How to Invest in Gold: Best Options for Indians in 2026

How to Invest in Gold: Best Options for Indians in 2026

If you’re searching “how to invest in gold”, you’re likely feeling one (or all) of these:

-

Your bank balance is growing… but inflation is growing faster

-

Stocks feel exciting, but sometimes too volatile

-

You want a simple mobile-first way to start (ideally with UPI)

-

You don’t want purity doubts, locker headaches, or big minimums

In 2026, you have multiple mainstream ways to invest in gold – but the “best” option depends on what you value most: lowest cost, easiest SIP habit, best liquidity, or long-term benefits.

Below is the cleanest, beginner-friendly breakdown – plus a modern framework to pick what fits you.

“As of Jan 14, 2026, gold prices have increased by 183.65% over the previous five years (CAGR ~23.19%).” – The Economic Times

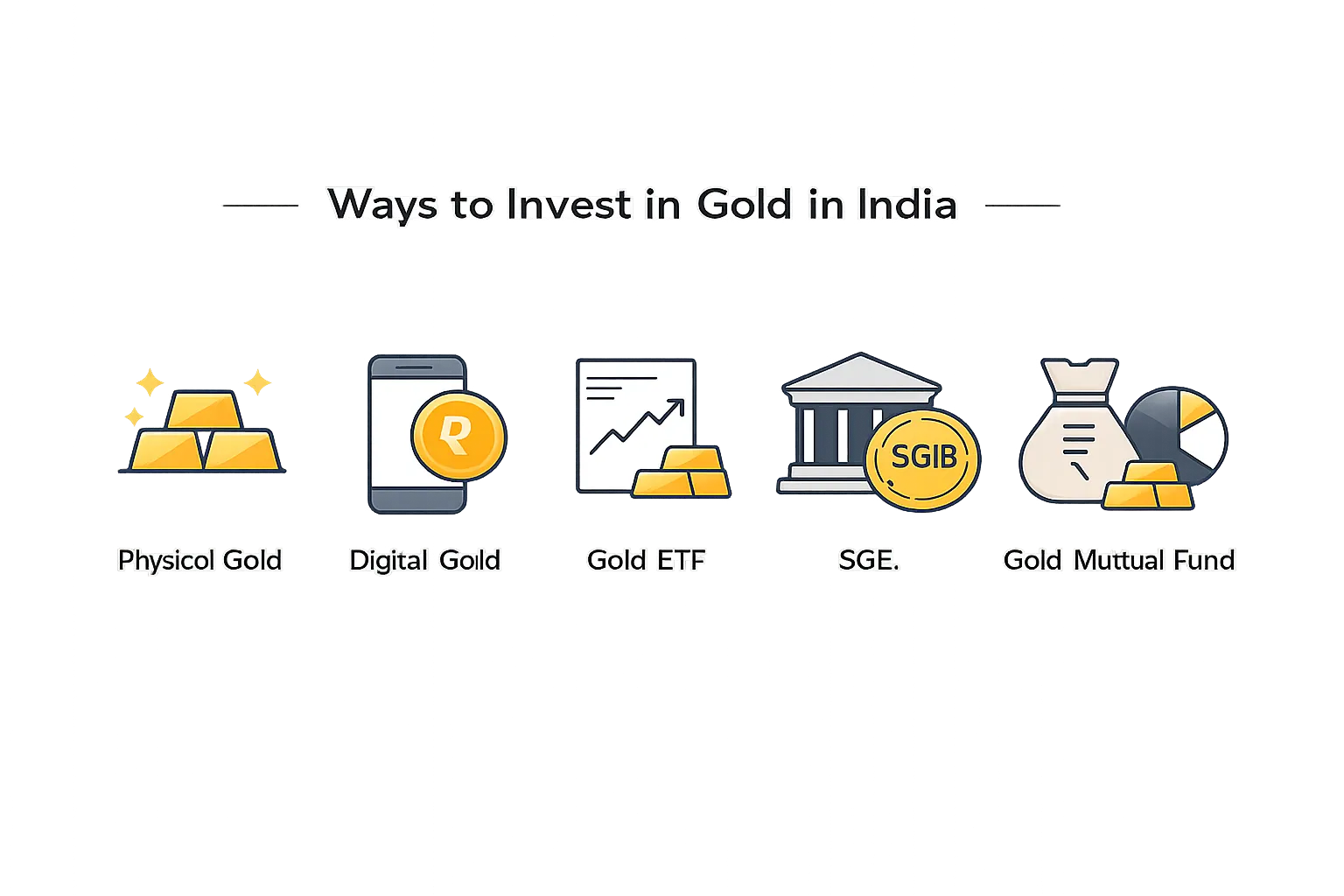

The 5 best ways Indians invest in gold (and who each is for)

Quick comparison table (what most people actually care about)

|

Option |

Best for |

Minimum |

Liquidity |

Main costs |

Complexity |

|---|---|---|---|---|---|

|

Digital gold (apps) |

Beginners, micro-saving, UPI convenience |

₹1–₹100 |

High (instant sell on most apps) |

GST + buy/sell spread |

Very low |

|

Gold ETFs |

Low-cost market-linked exposure |

1 ETF unit |

High (market hours) |

Expense ratio + brokerage |

Medium |

|

Sovereign Gold Bonds (SGBs) |

Long-term hold + (scheme) interest |

~1 gram |

Medium |

Low visible costs; liquidity limits |

Medium |

|

Gold mutual funds (FoF) |

SIP in gold without Demat |

₹100+ |

High |

Expense ratio (+ underlying ETF costs) |

Low–Medium |

|

Physical gold |

Gifting, jewellery usage |

Higher |

Medium |

Making charges + storage + deductions |

Low |

The big missing truth in most competitor guides:

The “best” gold product isn’t the one with the fanciest features. It’s the one you’ll actually buy consistently – without friction.

That’s why micro-investing + UPI has become the default behaviour for young India.

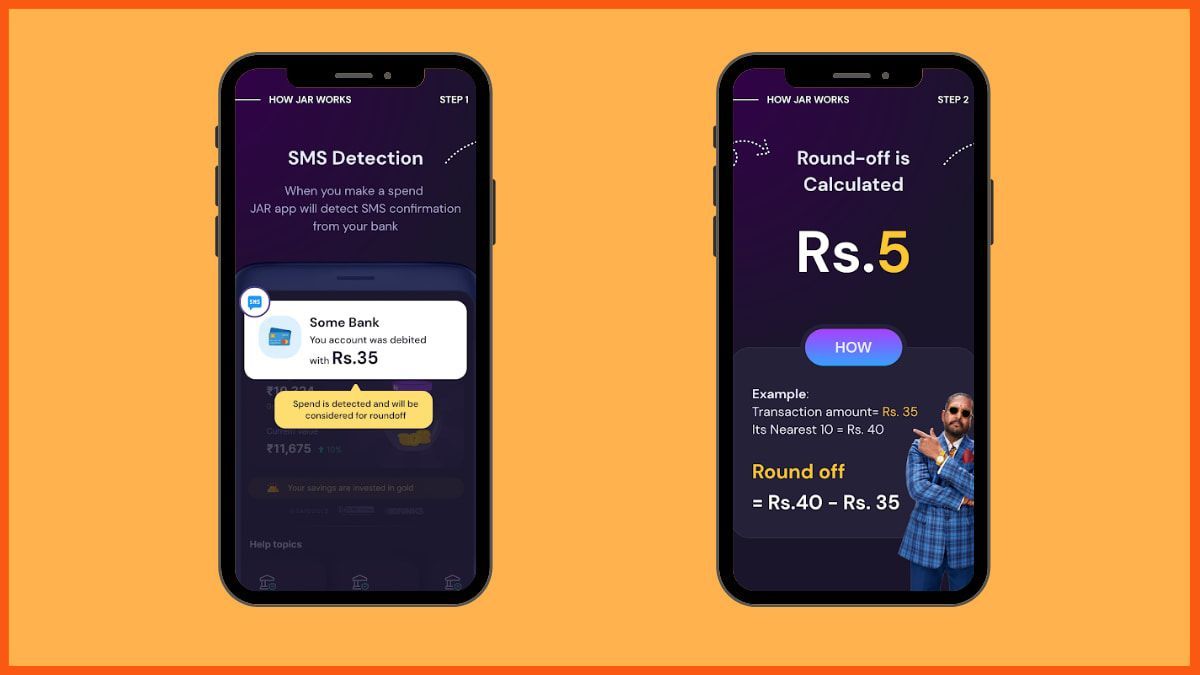

1) Digital Gold (apps): the fastest way to start investing in gold

What it is

You buy real 24K gold digitally, stored in insured vaults via authorised partners. You can sell anytime (and in some cases, redeem as coins).

Why it’s dominating in 2026

Because it solves the 4 biggest first-time investor problems:

-

Start tiny: ₹1 entry point

-

No locker: no storage stress

-

No purity drama: gold is standardised

-

UPI speed: buy in seconds, not days

If you want the step-by-step flow, see: how to buy digital gold in India via UPI (step-by-step).

Costs you must understand (so you don’t get surprised)

Digital gold typically includes:

-

3% GST on purchase

-

Buy/sell spread (difference between buy and sell rate; varies by provider)

“Digital gold purchase attracts 3% GST, and platforms often have a buy-sell spread (commonly ~2–3%).” – Axis Max Life (GST) + LinkedIn analysis on spread mechanics

For a deep, practical breakdown, read: digital gold charges explained (spread, GST, selling fees).

Why OroPocket is built for the real Indian investor (not just “finance nerds”)

OroPocket is designed for people who want progress, not complexity:

-

₹1 Entry Point: start instantly

-

Instant UPI payments: buy in under 30 seconds

-

100% secure & compliant: RBI-compliant + insured vault storage + authorised bullion partners

-

Gamified investing: streaks, spin-to-win, tiered rewards (habit > hype)

-

Free Bitcoin on every purchase: earn Satoshi cashback every time you buy gold/silver

You’re not “trading crypto.” You’re stacking rewards while building gold.

Emotional win: You feel in control – your wealth moves daily, even if it’s ₹10 at a time.

Stop watching. Start growing.

2) Gold ETFs: best for Demat users who want market pricing

What it is

A Gold Exchange Traded Fund tracks gold prices and trades like a stock on NSE/BSE. Typically needs a Demat + broker.

Best for

-

Investors already active in stocks

-

People who want transparent pricing during market hours

Watch-outs

-

Brokerage per buy/sell

-

Expense ratio (small, but real)

-

You’re restricted to market hours for execution

Verdict: Great for cost-conscious investors who already live inside Demat apps.

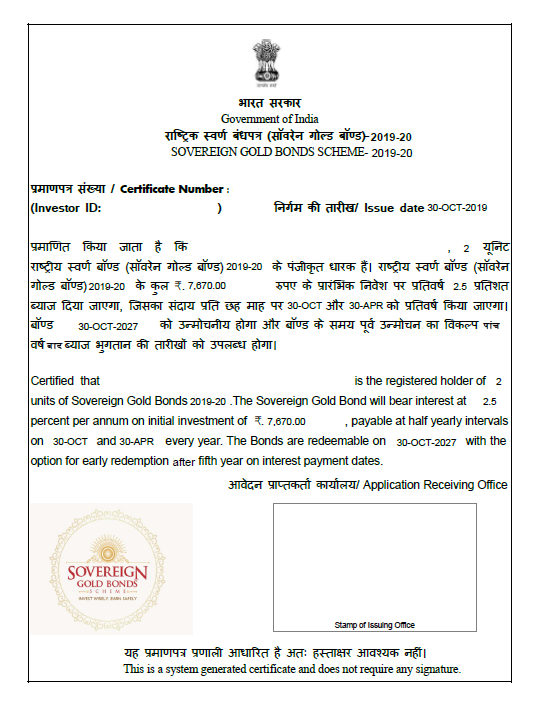

3) Sovereign Gold Bonds (SGBs): designed for long-term holders

What it is

Government-issued bonds where value tracks gold prices, and (depending on scheme terms) you may get fixed interest.

Best for

-

Long-term investors who can tolerate limited liquidity

-

People who like the “gold-linked + structured product” approach

Watch-outs

-

Issuances may be periodic

-

Secondary market liquidity can vary

-

Not ideal for “anytime buy/sell” behaviour

Verdict: Strong for planned long holds. Not the easiest product for building a weekly/monthly habit.

4) Gold mutual funds (Gold FoFs): SIP-friendly without Demat

What it is

Mutual funds that typically invest in Gold ETFs. You can invest via SIP without needing to trade ETFs directly.

Best for

-

SIP investors who prefer mutual fund platforms

-

People who don’t want Demat but still want gold exposure

Watch-outs

-

Expense ratios may stack (fund level + underlying ETF level)

-

Tracking error can happen vs spot gold

Verdict: A clean “set-and-forget” structure for SIP-style gold investing.

5) Physical gold (coins/jewellery): traditional, emotional, but expensive

What it is

Buying gold in hand – jewellery, coins, bars.

Best for

-

Weddings, gifting, cultural value

-

People who want usage value, not just investment returns

Watch-outs (hidden drags on returns)

-

Making charges (often the biggest return-killer in jewellery)

-

Purity checks, resale deductions

-

Storage/locker + theft risk

Verdict: Perfect for tradition and gifting. As an “investment,” it’s usually inefficient unless you buy investment-grade coins/bars and manage storage smartly.

The OroPocket edge: gold stability + Bitcoin upside (without “crypto trading”)

Most gold options give you one asset.

OroPocket gives you two:

-

Gold → stability, inflation hedge, long-term store of value

-

Bitcoin rewards (Satoshi cashback) → upside exposure as a reward layer, not a risky bet

This is the 2026 move for retail India:

-

Start tiny (₹1–₹100)

-

Build consistency (streaks + spin-to-win)

-

Stay motivated (rewards + progress you can see daily)

If you’re investing with small amounts, this guide is helpful: how to invest in gold with little money in India (start from ₹1).

Final verdict: Which gold investment should you choose in 2026?

-

Want the easiest beginner path with UPI + micro amounts? Digital gold

-

Want low-cost market exposure and already have Demat? Gold ETFs

-

Want a long-term structured hold? SGBs

-

Want SIP convenience without Demat? Gold mutual funds

-

Want tradition + gifting? Physical gold

The OroPocket move (for most beginners)

If you’re starting from zero and want a simple, rewarding way to build a gold habit:

Start with ₹1 on OroPocket. Buy digital gold via UPI. Earn free Bitcoin on every purchase.

Gold gives you stability. Bitcoin rewards add upside. The game mechanics build consistency.

Stop watching. Start growing.