Is Gold a Scam? Myths vs Facts About Gold as an Investment

Is Gold a Scam? Myths vs Facts Indians Must Know

Gold isn’t a scam. But in 2026, you’ll hear “gold is a scam” a lot – thanks to clickbait, shady sales pitches, and confusing products. The asset isn’t the problem; misinformation is. This guide cuts through noise with India-specific facts and shows how to use gold the smart way – without falling for gimmicks.

Why you’re hearing “gold is a scam” in 2026

-

Influencer hype and high-pressure sales: overpriced coins, hidden spreads, dubious “guaranteed buyback” schemes, and unregulated pitches make people suspicious of the entire asset.

-

Confusion between the product and the asset: bad experiences with certain sellers ≠ “gold is a scam.” The issue is the sales practice, not gold itself.

-

Quick answer: Gold as an asset has a long track record as a store of value and diversifier. The scam is the misinformation.

Gold as an investment (not just jewellery)

-

Where it fits: In a modern Indian portfolio, gold typically plays a 5–15% allocation role to hedge inflation, diversify equity risk, and offset rupee depreciation. It’s not a replacement for equities or FDs – it’s a stabilizer.

-

How it behaves vs other options:

-

Stocks: Higher long-term growth potential but volatile; gold often rises when risk assets wobble, reducing portfolio drawdowns.

-

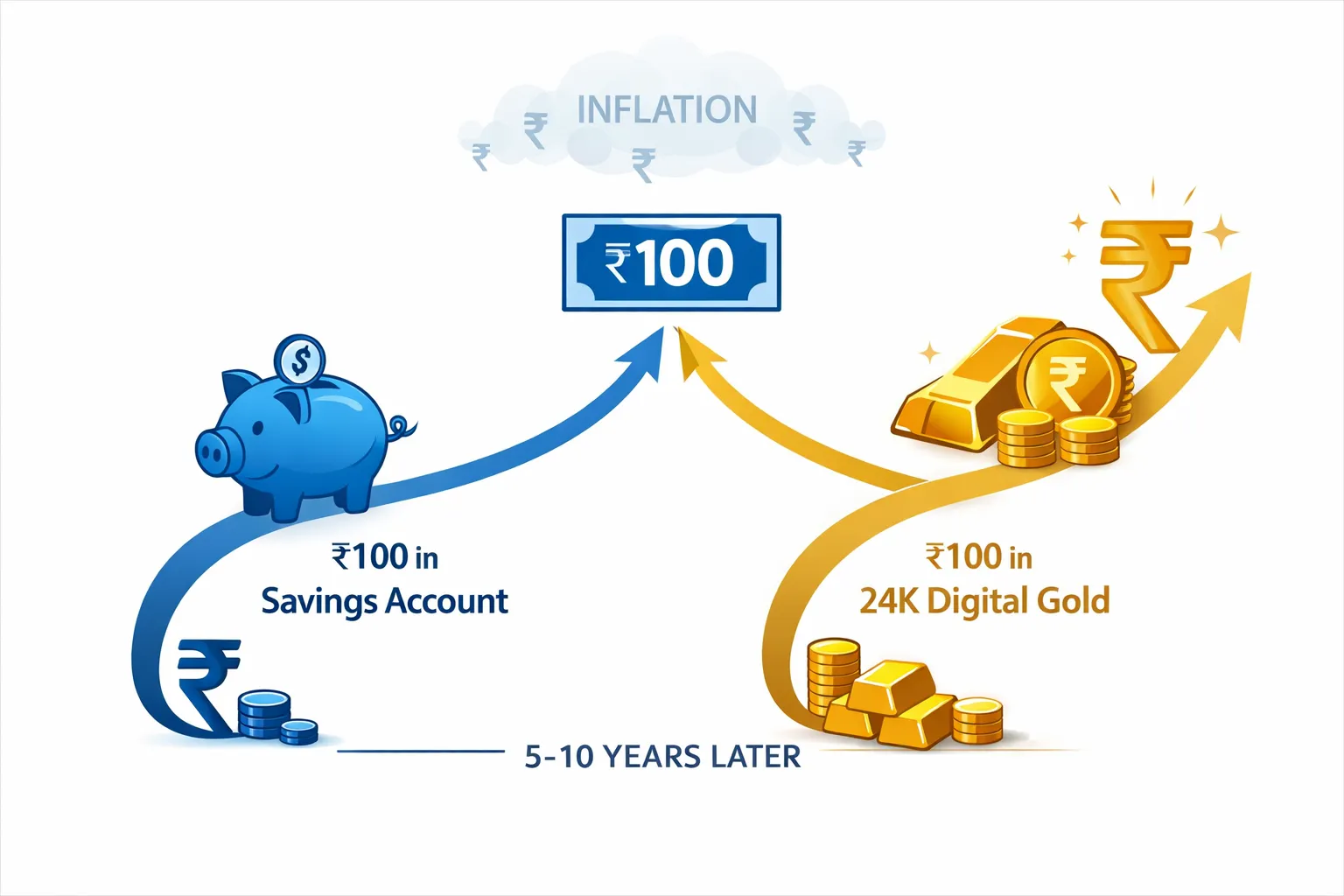

FDs/savings: Simple and stable in nominal terms, but often deliver negative “real” returns after inflation.

-

Crypto: High upside and high volatility; gold is the steadier counterweight, especially in INR terms.

-

-

Liquidity and access: Today you can buy/sell gold instantly via digital gold, SGBs, ETFs or SIPs – no jeweller haggling, no storage anxiety.

“Savings accounts often yield ~2.5–2.75% at major banks, while CPI inflation averaged ~5.69% in FY 2023–24 – idle cash lost purchasing power.” – Source

What this guide covers

-

Myths vs facts, India edition: We’ll debunk popular claims like “gold is a scam,” “gold never grows,” and “jewellery is the best investment.”

-

Smarter ways to buy: What to choose and when – digital gold, Sovereign Gold Bonds (SGBs), Gold ETFs, and gold SIPs – plus tax and liquidity basics.

-

How to start small and stay consistent: Begin with as little as ₹1, automate buys, and build a disciplined habit. With OroPocket, you can:

-

Start from ₹1 via UPI in under 30 seconds

-

Earn free Bitcoin (Satoshi) on every gold purchase

-

Build streaks and rewards that make investing fun and consistent

-

Ready to invest the modern way? Download the OroPocket app now: https://oropocket.com/app

Myth 1 – “Gold has no intrinsic value, it’s just hype” (Fact: scarce, useful, and trusted)

Calling gold “a scam” ignores why it’s endured across civilizations. Gold is scarce, doesn’t corrode, divides easily (per gram), and is accepted globally – from jewellers in Chennai to ETFs in global markets. Central banks (including RBI) hold and buy gold as a reserve asset, while institutions use it for diversification. That’s not hype; that’s utility and trust in action.

The reality behind “gold is a scam” claims

-

Scarcity and durability: Gold is finite, difficult to mine, and doesn’t decay – value stored today remains intact decades later.

-

Divisibility and portability: Priced per gram; easy to buy, sell, transfer, and even gift digitally.

-

Global acceptance: A 24/7, globally traded asset with deep liquidity in spot, futures, ETFs, SGBs, and digital gold.

-

Central bank and institutional demand: RBI and other central banks hold gold as reserves; institutions allocate for diversification and liquidity.

Real-world utility beyond jewellery

-

Electronics: Connectors and circuitry in smartphones, high-reliability aerospace electronics, and semiconductors.

-

Medical: Dental alloys, diagnostics, drug delivery, and gold nanoparticles in advanced therapies.

-

Aerospace: Satellite coatings and thermal shielding thanks to gold’s reflectivity and stability.

-

Finance and collateral: Gold-backed loans at banks/NBFCs and institutional collateral in derivative markets.

Portfolio role: diversification when it matters most

When equities wobble, gold’s behavior often flips from low correlation to negative correlation – helping cushion drawdowns. That’s why many Indian investors consider a 5–15% allocation to gold within a diversified portfolio. It’s not one-size-fits-all, but a pragmatic hedge that works with (not against) your equities, debt, and even crypto.

“Gold’s correlation to equities tends to turn negative in market drawdowns, improving risk-adjusted outcomes at modest allocations.” – Source

Watch-outs

-

Avoid extreme leverage or speculative trading that magnifies risk.

-

Skip shady “guaranteed buyback” or overpriced coins with hidden spreads.

-

Prefer regulated/credible routes and insured storage: SGBs, Gold ETFs, and trusted digital gold providers with transparent pricing, RBI/SEBI-aligned partners, and 100% insured vaults.

Is buying gold a good investment? Used smartly, yes – gold as an investment is a proven diversifier, not a get-rich-quick bet. Start simply and safely with OroPocket. Buy 24K digital gold from ₹1 via UPI, get free Bitcoin rewards, and build a habit that compounds. Download the app: https://oropocket.com/app

Myth 2 – “Gold always goes up” and Myth 3 – “Timing is everything” (Fact: cycles happen; consistency wins)

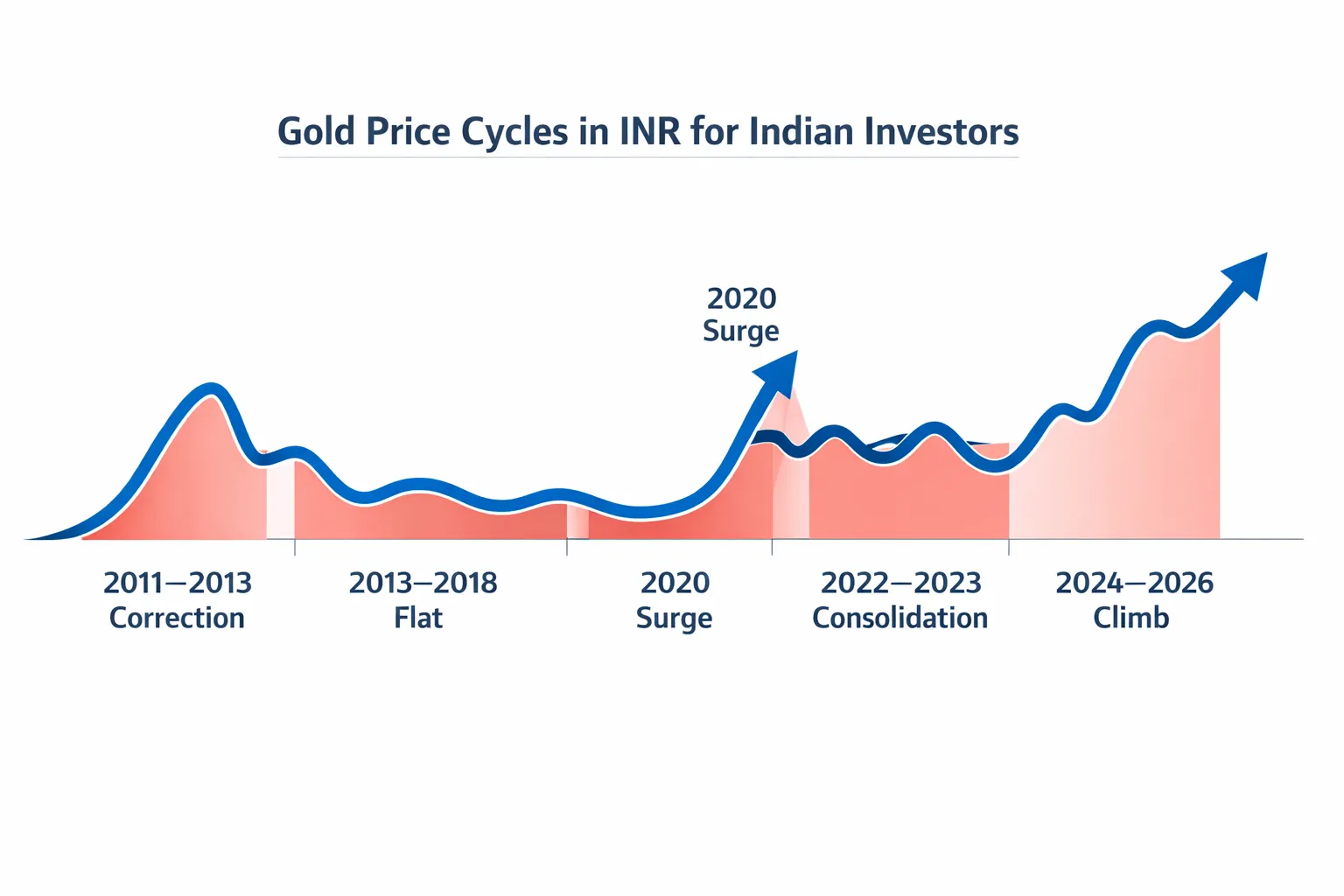

Gold moves in cycles – especially in INR. There are multi-year stretches when gold lags equities and periods when it leads. If you chase new highs, you risk buying right before a consolidation. If you panic at dips, you lock in losses.

Gold has cycles (especially in INR)

-

Leadership rotates: Some years equities run, some years gold does the heavy lifting – both have a role.

-

Peaks and pullbacks: Big surges are usually followed by digestion phases. Don’t chase peaks; don’t panic during dips.

-

INR lens matters: Rupee moves, import duties, and local demand can amplify cycles versus USD prices.

Smarter approach than timing

-

SIP/DCA your gold buys: Spread purchases monthly to average costs and reduce regret.

-

Set allocation bands: Decide a range (say 5–15%) and rebalance annually – trim after big rallies, add after drawdowns.

-

Process over prediction: You don’t need perfect timing to win – just a consistent system.

Is buying gold a good investment right now?

-

Match to your plan: If you’re underweight gold versus your target, add gradually. If you’re overweight after a rally, trim.

-

Purpose, not FOMO: Use gold as a stabilizer, not a moon-shot. It offsets equity/crypto volatility and inflation shocks.

-

Horizon check: Longer horizons favor discipline – small, steady buys beat guesswork.

Action framework

-

Decide allocation: Pick a percentage aligned to your risk (e.g., 5–15%).

-

Pick your vehicle: Digital Gold for micro-buys, SGBs for long-term + interest, ETFs for market hours liquidity.

-

Automate and review: Set monthly SIPs, review once a year, rebalance to target.

|

Myth |

Fact |

What to Do |

|---|---|---|

|

“It only goes up.” |

Gold has cyclical, mean-reverting phases. |

Use DCA/SIP; avoid lump-sum at euphoric peaks. |

|

“Timing is everything.” |

Timing is unreliable; reversion and volatility are normal. |

Set a 5–15% allocation band and rebalance annually. |

|

“Buy big after rallies.” |

Post-rally consolidations are common. |

Add gradually; stick to SIPs and rules, not FOMO. |

|

“Sell at first dip.” |

Dips are part of cycles, not a thesis-breaker. |

Rebalance – add on weakness if under target. |

Start small and stay consistent with OroPocket. Buy 24K digital gold from ₹1 via UPI, earn free Bitcoin rewards on every purchase, and automate your habit with streaks and SIP-style contributions. Download the app: https://oropocket.com/app

Myth 4 – “Jewellery is the best investment” (Fact: consider SGBs, Digital Gold, ETFs)

Jewellery is beautiful, sentimental, and perfect for occasions. But as an investment, it’s inefficient. If your goal is to build wealth with gold, 24K investment-grade options like Digital Gold, Gold ETFs/FoFs, and Sovereign Gold Bonds (SGBs) usually deliver better value, transparency, and liquidity.

The hidden costs of jewellery

-

Making charges: Often 8–25% (or more) added on top of the gold price

-

Wastage and design premiums: You pay for artistry that doesn’t add to resale value

-

Purity risk: 22K jewellery vs 24K investment-grade gold

-

Resale deductions: Jewellers typically deduct making charges and may offer a discount to spot price

Low-friction investment routes

-

Digital Gold (24K, vaulted): Buy/sell from ₹1 via UPI, real 24K gold in insured vaults, fractionally owned, instant liquidity

-

Gold ETFs/Gold FoFs: Market-traded, transparent pricing, suitable for SIPs; FoFs let you invest without a Demat

-

Sovereign Gold Bonds (SGBs): RBI-backed, 8-year maturity with early redemption windows; interest plus potential price appreciation

“Sovereign Gold Bonds pay 2.5% annual interest on the issue price; capital gains on redemption at maturity are tax-exempt.” – Source

Taxes, liquidity, and who should pick what

-

Jewellery/Coins/Bars/Digital Gold: Typically taxed like physical gold – short-term gains (≤3 years) at slab; long-term gains (>3 years) at 20% with indexation. Consult your advisor for your specific case.

-

Gold ETF/FoF: Post-April 2023 rules treat most gold funds like debt funds with gains taxed at slab rate irrespective of holding period.

-

SGBs: 2.5% interest is taxable; capital gains on redemption at maturity are tax-exempt (big plus for long-term investors). Pre-maturity sale on exchanges is taxable as per period of holding.

-

Liquidity spectrum: Digital Gold/ETFs = high liquidity; SGBs = limited liquidity on exchanges + 8-year tenor with early exit options after year 5.

Is it a good idea to invest in gold via jewellery?

-

Jewellery is primarily consumption + sentiment. It’s great for wearing, gifting, and tradition – but not the most efficient path to wealth.

-

Prefer 24K investment-grade formats (Digital Gold, ETFs/FoFs, SGBs) for transparent pricing, lower friction, and better long-term outcomes.

Gold Formats Compared

|

Gold Format |

Purity |

Min Investment |

Costs/Charges |

Liquidity/Exit |

Storage |

Tax Notes |

Best For |

|---|---|---|---|---|---|---|---|

|

Jewellery |

Usually 22K (sometimes 18K/14K) |

High ticket (making + design) |

Making charges, wastage, design premiums; buyback deductions |

Low to medium; resale often below spot |

Home/bank locker |

Gains treated like physical gold; no interest |

Wearing/occasions; not ideal as a pure investment |

|

Coins/Bars |

24K (or 999) |

From 0.5–1g upwards |

Dealer premium, potential buy-sell spread |

Medium; depends on dealer/market |

Home/locker |

Physical gold tax rules |

Savers who want tangible 24K gold |

|

Digital Gold |

24K (vaulted) |

From ₹1 |

Transparent spread; no making charges |

High; buy/sell instantly 24×7 |

Professional, 100% insured vaults |

Typically like physical gold gains; check T&Cs |

Micro-investing, instant liquidity, UPI buyers |

|

Gold ETF/FoF |

99.5%+ (as per ETF standards) |

1 unit/SIP |

Expense ratio, brokerage (ETF); FoF expense |

High during market hours |

Demat/custodian (ETF) |

Post-2023 gains generally taxed at slab |

SIP-friendly investors seeking market transparency |

|

SGB |

Denominated in grams (RBI-backed) |

1 gram per bond |

No making charges; issue/redemption prices |

Low to medium; 8-year tenor, early exit from year 5 |

Demat/certificate, no vault needed |

2.5% interest taxable; maturity redemption CG exempt |

Long-term investors seeking tax efficiency |

Bottom line: If you’re asking “is it a good idea to invest in gold,” jewellery isn’t the most efficient route. For building wealth, choose 24K investment-grade gold through regulated, liquid, and tax-efficient options.

Ready to invest the modern way? With OroPocket, buy 24K digital gold from ₹1 via UPI, get free Bitcoin (Satoshi) on every purchase, and store securely in insured vaults. Start now: https://oropocket.com/app

Myth 5 – “Gold doesn’t beat inflation or generate income” (Fact: it preserves purchasing power and smooths risk)

Gold as an investment isn’t a cashflow machine like FDs or bonds – and that’s okay. Its job is different: preserve purchasing power, diversify your portfolio, and cushion shocks when markets wobble. Calling gold a scam because it doesn’t pay interest misses the point; it’s the stabilizer that helps your overall portfolio breathe through inflation and volatility.

What gold does (and doesn’t) do

-

What it does:

-

Store of value across cycles (especially in INR)

-

Crisis hedge and diversifier when equities/crypto swing

-

Liquid, globally recognized collateral and savings asset

-

-

What it doesn’t do:

-

Regular income by itself (except SGB interest)

-

Replace equities for long-term growth or FDs for predictable payouts

-

INR reality check

-

In rupees, there have been multi-year periods when gold outpaced inflation and cushioned equity drawdowns – doing exactly what you want from a hedge.

-

Outcomes improve with longer holding periods and disciplined buying. Short-term chasing after a spike often disappoints; steady allocation works better.

-

If you’re asking “is buying gold a good investment” or “is it a good idea to invest in gold,” the answer depends on role: use gold to protect purchasing power and balance risk – not to chase quick income.

Practical positioning

-

Align with goals:

-

Near-term goals (1–3 years): Keep core emergency funds in liquid, income-generating options; add a small gold sleeve for shock protection.

-

Medium/long-term goals (3–10 years+): A 5–15% gold allocation can help offset inflation spikes and risk-asset selloffs.

-

-

Combine for total portfolio needs:

-

Pair gold with income assets (FDs, quality bonds, REITs/INVITs) for cashflow.

-

Maintain equity exposure for long-term growth; let gold smooth the ride.

-

How to get started now – without timing the market:

-

Decide your allocation (e.g., 5–15% based on risk tolerance)

-

Choose your vehicle: Digital Gold for seamless micro-buys, SGBs for long-term + interest, ETFs for market liquidity

-

Automate monthly buys and review annually

Build your inflation shield the smart way. With OroPocket, buy 24K digital gold from ₹1 via UPI, earn free Bitcoin (Satoshi) on every purchase, and stay consistent with streaks and rewards. Download the app: https://oropocket.com/app

Myth 6 – “Gold is hard to buy, sell, or store” (Fact: UPI + instant liquidity + insured vaults)

Gold used to mean jeweller visits, locker fees, and paperwork. Not anymore. Today, buying and selling 24K investment-grade gold is as simple as a UPI payment – and storage is handled by insured vaults with full audit trails.

Today’s frictionless options

-

Buy/sell in seconds via trusted apps with UPI, track live prices, and get instant confirmations.

-

Own 24K vaulted gold backed by authorized bullion partners, with third-party audits and 100% insurance.

How OroPocket makes it effortless (India-first)

-

Start from ₹1: No minimums – build the habit without pressure.

-

Instant UPI: Buy 24K gold in under 30 seconds; zero paperwork.

-

Secure by design: 24K pure gold, fully insured vaults, transparent audit trail.

-

Everyday utility: Send or gift gold to friends and family instantly.

-

Rewards that stack: Earn free Bitcoin (Satoshi) on every purchase, keep daily streaks, and spin-to-win bonuses.

Liquidity and fees to watch

-

Digital Gold: Instant buy/sell 24×7; watch the buy–sell spread.

-

Gold ETF/FoF: Market hours liquidity; brokerage + expense ratios; NAV/market price tracking.

-

SGBs: RBI-backed but with 8-year maturity (early exit from year 5); interest paid semi-annually; exchange liquidity varies.

Get modern, hassle-free access to gold – plus Bitcoin rewards for every purchase. Download OroPocket now: https://oropocket.com/app

Myth 7 – “Digital gold isn’t safe or compliant” (Fact: RBI-compliant partners, insured vaults, auditable ownership)

Digital gold, done right, is built on 24K purity, independent insured vaults, strict KYC, and transparent pricing. If you’re wondering “is buying gold a good investment” or “is it a good idea to invest in gold” without jeweller hassles, digital gold via credible partners is a safe, modern route.

What safety looks like

-

24K purity with authorized bullion partners

-

Independent vaulting with 100% insurance and regular third‑party audits

-

KYC-backed accounts, transparent buy–sell spreads and fees

-

Clear redemption options (sellback or doorstep delivery as per provider T&Cs)

“In the absence of formal regulation, credible digital gold platforms follow best practices – KYC, 24K purity, independent insured vaulting, and regular audits – to ensure safety and transparency.” – Source

OroPocket’s compliance posture

-

RBI-compliant operations with authorized bullion partners and 24K pure gold

-

100% insured, professionally vaulted metal with audit trails

-

Clear T&Cs, pricing transparency, and proof of ownership for every gram

-

Easy redemption and instant liquidity via UPI; send/gift gold seamlessly

Red flags to avoid

-

No KYC or vague onboarding; unclear ownership documentation

-

Vague or undisclosed vaulting/insurance arrangements

-

“Guaranteed returns” or hypey promises that sound too good to be true

-

Hidden charges, large spreads, or no clarity on redemption/delivery

Safe, modern, and compliant – digital gold with OroPocket lets you buy 24K from ₹1, store in insured vaults, and earn free Bitcoin (Satoshi) on every purchase. Download the app: https://oropocket.com/app

Myth 8 – “You need a lot of money to start” (Fact: micro-investing from ₹1 works)

You don’t need thousands to begin. In 2026, investing tiny amounts consistently beats waiting for “the perfect day.” Micro-investing removes excuses and compounds habits – exactly what most first-time investors need.

Why starting small beats waiting

-

Habit formation: Consistency > intensity. Small daily actions build real portfolios.

-

Rupee-cost averaging: Buying across prices smooths volatility and lowers regret.

-

Reduced decision fatigue: Set-and-forget beats overthinking and missing months.

Practical micro-plan

-

Start with a ₹100/day SIP in Digital Gold. Automate it. Review every quarter.

-

If the market rallies: rebalance back to your target band; don’t chase.

-

If prices dip: your SIP buys more grams; stay the course.

-

Use streaks and gamified rewards to stay consistent – it’s motivation that compounds.

OroPocket’s micro edge

-

₹1 entry point: Buy 24K gold with UPI in under 30 seconds.

-

Rewards that add up: Bitcoin (Satoshi) cashback on every purchase, daily streak bonuses, spin-to-win.

-

Social boosts: Referral rewards for you and your friends.

-

The Gold + Bitcoin combo: Stability from gold plus the growth potential of Bitcoin – without the complexity of buying crypto directly.

Start now. No pressure, just progress. Download OroPocket: https://oropocket.com/app

Smart Playbook for 2026: Is it a good idea to invest in gold now?

Short answer: Yes – if you need stability, diversification, or inflation protection. The smarter move isn’t guessing the peak; it’s setting a plan and sticking to it.

Quick decision tree

-

Do you need downside protection? Add gold.

-

Overweight in equities/crypto? Add gold to balance.

-

Short-term goal (<3 years)? Prefer liquid gold routes (Digital Gold or Gold ETFs).

-

New investor and uncertain? Start small (₹1–₹100/day) and automate.

Tactics for Indians

-

Allocation guidance: Typically 5–15% based on risk and goals (not advice).

-

Prefer 24K investment-grade options over jewellery for investing.

-

Automate via SIP/DCA; rebalance annually to your target band.

-

Mind taxes:

-

SGBs: 2.5% interest is taxable; capital gains on redemption at maturity are tax-exempt.

-

ETFs/FoFs: Capital gains taxed as per prevailing rules – check current slab/LTCG treatment.

-

Digital Gold/Physical: Taxed similar to physical gold; verify with your advisor.

-

-

Liquidity planning:

-

Need flexibility? Digital Gold/ETF for quick access and transparent pricing.

-

Long-term saver? SGBs for potential appreciation + interest + maturity tax benefit.

-

Bonus alpha with OroPocket

-

Bitcoin rewards on each gold/silver purchase – stack Satoshi while you build your gold.

-

Send/gift gold for life events; build consistency with daily streaks and spin-to-win.

-

Start from ₹1 via UPI; buy 24K vaulted, insured gold in under 30 seconds.

Build your 2026 plan today. Download the OroPocket app: https://oropocket.com/app

Conclusion – Gold isn’t a scam. Use it smartly with OroPocket

Key takeaways

-

Gold is a time-tested hedge and diversifier, not a get-rich-quick scheme. Use it to preserve purchasing power and smooth risk.

-

Myths cost money; facts build portfolios. Avoid hype, fees you don’t see, and unregulated promises.

-

Start small, stay consistent, and choose compliant, insured platforms with transparent pricing and audit trails.

Next step

-

Try digital gold in minutes via UPI. Earn Bitcoin rewards as you build your stack – no minimums, no hassle.

CTA: Download the OroPocket app – https://oropocket.com/app

![Best App for Investing in Gold in India [2026]: Fees, Rewards, and Safety Compared 7 Best20App20for20Investing20in20Gold20in20India205B20265D 20Fees20Rewards20and20Safety20Compared cover](https://blog.oropocket.com/wp-content/uploads/2026/01/Best20App20for20Investing20in20Gold20in20India205B20265D-20Fees20Rewards20and20Safety20Compared-cover-300x200.webp)