Is Buying a Gold Coin a Good Investment? What to Check Before You Buy

Is Buying a Gold Coin a Good Investment? The Short Answer (and Why It Depends)

If you want something you can hold, gift, or liquidate fast in an emergency, buying a gold coin can be a good investment. But if your goal is pure investing efficiency – lowest premiums, zero storage hassle, and easy SIPs – digital gold, SGBs, or gold ETFs typically win. The “best gold to purchase” depends on whether you value tradition and tangibility or low cost and convenience.

“Digital gold purchases in India via UPI nearly tripled in 2025, totaling ~13.5 tonnes.” – Source

What this guide covers (quick read)

-

Purity, hallmark (BIS + HUID), mint credibility

-

Denomination and premiums

-

Buyback, liquidity, taxes, and storage

-

Safer alternatives like digital gold, SGBs, ETFs – and when each wins

When gold coins make sense

-

You want a tangible asset for gifting, rituals, or emergency liquidity

-

You value privacy and portability

-

You can store and insure safely

When gold coins don’t make sense

-

You want lowest premiums and zero storage hassles

-

You plan SIP-style micro-investments (₹1–₹500/day)

-

You want to earn rewards on purchases and instant UPI settlement

TL;DR verdict

-

Coins are great for tradition, tangibility, and quick liquidity

-

For pure investing efficiency and habit-building, digital gold/SGBs/ETFs usually beat coins on cost and convenience

Ready to start with micro-investing in 24K digital gold and earn free Bitcoin on every purchase? Download the OroPocket app now: https://oropocket.com/app

Gold Coin vs Digital Gold vs SGB/ETF: Which Is Best for You Right Now?

Choosing the best gold to purchase starts with why you’re buying. If you’re asking “How do I purchase gold?” align your method with your goal and time horizon.

If you’re asking “How do I purchase gold?” start with your goal

-

Short-term liquidity (0–12 months): Need quick access to cash and minimal lock-ins

-

Medium-term hedge (1–5 years): Protect savings against inflation and market swings

-

Long-term wealth + interest (5–8 years): Maximise tax-efficiency and steady returns

-

Daily micro-investing habit (₹1–₹500/day): Build consistency with tiny, instant buys

Decision framework (who should buy what)

-

Coins: Best for gifting, rituals, and an emergency stash you fully control. You can sell or pledge quickly, but you’ll pay higher premiums over spot and must handle storage/insurance.

-

Digital gold (e.g., OroPocket):

-

Lowest entry point (start with ₹1), UPI instant buy/sell 24×7

-

Secure 24K gold, insured vaulting, easy liquidity

-

Rewards layer: earn free Bitcoin (Satoshi) on every purchase, daily streaks, spin-to-win, referrals

-

Ideal for habit-building and micro-investors who ask “how do you buy gold daily without hassle?”

-

-

SGBs (Sovereign Gold Bonds):

-

Best long-term option (8-year tenor; exits allowed from year 5)

-

Pays interest and capital gains are tax-exempt at maturity

-

Requires a longer holding period; secondary market liquidity can be uneven

-

-

ETFs:

-

Demat-based exposure with exchange liquidity and minimal spread

-

No storage headaches; expense ratio applies

-

Suits traders and investors already using a brokerage/demat account

-

“Best gold to purchase” depends on:

-

Premiums over spot, taxes, spreads: Coins often have the highest premiums; ETFs and SGBs typically lower all-in costs over time

-

Buyback speed and convenience: Coins and digital gold are fastest; SGBs/ETFs depend on market timings and liquidity

-

Storage, insurance, and risk tolerance: Coins need secure storage; digital gold/SGBs/ETFs remove storage hassles

Quick examples

-

First-time investor with ₹200/day: digital gold > coin

-

Long-term saver with tax focus: SGB > coin

-

Trader with demat: ETF > coin

-

Wedding gifting next week: coin > all

“Gold serves as a portfolio diversifier with low correlations to most assets and is widely considered a hedge against inflation.” – Source

Pro tip for beginners wondering “how to buy gold” the smart way: start with digital gold on OroPocket to build your habit from ₹1 with instant UPI, then add SGBs for long-term, tax-efficient exposure. Keep coins for gifting and emergency liquidity.

Start in 30 seconds, earn free Bitcoin on every gold purchase. Download OroPocket: https://oropocket.com/app

The Only Gold Coin Buying Checklist You Need (Purity, Hallmark, Denomination, Premiums, Buyback)

When buying gold, the right coin can be a smart, liquid asset – if you know exactly what to check. Use this 10-point, India-specific checklist to avoid overpaying and protect resale value.

1) Purity and fineness (24K vs 22K)

-

Look for 24K 999/999.9 for investment-grade coins (highest gold content; easiest to value).

-

22K (91.6%) is common for ornamental/gifting coins; may have slightly different resale dynamics.

2) BIS hallmark and HUID – non-negotiable

-

Verify four marks on the coin/pack:

-

BIS logo

-

Fineness (e.g., 999/999.9)

-

Jeweller/assay centre code

-

HUID (Hallmark Unique Identification)

-

-

HUID lookup steps overview:

-

Locate the HUID on the coin/package and on your invoice.

-

Open the BIS Care app (Android/iOS) and select “Verify HUID.”

-

Enter the HUID to confirm purity, article type, and jeweller details.

-

Buy only if the details match the product in hand.

-

3) Mint credibility and brand

-

Prefer LBMA-linked bullion partners and reputed Indian mints (e.g., MMTC-PAMP, government-authorised channels).

-

Avoid unknown private minting without robust, verifiable certification and tamper-proof packaging.

4) Weight/denomination strategy

-

1g–10g: Best for gifting, rituals, and frequent liquidity needs. Note: higher premiums per gram.

-

20g–100g: Better value per gram due to lower minting/packaging premiums.

5) Premiums over spot price (what you really pay)

-

Components that add up:

-

Spot gold value (based on live market rate)

-

Minting/packaging premium

-

Dealer margin

-

GST (3%) on the product price

-

-

Compare the “out-the-door” (final invoice) price across sellers – not just the spot rate.

6) Buyback and resale spread

-

Confirm same-brand buyback terms before purchase: on-the-spot pricing, documentation needed, and any deductions.

-

Understand bid–ask spread: smaller, standard coins from reputed mints usually have tighter spreads and better liquidity.

7) Packaging and serialisation

-

Choose a tamper-evident blister pack with a unique serial/HUID that matches your invoice.

-

Do not break the seal unless necessary – intact packaging supports authenticity and resale.

8) Invoice, KYC, and warranty terms

-

Ask for a full tax invoice listing purity, fineness, HUID/serial, brand/mint, weight, and GST.

-

Know KYC/payment norms for larger purchases (PAN/Aadhaar as per prevailing regulations).

9) Taxes and compliance basics

-

3% GST on purchase of coins.

-

Capital gains tax on sale depends on holding period; keep invoices to calculate gains correctly.

10) Quick pre-purchase checklist (printable)

-

24K 999/999.9 purity (for investing)

-

BIS hallmark + HUID verified on BIS Care app

-

Reputed mint/brand (LBMA-linked or authorised)

-

Compared total premiums and final invoice price

-

Clear, written buyback policy with spreads/deductions

-

Tamper-evident sealed pack with matching serial/HUID

-

Full tax invoice with all identifiers and GST

Gold coin price build-up (example for 10g coin)

|

Component |

Amount (₹) |

% of total |

Notes |

|---|---|---|---|

|

Spot gold value |

65,000 |

94.19% |

Example: ₹6,500/gram × 10g |

|

Minting/packaging premium |

1,200 |

1.74% |

Varies by brand/denomination |

|

Dealer margin |

800 |

1.16% |

Compare across authorised sellers |

|

GST (3%) |

2,010 |

2.91% |

Applied on product price (incl. making) |

|

Final invoice price |

69,010 |

100.00% |

Your actual “out-the-door” cost |

Prefer zero storage hassle, micro-purchases from ₹1, and instant UPI settlement? Build your gold stack the modern way – and earn free Bitcoin rewards on every purchase – with OroPocket. Download now: https://oropocket.com/app

Where to Buy Gold Coins in India (And How to Avoid Traps)

Choosing the right place to buy a gold coin matters as much as choosing the coin itself. Use this quick guide to compare your options and dodge common pitfalls.

Jewellers and bullion dealers

-

Pros:

-

Wide choice of weights/designs

-

Instant delivery and quick liquidity

-

Often offer same-brand buyback

-

-

Cons:

-

Premiums vary widely by store/brand

-

Seller reputation and certification matter a lot

-

Banks

-

Pros:

-

Strong trust perception

-

-

Cons:

-

Typically no buyback as per policy

-

Often higher premiums vs dealers

-

Official mints and authorised partners

-

Pros:

-

Purity assurance, hallmarking, certification

-

Tamper-evident packaging and serialisation

-

-

Cons:

-

Limited designs/locations

-

May have fixed pricing with less room to negotiate

-

Online platforms/marketplaces

-

Pros:

-

Transparent pricing and easy comparison

-

Home delivery and digital records

-

-

Cons:

-

Must vet the seller and certification carefully

-

Avoid uncertified or marketplace-only listings

-

Red flags to avoid

-

No BIS hallmark/HUID verification

-

Loose or tampered packaging; missing serial

-

No proper tax invoice

-

Aggressive “too good to be true” discounts

-

Unclear or no buyback policy

Want zero storage worries and instant UPI buy/sell instead of hunting for the “right” coin? Build your stack with 24K digital gold and earn free Bitcoin rewards on every purchase. Download OroPocket: https://oropocket.com/app

How to Verify a Gold Coin’s Authenticity at Home (and When to Use a Lab)

Trust, but verify. Here’s a simple, damage-free process to confirm your coin is genuine – and when to escalate to a professional lab.

At-home non-destructive checks

-

HUID lookup on BIS platform: Use the BIS Care app to verify the HUID. Ensure the fineness (e.g., 999/999.9), brand/mint, and weight match your coin and invoice.

-

Magnet test: Pure gold is non-magnetic. If a strong magnet attracts it, there may be steel/iron cores or alloys. Note: Very weak pull on packaging staples isn’t the coin.

-

Dimensions/weight check: Use calipers and a precise digital scale. Compare diameter, thickness, and weight to official mint specifications for that denomination.

Specific gravity (water displacement) – careful DIY

-

Fill a graduated container with water and note the level.

-

Gently submerge the coin (in a waterproof sleeve if sealed) and measure the displaced volume.

-

Calculate specific gravity = coin weight (g) ÷ displaced water (ml).

-

Expected range for 24K gold: around 19.3. Significant deviation suggests impurities or counterfeiting.

Professional testing

-

Visit an authorised assay centre for XRF (X-ray fluorescence) analysis.

-

You’ll receive a non-destructive purity report detailing fineness and alloy composition.

What not to do

-

Avoid acid tests at home – they can damage the coin, markings, and tamper-evident packaging, hurting resale value.

Red flags during verification

-

Off-weight beyond tolerance

-

Sloppy or inconsistent fonts/finish

-

Seal tampering, mismatched serial/HUID vs invoice

-

Magnet attraction or odd ring sound on a soft surface

Prefer gold you never have to test at home? Buy 24K digital gold on OroPocket – RBI-compliant partners, insured vaulting, instant UPI, and free Bitcoin rewards on every purchase. Download now: https://oropocket.com/app

Costs, Taxes, and Real Returns: Do the Math Before You Buy

Before you ask “how do I purchase gold” or decide the best gold to purchase, map out every rupee that leaves and enters your pocket. Upfront premiums, GST, spreads, and taxes can turn a good-looking sticker price into a mediocre real return.

Purchase costs you must factor in

-

Minting/packaging premiums and dealer margin: These sit on top of spot price and vary by brand and denomination (smaller coins often carry higher per-gram premiums).

-

3% GST on invoice value: Applied on the product price (including making/premium). This is unavoidable for coins.

Selling costs you may face

-

Buyback deductions/spread: You’ll usually receive slightly below spot; the gap varies by seller/brand and coin size.

-

Testing charges if packaging is broken: If you open or damage the tamper-evident pack, some dealers charge a testing fee or offer a lower rate.

Taxation on gains (simplified, not tax advice)

-

Short-term capital gains: If sold within 3 years, gains are added to your income and taxed at your slab.

-

Long-term capital gains: If sold after 3 years, gains are typically taxed at 20% with indexation (check latest rules, cess/surcharge may apply). Indexation can significantly reduce taxable gains.

Worked example (illustrative)

Assume you buy a 10g coin and sell it 4 years later. This is a simplified illustration to show the mechanics; actual prices, spreads, and tax rules can change.

-

Purchase (Day 0):

-

Spot gold: ₹6,500/g → Spot value for 10g = ₹65,000

-

Minting/packaging + dealer margin: ₹1,800

-

Subtotal (pre-GST): ₹66,800

-

GST @3% on ₹66,800 = ₹2,004

-

Final invoice you pay: ₹68,804

-

-

Sale (Year 4):

-

Spot gold: ₹8,500/g → Spot value for 10g = ₹85,000

-

Buyback spread: 1.5% below spot → Payout = ₹85,000 × 0.985 = ₹83,725

-

Assume seal intact → Testing charge = ₹0

-

Nominal gain (pre-tax) = ₹83,725 − ₹68,804 = ₹14,921

-

-

Tax (LTCG with indexation, simplified):

-

Assume an indexation factor of 1.17 over 4 years (illustrative)

-

Indexed cost = ₹68,804 × 1.17 ≈ ₹80,501

-

Taxable LTCG = ₹83,725 − ₹80,501 ≈ ₹3,224

-

LTCG @20% ≈ ₹645 (cess/surcharge ignored for simplicity)

-

Net proceeds after tax ≈ ₹83,725 − ₹645 = ₹83,080

-

Net gain after tax = ₹83,080 − ₹68,804 = ₹14,276

-

Nominal CAGR ≈ 4.8% p.a.; if average inflation over the period is ~5% p.a., real return is roughly flat

-

Key takeaway: premiums, GST, and spreads meaningfully drag returns. Holding longer (to use indexation) helps, but real returns depend on how much gold prices outpace inflation.

How to improve post-tax outcomes

-

Hold longer to benefit from indexation (subject to current rules).

-

Sell to the original seller/brand with a clear, written buyback policy to minimise the spread.

-

Keep the tamper-evident packaging intact; avoid opening or scratching the coin.

-

Compare “out-the-door” prices (including GST) and buyback spreads across reputed sellers before purchasing.

-

Maintain clean records (invoice, HUID/serial) for smooth resale and accurate tax filing.

Prefer zero storage hassles and want to build a daily investing habit from ₹1 with instant UPI? Buy 24K digital gold and earn free Bitcoin rewards on every purchase with OroPocket. Download now: https://oropocket.com/app

Compare: Gold Coins vs Digital Gold (OroPocket), SGBs, and ETFs

If you’re wondering how to buy gold without overpaying, compare the total cost, liquidity, and tax impact of each option – then pick what fits your goal and lifestyle.

What to compare (so you don’t overpay)

-

Minimum investment, premiums/spreads, liquidity speed, storage, rewards, taxation

Why many first-time investors start with digital gold

-

₹1 entry, instant UPI payments, real-time pricing

-

Insured vaulting, 24K purity, easy sell-back

-

Habit-building via streaks, SIP-like micro-buys

OroPocket edge (gold + Bitcoin rewards)

-

Free Satoshi on every gold/silver purchase (tiered)

-

Daily streak bonuses, Spin to Win, referral rewards

-

RBI-compliant, 100% insured vaults, authorized bullion partners

When coins still win

-

Cultural gifting, rituals, physical possession preference

When SGBs/ETFs may beat both

-

Long-term tax efficiency (SGB maturity), demat liquidity (ETFs)

Side-by-side comparison

|

Parameter |

Coins |

Digital Gold (OroPocket) |

SGBs |

ETFs |

|---|---|---|---|---|

|

Min investment |

Typically 1g+ |

Start from ₹1 |

Typically 1g minimum during issue window |

1 unit (varies by ETF price); demat required |

|

Purity |

22K/24K; prefer 24K 999/999.9 |

24K 999 (vaulted) |

Price linked to 24K purity (no physical coin) |

Usually 99.5%+ LBMA standard via custodian |

|

Premiums/spread |

Higher premiums (esp. <10g); resale spread 1–3%+ |

Low-to-moderate premiums; tight platform spreads |

No GST; issue price (often online discount); no making charges |

Expense ratio (~0.5–1%/yr) + brokerage; minimal bid–ask spread |

|

Liquidity speed |

Same-day at jeweller/dealer; depends on store hours |

24×7 instant buy/sell via app |

8-year tenor; early redemption from year 5 or sell on exchange (liquidity varies) |

Market hours on exchange; quick execution if liquid |

|

Storage/insurance |

Self-storage, locker/insurance extra |

Fully insured vaults (offsite) |

None (held electronically) |

None (held in demat) |

|

Rewards/benefits |

None |

Bitcoin cashback (Satoshi), streak bonuses, spin-to-win, referrals |

Periodic interest; capital gains exempt at maturity |

Exchange liquidity; SIP via broker; can be pledged with some brokers |

|

Buyback/exit |

Best with same-brand; possible testing charges if seal opened |

Instant sell-back to platform at live price |

Redeem at maturity; early exit allowed from year 5; secondary market pricing may vary |

Sell anytime on exchange (NAV-tracking, market-linked price) |

|

Tax considerations |

3% GST on buy; capital gains as per holding period and current rules |

Similar to physical (no GST on sell); capital gains as per current rules |

Interest taxable; capital gains at maturity exempt (as per current rules) |

Capital gains taxation as per current rules for gold ETFs; no GST |

|

Ideal for |

Gifting, rituals, emergency stash, privacy |

First-time investors, micro-investing, UPI convenience, habit-building |

Long-term savers focused on tax efficiency + interest |

Demat users and traders seeking low spreads and exchange liquidity |

Bottom line: Coins shine for tradition and tangibility. For pure investing efficiency and daily habit-building, digital gold on OroPocket is hard to beat. SGBs are a winner for long-term, tax-efficient exposure, while ETFs suit demat users who want exchange liquidity.

Start stacking in seconds. Buy 24K digital gold from ₹1, earn free Bitcoin on every purchase, and cash out instantly via UPI. Download OroPocket: https://oropocket.com/app

Common Mistakes to Avoid When Buying Gold Coins (And What to Do Instead)

New to gold? Here’s how to buy gold the smart way – avoid these traps and follow the fixes.

The big errors

-

Buying without BIS/HUID verification

-

Ignoring buyback policy and resale spread

-

Overpaying premiums for tiny denominations

-

Breaking blister pack (hurts resale value)

-

Skipping invoices/KYC; no paper trail

What to do instead

-

Verify HUID online; choose reputed mints

-

Check BIS hallmark (BIS logo, fineness 999/999.9, jeweller/assay code, HUID).

-

Use the BIS Care app to confirm HUID matches fineness/brand/weight.

-

-

Compare all-in prices (with GST) across 2–3 sellers

-

Don’t just ask “how do I purchase gold” – ask “what’s my out-the-door price?”

-

Compare spot + premium + dealer margin + 3% GST vs buyback spread.

-

-

Prefer 10g+ if your goal is pure investment value

-

Smaller coins (1g–5g) carry higher per-gram premiums.

-

If you plan SIP-style micro-buys, consider digital gold instead of coins.

-

-

Keep packaging intact; store securely

-

Tamper-evident blister + serial intact = faster resale and fewer testing deductions.

-

Use a dry, secure location or insured storage; avoid unnecessary handling.

-

-

Track market levels; avoid festival spikes when possible

-

Time bulk buys away from peak-demand days to limit premiums.

-

-

Document everything

-

Always take a full tax invoice with HUID/serial; keep KYC and payment proofs.

-

Selling back to the original seller typically narrows the spread.

-

Want to start small without premium shock or storage worries? Build a daily micro-investing habit from ₹1, earn free Bitcoin on every purchase, and cash out instantly via UPI with OroPocket. Download now: https://oropocket.com/app

Storage, Insurance, and Safety: Keep Your Coins (and Data) Secure

Protecting your gold is as important as buying it right. Choose the storage that matches your access needs, budget, and risk tolerance – then harden your setup.

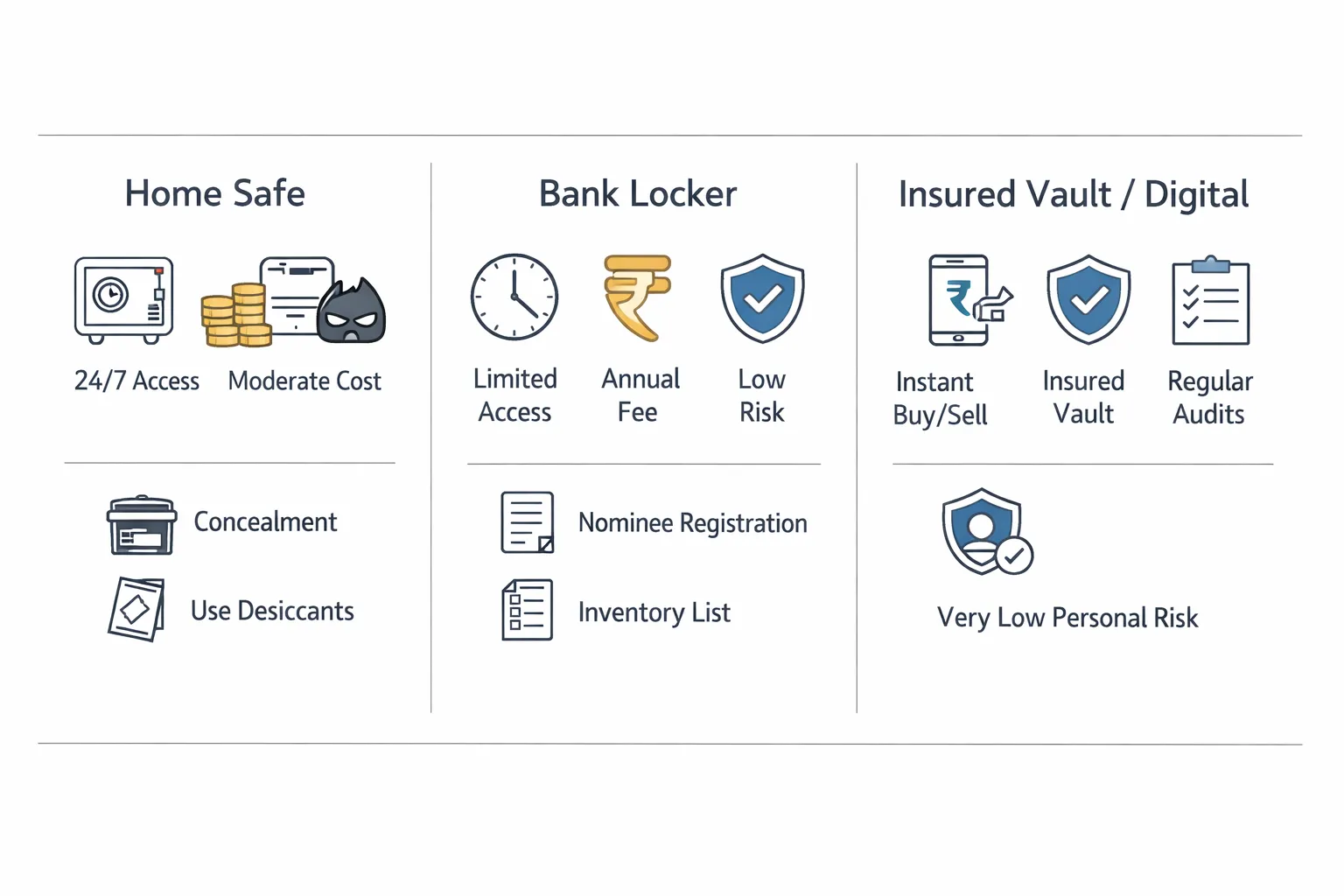

Home storage (safes)

-

Pros: Access anytime, immediate liquidity.

-

Cons: Theft/fire risk; insurance may require declarations and approved safes.

-

Tips: Use concealment and bolted, fire-rated safes; add desiccants to prevent moisture damage; don’t share locations on social media or with delivery personnel.

Bank lockers

-

Pros: Strong physical security; low probability of household theft risks.

-

Cons: Annual fee; limited access during banking hours; waitlists in some branches.

-

Tips: Register nominees; keep an updated inventory list and invoices; review locker terms and insurance coverage.

Professional vaulting (and the digital route)

-

Insured, audited vaults with professional custodians reduce personal risk.

-

Instant buy/sell without moving metal; digital records simplify tracking and inheritance.

-

OroPocket: 24K gold, 100% insured vaults, RBI-compliant partners, instant UPI.

Disaster-proofing your plan

-

Don’t put all holdings in one place – split across two methods if possible.

-

Maintain purchase invoices, HUID/serials, locker details, and nominee information in a secure, backed-up file.

-

Test your emergency liquidity: know exactly how to access/sell within hours if needed.

Prefer set-and-forget security with instant liquidity? Buy 24K digital gold on OroPocket and earn free Bitcoin rewards on every purchase. Download now: https://oropocket.com/app

Conclusion: Start Small, Buy Smart – Or Go Digital with OroPocket

Gold coins make sense when you want something tangible for gifting, traditions, or quick emergency liquidity. Just keep it tight: verify BIS hallmark + HUID, choose reputed mints, compare the real “out-the-door” price (spot + premium + GST), and confirm the buyback policy before you pay.

For everyday investing, digital gold usually wins on cost, speed, and habit-building. If your goal is to invest small amounts consistently and avoid storage hassles, go digital first – and keep coins for occasions.

Final takeaways

-

Coins are great for culture and quick liquidity – verify BIS/HUID, compare total costs, and confirm buyback

-

For everyday investing, digital gold often wins on cost, speed, and habit-building

Why start with OroPocket today

-

Invest from ₹1 via UPI in under 30 seconds

-

Earn free Bitcoin (Satoshi) cashback on every gold/silver purchase

-

Gamified streaks and Spin to Win build consistent investing habits

-

24K pure gold, 100% insured vaults, RBI-compliant, authorized bullion partners

Ready to invest the modern way? Download the OroPocket app now: https://oropocket.com/app

![9 best places to buy digital silver online in India [2025] 8 9 best places to buy digital silver online in India 2025 cover](https://blog.oropocket.com/wp-content/uploads/2025/12/9-best-places-to-buy-digital-silver-online-in-India-2025-cover-300x200.webp)