How to sell digital gold and silver online in India: the complete guide

Why sell digital gold and silver online in India right now

Gold and silver are emotional – selling them should be simple

In India, gold and silver are more than “assets” – they’re memories, milestones, and family security. But when you need liquidity, the process shouldn’t be slow, awkward, or dependent on a shop’s timing. Selling digitally lets you convert value to cash in minutes with live prices, instant UPI payouts, and zero awkward haggling. With OroPocket, you can sell digital gold or silver anytime – fast, transparent, and paperless.

“In 2024, gold in India delivered around 21% returns, outpacing average bank FD rates (~6%).” – Source

The online advantage vs. offline jewellers

-

Transparent live pricing, instant quotes, no haggling: See the live buy/sell rate in-app and sell at the best available price – no “backroom” price cuts.

-

Partial exits (sell a fraction of your holdings) anytime: Need ₹2,000 today and ₹5,000 next week? Sell small portions of your gold/silver instantly – no need to liquidate everything.

-

Instant UPI payouts, paperless flow, no store visits: Tap “Sell,” choose amount/grams, and receive funds via UPI. No paperwork, no queues, no store hours.

If you’ve been wondering “how can I sell gold online?” or “how to sell silver online with instant payout?”, this is the smarter way to do it.

What this guide covers (and why it’s better than what you’ll find elsewhere)

-

Step-by-step selling flow on OroPocket: From selecting units to confirming your sale and getting paid via UPI.

-

Settlement timelines and UPI withdrawals: What T+0/T+1 means and how fast money hits your account.

-

Exit costs and how to reduce them using rewards: Use OroPocket’s Bitcoin rewards earned on purchases to offset the spread when you sell.

-

When to sell (signals), partial exits, tax rules: Practical triggers to sell, how to stagger exits, and how STCG/LTCG works in India.

-

Silver-specific selling tips: Silver’s higher volatility, liquidity windows, and how to optimise your “silver sell” timing.

We don’t just tell you “sell high.” We show you how to execute, minimize costs, and get instant UPI cash-outs – step by step.

Quick glossary

-

Spread: The difference between the price you can buy at and the price you can sell at. It’s the core “exit cost” to watch.

-

Live price: The real-time market-linked rate for gold/silver that updates through the day.

-

Maker/taker fee: Small transaction fees applied when you place (maker) or take (taker) liquidity on certain platforms. OroPocket keeps fees transparent.

-

STCG (Short-Term Capital Gains): Profit on selling within 36 months; taxed as per your income slab.

-

LTCG (Long-Term Capital Gains): Profit on selling after 36 months; taxed at 20% with indexation benefits (as per current rules).

-

T+0/T+1: Settlement shorthand. T+0 means funds settle the same day; T+1 means the next working day.

-

Vaulting partner: The authorized, insured custodian that stores the physical gold/silver backing your digital holdings.

-

Redemption: Converting digital holdings into physical coins/bars or selling them for cash. In this guide, we focus on selling for instant UPI credit.

Ready to sell digital gold and silver the modern way? Download the OroPocket app to get live quotes and instant UPI payouts today: https://oropocket.com/app

How selling digital gold and silver works (vault-backed, compliance, and ownership)

The mechanics in plain English

-

You own units backed 1:1 by 24K gold or high-purity silver held in insured, third-party vaults. When you sell, you’re liquidating those units at the live sell price.

-

Platforms quote a live buy/sell price; you confirm and sell at a locked rate. No phone calls, no haggling – just a transparent quote you can accept in seconds.

-

Funds settle to your bank/UPI after execution. With OroPocket, payouts are UPI-native, so your sale converts to cash fast (T+0/T+1 depending on cut-off and bank rails).

Compliance and safety

-

RBI-compliant flows via authorized partners: OroPocket works with recognized bullion and payment partners, aligning with Indian compliance norms and secure payment rails.

-

Independent audits, insured vaulting, BIS hallmark standards for physical backing: Your gold/silver is stored in professional vaults, insured, and subject to independent checks – aligned with Indian hallmarking and custody best practices.

-

KYC thresholds and why platforms may request verification: For higher transaction limits and annual totals, platforms may require PAN/Aadhaar-based KYC. It keeps your account secure and enables seamless withdrawals above threshold limits.

“SEBI has clarified that digital gold falls outside its regulatory purview; it does not audit or verify the physical gold backing these products.” – Source

What this means for you: choose platforms that follow best practices – insured, independently audited vault holdings, and transparent user ownership records.

Proof of ownership and records

-

What your transaction history, invoices, and statements include: Each buy/sell shows date/time (IST), metal, rate, units/grams, consideration, fees/spread, and net proceeds. Your balance updates instantly after trade execution.

-

How to download invoices and capital-gains reports at financial year-end: OroPocket lets you export invoices and CG statements for tax filing. At FY-end, download your realized gains (STCG/LTCG), along with supporting contract notes, directly from the app.

Why OroPocket stands out

-

Micro-sell from ₹1, no minimums: Need to sell 0.05g of gold or a small fraction of silver? Do it in seconds – perfect for partial exits.

-

UPI-native payouts and transparent quotes: Sell at a clearly displayed live rate and receive funds via UPI with T+0/T+1 settlement clarity.

-

Bitcoin rewards layer on every buy (helps offset future selling spread): Every gold/silver purchase earns free Satoshi, which can effectively reduce your exit cost when it’s time to sell.

Want to see how fast a sell works? Open OroPocket, tap Sell, enter grams or ₹, confirm the live quote, and cash out to UPI.

Step-by-step: how to sell on OroPocket (partial exits + instant UPI)

Before you sell

-

Check live price; decide full vs partial exit.

-

Keep UPI ID or bank account linked.

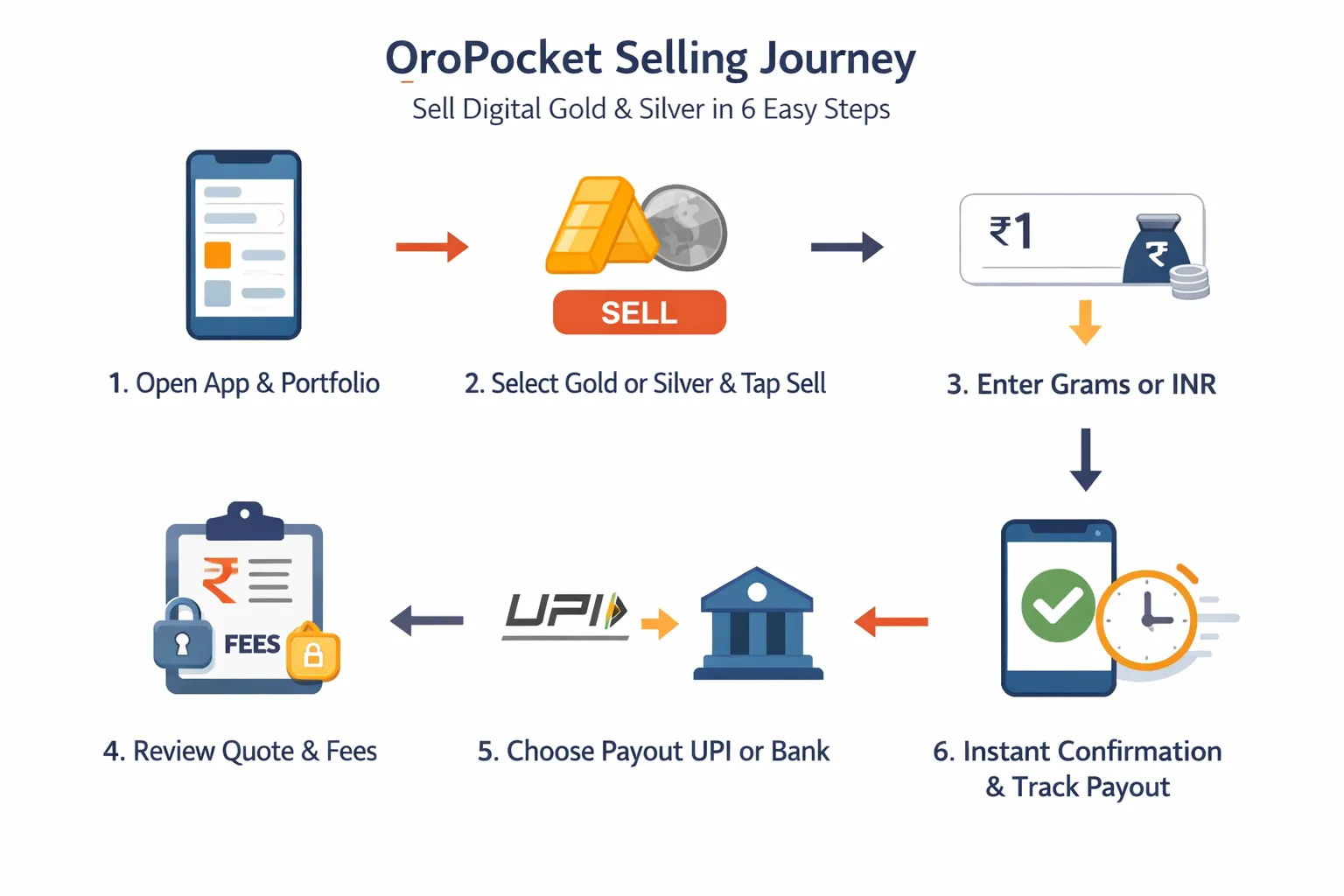

6-step flow

-

Open OroPocket app → Portfolio.

-

Choose Gold or Silver → Tap Sell.

-

Enter grams or ₹ amount (partial exits allowed from ₹1).

-

Review locked quote and fees → Confirm.

-

Choose payout: UPI or bank transfer.

-

Get instant confirmation; track payout status.

Pro tips

-

Use price alerts; sell in tranches.

-

Avoid peak volatility if you want tighter spreads.

-

Keep KYC updated for higher limits.

Where your money goes

-

T+0 credit attempts via UPI; banking rails fallback when needed.

-

Notifications for every step.

“In August 2025, UPI processed 20+ billion transactions worth nearly ₹25 trillion – powering real-time retail payments across banks and apps.” – Source

Download OroPocket and sell in seconds with instant UPI payouts: https://oropocket.com/app

Settlement timelines, limits, and UPI/bank withdrawals

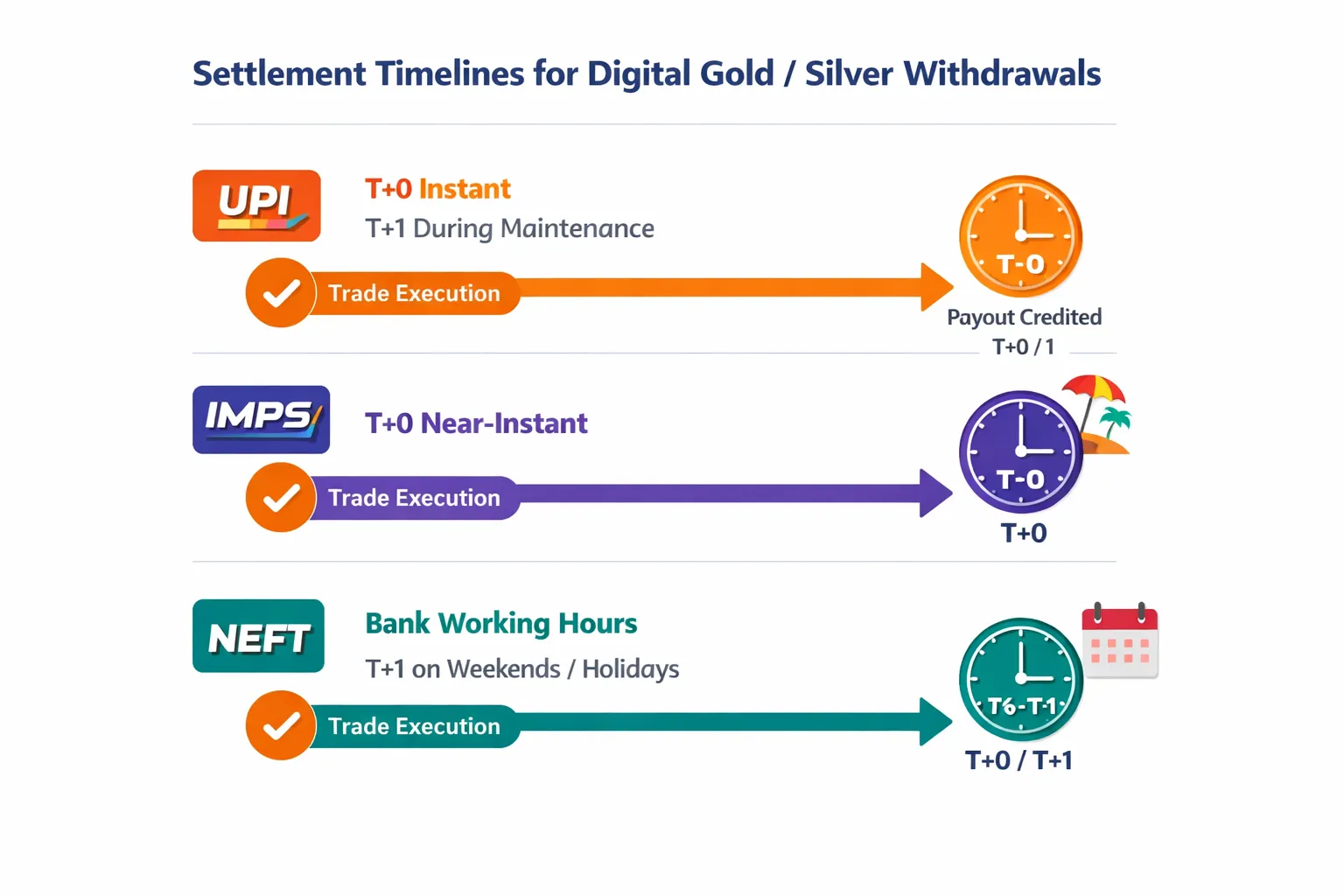

Typical timelines

-

UPI: near-instant T+0 during banking hours; may show as T+1 if rails are down/maintenance windows.

-

IMPS/NEFT: near-instant (IMPS) or bank working hours (NEFT). Weekends/holidays can shift to next working day.

Limits and KYC

-

Daily/monthly sell and withdraw limits; higher tiers unlock with completed KYC.

-

UPI per-transaction caps and bank limits explained.

Payout tracking and issue resolution

-

In-app status for “Processing / Credited / Reversed.”

-

What to do if payout fails (auto-retry or switch rails).

-

Support SLAs and documentation you may be asked for.

Best practices

-

Keep the same name on bank and app; mismatch can delay payouts.

-

Test a small withdrawal first if you recently changed bank/UPI.

-

Enable notifications and email receipts.

Download OroPocket to track settlements in real time and withdraw via UPI or bank in a tap: https://oropocket.com/app

Exit costs explained: spreads, fees, and how rewards can offset them

What you pay when you sell

-

Spread: the difference between the buy and sell quote. This is the primary “exit cost” when you sell digital gold or silver online.

-

Platform fee (if any) and taxes on purchase vs sale: You may see a small platform fee. GST typically applies on purchases, while exits are subject to capital-gains rules (STCG/LTCG).

-

Network fees for certain payout rails (if applicable): Rare, but if a specific bank rail adds a fee, we’ll disclose it upfront.

Lowering your effective costs

-

Sell during normal liquidity hours for tighter spreads: Avoid illiquid hours and maintenance windows to reduce slippage.

-

Use partial exits to average out in volatile markets: Sell in small tranches instead of all-at-once to smooth price swings.

-

Stack OroPocket rewards to offset spreads: Bitcoin cashback on every buy, daily streak bonuses, spin-to-win rewards, and referral Satoshis can reduce your net selling cost over time.

Worked examples (with numbers)

Below are illustrative scenarios to show how rewards can reduce your effective spread when you sell digital gold or silver online with OroPocket.

|

Transaction size |

Spread (₹) |

Rewards accumulated (₹ equivalent from Satoshis) |

Net effective cost (₹) |

Effective spread % |

|---|---|---|---|---|

|

₹500 (Scenario A: no rewards) |

7.50 |

0.00 |

7.50 |

1.50% |

|

₹500 (Scenario B: with rewards) |

7.50 |

2.00 |

5.50 |

1.10% |

|

₹10,000 (Typical medium sell) |

120.00 |

30.00 |

90.00 |

0.90% |

|

₹50,000 (Larger tranche) |

550.00 |

200.00 |

350.00 |

0.70% |

How to read this:

-

Scenario A vs B (small sell): The same “sell digital gold” action costs less in Scenario B because your earlier Bitcoin rewards offset today’s selling spread.

-

Medium/Large sells: As your rewards stack from past gold/silver buys, streaks, spins, and referrals, they can meaningfully reduce net exit costs.

Note: Numbers are examples. Actual spreads, fees, and reward values vary by market conditions, your rewards tier, and time of day.

When physical redemption makes sense (and when it doesn’t)

-

Makes sense: Gifting, weddings, festivals, or when you specifically want coins/bars in hand.

-

Doesn’t make sense: If your goal is pure liquidity (cash-in-bank fast), selling online with instant UPI is typically more efficient and avoids making charges and delivery fees.

Ready to minimize exit costs on your next silver sell or when you sell digital gold? Use partial exits, sell during liquid hours, and let OroPocket rewards do the heavy lifting. Sell in seconds with instant UPI payouts: https://oropocket.com/app

Taxes when you sell digital gold or silver in India (STCG, LTCG, indexation)

The basics

-

Digital gold/silver are capital assets.

-

Holding ≤ 36 months: Short-Term Capital Gain (taxed per your income slab).

-

Holding > 36 months: Long-Term Capital Gain (typically 20% with indexation, as per prevailing rules).

“Gains from the sale of gold are taxable as capital gains; long-term gains may be eligible for indexation benefits.” – Source

What counts as cost and sale consideration

-

Cost of acquisition: Purchase price plus applicable charges at buy (e.g., platform fee, taxes embedded at purchase).

-

Sale consideration: Amount you receive on sale; for gain calculation, consider sale value net of selling costs.

Documentation to keep

-

Invoices, contract notes, transaction statements, and payout proofs (UPI/bank confirmations).

-

Year-end capital gains summary/downloads from your app for filing.

Examples

-

Small STCG example (10-month hold): If you bought gold worth ₹20,000 and sold at ₹22,400 in 10 months, your gain is ₹2,400. Tax is as per your slab.

-

LTCG example with indexation (3+ years): If you bought at ₹50,000 and sold at ₹65,000 after 40 months, with an indexed cost of ₹55,000, taxable LTCG is ₹10,000; tax at 20% ≈ ₹2,000.

Tax scenarios (illustrative)

|

Holding period |

Type |

Tax rate |

Example numbers (buy price, sell price, indexed cost) |

Approx. tax due |

|---|---|---|---|---|

|

10 months |

STCG |

As per slab (example: 20%) |

Buy ₹20,000; Sell ₹22,400; Indexed cost: N/A |

₹2,400 gain × 20% = ₹480 |

|

40 months |

LTCG |

20% with indexation |

Buy ₹50,000; Sell ₹65,000; Indexed cost: ₹55,000 |

(₹65,000 − ₹55,000) × 20% = ₹2,000 |

|

48 months |

LTCG |

20% with indexation |

Buy ₹1,50,000; Sell ₹1,90,000; Indexed cost: ₹1,62,000 |

(₹1,90,000 − ₹1,62,000) × 20% = ₹5,600 |

|

37 months (silver) |

LTCG |

20% with indexation |

Buy ₹30,000; Sell ₹36,000; Indexed cost: ₹32,000 |

(₹36,000 − ₹32,000) × 20% = ₹800 |

Note: Examples are illustrative to explain STCG/LTCG and indexation mechanics. Actual tax depends on your slab, acquisition date, applicable rules in force, surcharge/cess, and your indexed cost.

Disclaimers

-

Tax rules can change; consult a qualified tax advisor for personalized guidance.

-

Keep thorough records (invoices, statements, payout proofs). OroPocket provides downloadable capital-gains reports at year-end to simplify filing.

Sell digital gold or silver with clarity – and keep clean records for taxes. Download OroPocket: https://oropocket.com/app

When should you sell? Smart signals to time exits (without guessing)

Personal triggers

-

Hitting a savings goal (wedding fund, emergency corpus top-up).

-

Rebalancing your portfolio if gold/silver weight exceeds your target allocation.

Market/context triggers (not advice, just signals)

-

Sharp rallies that push allocation high; scale out in tranches.

-

Rupee weakness/strength impacts INR metals pricing.

-

For silver: industrial demand cycles (solar, electronics) can increase volatility – plan partial exits.

Practical tactics

-

Use price alerts and staged selling (25%/25%/50%).

-

Pair sells with Bitcoin rewards earned on past buys to offset spread.

-

Keep a small strategic core; only sell the excess (habit-friendly).

Sell on your terms – then get instant UPI payouts in OroPocket: https://oropocket.com/app

How to sell silver online: extra tips for a more volatile metal

Silver is different from gold

-

Higher day-to-day price swings; spreads can widen at off-peak hours. Expect faster moves than gold, and plan exits accordingly.

-

Industrial cycles matter more (EVs, solar, electronics). Macro data, PMI numbers, and energy policy updates can move silver quickly.

Selling tips tailored to silver

-

Prefer partial exits; avoid all-or-nothing sells during spikes. Scale out in tranches to capture strength without timing the exact top.

-

Use alerts around key global data releases impacting industrial metals (US jobs/CPI, China PMI, major central bank decisions). Let alerts guide you instead of FOMO.

-

Consider pairing profit-booking with keeping a base position. Trim rallies but keep a core holding for long-term trends.

Liquidity checklist

-

Confirm live quote depth and execution window. Tighter spreads typically appear during globally active market overlaps; avoid maintenance windows.

-

Be flexible with payout rails if one rail is congested. Choose UPI for T+0 where possible, or switch to bank rails (IMPS/NEFT) if UPI acknowledgements are delayed.

SEO quick answers

-

How to sell silver online? Open OroPocket → Silver → Sell → Confirm price → UPI withdrawal. Fast, compliant, transparent.

-

Silver sell best time? During liquid hours; use tranches and alerts rather than guessing tops. Partial exits reduce timing risk.

Book profits on your terms with instant UPI withdrawals. Download OroPocket: https://oropocket.com/app

Pro tips, safety, and FAQs for sellers

Security and compliance

-

Only use RBI-compliant, audited platforms: Sell digital gold and silver online through providers that work with authorized bullion partners, insured vaults, and independent audits.

-

Enable 2FA/biometric login, keep app updated: Protect your account with OTP/biometric + a strong PIN, and always use the latest app version for security patches.

-

Verify payout details: Ensure your UPI ID and bank account name match your PAN/KYC to avoid reversals or delays.

Avoid common mistakes

-

Don’t chase intraday spikes blindly; plan tranches: Use staged exits (e.g., 25%/25%/50%) instead of all-or-nothing sells.

-

Check fees/spreads before confirming: Review the live sell quote, spread, and any fees to know your exact net proceeds.

-

Keep KYC and bank/UPI details current: Higher limits and faster withdrawals require updated KYC and verified payout rails.

-

Avoid low-liquidity windows: Sell during normal market hours for tighter spreads and smoother settlement.

Quick FAQs

-

How can I sell gold instantly?

-

Open OroPocket → Sell → choose UPI payout. Most transactions are T+0 during banking hours.

-

-

Can I sell a small amount?

-

Yes. Partial exits from ₹1 are supported – perfect for “silver sell” or “sell digital gold” in small tranches.

-

-

Is there a lock-in?

-

No mandatory lock-in for selling digital gold/silver.

-

-

Are payouts free?

-

UPI is typically free; check in-app disclosures for any rail/network charges.

-

-

Can I gift instead of selling?

-

Yes – use Send Gold to transfer to friends/family directly from your OroPocket app.

-

-

What if my payout fails?

-

The app auto-retries or switches to alternate rails (IMPS/NEFT). You’ll see status updates: Processing / Credited / Reversed.

-

Sell with confidence – secure, compliant, and fast. Get live quotes and instant UPI withdrawals on OroPocket: https://oropocket.com/app

Start selling with OroPocket today (fast, transparent, and rewarded)

Why OroPocket for selling gold & silver online

-

Start from ₹1; partial exits anytime (perfect for quick “sell digital gold” or “silver sell” needs).

-

Instant, seamless UPI withdrawals – get paid fast, typically T+0.

-

Transparent live quotes; no store visits, no haggling.

-

Unique Bitcoin rewards on every buy help offset future sell spreads.

-

Secure, insured vaulting with RBI-compliant partners – trustworthy and safe.

Take action in under 2 minutes

-

Download the app → Link UPI → Tap Sell.

-

Choose Gold or Silver, confirm the live price, and cash out.

-

Track orders, payouts, and statements in one clean dashboard.

CTA

Ready to sell digital gold or silver the modern way? Download OroPocket for iOS/Android: https://oropocket.com/app