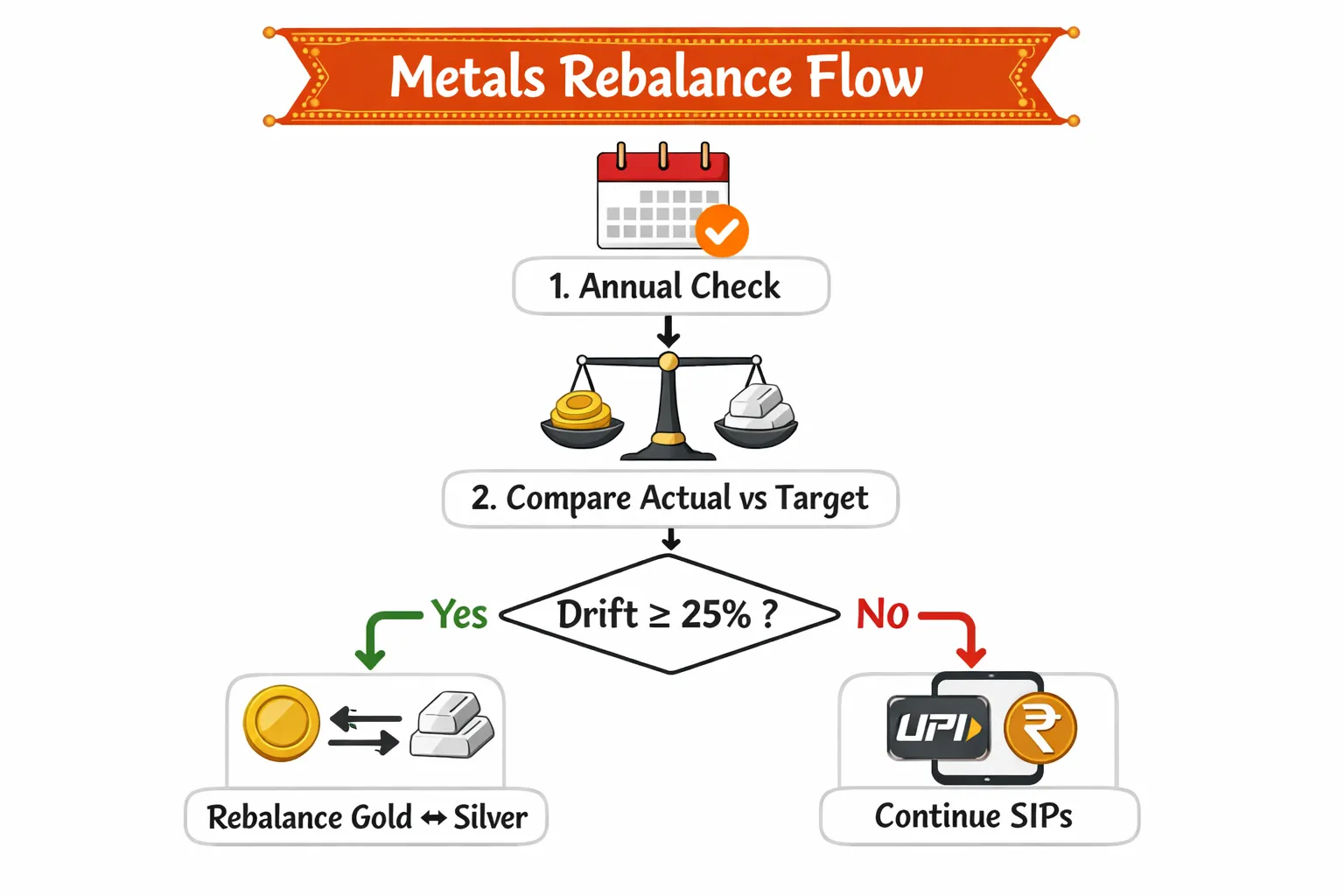

Rebalancing made simple: schedules, drift thresholds, and execution across tools

Your two-rule framework

-

Time-based: annual rebalance (good default for most investors).

-

Threshold-based: also rebalance if gold–silver split drifts ±25% from target within the metals sleeve.

How to execute per tool

-

OroPocket: check weights monthly; place a single corrective buy/sell during your annual review.

-

ETFs: review allocation on statement; place market-hour orders to restore targets.

-

SGB: generally do not trim core SGB unless reallocating for goal/tax reasons; adjust via ETFs/OroPocket instead.

Calendar anchors that help

-

Use Diwali/Dhanteras top-ups as mini-rebalances toward the underweight metal.

Keep it lean

-

Fewer, rules-based actions beat frequent tinkering; minimize taxes/fees and decision fatigue.

Risk controls and common mistakes to avoid

Guardrails

-

Cap silver at 40% within your precious‑metals sleeve (it’s higher beta); keep total metals at 5–15% of your overall portfolio based on risk.

-

Maintain a 3–6 month emergency fund outside investing apps so you never sell metals to fund short‑term needs.

-

Set your target split (e.g., 70% gold / 30% silver) and write it down. This answers “should I invest in gold or silver” by fixing roles: gold is the hedge, silver is the kicker.

Do/don’t

-

Do automate weekly SIPs; don’t chase headlines or short‑term spikes. The best way to invest in gold and silver is consistency.

-

Do one annual review; don’t overtrade to “optimize” every dip. Rebalance annually or on ±25% drift – nothing in between.

-

Do document rules (allocation caps, buy days, rebalance date); don’t improvise mid‑week.

-

Do prioritize large, liquid ETFs when using exchanges; don’t ignore bid–ask spreads and tracking error.

Behavioral edge

-

Fix two buy days (e.g., Monday/Thursday) to reduce decision fatigue and timing anxiety.

-

Use streaks and visible progress to keep momentum – simple, gamified cues help you stick to plan.

-

Keep silver as the smaller satellite sleeve; if you ever wonder “which is the better investment, silver or gold,” remember: gold is the core ballast, silver is the torque.

Ready to put rules over emotions? Start a gold‑heavy, silver‑light SIP from ₹1 via UPI and earn free Bitcoin on every purchase with OroPocket: https://oropocket.com/app

Copy-ready portfolios (India) you can start today

Student/first-jobber: ₹500/week

-

Metals sleeve = 7% of portfolio; within metals 70% gold / 30% silver.

-

Tools: OroPocket micro-SIPs; yearly rebalance.

Salaried pro: ₹5,000/month

-

Metals sleeve = 10%; within metals 70/30.

-

Tools: OroPocket for gold+silver; optional Silver ETF for exchange execution; annual + ±25% drift rule.

Long-horizon gold accumulator (low liquidity need)

-

Metals sleeve = 8–10%; 80/20 within metals.

-

Tools: Core via SGB; top-ups via OroPocket; adjust silver via Silver ETF.

Final verdict: Which should you choose? (+ next steps)

If you want the simplest way to build a gold+silver habit from ₹1

-

Choose OroPocket as your default: UPI speed, insured vaulting, and unique Bitcoin rewards that help offset costs. Ideal for first-time investors and micro-SIP discipline.

-

Practical answer to “what’s the best way to invest in gold and silver?” – start tiny, stay consistent, let rewards lower your effective cost.

If you need market-hour, regulated execution

-

Use ICICI Gold ETF and ICICI Silver ETF alongside or instead of micro-buys; great for tactical trims and broker-based SIPs if you already use a demat.

-

Works well if you prefer exchange execution and tighter control over orders and liquidity.

If your gold is truly long-term

-

Add SGB for the sovereign-backed hold component; plan around issuance windows and tenor.

-

Keep SGB as your core gold, and use OroPocket/ETFs for periodic rebalancing or top-ups.

Bottom line

-

Gold is your shock absorber; silver is your torque. Combine both, keep silver smaller, and rebalance on a schedule (annual or ±25% drift).

-

For most: a gold‑heavy sleeve with a smaller silver allocation offers a smoother ride. If you’re debating “should I invest in gold or silver,” the smart move is both – with gold as the anchor.

Call to action

-

Start in 30 seconds with ₹1 via UPI and earn free Bitcoin on every gold/silver purchase. Download the OroPocket app: https://oropocket.com/app