Is Gold a Good Investment? 7 Facts to Decide in 2026 (Plus How Much to Allocate)

Is Gold a Good Investment? 7 Facts to Decide in 2026 (Plus How Much to Allocate)

Gold at all-time highs makes people freeze: “Should I buy now or wait?”

The better question is simpler: Does gold deserve a permanent role in your portfolio in 2026?

If you’re a student, salaried professional, small business owner, or a first-time investor in India, you likely want:

-

a simple way to start (no big lump sum),

-

a UPI-first experience,

-

real inflation protection, and

-

ideally… extra rewards for building the habit.

That’s where modern digital gold investing (done right) changes the game. And that’s exactly why we built OroPocket: start from ₹1, buy in seconds, store securely, and earn free Bitcoin rewards on every purchase.

“In 2025, gold prices experienced a significant surge, rising nearly 60% from the beginning of the year.” – AP News

The “2026 Gold” Reality: Don’t speculate. Allocate.

Most competitor articles get one thing right: gold is not for getting rich quick. It’s for:

-

protecting purchasing power,

-

lowering portfolio shocks,

-

and balancing equity-heavy portfolios.

Where they often fall short is actionable decision-making – how much to allocate, which vehicle to use in India, and what costs quietly eat your returns.

If you want a deeper gold-market explainer (drivers, cycles, and smarter investing), read: gold market investment in 2026 – what drives gold prices and how to invest smarter.

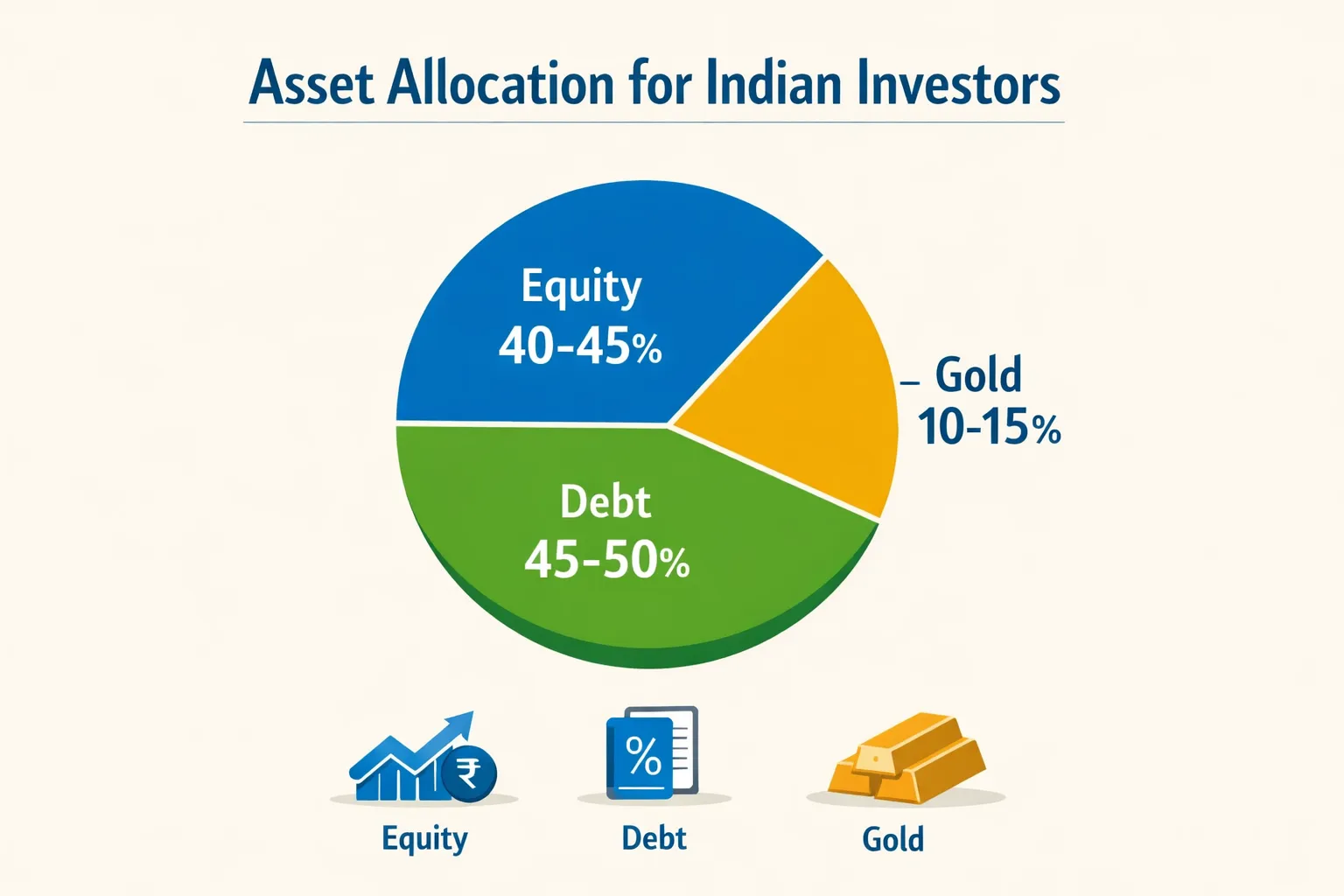

How much gold should you allocate in 2026?

For most Indian retail investors: 10%–15% of the portfolio in gold is a strong “set-and-rebalance” range.

If your equity exposure is very high or you’re close to a goal, you can go a bit higher – but don’t overdo it.

A simple allocation cheat-sheet (India, 2026)

|

Investor type |

Typical gold allocation |

Why it fits |

|---|---|---|

|

Conservative saver (mostly FD/RD/cash) |

5%–10% |

Adds hedge without sacrificing too much liquidity |

|

Balanced long-term investor (equity + debt) |

10%–15% |

Strong diversification, smoother ride |

|

Equity-heavy / aggressive investor |

12%–20% |

Helps manage drawdowns and crisis risk |

|

Short-term hedger (6–18 months) |

0%–10% |

Use cautiously; gold can correct after rallies |

7 facts to decide if gold is a good investment in 2026

1) Gold is “portfolio insurance,” not a growth engine

Gold doesn’t produce cash flows (no dividends, no coupons). That’s not a bug – it’s the point.

Gold’s job:

-

protect when risk assets fall,

-

offer stability when inflation/geopolitics spike,

-

reduce regret in bad years.

Your job: size it correctly, and rebalance.

2) Gold tends to shine in crises, rate cuts, and currency stress

Gold often performs best when:

-

real rates fall,

-

the dollar weakens,

-

geopolitical risk rises,

-

investors flee to safety.

A structural tailwind in recent years has been central bank demand.

“Central banks added 1,044.6 tonnes of gold in 2024 – marking the third consecutive year above 1,000 tonnes.” – World Gold Council

Translation: big institutions are treating gold like strategic reserves, not a trade.

3) Gold can be volatile (especially after big rallies)

A common investor mistake: buying gold only after it’s been on the news for months.

Gold can correct sharply after a fast run-up. So instead of timing:

-

build gradually (monthly buys),

-

stick to an allocation band,

-

rebalance once or twice a year.

If you’re trying to time entries, use a framework: is it a good time to buy gold now? how to decide in India.

4) Gold has long flat periods – your patience is part of the return

Gold isn’t “up-only.” It can do nothing for years, then move fast.

That’s why the smartest use case is a permanent allocation, not a temporary bet.

Rule of thumb: gold works best when you can hold for 5+ years.

5) Your returns depend heavily on how you buy gold (costs matter)

Many articles list options but don’t quantify the friction. Here’s the practical breakdown.

Gold investment options in India (2026)

|

Option |

Best for |

Key costs / trade-offs |

Liquidity |

|---|---|---|---|

|

Jewellery |

consumption + gifting |

making charges, wastage, lower resale value |

medium |

|

Coins/bars (physical) |

long-term holders |

premiums, storage/insurance, purity checks |

medium |

|

Gold ETFs |

demat investors |

expense ratio, brokerage |

high |

|

Gold mutual funds |

no demat |

fund expense + ETF layer |

high |

|

Digital gold (app-based) |

micro-investors, UPI users |

spread + GST on charges (varies) |

high |

|

SGB (if available/secondary market) |

long holding periods |

liquidity/price mismatch, issuance uncertainty |

medium |

Want a clean deep-dive on hidden frictions? Read: digital gold charges in India explained (spreads, GST, storage, selling fees).

6) Taxes can change outcomes – know the basics before you sell

Tax treatment depends on the product and holding period. In general:

-

Physical gold / ETFs / digital gold are usually taxed as capital assets.

-

SGBs historically had special benefits if held to maturity, but new issuance has been inconsistent.

Because tax rules evolve, treat this as orientation – not a substitute for CA advice. The practical move is to:

-

plan for a multi-year horizon, and

-

avoid frequent churn (churn = taxes + spreads).

7) Gold improves your behavior when it’s easy to buy and easy to stick to

This is the gap most competitor articles miss: the biggest edge isn’t prediction – it’s habit.

When investing is hard, people quit. When it’s effortless, people compound.

That’s why OroPocket is designed for real India:

-

Start from ₹1 (no “when I have more money” excuse)

-

Instant UPI payments (buy in under 30 seconds)

-

100% insured, compliant vault storage

-

Gamified streaks + spin-to-win (build a daily habit)

-

Free Bitcoin (Satoshi) on every gold/silver purchase (two assets, one action)

-

Referral rewards (100 Satoshi + free spin for both)

Best way to invest in gold in 2026 (simple decision guide)

Choose based on your “real” need

-

Want the lowest friction + smallest starting amount? Digital gold (with a trusted platform)

-

Want demat-based price tracking and tight spreads? Gold ETF

-

Want physical possession for cultural reasons? Buy coins/bars (investment-grade), not jewellery

-

Want a “government wrapper”? SGB only if the product terms and liquidity fit you

OroPocket’s sweet spot

If you’re a mass-market saver who wants small, frequent, UPI-based investing – OroPocket is built for you:

-

buy tiny amounts daily/weekly,

-

earn Bitcoin rewards automatically,

-

and grow a real hedge without overthinking it.

3 investor scenarios (and what to do next)

Scenario A: The conservative saver (FD-heavy)

Problem: you’re safe, but inflation is silently winning.

Move: allocate 5%–10% to gold over the next 6–12 months via small buys.

Best fit: OroPocket digital gold (₹1 start, UPI, insured storage).

Scenario B: The long-term equity investor (SIP-heavy)

Problem: your portfolio is strong but can swing hard in crashes.

Move: hold 10%–15% gold and rebalance annually.

Best fit: ETF or digital gold – choose based on whether you want demat or UPI convenience.

Scenario C: The short-term hedger (nervous about 2026 volatility)

Problem: you want protection, but don’t want to gamble.

Move: keep gold at 0%–10%, avoid lump sums, and define an exit rule.

Best fit: small incremental buys, strict allocation cap.

Quick checklist: Should you add gold in 2026?

-

I have an emergency fund (3–6 months expenses)

-

I’m not buying gold “because it’s going up”

-

I have a target allocation (e.g., 10–15%)

-

I will buy gradually and rebalance yearly

-

I understand costs (spreads/expense ratio/storage)

-

I’m choosing the vehicle that matches my liquidity and convenience needs

Final verdict + CTA (OroPocket take)

Yes – gold is a good investment in 2026 when it’s used correctly: as a long-term hedge and stabilizer, sized at ~10–15%, bought gradually, and held with discipline.

Stop watching. Start growing.

If you want the easiest way to build gold exposure in India – from ₹1, using UPI, with insured vault storage, and free Bitcoin rewards on every buy – start with OroPocket and turn “I should invest” into a daily habit.

![10 best places to buy digital silver online in India [2026] 8 1020best20places20to20buy20digital20silver20online20in20India205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/1020best20places20to20buy20digital20silver20online20in20India205B20265D-cover-300x200.webp)