How to Invest in Silver in India (Online and Offline): Complete Guide

Why Invest in Silver in India in 2026?

“Global industrial silver demand hit a record 680.5 million ounces in 2024.” – Source

The story for 2026 is simple: silver is no longer just “gold’s cousin.” It’s a powerful hedge against inflation and a critical input for the clean-energy and electronics boom. For Indian investors wondering how to invest in silver in India (online or offline), the timing aligns with strong structural demand and easy digital access.

Silver’s dual identity: hedge + industrial metal

-

Why silver complements gold in Indian portfolios

-

Gold is your core hedge; silver is the higher-beta satellite that can amplify returns when cycles turn favorable. Historically, silver tends to move more sharply than gold – both up and down – making it a tactical diversifier.

-

In rupee terms, silver helps diversify beyond equity/debt and often behaves differently from stocks during periods of inflation or global uncertainty.

-

-

How industrial demand (solar, EVs, electronics) drives cycles

-

Silver is essential for photovoltaic (solar) cells, vehicle electrification (EVs), 5G/AI-era electronics, medical devices, and power grid upgrades.

-

This industrial backbone creates multi-year demand cycles, which is why silver is both a store of value and a growth-linked commodity.

-

Is investing in silver a good idea right now?

-

Who should consider it

-

First-time investors: Want a low-ticket starting point beyond FDs? Silver offers affordability and diversification.

-

Diversifiers: Already own gold and mutual funds? Silver adds a distinct driver – industrial demand.

-

Bitcoin‑curious but cautious: Prefer a safer anchor with upside potential? Digital silver on OroPocket lets you accumulate silver from ₹1 and earn free Bitcoin rewards on every purchase.

-

-

How to size your allocation

-

Typical satellite allocation: 5–10% of your portfolio, depending on risk tolerance and time horizon.

-

Conservative: 3–5% as a stability-plus-diversifier sleeve.

-

Moderate: 5–10% to capture potential upside from the green-tech cycle.

-

Aggressive: Up to 10–15% only if you understand volatility and will rebalance.

-

Rebalance annually to avoid overexposure when silver rallies sharply.

-

Keywords to guide your research: how to invest in silver, how do I invest in silver, is investing in silver a good idea, should I buy silver, where to buy silver for investment.

Online vs offline at a glance

-

When to prefer digital/ETF/FoF vs physical coins/bars

-

Choose Digital Silver (app-based) if you want micro-investing from ₹1, UPI payments, instant liquidity, and hassle-free storage. Note: digital silver is not uniformly regulated like ETFs; choose compliant, transparent platforms.

-

Choose Silver ETFs/FoFs (SEBI-regulated) if you want market transparency, demat (for ETFs) or no-demat via FoFs, and exchange-traded liquidity. Great for SIP-style investing.

-

Choose Physical Coins/Bars if you want tangible ownership and gifting value, and you are comfortable handling purity checks, premiums, and storage.

-

-

Quick pros/cons snapshot (details later)

-

Digital silver (apps):

-

Pros: Start from ₹1, UPI, fractional quantities, fast buy/sell.

-

Cons: Platform custody/fees; not SEBI-regulated like ETFs.

-

-

Silver ETFs/FoFs:

-

Pros: SEBI-regulated, purity standards, transparent pricing, good liquidity.

-

Cons: Requires demat for ETFs; expense ratio and brokerage apply.

-

-

Physical coins/bars:

-

Pros: Tangible asset, gifting-friendly, no platform dependency.

-

Cons: Premiums over spot, 3% GST (bullion), storage/security risks, resale spreads.

-

-

SEO note: If you’re searching “how to invest in silver in India online” or “invest silver online,” consider starting with a small digital purchase or a Silver ETF/FoF and scale up gradually.

What this guide covers

-

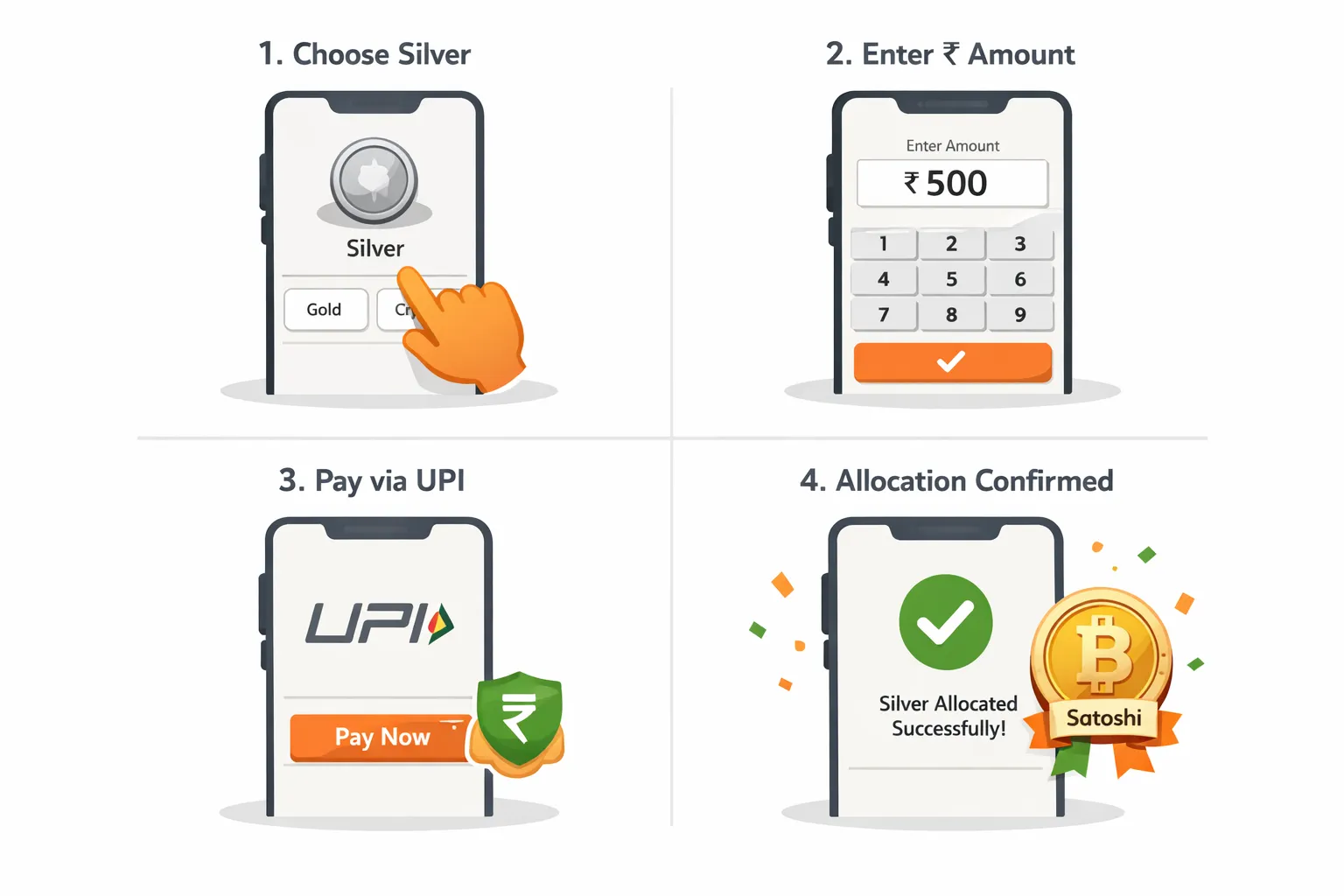

Step-by-step online UPI purchase flow to buy digital silver in minutes

-

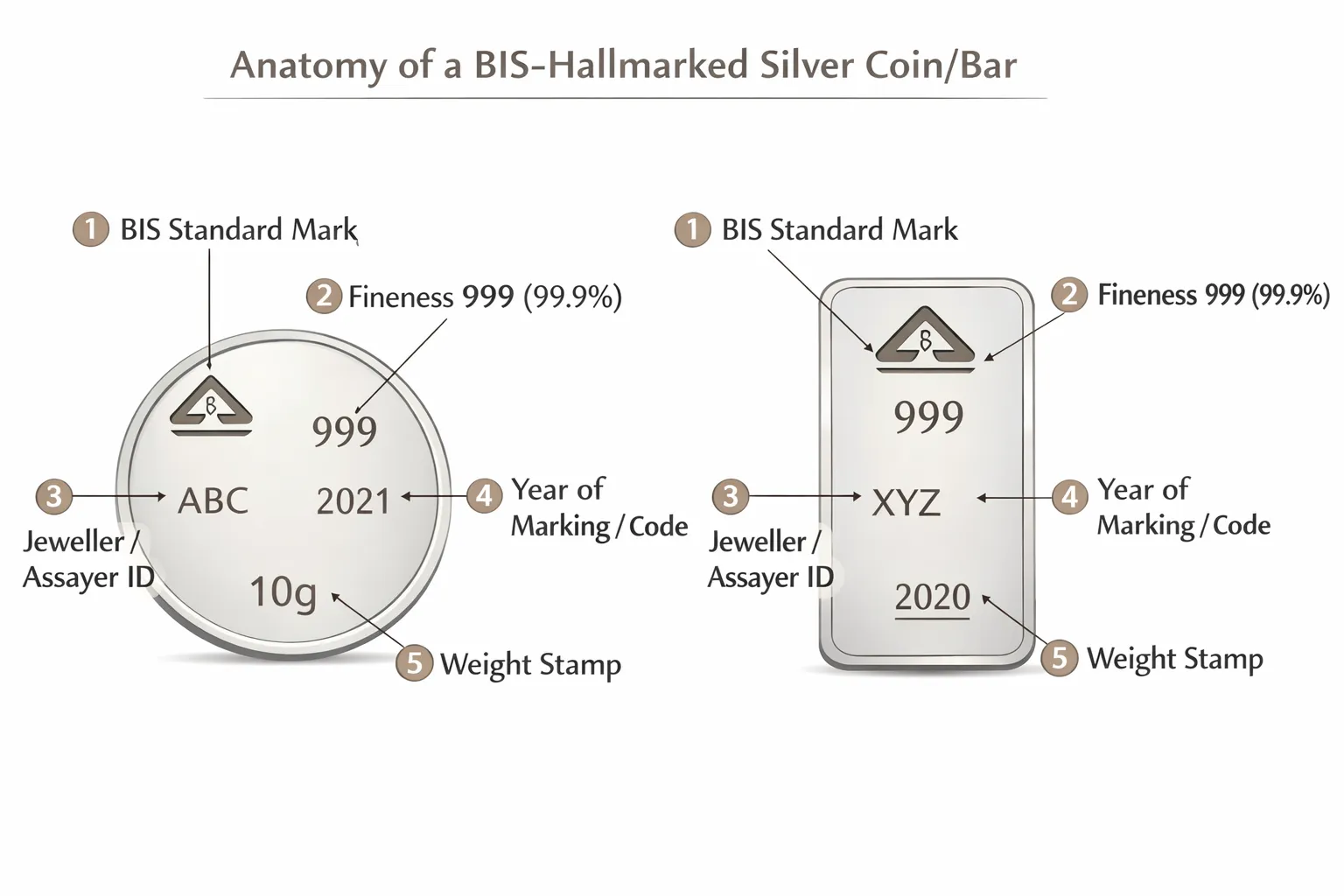

Purity checklist for physical silver (999 fineness, BIS hallmark, buyback policies)

-

Total cost calculator: premiums, spreads, storage, expense ratios, taxation

-

Liquidity and exit options across digital, ETF/FoF, and physical formats

-

Common mistakes to avoid (overpaying premiums, skipping purity checks, ignoring rebalancing)

Ready to start with as little as ₹1 and earn free Bitcoin on every silver purchase? Download the OroPocket app today: https://oropocket.com/app

Silver Basics in India: Pricing, Purity, and Regulation

How silver prices work in India

-

Global spot (USD) → INR: Silver is priced globally in USD (spot). Indian prices reflect USD/INR conversion plus applicable customs duty, logistics, and dealer margins.

-

Import duties and GST: Final retail quotes factor in customs duty on silver imports and 3% GST on bullion (higher GST applies to jewellery making charges).

-

Premiums over spot: Coins/bars trade at a premium due to fabrication (minting costs), freight/insurance, vaulting, and dealer margins. Smaller denominations (coins) carry higher per-gram premiums than large bars.

-

Market references: MCX prices and international spot move in tandem after currency and duty adjustments. Local supply/demand can add short-term basis differences.

Keywords to guide your research: how to invest in silver in India, silver how to buy, where to buy silver for investment.

Purity standards you must know

-

999 (99.9%) fineness for investment-grade silver: For investing (not adornment), look for 999/99.9% purity and clear weight stamps.

-

LBMA Good Delivery bars (for ETFs): Silver ETFs hold 30 kg bars meeting LBMA Good Delivery standards (99.9% fineness), with custody, valuation, and audits defined by SEBI.

-

BIS hallmarking for physical: When buying coins/bars offline, check for BIS mark, fineness (e.g., 999), jeweller/assayer ID, and year/code. Also ask about buyback terms and assay reports.

Who regulates what?

-

SEBI (Silver ETFs and Silver FoFs): Sets norms for investment in physical silver/silver-related instruments, custody with SEBI-registered custodians, valuation (LBMA reference), disclosure of NAV/risks, and audits. FoFs investing in Silver ETFs follow mutual fund disclosure frameworks.

-

Digital silver (private platforms): Not uniformly regulated like ETFs. Choose platforms with transparent pricing, trusted bullion partners, insured vaults, and clear redemption/buyback policies.

-

OroPocket compliance and safety: RBI-compliant flows with authorized bullion partners and 100% insured vaults. Start from ₹1 via UPI, invest silver online in seconds, and earn free Bitcoin (Satoshi) on every purchase.

“On Nov 24, 2021, SEBI enabled Silver ETFs via Circular SEBI/HO/IMD/DF2/CIR/P/2021/668, laying out investment, valuation, custody and disclosure norms.” – Source

Watch this before you buy

A quick explainer on silver formats in India – ETFs vs Digital vs Physical – so you can match the method to your goals and risk tolerance.

Ready to buy silver online with UPI and earn free Bitcoin on every purchase? Download the OroPocket app: https://oropocket.com/app

All the Ways to Invest in Silver (Online and Offline)

“As of Aug 2024, India’s Silver ETF category managed ~₹9,641 crore in AUM.” – Source

1) Digital Silver (OroPocket and similar platforms)

-

Fractional buying (start with ₹1), instant UPI, insured vaulting, easy gifting

-

Invest silver online in seconds via UPI, build a habit with micro-amounts, gift silver to family, and withdraw/sell anytime.

-

On OroPocket, you also earn free Bitcoin (Satoshi) on every silver purchase, with daily streaks and spin-to-win rewards to keep you motivated.

-

-

Platform and custody considerations

-

Digital silver isn’t uniformly regulated like ETFs. Choose platforms with authorized bullion partners, transparent pricing, insured vaults, and clear redemption options. Check storage fees and spreads.

-

2) Silver ETFs (SEBI-regulated)

-

Holds physical 99.9% silver, daily NAV, exchange liquidity; needs Demat

-

SEBI-regulated schemes investing in LBMA-standard 99.9% purity silver bars. Traded on NSE/BSE with live market liquidity.

-

Requires a demat + trading account; expense ratios and brokerage/DP charges apply.

-

3) Silver Fund of Funds (FoFs)

-

Invests into Silver ETF; no Demat needed; SIP-friendly

-

Mutual funds that buy units of Silver ETFs; ideal if you don’t want a demat account.

-

Great for SIPs and long-term accumulation with full transparency on NAV and holdings via fund disclosures.

-

4) Physical Silver (coins, bars, jewellery)

-

Ownership, BIS hallmarking, premiums/making charges, storage

-

Tangible asset for holding or gifting; check BIS hallmark, 999 fineness, and buyback policy.

-

Expect premiums over spot for coins/bars and making/wastage charges for jewellery; arrange safe storage (locker, insurance).

-

5) MCX Silver Futures (advanced)

-

Leverage, margins, roll-over costs; for experienced traders only

-

Exchange-traded derivatives with leverage; suitable for short-term trading strategies, not beginners.

-

Requires understanding margins, mark-to-market, and roll costs when shifting to next contracts.

-

Which method fits your goal and budget?

-

Beginner: Start with Digital Silver (₹1 via UPI) or a Silver FoF (no demat, SIP-friendly).

-

Long-term investor: Silver ETF (SEBI-regulated, transparent) or Silver FoF if you prefer no demat.

-

Trader/speculator: MCX Silver Futures (only if you’re experienced with leverage and risk).

-

Gifter: Physical coins/bars (BIS-hallmarked) or Digital Silver for quick, hassle-free digital gifting.

Comparison: Silver Investment Methods

|

Method |

How it works |

Minimum investment |

Regulation |

Purity standard |

Liquidity |

Storage |

Typical costs/fees |

Risks |

Who it suits |

|---|---|---|---|---|---|---|---|---|---|

|

Digital Silver (OroPocket) |

Buy fractional silver online; backed by vaulted metal; buy/sell via app |

From ₹1 |

Private platforms; choose trusted, compliant partners |

Typically 999 (platform-dependent) |

High (app-based instant sell) |

Custodied in insured vaults |

Platform spread, possible storage/withdrawal fees |

Platform/custody risk, pricing spreads |

First-time investors, micro-investors, gifters |

|

Silver ETF |

SEBI-regulated fund holding physical silver; traded on exchange |

Price of 1 unit (varies by ETF) |

SEBI-regulated |

LBMA Good Delivery, 99.9% |

High during market hours (NSE/BSE) |

Vaulted by custodian |

Expense ratio, brokerage, DP charges |

Tracking error, market volatility |

Long-term investors wanting transparency |

|

Silver FoF |

Mutual fund that invests in Silver ETF units |

Often ₹100–₹500 via SIP |

SEBI-regulated MF |

Same as underlying ETF (LBMA, 99.9%) |

Moderate (MF redemption timelines) |

Vaulted by ETF custodian |

Expense ratio (FoF + underlying ETF), exit loads (if any) |

Tracking difference, fund costs |

SIP investors, no-demat users |

|

Physical coins/bars/jewellery |

Buy from jewellers/refiners; you store and resell |

Varies (coins from ~₹1,000+) |

BIS hallmark standard for retail |

999 preferred for investment |

Variable; depends on dealer buyback |

At home or locker (insurance advised) |

Premiums over spot; jewellery making/wastage charges; 3% GST on bullion |

Theft, purity disputes, resale spreads |

Tangible-asset lovers, gifting |

|

MCX Silver Futures |

Trade standardized futures with margin/leverage |

Exchange margin requirement |

Exchange-regulated derivatives |

Price-linked; no physical purity unless taking delivery |

High (futures market hours) |

None (unless delivery) |

Brokerage, exchange fees, slippage; roll-over costs |

Leverage risk, volatility, margin calls |

Experienced traders/speculators |

Pro tip for SEO searchers of “how to invest in silver in India online” and “how to buy silver for investment”: start small with a Silver FoF or Digital Silver, learn the pricing/premium dynamics, then scale into a SEBI-regulated Silver ETF for long-term allocation.

Ready to invest silver online with UPI from ₹1 and earn free Bitcoin on every purchase? Download OroPocket now: https://oropocket.com/app

How to Invest in Silver Online via UPI (Step-by-Step with OroPocket)

Why go online with OroPocket

-

Start from ₹1, 24×7 convenience, instant UPI payments

-

Earn free Bitcoin (Satoshis) on every silver purchase – two assets for the price of one

-

Gamified wealth-building: daily streaks, spin-to-win, referral rewards

Step-by-step: buy silver in under 30 seconds

-

Download OroPocket (iOS/Android) and complete quick KYC

-

Tap “Silver” → enter amount (₹1+)

-

Pay via UPI (any app)

-

Receive instant confirmation; silver is allocated and stored in insured vaults

-

Track holdings in real time; sell anytime for instant liquidity

Maximize rewards and habits

-

Stack Satoshis: tiered Bitcoin cashback on every buy

-

Daily streak bonus (every 5 consecutive days)

-

Spin-to-win for extra gold/Bitcoin rewards

-

Refer friends: earn 100 Satoshi + free spin (both referrer and referee)

Safety and transparency

-

100% insured vaults; authorized bullion partners

-

RBI-compliant flows; clear pricing; audit-ready statements

Get started now and earn free Bitcoin on every silver purchase. Download the OroPocket app: https://oropocket.com/app

How to Buy Physical Silver in India (Coins, Bars, Jewellery) the Right Way

Decide your form: coins vs bars vs jewellery

-

Coins: Best for small denominations, gifting, or testing the waters. Expect higher per-gram premiums vs bars.

-

Bars: Lower premium per gram for larger amounts; ideal for investment-focused buyers seeking 999 fineness.

-

Jewellery: Great for sentimental and cultural value, but typically higher making/wastage charges and lower resale efficiency.

Purity and hallmarking checks

-

Look for 999 fineness and BIS hallmarking identifiers on coins/bars

-

Ensure the fineness stamp (e.g., 999/99.9%) is clearly visible.

-

Check for BIS hallmark components and HUID where applicable.

-

-

Verify weight, brand/refiner, packaging integrity

-

Prefer sealed, tamper-evident packs from reputed refiners.

-

Cross-check weight on a calibrated scale; retain assay cards/certificates.

-

“BIS hallmarking for silver specifies purity/fineness (e.g., 999) and hallmark identifiers; consumers can verify details via BIS systems and guidelines.” – Source

Understanding pricing

-

Spot price vs premium: Retail price = global/MCX-linked spot + dealer premium (fabrication, logistics, margin).

-

Making and wastage charges: Significantly higher on jewellery than coins/bars; confirm before buying.

-

GST: 3% on silver bullion; jewellery typically attracts 3% on metal + ~5% on making charges.

Storage and insurance

-

Home safe vs bank locker: Use a high-quality safe or bank locker; avoid frequent handling.

-

Documentation: Keep invoices, hallmark/assay certificates, and photos for insurance claims and resale.

Buyback and liquidity

-

How jewellers/refiners quote: Expect a discount to spot on resale; spreads are wider for jewellery, narrower for larger bars.

-

Documentation needed: Carry original invoice and any assay/hallmark documentation to streamline buyback.

Planning to start with digital first and keep it hassle-free? Buy silver from ₹1 with UPI and earn free Bitcoin on every purchase – download OroPocket: https://oropocket.com/app

Costs, Liquidity, Storage, and Risk: What You Actually Get

True cost of ownership by method

-

Digital silver (apps like OroPocket)

-

Platform spread: The difference between buy/sell price covers minting, vaulting, and operations. Always check live spread before placing an order.

-

Vaulting/maintenance: Some platforms charge storage or redemption/delivery fees; verify in-app pricing and FAQs.

-

GST applicability: GST may apply to platform fees or redemption; review tax notes in the app.

-

Bonus offset: On OroPocket, Bitcoin rewards (Satoshis) on every silver purchase can offset part of your effective cost.

-

-

Silver ETFs/FoFs (SEBI-regulated)

-

Expense ratio: Ongoing fund management cost embedded in NAV.

-

Brokerage/DP charges: Pay when buying/selling ETFs through a broker; FoFs avoid DP fees but have mutual fund expense.

-

Bid–ask spreads: Small gap between ETF buy/sell quotes can impact intraday execution.

-

Tracking error/difference: Returns can deviate slightly from physical silver due to costs and cash positions.

-

-

Physical (coins, bars, jewellery)

-

Premium over spot: Fabrication, dealer margin, and logistics; smaller coins often carry higher per-gram premiums vs larger bars.

-

Making/wastage charges: High for jewellery; confirm these upfront.

-

GST: Generally 3% on bullion; jewellery typically adds ~5% on making charges (in addition to metal GST).

-

Locker cost: Bank locker or home safe costs; consider insurance as well.

-

-

MCX Silver Futures (advanced)

-

Trading costs: Brokerage, exchange fees, and potential slippage.

-

Roll costs: If you hold beyond expiry, shifting to the next contract can add carry costs (especially in contango).

-

Margin funding: You must maintain margins; adverse moves trigger margin calls.

-

Liquidity and exit considerations

-

ETFs/FoFs: ETFs trade during market hours with T+2 settlement for delivery; FoFs follow mutual fund redemption timelines (not instant).

-

Digital silver: Platform-led instant sell (subject to spreads and platform hours/policies). Funds are typically credited to your linked payment method or wallet quickly.

-

Physical: Liquidity depends on jeweller/refiner buyback policies. Expect buyback spreads; documentation (invoice, assay) speeds up the process.

-

Futures: High market liquidity but mark-to-market settlement daily; not “investment” liquidity – this is a trading product.

Storage, purity, and counterparty risks

-

Physical: You are responsible for storage, theft risk, and verification. Use BIS-hallmarked products (999 fineness), keep invoices, and consider insurance.

-

Digital: Custody and vaulting are platform-managed. Choose transparent providers with authorized bullion partners, insured vaults, and clear redemption/buyback terms. OroPocket uses 100% insured vaults and authorized bullion partners.

-

ETFs/FoFs: Custody is with SEBI-registered custodians; funds follow disclosure, valuation, and audit norms. This reduces counterparty opacity relative to unregulated channels.

-

Counterparty concentration: Avoid overexposure to any single dealer/platform; for larger allocations, diversify by instrument type (ETF + digital + physical as needed).

Volatility and leverage

-

Silver’s higher beta vs gold: Silver typically moves more than gold in both directions – great for upside bursts, but you must be comfortable with drawdowns.

-

Futures are advanced tools: Leverage magnifies P&L; small price moves can trigger margin calls. Suitable only for experienced traders with strict risk controls and clear stop-loss rules.

Putting it together

-

Investing (long-term, hands-off)

-

Prefer SEBI-regulated Silver ETFs (or FoFs if you don’t want a demat) for transparent pricing, custody, and easy portfolio integration.

-

Use Digital Silver (OroPocket) for micro-investing via UPI from ₹1 and to build discipline with daily streaks; Bitcoin rewards add an extra edge.

-

-

Trading/speculation (short-term, active)

-

Consider MCX Silver Futures only if you understand leverage, roll mechanics, and risk management.

-

-

Gifting/sentimental ownership

-

Physical coins/bars with BIS hallmarking for occasions; budget for premiums and storage; keep documentation for buyback.

-

-

Sizing and behavior

-

Keep silver as a satellite allocation aligned to your risk tolerance and time horizon; rebalance annually.

-

Compare total cost of ownership (fees, spreads, taxes) and the ease of exit before choosing your channel.

-

Want low-cost, instant access and free Bitcoin rewards on every silver buy? Start with OroPocket from ₹1 via UPI: https://oropocket.com/app

Taxes on Silver Investments in India (2026 Rules)

The basics

-

Capital gains apply across methods; keep invoices, contract notes, and platform statements for accurate computation.

-

New regime highlights (post-2024 changes): Long-term capital gains (LTCG) on specified non‑equity assets taxed at 12.5% without indexation, once you cross the prescribed holding period. Short-term capital gains (STCG) taxed at your income tax slab.

-

Always verify current Finance Act updates and consult a qualified tax advisor for your situation.

Method-wise overview

-

Physical silver (coins, bars, jewellery): Capital gains on sale; premium and making charges paid upfront don’t get indexation. Jewellery may have higher buy/sell spreads.

-

Digital silver (platforms): Treated like physical for tax purposes; capital gains on redemption/sale; platform/storage fees may include GST.

-

Silver ETFs and Silver FoFs (mutual funds): Non‑equity classification; capital gains based on holding period. ETFs need demat; FoFs don’t.

-

MCX silver futures: Business/speculative income, marked to market daily; turnover, audit thresholds, and ITR-3 implications may apply.

How to calculate gains and plan ahead

-

Set-off and carry-forward rules: Loss set-off differs for capital gains vs business/speculative income; consult a professional for treatment and return filing.

-

Documentation checklist:

-

Physical: Invoice, weight/purity details, BIS/HUID info (if applicable).

-

Digital: Platform purchase/sale statements, fee schedules.

-

ETFs/FoFs: Contract notes, demat statements (ETF), account statements (FoF).

-

Futures: Broker contract notes, P&L/MTM statements, turnover report.

-

Tax Treatment Summary (Verify latest Finance Act updates)

|

Method |

Holding period for STCG/LTCG |

STCG tax rate |

LTCG tax rate |

Indexation |

GST notes |

Special considerations |

|---|---|---|---|---|---|---|

|

Physical silver (coins, bars, jewellery) |

STCG: ≤24 months; LTCG: >24 months |

Taxed at slab |

12.5% (plus surcharge/cess) |

Not allowed |

3% GST on bullion; jewellery typically 3% on metal + ~5% on making charges |

Keep invoices; resale spreads may reduce effective gains |

|

Digital silver (platforms) |

STCG: ≤24 months; LTCG: >24 months |

Taxed at slab |

12.5% (plus surcharge/cess) |

Not allowed |

Platform/storage/redemption fees may include GST |

Treated akin to physical; verify platform statements |

|

Silver ETF (SEBI-regulated) |

STCG: ≤12 months; LTCG: >12 months |

Taxed at slab |

12.5% (plus surcharge/cess) |

Not allowed |

No GST on buy/sell; brokerage/DP charges apply |

Exchange-traded; tracking error possible |

|

Silver FoF (mutual fund) |

STCG: ≤24 months; LTCG: >24 months |

Taxed at slab |

12.5% (plus surcharge/cess) |

Not allowed |

No GST on units; expense ratio/exit load (if any) |

No demat needed; NAV-based redemption timelines |

|

MCX silver futures |

Not applicable (business/speculative income) |

Taxed at slab as business/speculative income |

Not applicable |

Not applicable |

Brokerage/exchange fees; no GST on trading |

MTM daily; turnover/audit/ITR-3 considerations apply |

Note: The above is a general guide. Tax laws can change; verify current rules, surcharge/cess, and filing requirements with a tax professional.

Want a simple, tax‑aware way to start? Buy silver from ₹1 via UPI and get free Bitcoin rewards on every purchase with OroPocket: https://oropocket.com/app

Smart Strategies to Invest in Silver (SIPs, DCA, Timing, Allocation)

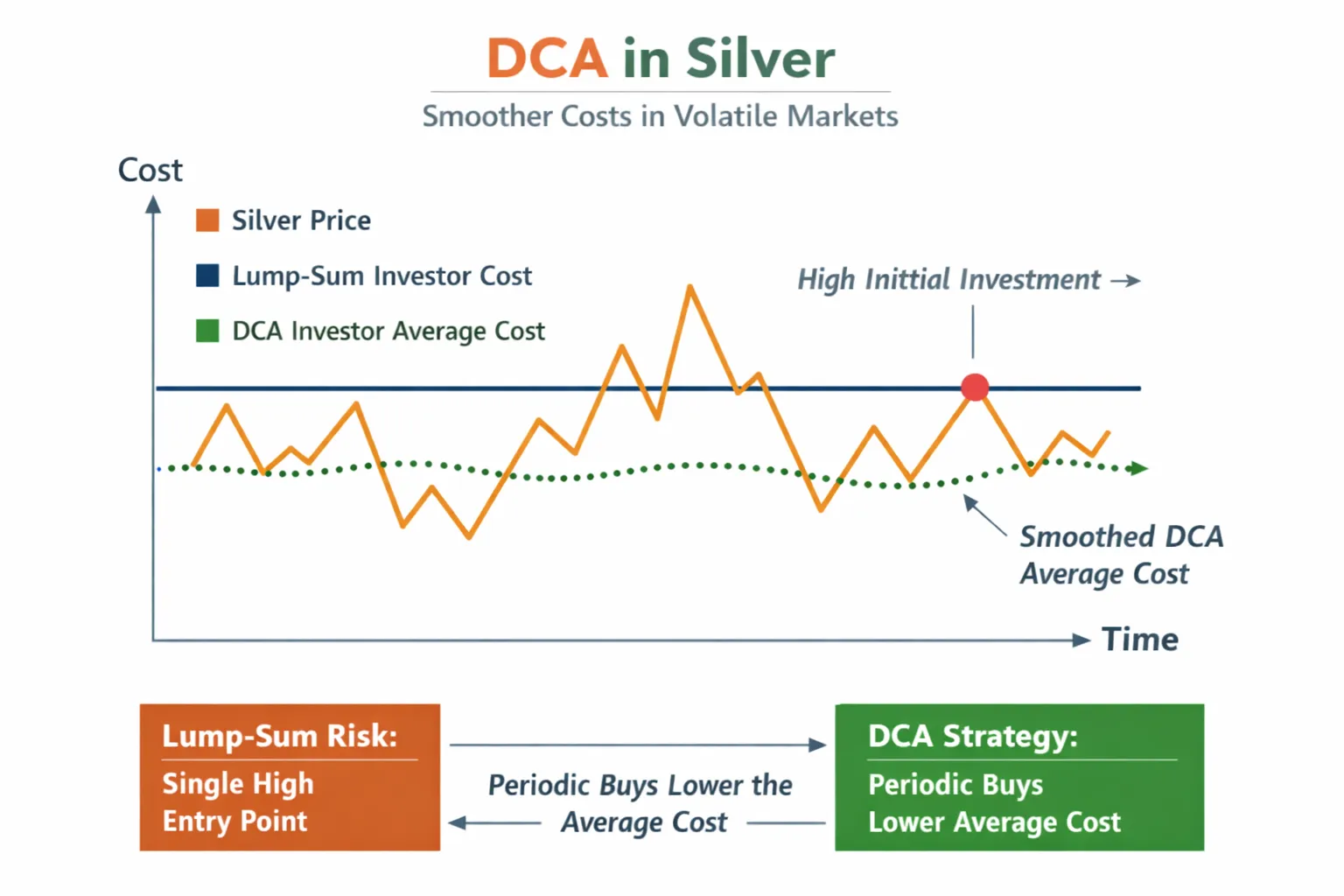

Build gradually with SIP/DCA

-

Why rupee-cost averaging suits a volatile asset like silver

-

Silver is more volatile than gold; fixed periodic purchases smooth out your average cost and reduce timing risk.

-

DCA limits regret: you won’t overcommit at peaks or miss dips entirely.

-

-

Sample DCA plan (via OroPocket)

-

Start small: ₹100–₹500 daily or weekly.

-

Automate buys with reminders; use UPI for quick, frictionless payments.

-

Scale up during market weakness; keep the base DCA constant.

-

Allocate wisely and rebalance

-

Treat silver as a satellite holding; rebalance annually

-

Keep silver at 5–10% (typical range); trim on big rallies, add after corrections.

-

-

Combine with gold for stability

-

Use gold as the core, silver as higher-beta satellite. OroPocket’s Bitcoin rewards add asymmetric upside on every purchase – two assets for the price of one, without buying crypto directly.

-

Event- and seasonality-aware buying

-

Festive demand spikes can widen retail premiums; plan big physical purchases off-peak.

-

Watch USD, interest rates, and risk sentiment: stronger USD/tighter rates can pressure silver; easing conditions often help.

Automate habits with OroPocket

-

Daily streaks keep you consistent; earn a bonus every 5 consecutive days.

-

Spin-to-win for extra gold/Bitcoin rewards.

-

Refer and grow together: earn 100 Satoshi + a free spin when friends join.

Start building your silver stack from ₹1 via UPI – and earn free Bitcoin on every buy. Download OroPocket: https://oropocket.com/app

Common Mistakes to Avoid When Investing in Silver

Chasing price spikes or trying to time every move

Silver is volatile. Buying after big green candles often means overpaying. Most retail losses come from fear/greed whiplash.

-

Fix it: Use SIP/DCA (small, periodic buys) to smooth your entry price. Set a target allocation and stick to it.

Ignoring purity and hallmarking (physical)

Unstamped, non‑hallmarked pieces can mean under‑purity or disputes at resale.

-

Fix it: For investment, prefer 999 (99.9%) purity with BIS hallmark and proper invoices/assay cards. Verify weight and packaging integrity.

Overpaying making charges for jewellery as “investment”

Jewellery carries making/wastage charges and may fetch a lower buyback price.

-

Fix it: If your goal is returns, buy coins/bars (lower premium per gram) or consider ETFs/FoFs. Keep jewellery for sentimental use.

Misjudging liquidity (large bars vs ETFs vs platform sells)

A 1 kg bar can be harder to liquidate at fair spreads than smaller denominations or exchange‑traded units.

-

Fix it: Match format to your exit plan. ETFs offer market‑hour liquidity; digital platforms can enable instant sells; large physical bars suit long‑term holding.

Using leverage via futures without experience or risk controls

Margin calls and slippage can wipe out capital fast.

-

Fix it: Avoid MCX futures unless you’re an experienced trader with strict position sizing and stop‑loss rules. Long‑term investors should stay unlevered.

Over-allocating to one metal; not rebalancing

Putting 30–50% in a single commodity amplifies drawdowns and regret.

-

Fix it: Keep silver as a satellite (typically 5–10%). Rebalance annually – trim after strong rallies, add after corrections.

Choosing unverified platforms; not reviewing custody/audit disclosures

Platform risk is real. Lack of clarity on vaulting, insurance, and spreads can erode returns.

-

Fix it: Use transparent providers with authorized bullion partners, insured vaults, and clear pricing. OroPocket offers RBI‑compliant flows, 100% insured vaulting, and instant UPI buys from ₹1 – plus Bitcoin rewards on every purchase.

Invest smart, avoid these traps, and let habits do the heavy lifting. Start from ₹1, automate with UPI, and earn free Bitcoin on every silver buy with OroPocket: https://oropocket.com/app

Conclusion: Start Small, Go Digital – Earn Free Bitcoin with OroPocket

-

Silver is a powerful diversifier with industrial tailwinds. Start with a small allocation, keep a long horizon, and let compounding plus discipline do the work.

-

For beginners, seamless online investing via UPI changes the game – no storage hassles, transparent pricing, and instant liquidity.

-

With OroPocket, you can start from ₹1, buy/sell anytime, and earn free Bitcoin (Satoshis) on every silver purchase – plus daily streaks, spin-to-win, and referral rewards to build habits that last.

-

100% insured vaulting, RBI‑compliant flows, and authorized bullion partners ensure peace of mind from day one.

-

Next step: download the OroPocket app and make your first ₹1 silver purchase today.

Start now: Download OroPocket at https://oropocket.com/app and stack silver with UPI in seconds – while earning Bitcoin rewards on every purchase.