Is Digital Gold Safe in India? Vaulting, Regulation, and Risks Explained

Is Digital Gold Safe in India? What Changed After SEBI’s Advisory

Quick answer

-

Digital gold can be safe if your provider uses authorized bullion partners (e.g., MMTC-PAMP, SafeGold), fully insured vaults, independent audits, and transparent T&Cs – but it isn’t a SEBI-regulated product. Due diligence is on you.

Why Indians love digital gold

-

Start with as little as ₹1 via UPI – no minimums, no paperwork.

-

No storage hassle – vaulted, insured, and audit-trailed.

-

24/7 liquidity – buy/sell instantly based on live prices.

-

Builds micro-investing habits – small, frequent purchases compound over time.

What changed after the SEBI advisory

-

Clarity: Digital gold isn’t regulated by SEBI/RBI. Extra caution and platform-level verification are essential.

-

Brokers can’t sell digital gold through trading accounts. Buy via dedicated gold platforms that clearly disclose their bullion partners, vaults, insurance, and redemption policies.

What this guide covers

-

Vaulting, custodians, and insurance explained

-

How to verify partners (MMTC-PAMP/SafeGold)

-

Spreads, limits, taxes, and redemption

-

Safer alternatives and how OroPocket keeps you protected

“UPI purchases of digital gold in India nearly tripled in 2025 – from ₹8 billion to ₹21 billion – amounting to ~13.5 tonnes.” – Source

Ready to invest smarter? Download the OroPocket app for RBI-compliant flows, authorized bullion partners, fully insured vaults – and free Bitcoin rewards on every gold purchase: https://oropocket.com/app

SEBI Advisory and Regulation: What It Means (and Doesn’t)

The reality

-

Digital gold is not regulated by SEBI or RBI. It’s a commodity purchase where a private custodian holds the underlying gold on your behalf.

-

SEBI instructed brokers/market intermediaries not to offer digital gold through trading accounts.

-

Practical implication: If you’re asking “is digital gold safe in India?”, the answer depends on the platform. Pick dedicated gold platforms that clearly disclose custodians, conduct independent audits, and provide 100% insured vaults.

What protections you do and don’t get

-

You don’t get SEBI’s investor protections like in mutual funds/equities. So if you wonder “digital gold is safe or not,” know that there’s no SEBI dispute-resolution framework.

-

You can get safety via:

-

Authorized bullion partners (e.g., MMTC-PAMP, SafeGold)

-

Independent vault audits and published audit reports

-

Comprehensive insurance (theft, damage, transit)

-

Transparent redemption policies (coins/bars, timelines, charges)

-

Related guardrails and standards

-

NITI Aayog has proposed working guidelines for digital gold providers – use them as a due-diligence checklist.

-

BIS hallmarking applies when you convert to physical coins/bars; always check BIS marking and purity before delivery.

-

KYC/PAN norms apply for higher-value buys and redemptions; follow limits to stay compliant and ensure smooth withdrawals.

Watch this first

A quick explainer on how digital gold works in India – vaulting, who actually holds the gold, and what SEBI’s stance means for you.

“Digital gold is not a SEBI-regulated product; brokers were directed to discontinue its sale on trading platforms by September 10, 2021 (NSE Circular, Aug 10, 2021).” – Source

Want a platform that puts safety first and still keeps it rewarding? Download OroPocket for authorized bullion partners, fully insured vaults, instant UPI buys – and free Bitcoin on every gold purchase: https://oropocket.com/app

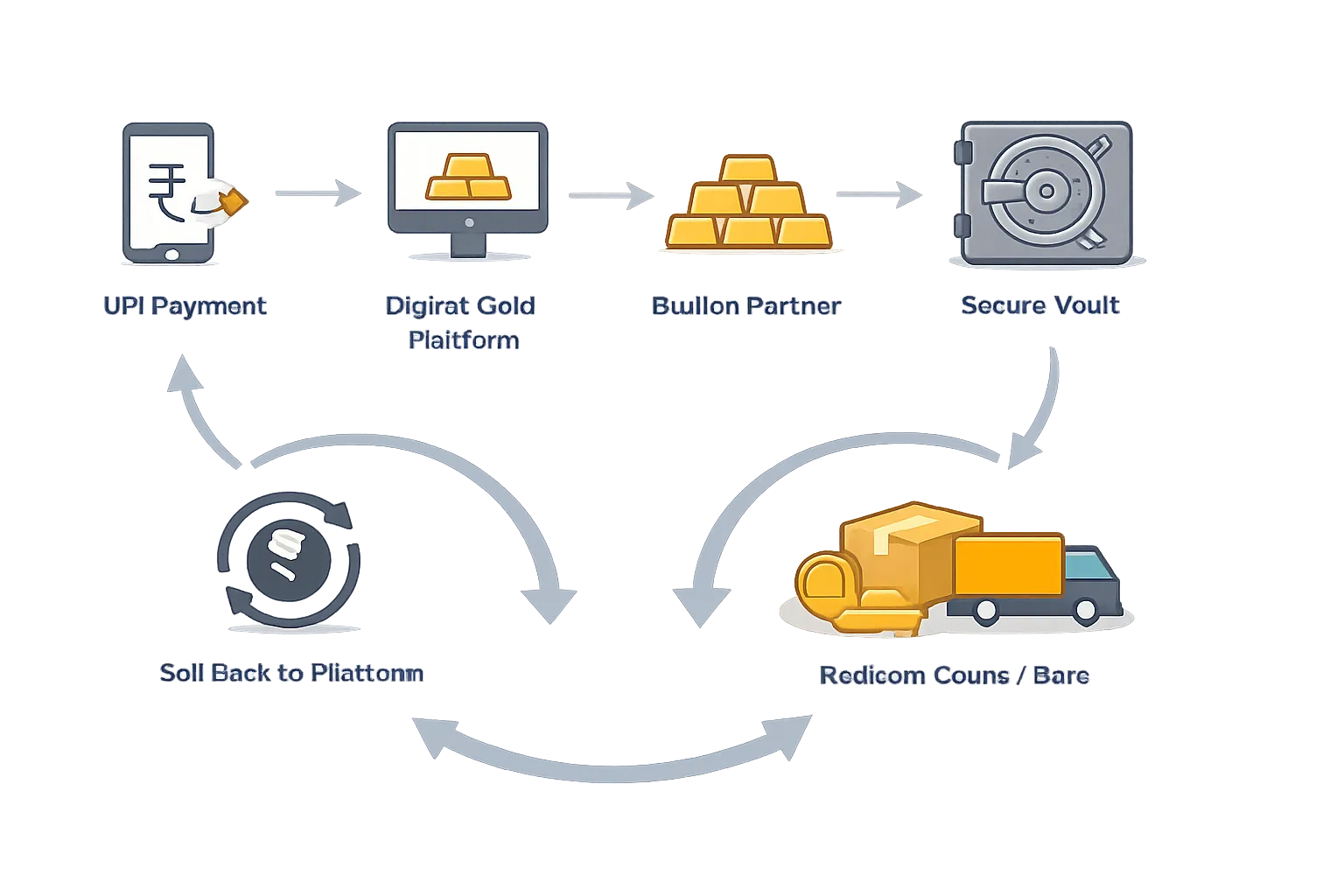

How Digital Gold Works End-to-End (UPI to Vault and Back)

Step-by-step flow

-

You pay via UPI → The platform executes a buy order with an authorized bullion partner (e.g., MMTC-PAMP/SafeGold) → Specific grams are allocated in your name → The gold is stored in fully insured, professional vaults with an independent custodian → You can sell anytime in-app at live prices or redeem into BIS-hallmarked coins/bars for delivery.

Allocated vs. unallocated

-

Prefer allocated holdings: Your grams are uniquely identified and fully backed by physical gold held with a custodian.

-

Ask for 1:1 backing: Confirm that each unit is backed gram-for-gram, and check where this is documented (allocation certificate, vault statement, and third-party audit reports).

Price discovery and settlement

-

Pricing: Mirrors international spot prices, converted to INR, plus applicable taxes, platform spread, and fees.

-

Settlement: Most platforms offer T+0 for small orders; larger or off-market-hour orders may settle T+1.

-

Price locks: Many platforms lock a quote for a short window (e.g., 3–5 minutes). If payment exceeds the window, the order re-quotes at the live rate.

Risk points and mitigation

-

Counterparty risk → Verify the bullion partner (MMTC-PAMP/SafeGold) and the vault custodian. Read platform T&Cs and ownership clauses.

-

Storage risk → Insist on 100% insurance coverage (theft, damage, transit) and independent third-party vault audits; look for published audit trails.

-

Liquidity risk → Review buyback policies, spreads, and minimum redemption quantities before you buy; prefer platforms with 24/7 liquidity and transparent pricing.

Make your first gold purchase in under 30 seconds via UPI – and earn free Bitcoin on every buy. Download OroPocket: https://oropocket.com/app

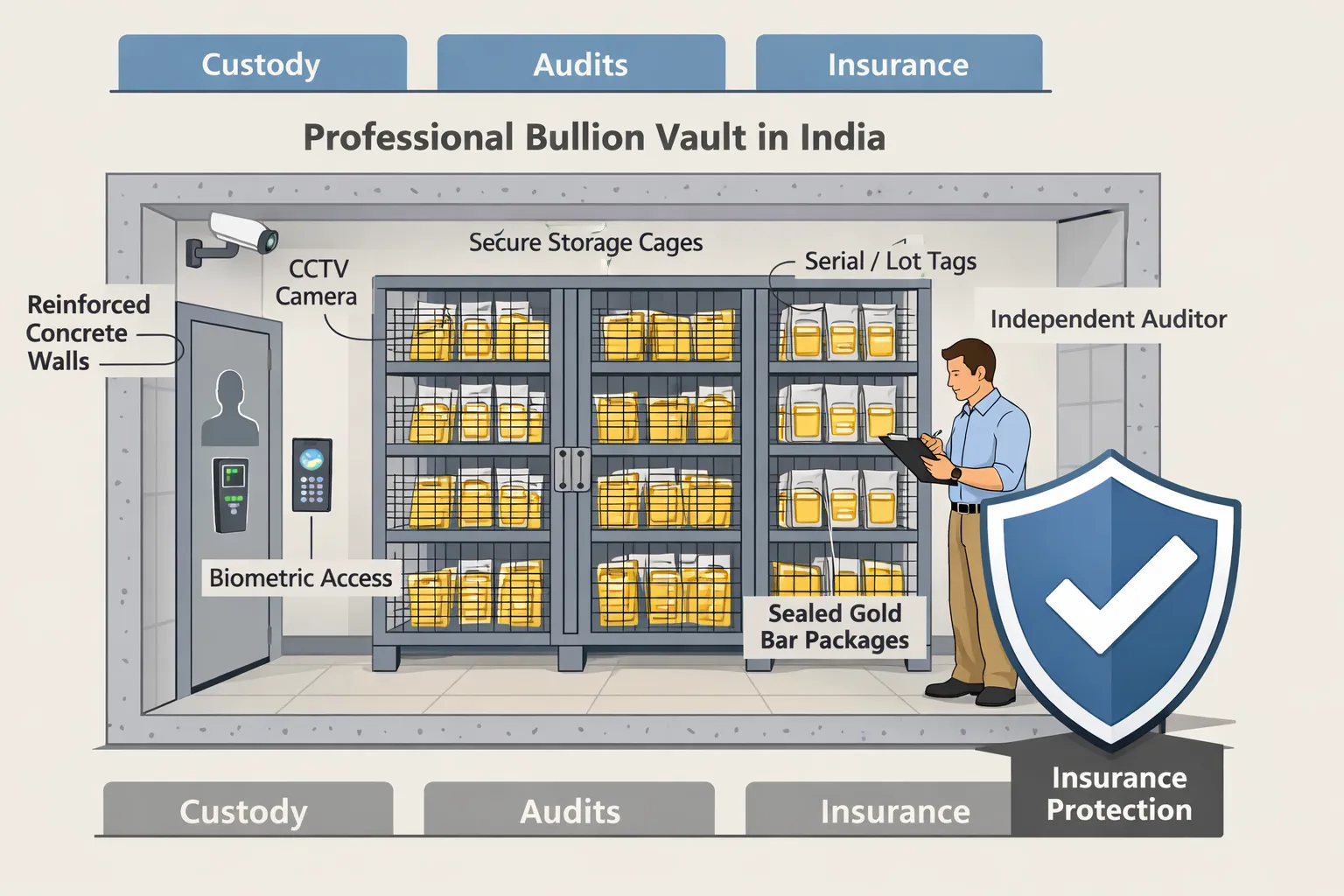

Vaulting, Custodians, Audits, and Insurance: Non‑Negotiables

Custodian and vault partners to look for

-

Reputable vault operators: Brink’s, Sequel, and MMTC-PAMP-operated facilities with documented security standards.

-

Named custodianship: Clear, named custodianship agreements that you can access on request – stating who holds the gold, where it’s stored, and under what terms.

Insurance that actually covers you

-

100% coverage: Insurance against theft, fire, flood, and accidental damage – underwritten by top-tier insurers.

-

Replacement value + transit: Confirm full replacement value coverage and whether insurance extends to transit during redemption/delivery and returns.

Independent audits

-

Cadence and credibility: Monthly or quarterly reconciliation by independent auditors with a strong track record in bullion or warehouse audits.

-

User access: Audit summaries/certificates available in-app or on the provider’s website so you can verify holdings anytime.

Green flags vs. amber flags

-

Green flags:

-

Named vault operator and custodian

-

Regular third-party audit reports published

-

Public insurance summary with coverage scope and limits

-

Serial/lot-level traceability and allocation certificates

-

Clear redemption SLAs (timelines, fees, purity standards)

-

-

Amber flags:

-

Vague “securely stored” claims without naming partners

-

No stated audit cadence or auditor identity

-

Unclear insurance scope or exclusions

-

No serial/lot traceability or allocation proof

-

Ambiguous or shifting redemption timelines and charges

-

Choose platforms that check every green box. With OroPocket, your gold is vaulted with authorized partners, 100% insured, and independently audited – so you focus on growing wealth, not chasing paperwork. Start now: https://oropocket.com/app

Fees, Spreads, Limits, and Taxes: What Affects Your Returns

The costs you should compare across apps

-

Buy–sell spread: The difference between app buy/sell price (often quoted in % or paise/gram). Lower is better for frequent buyers.

-

GST: 3% GST applies on purchases; additional GST/charges may apply on making and delivery when you redeem coins/bars.

-

Storage/maintenance fees: Some platforms bundle storage into spreads; others charge a periodic fee or only after a free period. Check minimum holding conditions.

Payment and operational limits

-

UPI: Per-transaction and daily limits vary by bank/PSP and app policy. Platforms may add their own minimums/maximums.

-

KYC/PAN: Higher limits typically require PAN and full KYC. Expect extra verification for large buys and redemptions.

Tax basics (not tax advice)

-

Digital gold is treated like physical gold for capital gains. Holding period influences tax rate and indexation eligibility. Consult your tax advisor for your specific situation.

Pro tip

-

Track your Effective Total Cost (ETC) = spread + GST + any storage/redemption fees. This is the real cost that impacts returns.

Digital Gold Cost & Limits Checklist

|

Cost/Limit item |

What to check |

Typical range/notes |

|---|---|---|

|

Buy–sell spread |

Difference between buy and sell price at the same time |

Often 0.5%–3.0% depending on provider, volume, and time of day |

|

GST on purchase |

GST on metal value; extra GST on making/delivery at redemption |

3% on gold value; additional GST/charges may apply on minting/shipping |

|

Storage/maintenance fee |

Whether storage is bundled or charged separately; any free period |

0%–0.5% p.a. or bundled into spread; sometimes free up to a limit |

|

Redemption making+delivery charges |

Minting premium and shipping when converting to coins/bars |

Fixed fee + per-gram minting premium; e.g., ₹199–₹799 shipping, varies by weight |

|

Price lock window |

How long the quoted price is valid while you pay |

Commonly 3–5 minutes; re-quotes if exceeded |

|

UPI per-transaction limit |

Bank/app limits for a single UPI payment |

Typically up to ₹1,00,000 per txn (bank-specific; some allow higher) |

|

Daily purchase limit |

Platform cap per day; may scale with KYC level |

Platform-specific; e.g., ₹50,000–₹2,00,000/day or more with full KYC |

|

KYC/PAN thresholds |

When PAN and full KYC are required |

PAN usually needed for larger/cumulative buys/redemptions (e.g., >₹50,000); full KYC for higher limits |

|

Early redemption conditions |

Minimum grams, processing time, and any early/extra fees |

Min quantities (e.g., 0.5g/1g/2g); processing 2–7 business days; shipping/packing fees apply |

Want low spreads, instant UPI, and transparent fees – plus free Bitcoin on every gold purchase? Download OroPocket and keep more of your returns: https://oropocket.com/app

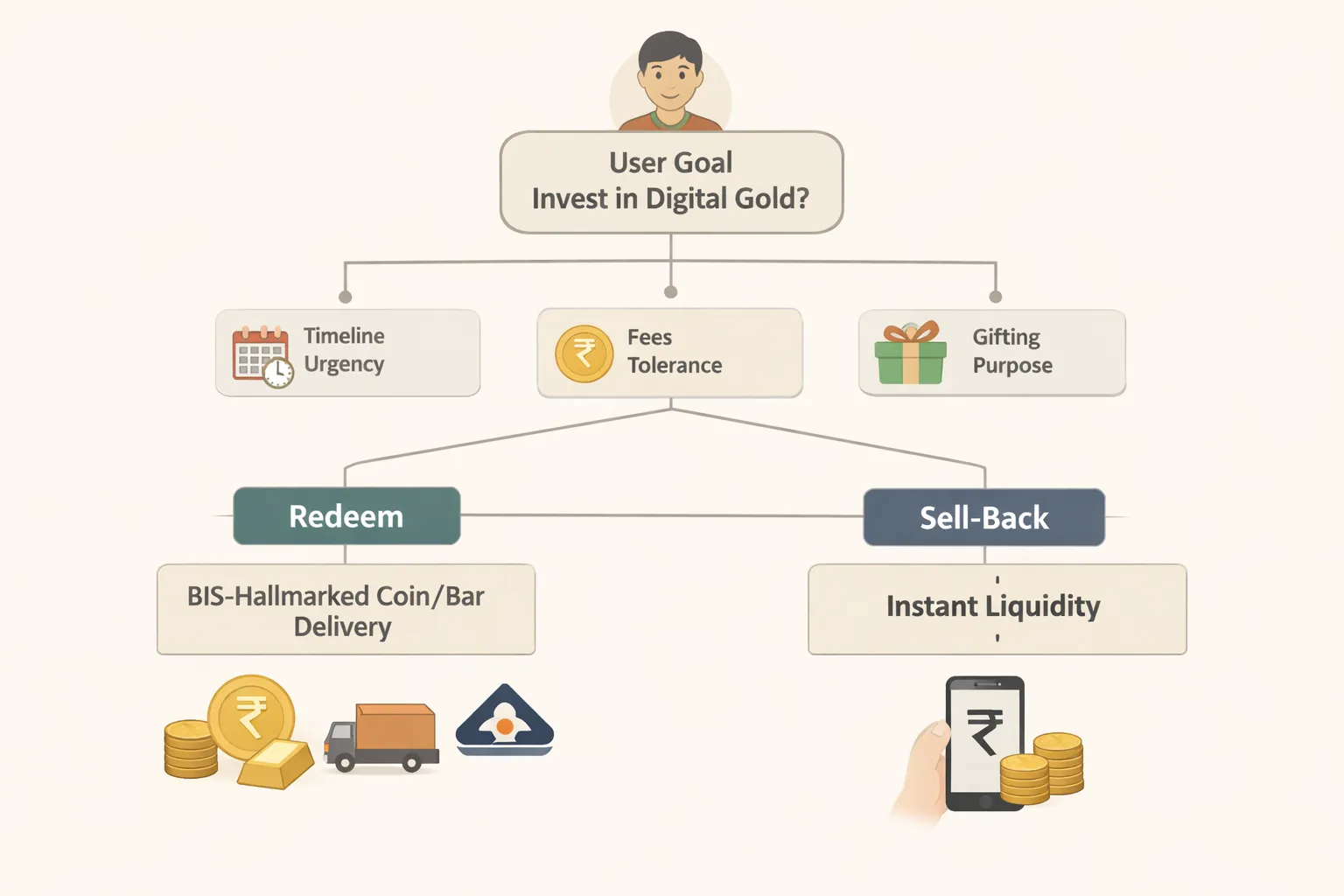

Redemption and Buyback: From App Balance to BIS‑Stamped Coin

Redemption options

-

Choose coins/bars in common denominations (e.g., 0.5g, 1g, 2g, 5g, 10g, 20g).

-

Ensure BIS hallmarking and purity (typically 24K 999) with protective, tamper-evident packaging and serial/lot traceability.

-

Check delivery timelines (e.g., 2–7 business days) and logistics partners; confirm delivery insurance and tracking.

Charges and SLAs

-

Expect making charges, delivery fees, and insurance-in-transit. Doorstep delivery vs. pickup center may have different fees.

-

Review SLAs: processing time after request, dispatch window, and return/exchange policy for defects or damages.

-

We recommend comparing total fees before redeeming – sometimes selling back and re-buying a coin locally is cheaper.

Buyback and liquidity

-

In-app sell-back: Often available 24/7 at live prices; some platforms stick to market hours for large orders.

-

Settlement: T+0 for instant bank/UPI credits in many cases; T+1 for higher amounts or after cutoff times.

-

Pricing: Benchmarked to international spot + INR conversion, minus platform spread/fees.

Checklist before you redeem

-

BIS hallmark present and purity 24K 999 confirmed.

-

Minimum redemption denomination and available weights.

-

All fees (making, delivery, insurance) disclosed upfront.

-

Return/exchange terms for manufacturing defects or transit damage.

-

Address and KYC details updated for a smooth delivery experience.

Want flexible redemption and fast buyback with transparent fees? Download OroPocket – redeem BIS-hallmarked coins/bars or sell back instantly, and earn free Bitcoin on every purchase: https://oropocket.com/app

Platform Due-Diligence: Verify Partners, T&Cs, and Security

Verify the bullion partner

-

Look for MMTC-PAMP or SafeGold. Cross-check the platform’s name on the official partner pages.

-

Verify the vaulting/custodian partner (e.g., Brink’s, Sequel, MMTC-PAMP facilities) and storage location disclosure.

-

Do a small test buy to confirm you receive an allocation/ownership certificate and transaction invoice.

Read the T&Cs like a hawk

-

Ownership structure: Is it allocated 1:1 in your name? Who holds title (you vs. trustee)?

-

Custodian: Named vault operator and the exact storage terms (bailment/escrow).

-

Audits: Frequency (monthly/quarterly), independent auditor’s name, user access to summaries.

-

Insurance: Scope (theft, fire, transit), replacement-value coverage, exclusions, insurer name.

-

Buyback rules: Price benchmark, spreads, settlement timelines (T+0/T+1).

-

Redemption: Minimum denominations, making + delivery fees, BIS hallmarking, SLAs, returns policy.

-

Dispute resolution: Jurisdiction, escalation path, TAT for support tickets and chargebacks.

-

Data & privacy: Encryption, data-sharing with partners, opt-out controls.

-

KYC/PAN: Thresholds that trigger verification and how they affect limits.

Security hygiene

-

2FA on login and payments; device binding; biometric unlock.

-

Session alerts (email/SMS/push), IP/device anomaly detection.

-

Bank-grade encryption in transit and at rest; secure UPI intent flow.

-

Clear recovery paths: account lock, PIN reset, and fraud reporting.

-

Responsive customer support via chat/email/phone with ticket IDs.

Red flags

-

No ownership certificate or allocation proof; “wallet credits” instead of grams.

-

No named partner or custodian; vague “securely stored” claims.

-

Unusually wide or fluctuating spreads without explanation.

-

No third-party audit reports; “self-audited” only.

-

Insurance claims like “up to” amounts with no policy details.

-

Inconsistent pricing vs. live benchmarks; hidden redemption fees.

-

Pushy sales via social DMs or unverifiable affiliates.

Quick 7‑point check

-

Named bullion partner (MMTC-PAMP or SafeGold)

-

Named custodian/vault operator (e.g., Brink’s/Sequel/MMTC-PAMP facilities)

-

Insurance summary with replacement value and transit coverage

-

Published audit frequency and independent auditor credentials

-

Clearly published spread and fees

-

Redemption SLA (timelines, denominations, fees, BIS hallmark)

-

Responsive customer support with guaranteed TAT

Choose a platform that passes every check. With OroPocket, you get authorized partners, insured vaults, independent audits – and free Bitcoin on every gold purchase. Start now: https://oropocket.com/app

Digital Gold vs SGBs vs Gold ETFs vs Physical vs Gold Loans

Use-cases at a glance

-

Digital gold: Micro-buys via UPI, habit-building, quick liquidity. Great for first-time investors asking “is digital gold safe?” when using audited, insured platforms.

-

SGBs: RBI-issued (on behalf of GoI), 2.5% interest p.a., best for long-term savers comfortable with lock-ins.

-

Gold ETFs: SEBI-regulated market exposure via Demat; brokerage + expense ratios; exchange liquidity.

-

Physical: Full control, gifting/ceremonial use; you manage storage/security.

-

Gold loans: Regulated credit against your gold; quick liquidity without selling your asset.

Choosing the right mix

-

Short-term goals and habit-building: prioritize digital gold for micro-buys and fast sell-back.

-

Long-term compounding and tax efficiency: consider SGBs; use ETFs for Demat-based, market-hours exposure.

-

Need cash now but don’t want to sell: gold loan.

-

Cultural gifting/keepsakes: physical coins/bars (BIS-hallmarked).

Gold Options Compared

|

Product |

Regulator/Backstop |

Liquidity |

Costs |

Tax notes |

Custody risk |

Best for |

|---|---|---|---|---|---|---|

|

Digital Gold |

Not SEBI/RBI regulated; platform-level guardrails (authorized bullion partners, insured vaults, audits) |

In-app; often 24/7 sell-back; physical redemption TAT applies |

Buy–sell spread, GST (3% on purchase), redemption making + delivery fees; storage may be bundled |

Treated like physical gold for capital gains; consult your tax advisor |

Private custodian risk mitigated by insurance, audits, and named partners |

UPI-native micro-investing, small goals, flexible liquidity |

|

SGBs |

Issued by RBI on behalf of Government of India |

Low during lock-in; exchange liquidity varies; full redemption at maturity |

No GST on issue; zero making charges; brokerage if bought/sold on exchange |

2.5% interest taxable; capital gains on redemption at maturity currently tax-exempt (check latest rules) |

Sovereign backstop; held in Demat/SoI |

Long-term savers seeking sovereign-backed exposure and interest |

|

Gold ETFs |

SEBI-regulated mutual fund units; held in Demat |

Market hours; depends on ETF liquidity and spreads |

Expense ratio (~0.3%–1%); brokerage + STT/charges |

Post-2023 rules: gains from debt-style funds taxed at slab rates; verify latest tax law |

Fund-level custody with trustees, custodians, auditors |

Demat investors wanting regulated, market-traded exposure |

|

Physical Gold |

None (follow BIS hallmarking for purity) |

High at jewellers, but may face buyback deductions |

Making charges, wastage, GST (3% on purchase), storage costs/security |

Capital gains like physical asset; invoice helps for provenance |

You handle storage/theft/verification |

Gifting, ceremonies, long-term holding with personal custody |

|

Gold Loan |

RBI-regulated (banks/NBFCs) |

Very high; instant disbursal against pledged gold |

Interest rate + processing/valuation fees |

It’s a loan, not a sale; interest generally not deductible for personal use |

Pledged gold stored with regulated lender/approved vault |

Liquidity without selling your gold; short-term cash needs |

Build your perfect mix on your terms. Buy digital gold from ₹1 via UPI, redeem when you need, or sell back instantly – while earning free Bitcoin on every purchase. Download OroPocket: https://oropocket.com/app

Why OroPocket Is a Safer, Smarter Way to Buy Digital Gold (and Earn Bitcoin)

Safety first

-

Authorized bullion partners and fully insured vaults with independent audits.

-

Transparent buy–sell spreads you can verify in-app.

-

24K pure gold (999). RBI-compliant operations and guidelines aligned with industry best practices.

Start with ₹1, pay via UPI

-

No minimums. Buy and sell in seconds from your phone – ideal for first-time investors and micro-savers.

Dual benefit: gold + Bitcoin rewards

-

Earn free Satoshi on every gold/silver purchase. You build the stability of gold while stacking Bitcoin rewards automatically.

Build habits, not stress

-

Daily streaks, Spin to Win, and referral bonuses (100 Satoshi + free spin) make consistent micro-investing fun and rewarding.

Practical safeguards in-app

-

Turn on 2FA, verify your device, keep ID docs updated, download statements, and review T&Cs before redeeming.

Gifting and sharing

-

Send gold instantly to friends and family – easy, traceable, and secure.

Ready to try the OroPocket way – safe, smart, and rewarding? Download the app: https://oropocket.com/app

Conclusion: Make Digital Gold Work for You – Start with OroPocket

Key takeaways

-

Digital gold can be safe when you verify the essentials: authorized bullion partner (MMTC-PAMP/SafeGold), named custodian, insured vaults, independent audits, transparent spreads, and clear redemption terms.

-

The SEBI advisory doesn’t ban digital gold – but it means you must practice due diligence. Read T&Cs, check audits/insurance, and confirm 1:1 allocated holdings before you buy.

Your next step

-

Download OroPocket, start with ₹1 via UPI, and build a gold habit while earning Bitcoin rewards on every purchase.

Ready to invest the modern way – secure, simple, and rewarding? Download the OroPocket app now: https://oropocket.com/app