How to Sell Gold and Silver Online in India: Price Discovery, Taxes, Payouts

Why sell gold and silver online now? (Price, convenience, trust)

If you’ve ever asked yourself “how to sell gold” or “how do I sell gold without getting lowballed?”, you’re not alone. Prices are near all-time highs, spreads are visible in real time, and you can now sell gold and silver online with instant UPI payouts – in minutes, not days. With OroPocket, you get transparent quotes, lower friction, and RBI-compliant, 100% insured storage backing your holdings.

“Indian households hold roughly 24,000–25,000 tonnes of gold (World Gold Council, 2019).” – Source

The new reality of selling precious metals

-

Offline vs online: discovery, speed, and transparency

-

Offline: You hunt for buyers, negotiate across jewellers, wait for purity tests, and face melt-loss deductions. Price discovery is slow and opaque; spreads vary wildly by store and city.

-

Online: You see live buy prices 24×7, confirm the quote, and get instant UPI payout. No haggling. No hidden “making charge reversals.” Full transparency on spreads for buying and selling gold or silver.

-

Trust layer: OroPocket works with authorized bullion partners, stores 24K gold in fully insured vaults, and follows RBI-compliant processes – so when you sell gold online in India, you’re exiting at a fair, market-linked price.

-

-

When it makes sense to sell: goal-based, rebalancing, or emergency liquidity

-

Goal-based: Hitting a target (house down payment, education fund)? Lock in gains systematically instead of timing the peak.

-

Rebalancing: If gold overshoots your target allocation after a rally, trim and redeploy to maintain risk levels.

-

Emergency liquidity: Need funds today? Selling gold or choosing silver sell online provides same-day cash via UPI without breaking FDs or incurring loan interest.

-

-

Where online shines: live quotes, instant payouts, low friction

-

Live quotes: Monitor market-linked prices and execute when your target is hit – no phone calls, no queues.

-

Instant payouts: UPI/IMPS transfers typically settle in minutes; NEFT for larger transfers if needed.

-

Low friction: No physical visits, no paperwork runs, no purity disputes. Just tap, confirm, and cash out.

-

What this guide covers

-

Price discovery and spreads: How your sell price is set, and how to minimize the spread when you buy or sell gold or sell silver online.

-

Taxes: The difference between GST on purchases vs capital gains when you exit gold and silver.

-

Payouts and verification: How UPI, IMPS, and NEFT work for instant redemptions and what KYC you need.

-

Tactics to minimise slippage: Practical tips to execute at better prices, reduce fees, and avoid timing mistakes.

-

Step-by-step OroPocket walkthrough: From verification to your first sale, plus how to automate smart exits.

Ready to sell gold or silver with live quotes and instant UPI payout? Download the OroPocket app now: https://oropocket.com/app

How online price discovery works (spot, spreads, and timing)

If you’re figuring out how to sell gold or planning to sell silver online, understanding how your sell quote is built helps you execute smarter and get a better net payout. Here’s the breakdown.

“MCX gold futures provide a transparent platform for price discovery and are widely referenced for domestic gold pricing in India.” – Source

Components of your sell quote

-

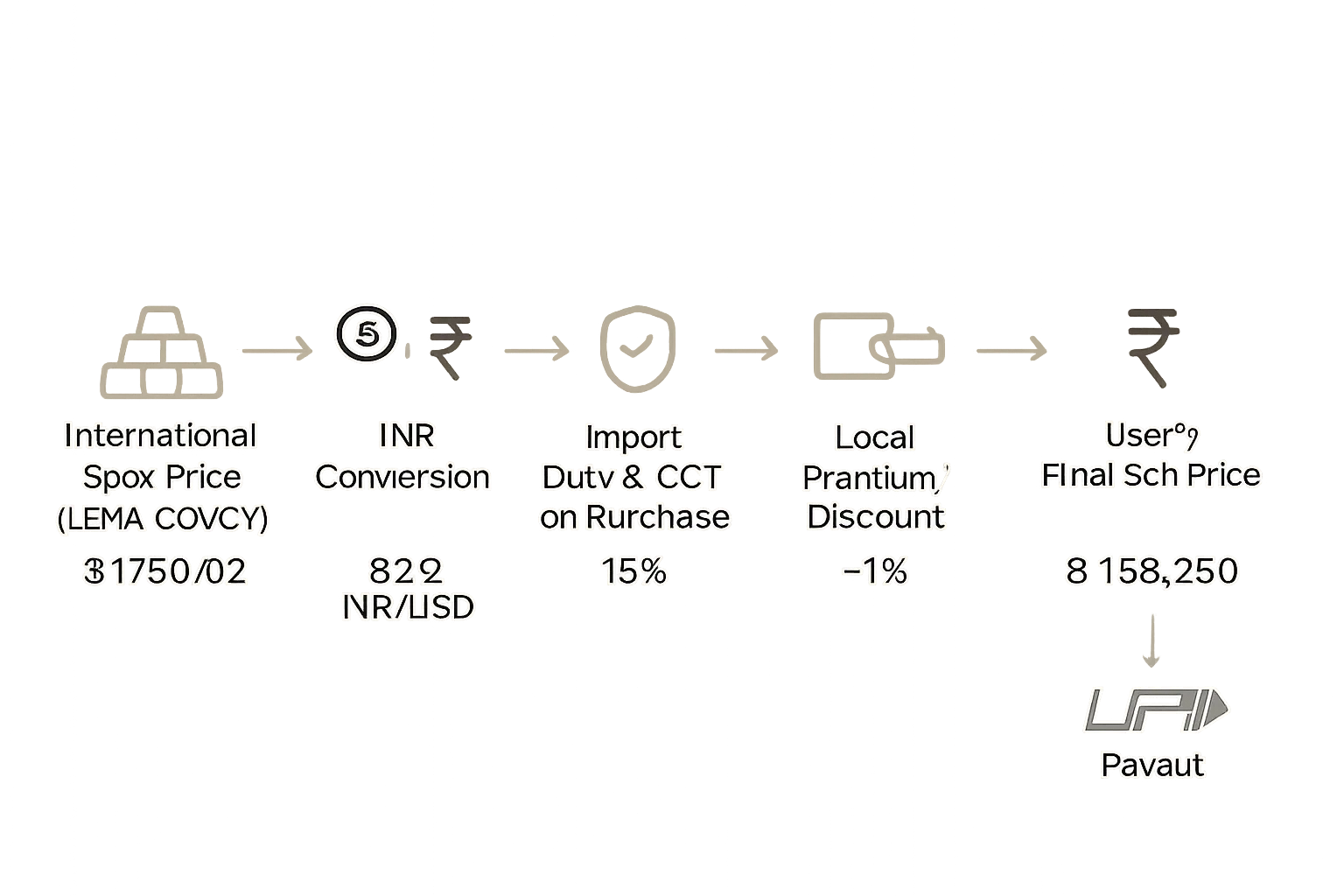

Global reference price (LBMA/COMEX), domestic basis (INR, import duty), local premium/discount

-

Global spot: International benchmarks like the LBMA Gold Price and COMEX futures guide directional pricing.

-

INR conversion: Spot USD/oz is converted using the live USD/INR rate.

-

Import duties and taxes: India’s import duty plus other levies shape the domestic base.

-

Local premium/discount: Reflects onshore demand/supply and logistics.

-

Result: A domestic reference that most platforms use to quote buying and selling gold.

-

-

Platform bid vs ask (spread) and why it moves

-

The bid is what you receive when you sell; the ask is what you pay when you buy or sell gold online in India.

-

Spreads change with volatility, liquidity, operational costs, and hedging risk. Tighter markets and deeper liquidity typically mean narrower spreads.

-

“The LBMA Gold Price is the globally recognized benchmark for gold, set twice daily and administered by ICE Benchmark Administration.” – Source

What widens spreads

-

High volatility windows: Sharp intraday moves force market makers to widen quotes.

-

Low-liquidity hours: Off-peak global trading or holidays can reduce depth.

-

Large trade sizes: Big orders may move the market; spreads can reflect execution risk.

-

Regulatory announcements: Duty changes, tax updates, or policy shifts raise uncertainty.

Timing exits smartly

-

Quoting windows (e.g., 30–120 seconds locks)

-

Many platforms lock your quote for a short window. Execute within the lock to avoid requotes.

-

-

Partial exits to reduce impact

-

Break a large sale into tranches to average out micro-moves and liquidity gaps.

-

-

Comparing channels: jeweller vs app vs ETF redemption

-

Jeweller: Negotiated rates, possible purity deductions.

-

App: Live quotes, transparent fees, instant UPI payout for “silver sell online” or gold exits.

-

ETF redemption: Tracks NAV and market price; settlement through your broker and DP, not instant cash.

-

Visual explainer

-

Example numbers (illustrative):

-

International spot: $2,300/oz

-

USD/INR: ₹84

-

Domestic base (after duties): ₹6,800/gram

-

Platform spread: 0.30%–0.80%

-

Your net sell price: ₹6,755–₹6,777/gram before any platform fee

-

When you’re ready to buy or sell gold or sell silver online with instant UPI payouts and transparent spreads, download OroPocket: https://oropocket.com/app

Taxes when you sell: GST vs capital gains for gold and silver

Selling right means knowing what’s actually taxed. If you’re figuring out how to sell gold or planning to sell silver online, this section clears the confusion on GST vs capital gains.

Know the difference

-

GST applies on purchase (not on sale proceeds)

-

You pay GST when buying gold/silver (physical or digital). There’s no GST levied on your sale proceeds.

-

-

Capital gains apply on profits when you sell (gold and silver)

-

Profit = Sell price – Cost of acquisition (adjusted as per current law). Tax depends on holding period (short-term vs long-term) and the instrument.

-

“Finance (No. 2) Act, 2024 rationalised capital gains: a uniform 12.5% LTCG rate without indexation and standardised holding periods (12 months for listed, 24 months for others), effective July 23, 2024.” – Source

Current rules at a glance (verify latest)

-

Short-term vs long-term holding period (post-2024 updates)

-

Listed instruments (e.g., exchange-traded gold/silver ETFs): generally long-term if held >12 months.

-

Other assets (e.g., physical/digital vaulted gold/silver, most mutual funds): generally long-term if held >24 months.

-

-

Long-term capital gains rate framework

-

Post-Finance Act 2024: 12.5% LTCG without indexation for many assets.

-

Legacy framework (earlier years): 20% LTCG with indexation often applied to gold/silver; check your assessment year and acquisition/sale dates.

-

-

Silver taxation parallels

-

Silver follows the same STCG/LTCG structure as gold for physical and digital holdings.

-

-

Always verify the rule-year

-

Regulations evolve. Confirm your exact holding period and rate based on when you purchased and sold.

-

Special instruments

-

SGBs (Sovereign Gold Bonds)

-

Redemption with RBI at maturity: capital gains tax exempt; periodic interest (if any) is taxable as per slab.

-

Off-market/on-exchange sale before maturity: taxable per holding period; post-2024 reforms, sales after 12 months typically treated as LTCG at 12.5% without indexation; ≤12 months taxed as STCG at slab. Verify current rule-year.

-

-

Gold/Silver ETFs & mutual funds

-

ETFs (listed): typically LTCG after 12 months at 12.5% (no indexation); STCG at slab.

-

Gold/silver mutual funds and FoFs (usually non-equity): typically LTCG after 24 months at 12.5% (no indexation); STCG at slab. Certain purchase-date cohorts in earlier years may be taxed at slab regardless – verify your cohort.

-

-

Digital gold (vaulted)

-

Treated like physical Gold/Silver for capital gains: typically LTCG after 24 months (12.5% without indexation post-2024), otherwise STCG at slab.

-

At-a-glance matrix

|

Instrument |

Holding period for LTCG |

LTCG rate/indexation status |

STCG rate basis |

Notes (SGB maturity exemption, derivatives as business income) |

|---|---|---|---|---|

|

Physical gold jewellery/coins |

>24 months (verify rule-year) |

Typically 12.5% without indexation post-2024; legacy 20% with indexation may apply for prior periods |

Added to income; taxed at slab |

GST only on purchase (not sale). Keep invoices for cost tracking. |

|

Physical silver (bars/coins) |

>24 months |

Typically 12.5% without indexation post-2024; legacy 20% with indexation may apply for prior periods |

Slab |

Same treatment as gold for CGT. |

|

Digital vaulted gold |

>24 months |

Typically 12.5% without indexation post-2024 |

Slab |

Treated like physical for CGT; no GST on sale. |

|

Digital vaulted silver |

>24 months |

Typically 12.5% without indexation post-2024 |

Slab |

Same as digital gold. |

|

Gold ETF (listed) |

>12 months |

Typically 12.5% without indexation post-2024 |

Slab |

Listed security; confirm broker statements for exact tax classification. |

|

Silver ETF (listed) |

>12 months |

Typically 12.5% without indexation post-2024 |

Slab |

Listed security; verify current circulars. |

|

Gold mutual fund/FoF (non-equity) |

>24 months |

Typically 12.5% without indexation post-2024; prior purchase cohorts may differ |

Slab |

Certain cohorts (e.g., FY2023–FY2025 windows) had slab treatment regardless – confirm before filing. |

|

SGB (maturity with RBI) |

N/A |

Exempt on redemption at maturity |

N/A |

Interest component taxable as per slab. |

|

SGB (sold before maturity: exchange/off-market) |

>12 months (if listed), else verify |

Typically 12.5% without indexation post-2024 |

Slab |

Pre-2024: often 20% with indexation after 36 months; rule-year matters – verify. |

|

Gold/silver derivatives (F&O on commodities) |

N/A |

N/A (not CGT) |

Business income at slab |

Treated as non-speculative business income; P&L, expenses, and audit thresholds may apply. |

Tip: If you plan to buy or sell gold (or sell silver online) frequently, maintain clean records (invoices, dates, charges). It makes calculating CGT and filing much easier, and helps you optimise timing for LTCG.

Ready to sell with transparent quotes and instant UPI payouts? Download the OroPocket app: https://oropocket.com/app

Payouts and settlement speed: UPI, IMPS, NEFT, and OroPocket flow

You want your money fast after you sell. Here’s how payouts work – and how OroPocket gets funds to you quickly via UPI, IMPS, or NEFT.

“UPI processed 12.20 billion transactions in January 2024 (₹18.41 lakh crore), with real-time, instant inter-bank settlement design.” – Source

How fast can you get paid?

-

UPI instant credit (subject to bank rails and limits)

-

Typically near-instant once a sell order is confirmed and payout is triggered. Final credit depends on your bank’s UPI infrastructure and any temporary throttling.

-

-

IMPS/NEFT windows and cut-offs

-

IMPS: 24×7, including holidays; good fallback if your bank throttles UPI.

-

NEFT: Batch-based; operates during RBI settlement windows. If you sell late evening or on a holiday, funds may reflect next working window.

-

Typical payout limits and checks

-

Per-transaction and daily UPI limits

-

Most banks cap UPI per transaction at ₹1–₹2 lakh (some support higher for verified profiles); daily limits also apply.

-

-

Name/beneficiary matching and bank verification

-

OroPocket validates your beneficiary name against your bank mapping to reduce failures. If mismatch occurs, we prompt a quick fix before payout.

-

OroPocket experience

-

Instant UPI payouts on confirmed sell orders

-

Sell gold or sell silver online, confirm your quote, and we initiate UPI instantly for supported amounts.

-

-

Real-time status tracking in app (pending → processed → credited)

-

See live status, reference IDs, and timestamps for your payout – no guesswork.

-

-

What to do if your bank is down or throttled (fallback to IMPS/NEFT)

-

If UPI rails are congested, switch to IMPS for 24×7 settlement or NEFT for larger limits. We’ll surface the best available route in-app.

-

What to keep handy

-

PAN for high-value compliance, bank account mapped to UPI ID, updated KYC

-

Keep PAN, Aadhaar-based KYC, and the bank account you want credited mapped to your UPI ID for smooth verification and faster payouts.

-

Ready for fast exits with transparent quotes? Download OroPocket and get instant UPI payouts on your sale: https://oropocket.com/app

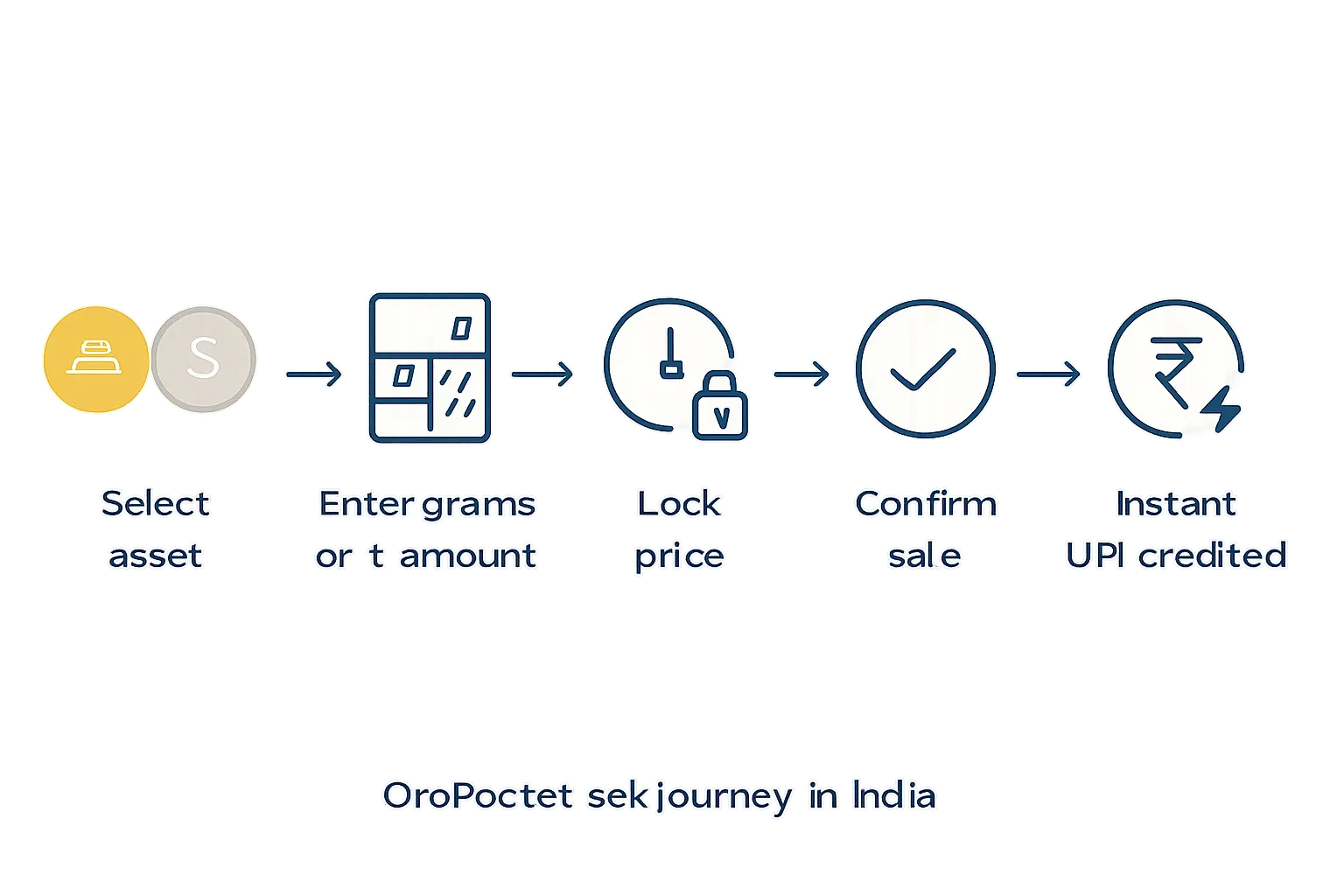

Step-by-step: How to sell gold and silver online with OroPocket

Before you start

-

Complete KYC in-app (AADHAAR/PAN-based), link your UPI ID or bank account.

-

Ensure the bank account name matches your KYC name for smooth payouts.

Sell flow

-

Open OroPocket → Select Gold or Silver → Tap Sell.

-

Enter grams or ₹ amount (see live locked price + spread).

-

Review fees (if any) and your net payout.

-

Confirm sale → Receive payout via UPI instantly.

Post-sale

-

Download invoice/contract note for your records.

-

Track orders in History for real-time status.

-

Export tax report for ITR capital gains.

Pro tips

-

Use smaller tranches in volatile markets to reduce price impact.

-

Set alerts for target prices and daily streak reminders to plan exits while earning rewards.

Minimise slippage: Tactics to improve your net sell price

Practical ways to get a better exit

-

Avoid thin-liquidity windows; sell during active market hours

-

For better bids, execute when global markets are active (London/NY overlap). Avoid late-night/holiday gaps.

-

-

Watch spreads; wait for tighter quotes if not urgent

-

If spreads widen during spikes, set alerts and wait for quotes to normalise before you sell gold or sell silver online.

-

-

Split larger exits into tranches

-

Break big orders into smaller tranches to reduce market impact and average out the bid.

-

-

Compare net proceeds (fees + spread), not just headline price

-

Always review the bid-ask spread, platform/broker fees, taxes, and payout timelines. The best “headline” price isn’t always the best net.

-

Channel comparison

From jeweller buybacks and pawn brokers to digital apps and exchange-traded options, your channel affects spreads, fees, and speed. If you’re figuring out how to sell gold or buy or sell gold efficiently, use the matrix below to pick the right lane for your situation.

Where to sell and what it costs

|

Channel |

Typical spread/discount range |

Fees |

Liquidity |

Payout speed |

Paperwork |

|---|---|---|---|---|---|

|

Jeweller buyback |

−1% to −5% vs domestic reference; purity/melt deductions possible |

Purity test charges; making charges non-refundable |

Medium (store hours, local demand) |

Same-day cash/NEFT (store dependent) |

Purchase invoice; PAN/KYC for high-value |

|

Pawn broker |

−3% to −15% vs reference; often structured as loan, lower liquidation value |

Interest + processing (if loan); encashment costs |

High (walk-in) |

Instant cash (risk of lower quote) |

Basic ID; bill if available |

|

Digital app (OroPocket) |

~0.30%–0.80% platform spread (indicative; market-linked) |

Low/transparent; shown upfront |

High (24×7 quotes) |

UPI instant; IMPS/NEFT fallback |

One-time KYC; bank/UPI mapping |

|

ETF sell on exchange |

Market bid-ask ~0.10%–0.50% (varies by ETF liquidity) |

Brokerage, exchange/DP charges, taxes on brokerage |

Varies by ETF AUM/volume |

T+2 to bank via broker |

KYC + demat + broker account |

|

SGB offloading (exchange) |

Market discount vs gold (often 0%–5%+ depending on season/liquidity) |

Brokerage/exchange charges |

Moderate (seasonal spikes) |

T+2 settlement |

KYC + demat + broker account |

Long-term planning

-

Plan exits around tax milestones

-

If you’re near the long-term threshold, waiting to cross STCG → LTCG (as applicable to your instrument/assessment year) can improve post-tax outcomes.

-

-

Use goal-based selling

-

Rebalance when gold/silver allocation exceeds your target, or set rule-based exits at predefined price levels to avoid emotional selling.

-

Want transparent spreads, live quotes, and instant UPI payouts to maximise your net? Sell on OroPocket today: https://oropocket.com/app

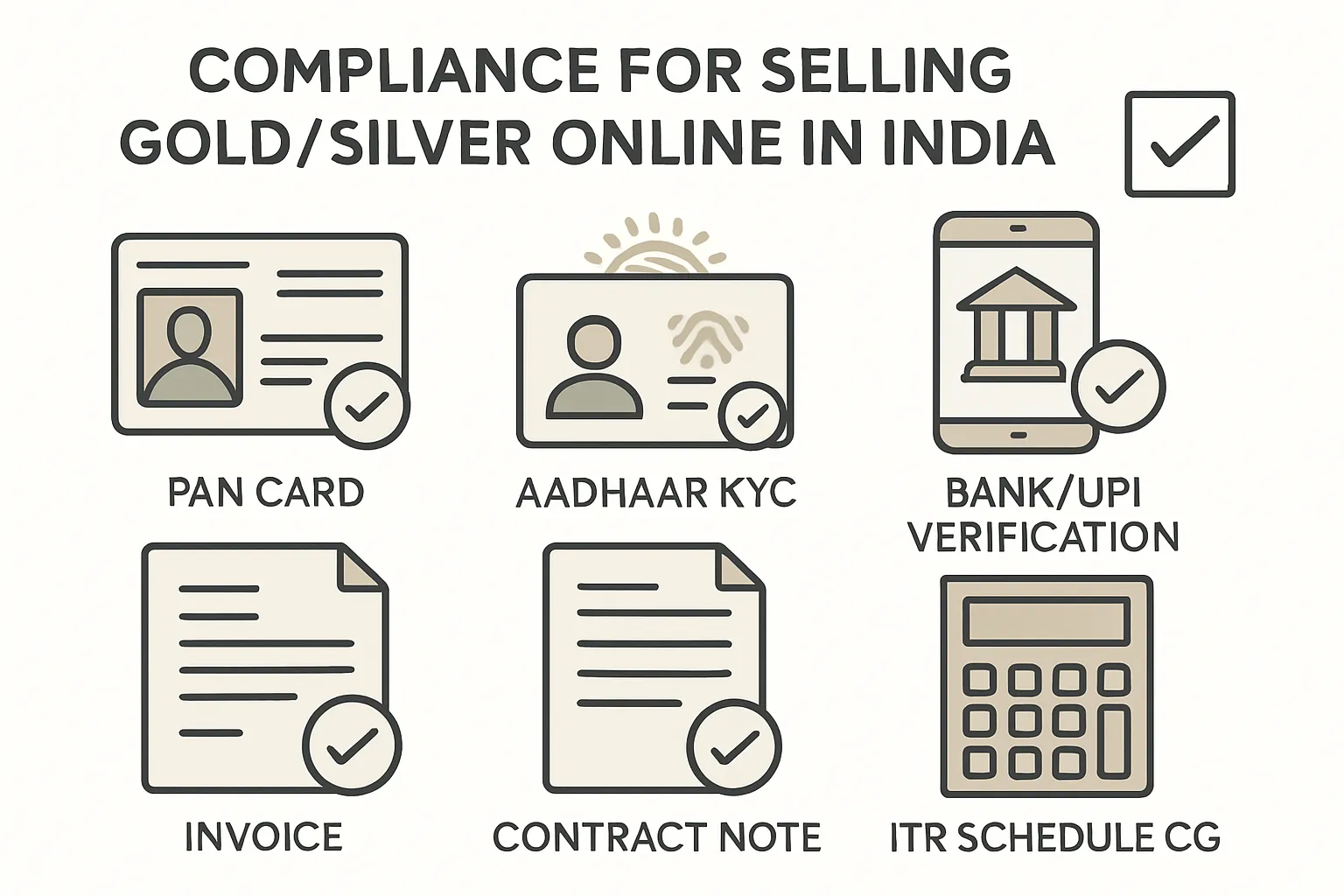

Compliance and verification: KYC, limits, and records to keep

Staying compliant keeps your exits smooth and your ITR clean. Here’s what to know before and after you sell gold or silver online.

Identity and AML requirements

-

PAN for high-value sales; Aadhaar-based KYC

-

PAN is typically required for high-value transactions; complete Aadhaar-based eKYC in-app for faster limits and instant payouts.

-

-

PMLA checks and suspicious transaction monitoring

-

Platforms perform PEP/sanctions screening, velocity checks, and suspicious transaction monitoring under PMLA guidelines to prevent misuse.

-

Record-keeping for taxes

-

Keep invoices, contract notes, purchase dates, holding period proofs

-

Preserve original purchase invoices, digital contract notes, and transaction IDs. If you transferred holdings between platforms, keep transfer proofs.

-

-

How to compute CGT (FIFO assumptions if applicable)

-

Use FIFO where applicable to determine which units you sold first. Capital gain = Sale proceeds − Cost of acquisition (adjusted per the rule-year). Retain expense proofs (delivery, brokerage, platform fees) to claim as cost.

-

Reporting

-

ITR schedules for capital gains; when to consult a CA

-

Report gains in the relevant ITR schedule (e.g., Schedule CG). If you traded derivatives (commodities F&O), report as non-speculative business income with P&L.

-

-

TDS/TCS scenarios (rare; specifics for very high-value deals)

-

In exceptional high-value cases, TDS/TCS may apply under specific sections; check your broker/platform intimation and consult a CA.

-

Keep your compliance airtight and cash out fast with OroPocket. Download the app: https://oropocket.com/app

Special cases: SGBs, ETFs, derivatives, gifts/inheritance

SGBs

-

Tax-free redemption at maturity with RBI

-

If you hold Sovereign Gold Bonds to maturity and redeem with RBI, capital gains are exempt. The semi-annual interest (if applicable to your tranche) is taxable as per your slab.

-

-

Selling before maturity (on exchange/off-market) and tax treatment

-

If you sell on exchange or off-market before maturity, gains are taxable based on your holding period. Post-2024 reforms, many listed units qualify for LTCG after 12 months at a 12.5% rate without indexation; ≤12 months is STCG at slab. Always verify the rule-year and your specific tranche dates.

-

ETFs and mutual funds

-

Cohort-based rules by purchase date

-

Gold/Silver ETFs (listed) typically follow listed security rules; many cohorts qualify for LTCG after 12 months at a 12.5% rate (no indexation) post-2024, while earlier cohorts may have legacy treatments – check your purchase date and assessment year.

-

Gold/silver mutual funds and FoFs (usually non-equity) often follow a 24-month LTCG threshold with 12.5% (no indexation) post-2024; certain windows (e.g., FY2023–FY2025) had slab-based treatment regardless of period. Confirm with your fund’s tax note and rule-year.

-

-

Exit via broker/Demat

-

Selling ETFs/SGBs occurs via your broker and Demat account; settlement and credits follow exchange timelines (e.g., T+2).

-

Gold/silver derivatives

-

Treated as non-speculative business income

-

Profits/losses from commodity F&O on gold/silver are typically non-speculative business income, taxed at slab rates.

-

-

P&L and expense claims

-

Maintain a proper P&L; broker costs, exchange charges, and eligible expenses can be claimed. Turnover, audit thresholds, and presumptive provisions (e.g., Section 44AD) may apply – consult a CA for compliance.

-

Gifts and inheritance

-

Section 56(2) gift rules; wedding gift exemption

-

Gifts from “relatives” are generally exempt. Gifts from non-relatives above ₹50,000 are taxable as “Income from Other Sources.” Wedding gifts are specifically exempt.

-

-

Cost/holding period for CGT on subsequent sale

-

On selling gifted/inherited gold, your cost of acquisition is typically the previous owner’s cost, and the holding period may include the previous owner’s period – critical for STCG/LTCG classification. Keep supporting documents.

-

Want a clean, compliant exit with instant UPI payouts and downloadable contract notes for your records? Sell on OroPocket: https://oropocket.com/app

Why OroPocket for selling? Pricing, rewards, and security

Transparent pricing

-

Live quotes with a visible spread – no hidden making charges or melt-loss gimmicks.

-

Market-linked prices so you can compare and sell with confidence.

Fast payouts and ease

-

Instant UPI payouts after you confirm the sell order; IMPS/NEFT fallback if your bank throttles UPI.

-

Mobile-first design: sell gold or sell silver online in under a minute.

Unique upside: Bitcoin rewards on buys

-

Earn free Satoshis on every gold/silver purchase with tiered rewards, daily streaks, and spin-to-win.

-

Two-asset benefit: accumulate gold/silver while stacking Bitcoin rewards – without buying crypto directly.

Security and compliance

-

24K pure gold, fully insured vaulting with authorised bullion partners.

-

RBI-compliant processes and rigorous KYC/AML checks for safe, transparent exits.

Social features

-

Send gold to friends and family in a few taps.

-

Referral rewards: both you and your friend earn 100 Satoshi + a free spin.

Sell with transparent pricing and instant payouts. Download OroPocket: https://oropocket.com/app

Conclusion: Sell smarter, get paid faster – start with OroPocket

Key takeaways

-

Understand spreads and timing to improve price

-

Know your tax bucket before you sell

-

Use instant UPI payouts for quick liquidity

Next step

-

Download OroPocket on iOS/Android and sell gold or silver in minutes

Compliance note

-

Tax rules change – verify latest slabs/holding periods and consult a qualified tax professional for personal advice

![How to Buy Digital Silver Online in India: Fees, Safety, Redemption [2026] 8 How20to20Buy20Digital20Silver20Online20in20India 20Fees20Safety20Redemption205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20Buy20Digital20Silver20Online20in20India-20Fees20Safety20Redemption205B20265D-cover-300x200.webp)