How to Invest in the Gold Market in 2026: Digital Gold, SGBs, ETFs, and Gold Stocks

Why Gold Still Wins in 2026 (India-first, no-nonsense intro)

The problem you’re solving in 2026

-

Your money is silently shrinking. Savings accounts rarely beat inflation, and FDs barely keep up. That’s negative real return – your ₹100 today buys less next year.

-

Equity markets are choppy. You need a hedge that actually works in India, not just in textbooks.

“In FY24–FY25, typical big-bank savings rates hovered around 3–3.5% while CPI inflation averaged 5–6% – net negative real returns.” – Source

Note: Source: RBI banking data; MOSPI CPI releases.

Why gold remains core

-

Hedge against inflation and INR depreciation: When the rupee weakens or prices rise, gold historically holds value.

-

Liquidity across market cycles: Globally accepted; easy to sell or pledge when you need cash.

-

Works for every budget: From lump-sum to micro-investing via UPI – start from ₹1 on OroPocket and build a habit without “waiting to save more.”

What this guide covers

-

How to invest in the gold market: Digital Gold, Sovereign Gold Bonds (SGBs), Gold ETFs, Gold Mutual Funds, and how invest in gold stocks (gold miners).

-

What is the best investment for gold in 2026? We compare returns, risks, taxes (latest 2026 rules), and costs for each route.

-

A no-jargon decision tree to choose your path + step-by-step actions to start from ₹1 on OroPocket.

Who this is for

-

First-time investors taking control of idle savings

-

Salaried professionals who want stability without sacrificing growth

-

Bitcoin-curious folks who want upside without direct crypto risk

-

Tradition-meets-tech buyers who want the purity and cultural comfort of gold, with the speed of UPI

If you’re searching where to invest in gold, how to invest in gold market efficiently, or what is the best investment for gold this year (including how invest in gold stocks), this guide gives you a simple, India-first plan to act today – not “someday.”

Start building your gold stack in 30 seconds. Download the OroPocket app: https://oropocket.com/app

2026 Gold Market Snapshot + The 4 Main Ways to Invest

India’s gold story is as strong as ever. Cultural demand stays sticky even at record prices, while investment demand has surged with UPI-native, app-based access. If you’re asking where to invest in gold or how to invest in gold market routes that fit your budget and risk, here’s the no-fluff view.

Quick snapshot of the Indian gold market

-

Dual engine: cultural + investment demand; prices at/near highs keep hitting headlines.

-

Digital rails: UPI-native apps make micro-investing seamless – buy gold in seconds from ₹1.

-

Broader participation: SIPs in paper-gold, SGBs for long-term, and even selective exposure via gold miners.

“India remains among the top global consumers; 2025 investment demand reached ~239 tonnes (highest since 2013) despite price highs.” – Source

The 4 main ways to invest today

-

Digital Gold (OroPocket): Start from ₹1 via UPI, 24K insured vaulting, instant liquidity, and you earn free Bitcoin rewards (Satoshi) on every purchase – two assets for the price of one.

-

Sovereign Gold Bonds (SGBs): Govt‑backed, earn 2.5% interest annually plus gold price returns; best for long-term holders who can wait till maturity.

-

Gold ETFs/Gold Mutual Funds: Market-traded “paper gold,” SIP-friendly, no storage hassles; suitable if you prefer regulated market exposure and portfolio automation.

-

Gold Stocks/Mining ETFs: Indirect play on gold prices via miners; higher risk/higher potential upside than bullion – ideal if you’re exploring how invest in gold stocks with a longer horizon.

When each shines

-

Short-term parking: Digital Gold offers quick entry/exit and tiny ticket sizes – great for building a daily/weekly habit or parking cash between paychecks.

-

Long-term compounding: SGBs reward patience (interest + potential tax benefits at maturity). Gold ETFs/Gold MFs work well for disciplined SIPs.

-

Liquidity needs: Digital Gold and ETFs are easiest to liquidate fast; SGBs shine if you hold to maturity.

-

Ticket size: Start from ₹1 with Digital Gold; ETFs/MFs can start with small SIPs; SGBs typically require at least 1 gram equivalent.

-

Tax preference: SGBs at maturity are tax-exempt (as per current rules). ETFs/MFs and digital gold follow capital gains rules – know your slab and holding period.

What changed recently (high level)

-

Capital gains regime rationalised; indexation rules simplified to make comparisons easier across products.

-

SGB redemption at maturity remains tax-exempt under current rules, reinforcing their long-term appeal.

Quick safety checklist

-

Counterparty: Who issues the product (Govt/SEBI-regulated fund/platform)?

-

Custody: Where is your gold held – insured vault, trustee, or fund custodian?

-

Costs: Spreads, expense ratios, making charges (if any), brokerage, exit loads.

-

Taxation: Holding period, LTCG/STCG rules, and SGB exemptions at maturity.

-

Exit routes: How (and how fast) can you sell or redeem? Any lock-ins or penalties?

If you’re deciding what is the best investment for gold – physical alternatives vs paper-gold vs miners – this guide will make the trade-offs clear and show you exactly where to invest in gold based on your goals.

Ready to start from ₹1 and get free Bitcoin rewards on every gold purchase? Download the OroPocket app: https://oropocket.com/app

Compare Your Options: Digital Gold vs SGBs vs ETFs vs Gold MFs vs Stocks

A clear, side-by-side view so you can decide where to invest in gold based on your budget, liquidity needs, taxes, and risk appetite.

Feature-by-feature comparison (at a glance)

|

Option |

Minimum investment |

Liquidity |

Typical costs (GST/spread/expense ratio) |

Taxes (holding period + LTCG/STCG) |

Storage/Counterparty |

Ideal for |

Key risks |

|---|---|---|---|---|---|---|---|

|

Digital Gold (OroPocket) |

From ₹1 via UPI |

Instant buy/sell on app; fast access to funds |

~3% GST on buy; platform buy–sell spread (often ~1–3%); vaulting insured |

>24 months: LTCG ~12.5% (no indexation); ≤24 months: STCG at slab rates |

24K gold in insured vaults with authorized bullion partners; platform/custodian oversight |

Micro-investing, daily/weekly stacking, gifting, quick liquidity |

Platform spread, GST on purchase, policy changes |

|

Sovereign Gold Bonds (SGBs) |

1 gram equivalent per unit |

Primary: 8-year maturity (early exit from year 5 via RBI windows); Secondary market liquidity varies (may trade at premium/discount) |

No GST; no making charges; brokerage if bought/sold on exchange |

Interest taxable at slab; capital gains exempt on redemption at maturity; secondary market sale taxed per holding period |

Govt of India/RBI issued – no storage risk |

Long-term compounding with tax-exempt maturity; goal-linked investing |

Lock-in, secondary market discounts, interest taxed |

|

Gold ETFs |

~1 unit ≈ 1 gram (varies by fund) |

Market hours; typically T+2; liquidity depends on AUM/spreads |

Expense ratio ~0.5–1.0%; brokerage; small tracking error; no GST on buy |

>12 months: LTCG ~12.5% (no indexation); ≤12 months: STCG at slab rates |

SEBI-regulated AMC; gold held with custodian/trustee |

SIPs, demat users, transparent market pricing |

Tracking error, bid–ask spreads, expense ratio |

|

Gold Mutual Funds (FoFs) |

SIPs from ~₹100–₹500 (AMC dependent) |

T+2/T+3 redemption; no demat needed |

Expense ratio ~0.5–1.5%; possible exit load; tracks underlying ETFs |

>24 months: LTCG ~12.5% (no indexation); ≤24 months: STCG at slab rates |

SEBI-regulated AMC; invests in gold ETFs |

Automated SIPs without demat; hands-off investors |

Higher total cost than ETFs; tracking via underlying |

|

Gold Stocks/Mining ETFs |

1 share/unit (broker minimums) |

Market hours; depends on scrip/ETF liquidity |

Brokerage/STT; mining ETFs expense ratio; no GST |

Equity capital gains rules apply (typically >12 months for LTCG; ≤12 months for STCG; rates per current equity regime) |

Listed companies/ETFs; market and business risk |

Higher risk/higher upside vs bullion; satellite allocation |

Company execution risk, commodity cycles, equity volatility |

|

Physical Gold (coins/bars/jewellery) |

Typically higher ticket; jewellery often 1–10g+; coins/bars from 0.5–1g |

Moderate; jeweller buyback subject to checks; possible deductions |

3% GST on gold; jewellery making charges ~8–25% + 5% GST on making; buyback deductions |

>24 months: LTCG ~12.5% (no indexation); ≤24 months: STCG at slab rates |

Self-storage risk; purity/hallmark checks |

Cultural needs, gifting, sentimental value |

Theft/storage, purity disputes, high making charges, resale cuts |

“SGBs pay a fixed 2.5% annual interest (semi-annual payout) in addition to gold price movement.” – Source

Fees & the fine print

-

Digital/physical spreads: Digital gold has platform spreads; jewellery adds heavy making charges (8–25%) and GST on making.

-

ETFs/MFs: Expense ratios (ETFs ~0.5–1.0%; MFs ~0.5–1.5%), brokerage, and tracking error matter over multi-year horizons.

-

SGBs: No expense ratio; interest taxed at slab; secondary market trades can be at premium/discount to issue price.

-

Hidden frictions: Exit loads (some MFs), bid–ask spreads (ETFs/stocks), and jeweller buyback deductions.

Minimums & liquidity realities

-

Tiny tickets: Digital Gold starts from ₹1 – best for habit-building and flexible parking.

-

Paper gold: ETFs typically map to ~1g per unit; Gold MFs allow small SIPs without demat.

-

SGBs: Best held to maturity; secondary market liquidity exists but pricing can be lumpy with premiums/discounts.

-

Physical: Liquidity depends on buyback policies; expect testing and potential deduction.

What is the best investment for gold?

-

It depends on your time horizon, tax profile, and flexibility needs:

-

Need instant liquidity and micro-investing? Digital Gold (OroPocket) wins.

-

Long-term, tax-efficient compounding? SGBs shine at maturity.

-

Automated, regulated, SIP-friendly? Gold ETFs/Gold MFs are solid.

-

Looking at how invest in gold stocks for higher upside (and higher risk)? Consider a small satellite allocation to miners/mining ETFs.

-

-

Not sure? Use our decision tree below to shortlist and act today.

If you want a simple, UPI-native start with rewards, build your gold stack from ₹1 and earn free Bitcoin on every purchase with OroPocket. Download the app: https://oropocket.com/app

Digital Gold (OroPocket): Start from ₹1 via UPI + Earn Free Bitcoin

How digital gold works

-

Buy fractional 24K gold credited to your account; fully insured, vaulted with authorised partners.

-

Live pricing with instant buy/sell 24×7. Prefer coins/bars later? Convert and request delivery.

Why OroPocket stands out

-

₹1 entry point via UPI – no demat, no minimums. Buy gold in seconds.

-

Earn free Bitcoin (Satoshi) cashback on every gold/silver purchase with tiered rewards.

-

Gamified growth: Daily streaks, spin-to-win bonuses, and referrals (get 100 Satoshi + a free spin when friends join).

-

Trust-first: 100% insured vaults, RBI-compliant operations with authorised bullion partners.

Costs & spreads

-

Transparent buy/sell spread with zero paperwork and no jewellery making charges.

-

No hidden fees; clear conversion and delivery terms if you choose physical redemption.

Who should pick digital gold

-

First-time investors who want to start small and learn by doing.

-

Small-ticket SIPs and goal-based micro-saving (festivals, travel, emergency fund).

-

Gifters who want to send gold instantly to friends and family.

Step-by-step: Start from ₹1 using UPI on OroPocket

-

Download the OroPocket app (iOS/Android)

-

Complete quick KYC

-

Tap “Buy Gold,” enter ₹1 (or more), choose UPI

-

Pay via your favourite UPI app – get instant gold balance

-

Track streaks, spin daily, and share your referral link for Satoshi rewards

Safety & compliance

-

24K pure, audited holdings with secure, fully insured vaults.

-

Clear redemption and delivery options explained upfront; RBI-compliant ecosystem and authorised partners.

Start building your gold stack today and earn free Bitcoin on every purchase. Download the OroPocket app: https://oropocket.com/app

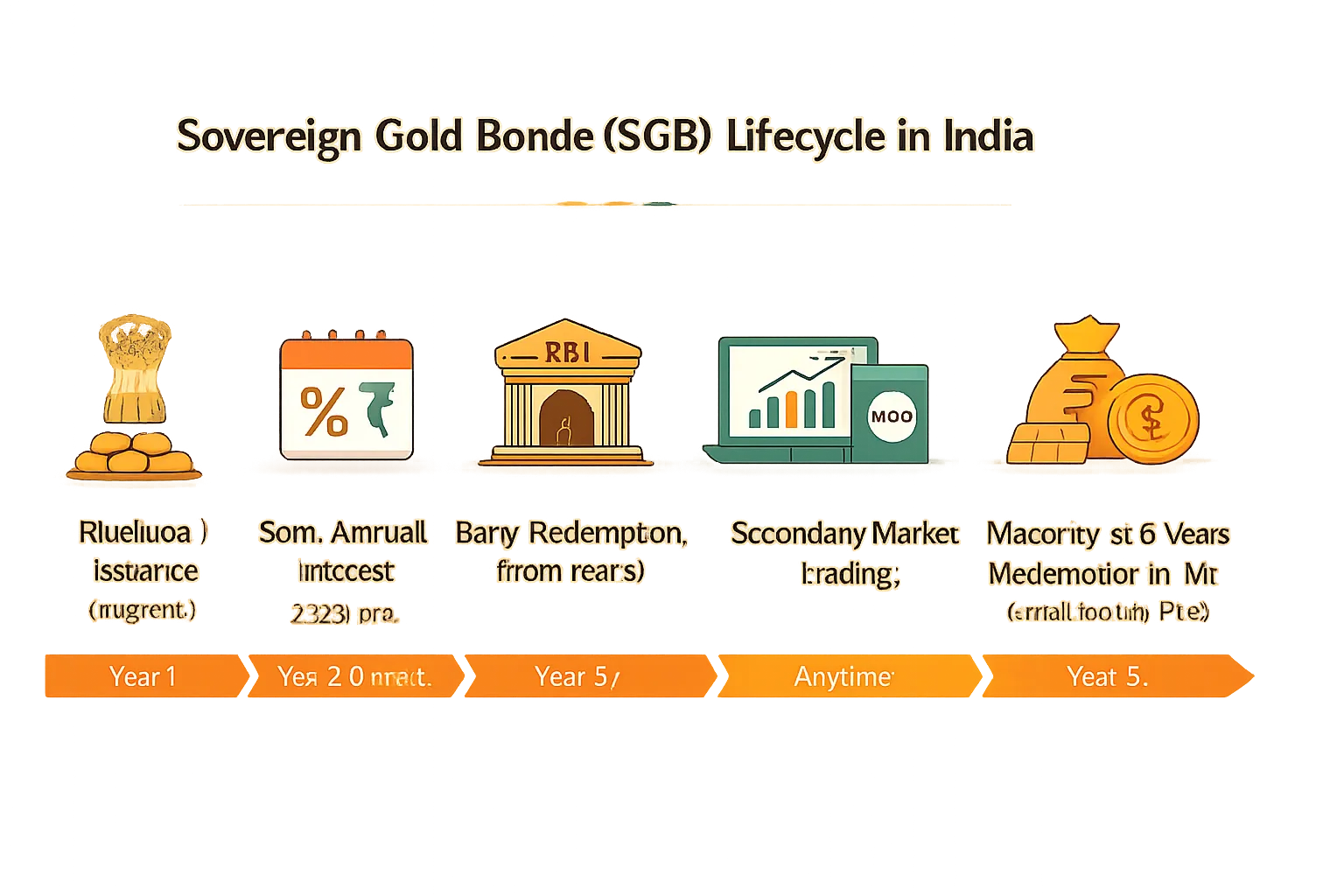

Sovereign Gold Bonds (SGBs): Pros, Cons, and How to Buy in 2026

What SGBs are (quick refresher)

-

Government of India-backed bonds denominated in grams of gold.

-

Tenor: 8 years. Optional early exit from year 5 through RBI’s redemption windows.

-

Tradable on exchanges in demat form; prices may differ from the day’s gold price.

Returns & cash flows

-

Earn 2.5% interest per year, paid semi-annually, on the initial subscription amount – plus whatever gold price movement delivers at redemption.

-

Secondary market prices can trade at a premium/discount to gold and to issue price, depending on demand, liquidity, and interest rate moves.

Tax treatment (high level; full table below)

-

Redemption at maturity is currently exempt from capital gains tax.

-

Semi-annual interest is taxable at your income tax slab.

Availability in 2026

-

Primary tranches open as notified by RBI/government. Subscribe online via banks, post offices, brokers when a tranche is live.

-

If no fresh tranche is open, you can buy listed SGBs in the secondary market via your demat/broker account (note: liquidity and pricing vary).

Who SGBs suit

-

Long-horizon investors who value tax efficiency, government backing, and steady cash flow.

-

Goal-based planners (5–8+ years) who can hold and avoid timing the market.

Pitfalls to note

-

Liquidity is lower than ETFs; bid–ask spreads and odd-lot issues can appear in the secondary market.

-

Premium/discount risk vs spot gold and vs issue price.

-

Early-exit timing matters: optimal outcomes often come from holding to maturity.

Ready to start small and stay flexible? Build your core allocation with Digital Gold on OroPocket and use SGBs for the long-term tax edge. Download the app: https://oropocket.com/app

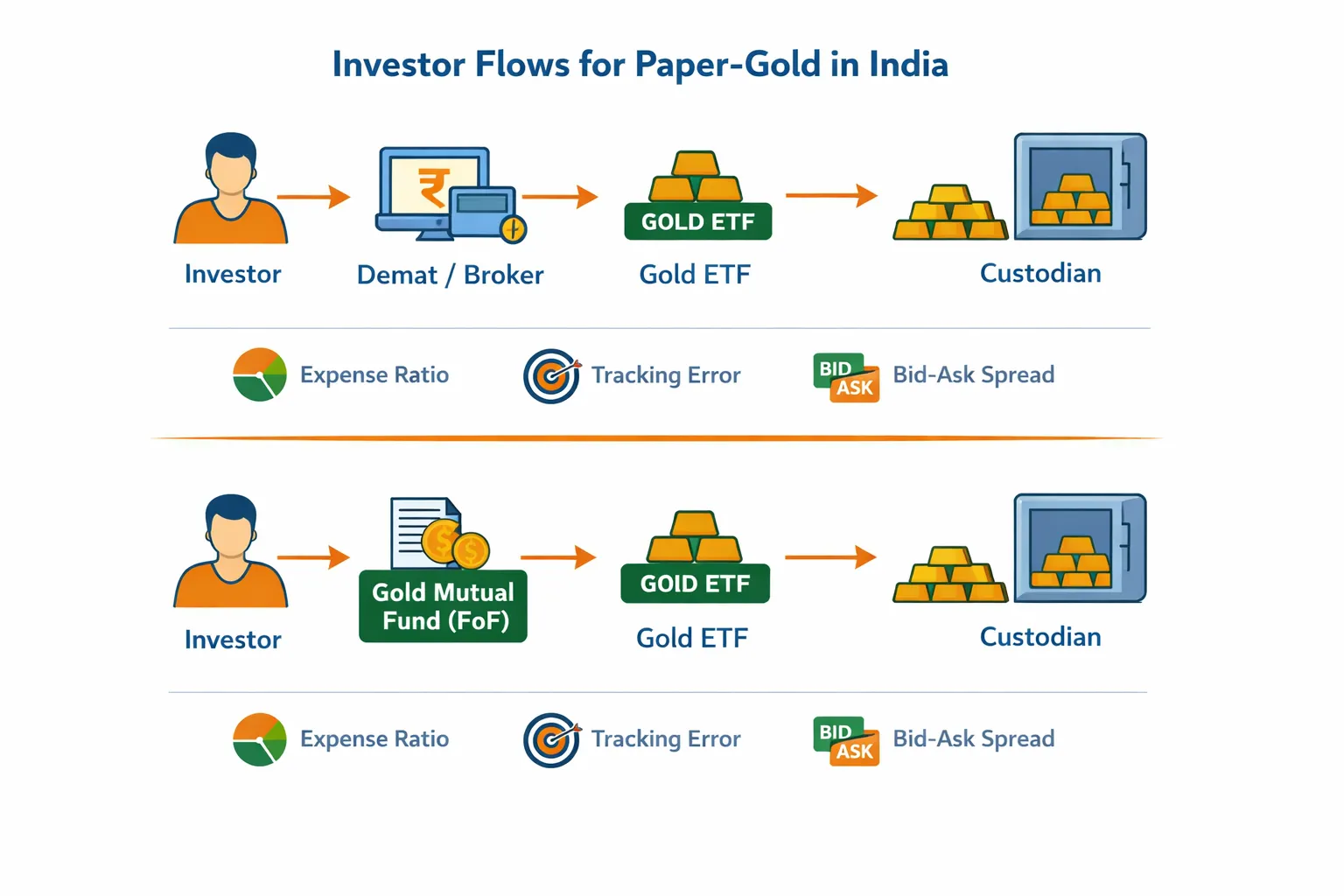

Gold ETFs and Gold Mutual Funds: Paper-Gold with High Liquidity

How Gold ETFs track bullion

-

Gold ETFs are backed by physical gold or approved gold-linked instruments held with a custodian.

-

The fund’s NAV mirrors the domestic gold price; the market price you trade can differ slightly due to a bid–ask spread and liquidity.

-

Creation/redemption by authorized participants helps keep ETF prices close to NAV.

Gold Mutual Funds vs ETFs

-

Gold Mutual Funds typically invest in one or more Gold ETFs (fund-of-funds structure). No demat account is required; invest via any MF app or platform.

-

Gold ETFs require a demat + broker account but offer intraday liquidity and live market pricing.

-

Both are SEBI-regulated, transparent paper-gold routes – choose based on convenience vs trading flexibility.

Costs & slippage

-

Expense ratio: ETFs ~0.5–1.0% p.a.; Gold MFs ~0.5–1.5% p.a. (as they add a layer over ETFs).

-

Tracking error: Small deviations vs spot gold due to costs, cash holdings, and operational factors.

-

Market frictions: Bid–ask spreads and brokerage can add to total cost when buying/selling ETFs.

How to invest online

-

ETFs: Open/use your broker + demat account, search for a Gold ETF, place a buy order (lump sum or periodic). You can set reminders to buy monthly or use broker-based SIP features where available.

-

Mutual Funds: Use your MF app or RTA platform to start a SIP in a Gold MF (FoF). Pick your date, amount, and let the SIP automate accumulation.

-

Tip: Align SIP date with salary credit to keep it effortless.

Who should pick ETFs/MFs

-

Investors who want SEBI-regulated, transparent paper-gold with high liquidity and clean audit trails.

-

People preferring SIPs without worrying about storage – especially for long-term diversification.

-

Demat users who want intraday price control (ETFs) or app-first users who want simplicity (Gold MFs).

Build your core gold allocation the simple way – then add OroPocket Digital Gold for micro-investing from ₹1 and Bitcoin rewards on every purchase. Download the OroPocket app: https://oropocket.com/app

Gold Stocks and Mining ETFs: Higher Risk, Higher Upside

How gold miners differ from gold

-

Operating leverage: Miners’ profits swing more than bullion. A small move in gold price can cause a big change in cash flows.

-

Cost of production (AISC): All-in sustaining cost is the breakeven per ounce. The lower the AISC vs gold price, the higher the margin. If gold falls toward AISC, margins compress fast.

-

Cyclicality: Earnings depend on grade, production volumes, capex, and exploration success – on top of gold price.

Example (illustrative): If a miner’s AISC is $1,250/oz and gold is $2,500/oz, margin is ~$1,250/oz. A 10% drop in gold (to $2,250) cuts margin by 20% – showing operating leverage in action.

Volatility & diversification

-

Equity-like volatility: Mining stocks behave more like cyclicals than like bullion.

-

Macro drivers: USD strength, interest rates/real yields, geopolitics, and commodity cycles all matter.

-

Stock-specific risk: Balance sheets, hedging policies, reserves/resources, jurisdictional risk, and ESG issues drive dispersion.

How invest in gold stocks in India

-

Domestic routes: Look for Indian mutual funds/ETFs with commodity/gold-miner mandates (FoFs that invest in global mining ETFs or baskets). These are demat/broker or MF-app friendly.

-

International exposure: Access global gold mining ETFs via international investing platforms under LRS (subject to RBI limits and your broker’s offerings).

-

Direct equities abroad: Advanced users may buy individual miners on global exchanges (requires higher research depth and overseas brokerage access).

If you’re searching how invest in gold stocks in India, start by comparing: mandate (pure-play gold miners vs diversified metals), expense ratio, liquidity, and tracking error (for ETFs/FoFs).

Who this suits

-

Advanced investors chasing growth who understand drawdowns and factor cycles.

-

Diversifiers building a small “satellite” sleeve around a core bullion allocation (Digital Gold/SGBs/ETFs).

Risk controls

-

Position sizing: Keep miners a small slice (e.g., 2–5% of portfolio) to limit downside.

-

SIP and phasing: Stagger entries to reduce timing risk; avoid lump-sum at peaks.

-

Rebalancing: Trim on rallies, add on deep corrections – stick to preset bands.

-

Avoid concentration: Spread across geographies, market caps, and cost curves (AISC levels).

-

Review fundamentals: Balance sheet strength, reserve life, jurisdiction, and management track record.

Miners can amplify gold’s upside – but they also magnify volatility. Build your core with bullion exposure first, then add a measured miner sleeve if it fits your risk profile. For effortless, UPI-native bullion stacking from ₹1 (with free Bitcoin rewards), download OroPocket: https://oropocket.com/app

Taxes, GST, and Compliance in 2026: What You’ll Actually Pay

“Budget 2024–25 rationalised capital gains: a uniform 12.5% LTCG (without indexation) for specified assets; SGB redemption at maturity remains exempt.” – Source

Capital gains – holding periods and rates (2026)

-

Physical/Digital/Gold MFs: STCG if held ≤24 months (taxed at your slab); LTCG if >24 months (12.5%, no indexation).

-

Gold ETFs: STCG if held ≤12 months (slab); LTCG if >12 months (12.5%).

-

SGBs: Interest is taxable at slab; capital gains on redemption at maturity currently tax-exempt. Secondary-market sale taxed per holding period (≤12 months: STCG; >12 months: LTCG 12.5%).

GST & other charges

-

3% GST on physical gold and typically on digital gold purchases (since underlying is physical).

-

No making charges for digital/ETFs/MFs. Jewellery carries 8–25% making charges (+5% GST on making), which hurts resale value.

-

ETFs/MFs: No GST on buy; expect brokerage, exchange charges, and expense ratios (MF/ETF).

2026 Tax summary by instrument

|

Instrument |

GST/Entry Charges |

STCG Holding & Tax |

LTCG Holding & Tax |

Special Rules (SGB interest/redemption) |

Who it suits |

Notes |

|---|---|---|---|---|---|---|

|

Digital Gold (OroPocket) |

3% GST on purchase; platform buy/sell spread |

≤24 months; STCG at slab |

>24 months; 12.5% (no indexation) |

N/A |

Micro-investors, SIPs, gifters |

Instant UPI; insured vaulting; no making charges |

|

Physical Gold (coins/bars/jewellery) |

3% GST on gold; jewellery has 8–25% making charges (+5% GST on making) |

≤24 months; STCG at slab |

>24 months; 12.5% (no indexation) |

N/A |

Cultural/gifting needs |

Purity, buyback deductions, storage risk |

|

Gold ETFs |

No GST; brokerage + exchange charges; expense ratio (~0.5–1.0% p.a.) |

≤12 months; STCG at slab |

>12 months; 12.5% (no indexation) |

N/A |

Demat users needing intraday liquidity |

Tracking error, bid–ask spreads |

|

Gold Mutual Funds (FoFs) |

No GST; expense ratio (~0.5–1.5% p.a.); possible exit load |

≤24 months; STCG at slab |

>24 months; 12.5% (no indexation) |

N/A |

SIP-first, no demat needed |

Invests in underlying Gold ETFs |

|

Sovereign Gold Bonds (SGBs) |

No GST or making charges; brokerage if bought/sold on exchange |

Secondary sale ≤12 months; STCG at slab |

Secondary sale >12 months; 12.5% |

Interest (2.5% p.a.) taxable at slab; redemption at maturity is capital-gains tax-exempt |

Long-horizon investors |

Early exit from year 5 via RBI windows; secondary market premium/discount risk |

Worked examples (illustrative only; exclude brokerage/charges for simplicity)

-

Example 1: Digital Gold

-

Buy ₹20,000 (plus 3% GST = ₹20,600 cost). Sell at 10 months for ₹23,000 → Gain ≈ ₹2,400 → STCG at your slab.

-

Hold instead for 26 months and sell at ₹27,000 → Gain ≈ ₹6,400 → LTCG @ 12.5% ≈ ₹800.

-

-

Example 2: Gold ETF

-

Buy units worth ₹50,000. Sell at 8 months for ₹55,000 → Gain ₹5,000 → STCG at slab.

-

Sell at 14 months for ₹58,000 → Gain ₹8,000 → LTCG @ 12.5% = ₹1,000.

-

-

Example 3: SGB

-

Subscribe at ₹6,000 per gram; hold to maturity when price is ₹9,000 → Capital gains ₹3,000 → Exempt at redemption. Interest: 2.5% p.a. on ₹6,000 (=₹150/year), paid semi-annually, taxable at slab.

-

If sold on exchange after 18 months at ₹7,200 → Gain ₹1,200 → LTCG @ 12.5% = ₹150 (pricing may be at premium/discount to gold).

-

Compliance tips

-

Save invoices/contract notes and match with PAN; keep ISIN/folio statements for ETFs/MFs/SGBs.

-

Understand gift/clubbed income basics for family transfers.

-

Rebalance annually; document average purchase price for SIPs (FIFO applied for most holdings).

-

Track holding periods carefully (12 months for ETFs/SGB secondary sales; 24 months for digital/physical/MFs).

-

When in doubt, consult a tax professional before large redemptions.

Want the simplest, UPI-native path? Build your gold stack from ₹1 – and earn free Bitcoin on every purchase – with OroPocket. Download the app: https://oropocket.com/app

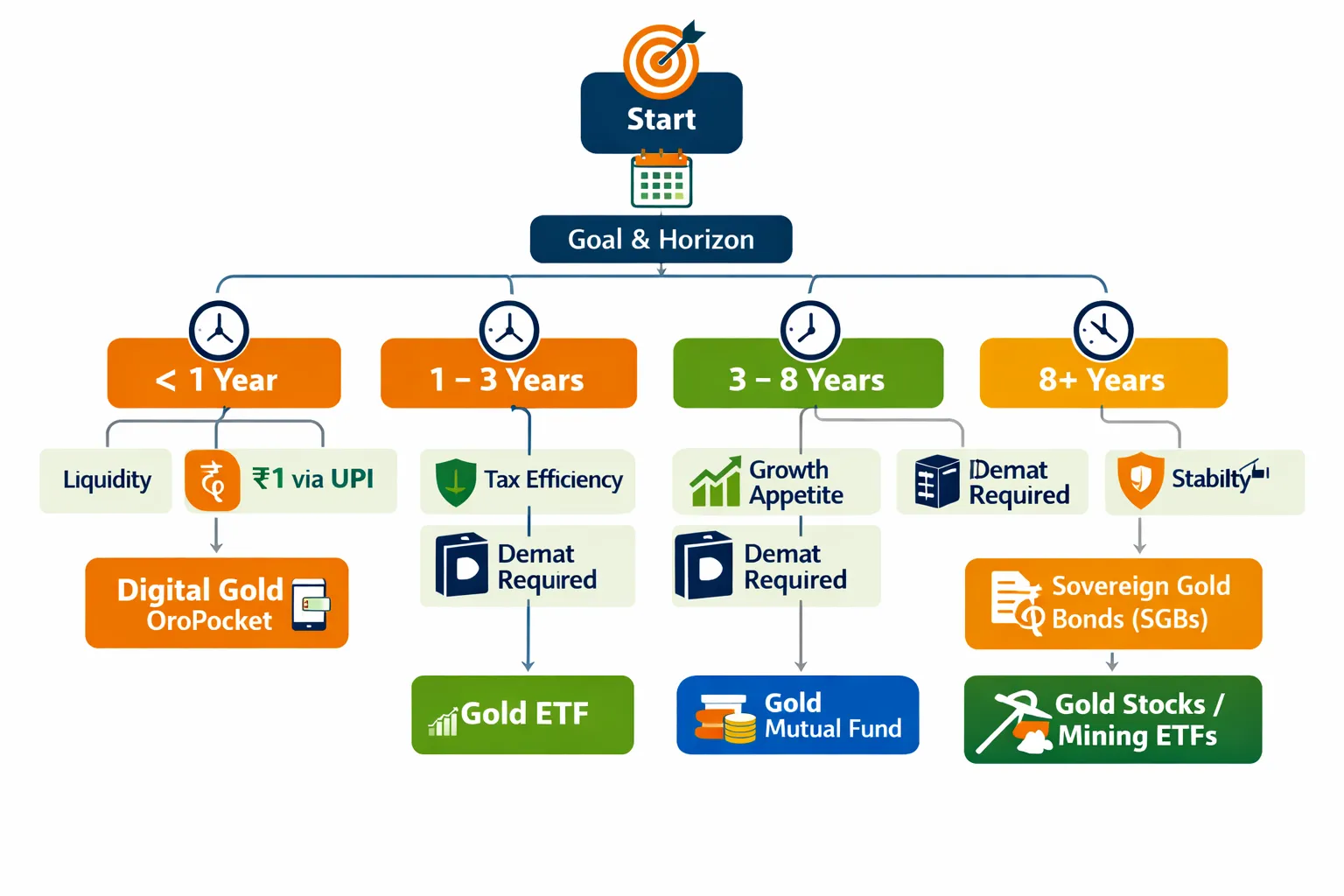

Decision Tree: Where to Invest in Gold Based on Your Goal

Start with your goal and horizon

-

Under 1 year: Prioritise liquidity and low friction.

-

1–3 years: Balance stability with flexibility.

-

3–8 years: Optimise for cost and tax efficiency.

-

8+ years: Maximise tax efficiency with stable compounding.

Decision branches

-

Need high liquidity? Choose Digital Gold (OroPocket) or a Gold ETF.

-

Want tax-efficient long-term exposure? Consider SGBs (hold to maturity).

-

Prefer SIP without demat? Pick a Gold Mutual Fund (FoF).

-

Seeking growth beyond bullion? Add Gold stocks/mining ETFs (advanced, small allocation).

Example personas (quick picks)

-

First-jobber investing ₹500/week → Digital Gold on OroPocket + monthly SIP.

-

Long-term tax-savvy saver → Ladder SGBs across tranches and secondary buys.

-

Trader who wants intraday flexibility → Gold ETF.

-

Bitcoin-curious, risk-managed → Digital Gold on OroPocket with Satoshi rewards.

Allocation guardrails (not advice)

-

Keep a core 5–15% allocation in gold depending on risk profile and goals.

-

Rebalance annually; add on dips, trim on rallies.

-

Avoid overconcentration in miners; treat them as a satellite to core bullion exposure.

Take the next step in minutes. Start from ₹1 on OroPocket and earn free Bitcoin on every purchase: https://oropocket.com/app

Conclusion: Start Small Today – Build Your Gold + Bitcoin Stack with OroPocket

The bottom line

-

Gold still hedges inflation and adds stability to your portfolio – and in 2026, accessing it is easier than ever through Digital Gold, SGBs, ETFs, Gold MFs, and even gold stocks.

-

There’s no single “best way to invest in gold.” The right choice depends on your horizon, liquidity needs, and tax preferences. Use the decision tree above, mix routes smartly, and keep your core allocation disciplined.

Your next step (30 seconds)

-

Download OroPocket, buy 24K digital gold from ₹1 via UPI, and earn free Bitcoin (Satoshi) on every purchase – two assets, one move.

-

Build the habit: keep daily streaks, spin-to-win for bonuses, and invite friends (100 Satoshi + a free spin for both).

Call to action

-

Take control of your money today. Start your gold stack and get rewarded in Bitcoin – stable meets modern, without complexity.

-

Download the OroPocket app now: https://oropocket.com/app

![How to Buy Digital Silver Online in India: Fees, Safety, Redemption [2026] 6 How20to20Buy20Digital20Silver20Online20in20India 20Fees20Safety20Redemption205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20Buy20Digital20Silver20Online20in20India-20Fees20Safety20Redemption205B20265D-cover-300x200.webp)

![9 best places to buy digital silver online in India [2025] 7 9 best places to buy digital silver online in India 2025 cover](https://blog.oropocket.com/wp-content/uploads/2025/12/9-best-places-to-buy-digital-silver-online-in-India-2025-cover-300x200.webp)