Invest in Silver (2026): Pros, Risks & Who Should Buy

Invest in Silver (2026): Pros, Risks & Who Should Buy

Silver is having a moment in India – and not just because it’s “cheaper than gold.”

If you’re a student, a salaried professional, a first-time investor, or a small business owner trying to beat inflation without taking stock-market-level stress, silver can be a smart add-on. But it’s not a chill, FD-like asset. Silver is fast, jumpy, and industrial-demand-driven – which means big upside and sudden drawdowns.

This guide will help you decide if you should invest in silver in 2026, how much to allocate, what traps to avoid (GST, spreads, storage, fake purity), and how to do it the modern way – starting from ₹1 with UPI on OroPocket, while earning free Bitcoin (Satoshi) rewards on every buy.

What competitors get right (and what they miss)

What top-ranking articles agree on

Across ICICI Direct, Grip Invest, and OroPocket-style “2026 outlook” posts, the winning themes are consistent:

-

Silver outperformed hard in the last upcycle and stays in focus due to macro uncertainty + industrial demand (solar, EVs, electronics).

-

Silver is more volatile than gold, so it works best as a satellite allocation.

-

A practical “how to invest” section matters: physical vs ETF vs digital vs futures.

The content gaps we’ll fix in this post

Most competitors gloss over:

-

The real cost math (spreads + GST + storage) that decides whether you actually make money.

-

A simple allocation framework that prevents silver from hijacking your portfolio.

-

A beginner-proof “do this / avoid this” plan for India-first investing (UPI, small-ticket SIPs, easy liquidity).

-

How to pair silver with gold + rewards so you’re not just buying a volatile metal – you’re building a habit and getting paid to invest.

Silver in 2026: the one-minute outlook (India-first)

Silver is pulled by two engines:

-

Precious metal behavior: reacts to USD moves, interest-rate expectations, risk sentiment.

-

Industrial metal behavior: reacts to solar manufacturing cycles, EV/electronics demand, supply chain constraints.

That’s why silver often:

-

Outruns gold in risk-on phases

-

Falls harder than gold during global slowdowns

“The silver market is projected to face a fifth consecutive deficit in 2025, with an anticipated shortfall of 95 million ounces.” – Source

Pros of investing in silver (2026)

1) Lower entry point than gold (easier to start small)

Silver lets you build precious-metals exposure without needing a big ticket size.

That matters because the real game is consistency:

-

small buys

-

automated SIPs

-

long holding periods

2) Real industrial demand tailwinds (not just “safe haven” hype)

Silver demand isn’t only emotional like gold. It’s also functional: solar PV, electronics, EV components, power grids.

If you believe in India’s manufacturing + renewable push, silver gets a long-term “use-case” backbone.

3) Diversification (with a twist)

Silver can diversify beyond equities and can complement gold – but it is not as stable as gold.

A good way to think about it:

-

Gold = portfolio shock absorber

-

Silver = portfolio “torque”

4) Big upside in fast rallies

Silver is known for sharp “catch-up” moves. If you can tolerate volatility and buy with discipline, it can reward you.

Risks of silver investing (what can go wrong)

1) Volatility: silver can behave like equities

If you want smooth returns, silver will disappoint you.

“A study (1990–2024) found silver’s standard deviation at ~26.6% (vs gold’s ~14.7%); silver CAGR ~7.6% vs gold ~10.6%.” – Source

2) Physical silver cost traps (GST, making charges, bulky storage)

Physical silver looks simple but can leak returns via:

-

3% GST

-

dealer premium/spread

-

storage (it’s bulky)

-

purity risk + resale discounting

If you’re buying jewellery as “investment,” you’re often paying for design + making, not metal.

3) Product mismatch: the wrong vehicle for your goal

-

Futures/options: leverage → margin calls → not beginner-friendly

-

Physical: storage/purity spreads

-

ETFs: demat + expense ratios + market-hour liquidity

-

Digital: depends on platform transparency and vaulting

If you’re unsure, start with a beginner-safe vehicle and scale up later.

Who should invest in silver in 2026 (and who should not)

Silver is a good fit if you are:

-

Building a diversified long-term portfolio (3+ years)

-

Okay with 20–30% drawdowns without panic-selling

-

Bullish on solar/EV/electronics demand over time

-

Willing to invest via SIPs / staggered buying, not hype-chasing

Avoid or go slow if you are:

-

Under a 3-year time horizon

-

Looking for FD-like stability

-

Investing money you might need for emergencies

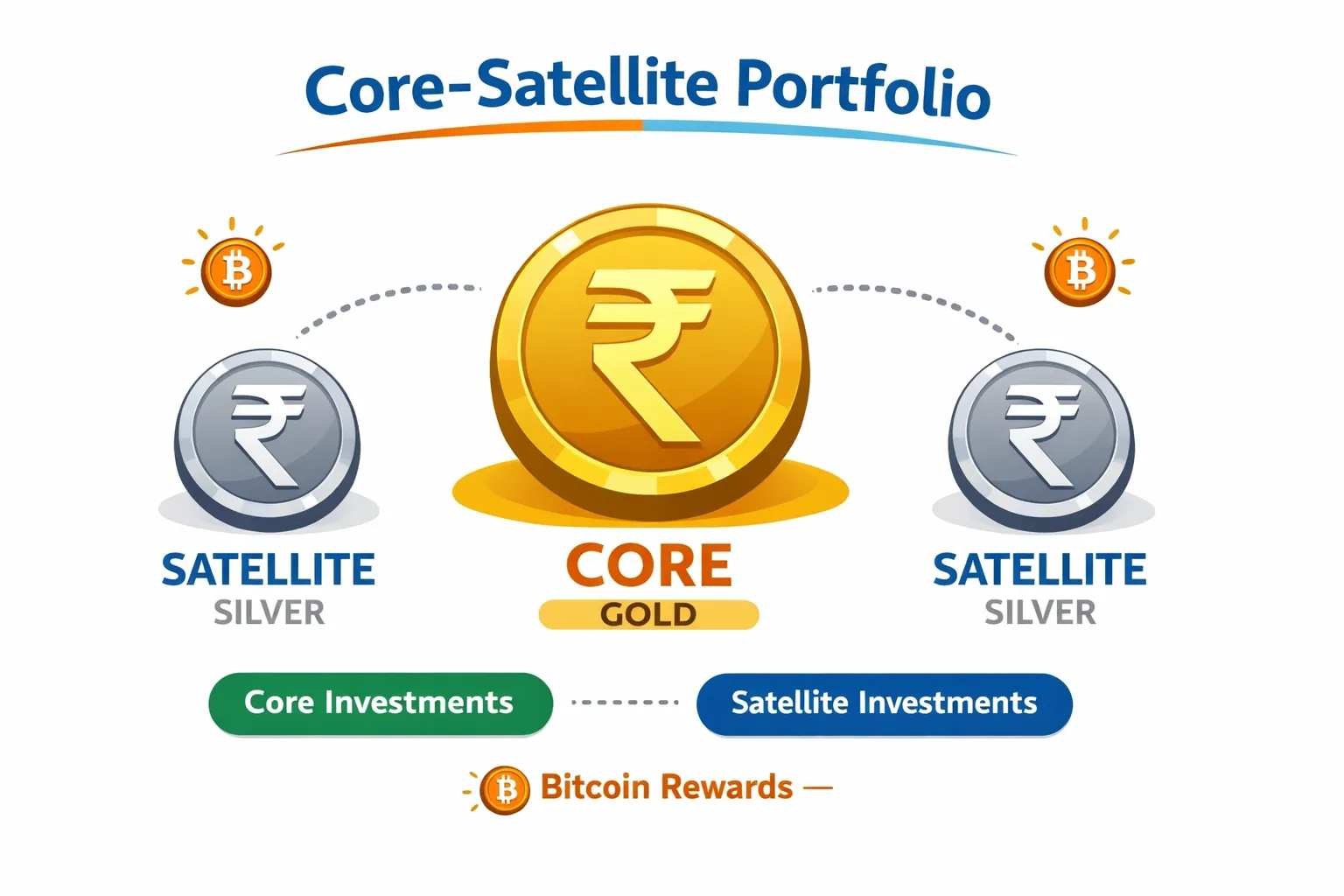

If you’re unsure, learn the mechanics first via a safer structure like gold + small silver allocation. (This guide on investing in gold and silver together: allocation strategies and rebalancing makes it simple.)

How much silver should you allocate? (Simple portfolio rule)

Silver should usually be satellite, not the core.

A clean framework for most Indian retail portfolios

|

Risk appetite |

Silver allocation |

Gold allocation |

Notes |

|---|---|---|---|

|

Conservative |

0–3% |

8–12% |

Keep silver minimal; gold does the heavy lifting. |

|

Balanced |

3–7% |

8–12% |

Good for most salaried investors. |

|

Growth / higher-risk |

7–10% |

6–10% |

Only if you can handle sharp moves. |

Rebalancing rule (important):

If silver rallies and becomes oversized, trim back to your target. If it crashes, add slowly via SIPs. That’s how you turn volatility into an advantage.

Best ways to invest in silver in India (2026)

If you’re deciding “where should I invest in silver,” here are your practical options – ranked for beginners.

1) Digital silver (best for small-ticket + habit-building)

-

Start from ₹1

-

Buy/sell quickly (platform dependent)

-

No storage hassle

-

Great for SIPs and rupee-cost averaging

If you’re comparing options, read digital silver vs silver ETF in 2026 to pick the right instrument for your goal.

2) Silver ETFs (good for demat investors)

-

Transparent pricing

-

Exchange-traded convenience

-

Expense ratio + tracking difference risk

-

Only market-hour transactions

3) Physical silver (coins/bars)

-

Tangible, giftable

-

But: GST + premiums + storage + resale spreads

-

Best only if you can buy close to spot and have secure storage

4) Futures & options (advanced only)

-

Leverage magnifies gains and losses

-

Not recommended unless you’re experienced and disciplined

The OroPocket advantage: invest in silver + get free Bitcoin too

Most apps help you buy silver. OroPocket helps you build wealth habits.

What you get with OroPocket

-

₹1 entry point: start instantly, no “minimum investment” friction

-

Instant UPI payments: buy in under 30 seconds

-

Free Bitcoin (Satoshi) on every purchase: two assets for the price of one

-

Gamified investing: daily streaks, spin-to-win rewards, tiered benefits

-

Referral rewards: invite friends, both earn 100 Satoshi + free spin

-

Security & trust: RBI-compliant model, authorized bullion partners, 100% insured vaults

This is the real unlock for beginners: You stop waiting for the “perfect price” and start building a consistent investing habit – while getting rewarded.

Want to go deeper on the mechanics? Use this guide to buy, store, and sell digital silver safely in India.

A simple 30-day plan to start investing in silver (without overthinking)

Week 1: Start tiny

-

Buy silver for ₹10–₹100 to understand pricing and behavior.

-

Focus on building the habit, not timing.

Week 2: Add structure

-

Set a weekly SIP (even ₹50–₹200).

-

Pair silver with a gold core (gold stabilizes the ride).

Week 3: Add discipline

-

Decide your target allocation (e.g., 5% silver).

-

Don’t chase rallies. Let SIPs do the work.

Week 4: Make it rewarding

-

Maintain streaks, use spin-to-win.

-

Refer one friend and earn Satoshi rewards.

-

Track progress – small wins compound fast.

Stop watching. Start growing.

Conclusion: Should you invest in silver in 2026?

Yes – if you treat silver as a satellite allocation, invest with a 3+ year horizon, and use SIPs to handle volatility.

Silver can be powerful because it sits at the intersection of:

-

precious metal protection

-

industrial growth demand

-

affordable accumulation for Indian retail investors

But it can also punish impulsive buyers who go lump-sum at peaks.

The smart move in 2026: Use gold as your anchor. Add silver for upside. Invest consistently. Rebalance.

Your next step

Download OroPocket and start investing in silver from ₹1 via UPI – and earn free Bitcoin rewards on every purchase.

You’re not just buying metal. You’re buying momentum.