India Gold Rate Today: What Changes It City to City? (2026)

India Gold Rate Today: What Changes It City to City? (2026)

If you’re searching “india gold rate today”, you’re not alone – and you’re not overthinking it. Two people can check gold prices at the same time and still see different numbers across Mumbai vs Chennai, Tanishq vs a local jeweller, or IBJA vs retail apps.

That difference isn’t “random.” It’s a mix of global spot price moves, USD-INR, local demand, logistics, jeweller premiums, and how/when the price is updated. This guide breaks it down so you can spot a fair price fast – and avoid overpaying.

To go deeper on what moves gold overall (beyond city-level differences), read our breakdown: what drives gold prices and how to invest smarter.

The simplest truth: “Gold rate” isn’t one number

When people say “gold rate today,” they may be referring to:

-

International spot gold (global benchmark in USD/oz)

-

Domestic wholesale reference rates (like IBJA indicative rates)

-

Retail jewellery rates (often higher due to margins + making charges)

-

Digital gold rates (usually track live market pricing with platform spread)

So if you’re comparing prices, compare like-for-like:

-

Same purity (24K vs 22K vs 18K)

-

Same unit (per gram vs per 10 grams)

-

Same type (bullion bar vs jewellery vs digital gold)

-

Same time window (AM vs PM updates)

Today’s example (why your screenshot doesn’t match your friend’s)

Gold can swing meaningfully within a day or across two sessions.

“As of February 5, 2026, the price of 22-karat gold in India is ₹14,155 per gram, reflecting a decrease of ₹460 from the previous day’s price of ₹14,615 per gram.” – Source

That’s a perfect real-world example of how “today” can differ depending on:

-

the source (GoodReturns vs a jeweller vs IBJA),

-

the time (opening vs closing),

-

and the pricing method (indicative vs retail selling).

The 8 real reasons gold prices differ city to city in India

1) International gold price changes (the base layer)

Gold is globally priced. If spot gold moves overnight (US session), Indian morning rates adjust quickly – especially for digital and bullion-linked pricing.

2) USD-INR exchange rate (the silent multiplier)

India imports most of its gold. So even if global gold is flat, a weaker rupee can push India prices up.

3) Local demand spikes (wedding/festival season effect)

Some cities see stronger buying around:

-

weddings

-

Akshaya Tritiya

-

Dhanteras/Diwali

-

regional festivals

Higher demand = higher local premium.

4) Local supply & bullion availability

Metro hubs often have better bullion supply chains. Smaller cities may face tighter supply, especially when demand jumps suddenly.

5) Logistics, handling, and working capital costs

Shipping, insurance, storage, and financing costs get baked into the final number – especially for physical gold movement.

6) Jeweller-specific premiums and brand positioning

Two stores in the same city can quote different “rates” because:

-

one bakes margin into the headline rate

-

another shows lower rate but adds higher making charges

7) Purity & product type (coin vs bar vs jewellery)

-

24K is typically for investment (bars/coins/digital)

-

22K / 18K are common for jewellery and have different pricing structure

8) Update timing (AM vs PM) and data source differences

Some sources update multiple times daily; some jewellers update once. IBJA can show opening/closing reference points; retailers may lag.

“IBJA rate” vs “Jeweller rate” vs “Digital gold rate” (don’t mix these)

Here’s a clean way to interpret what you’re seeing:

|

Rate Type |

What it represents |

Best for |

Why it can differ |

|---|---|---|---|

|

International Spot |

Global benchmark (USD) |

Macro trend |

FX conversion + local premia not included |

|

IBJA (Indicative) |

Wholesale reference-style rate |

Market reference |

Doesn’t include GST/making/margins; timing matters |

|

Retail Jewellery Rate |

What brands/jewellers sell at |

Jewellery buyers |

Includes retailer margin, sometimes hidden costs |

|

Digital Gold Rate |

App-based buy/sell pricing |

Investors, SIPs, micro-savers |

Spread + GST (where applicable) + platform pricing model |

If you want to understand the “rules” and compliance expectations around buying gold in India, see: rules for buying gold in India.

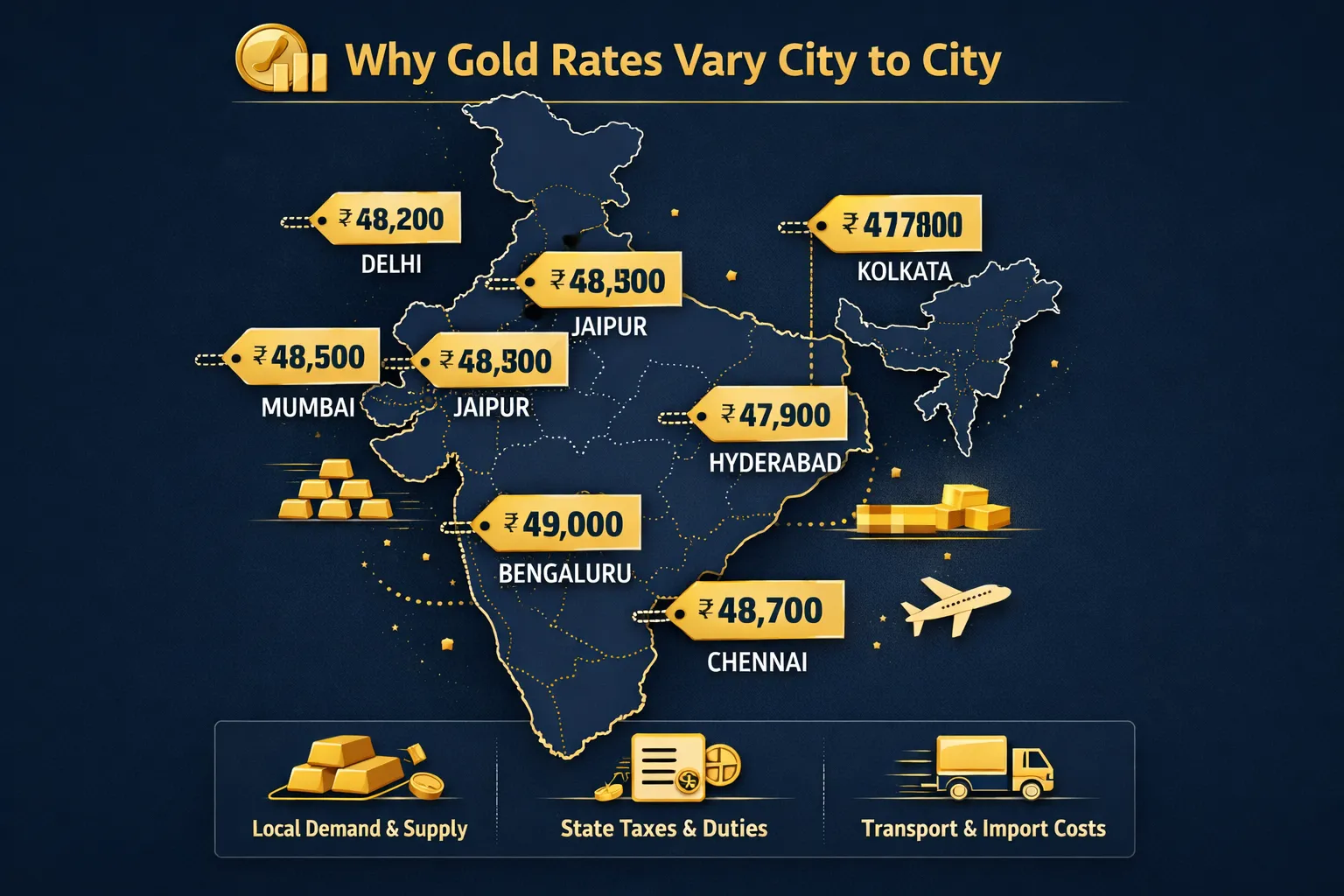

City-wise differences: what usually explains Chennai vs Mumbai vs Delhi?

Competitors often list city prices – but skip the why behind those differences. Here’s the practical explanation:

Chennai

-

Strong jewellery culture and high volume

-

Local market dynamics can support slightly different retail pricing

-

More variation can come from making charges + demand, not just bullion

Mumbai

-

Major financial/bullion hub influence

-

Competitive pricing in many segments

-

Price discovery tends to be fast due to active market participants

Delhi / NCR

-

High retail competition + strong wedding demand cycles

-

Big swings around peak season due to local buying pressure

Bottom line: city-to-city differences are often more about premiums and demand than “different gold.”

The “fair price” checklist (use this before you buy)

When you see a quote, ask these 6 questions:

-

Is this 24K/22K/18K?

-

Is the price per gram or per 10 grams?

-

Does it include GST?

-

For jewellery: what are the making charges + wastage?

-

What’s the buy-back policy (especially for coins/jewellery)?

-

Is the rate locked at billing time or just a display price?

This is exactly why many investors prefer investment-grade formats over jewellery. If you’re comparing options, see: is physical gold a good investment in India? jewellery vs investment-grade.

Why OroPocket users don’t stress about city-to-city gold rates

Because the goal isn’t to “guess the perfect city price.” The goal is to build gold consistently, at transparent live-linked pricing, without getting trapped in hidden add-ons.

With OroPocket:

-

Start from ₹1 (yes, literally) – no “minimum amount” excuses

-

Buy in seconds via UPI – no paperwork, no delays

-

Your gold is vaulted, insured, and compliant – built for trust

-

You earn free Bitcoin (Satoshi) on every purchase – two assets for the price of one

-

Gamified investing – streaks, spin-to-win, tiered rewards help you stay consistent

-

Referral rewards – both sides get 100 Satoshi + free spin (habit-building + viral by design)

Stop watching. Start growing.

Jewellery vs digital gold: where the “extra cost” hides

Jewellery is emotional and beautiful – but as an investment, many buyers get surprised by:

-

making charges

-

wastage

-

GST on making charges

-

lower resale value vs expected

Digital gold is typically designed for saving/investing, not wearing – so the cost structure is usually cleaner for accumulation.

Conclusion: city-wise gold rate differences are normal – overpaying isn’t

Yes, india gold rate today can differ across cities and sellers. But once you understand the drivers – global spot + USD-INR + local premium + jeweller margins + timing – you can quickly judge whether a quote is fair.

If you want the modern way to invest:

-

start small (₹1),

-

invest fast (UPI in under 30 seconds),

-

stay consistent (streaks + rewards),

-

and get extra upside (free Bitcoin cashback),

then OroPocket is built for you.

Don’t wait for the “perfect rate.” Build the perfect habit – starting today.