Is Gold or Silver a Better Investment? Gold vs Silver Compared (2026)

Is Gold or Silver a Better Investment? Gold vs Silver Compared (2026)

If you’re an Indian retail investor in 2026, you’re probably stuck between two feelings:

-

“I want safety.” (Inflation is quietly eating your savings.)

-

“I also want growth.” (You don’t want your money to just sit there.)

Gold and silver can both help – but they behave very differently. This guide breaks down gold vs silver across volatility, inflation protection, industrial demand, liquidity, costs, and what it means for your portfolio.

And if you want the simplest way to start: OroPocket lets you buy digital gold or silver from just ₹1, instantly via UPI, with 100% insured vault storage – and gives you free Bitcoin (Satoshi) rewards on every purchase.

Stop watching. Start growing.

Quick verdict (for most Indians in 2026)

-

Choose gold if your goal is: stability, wealth protection, smoother ride.

-

Choose silver if your goal is: higher upside, but bigger swings (and you can handle volatility).

-

Choose both if you want a smarter balance: gold as the “core,” silver as the “booster.”

If you’re investing monthly, also read: how to invest in gold with little money in India (start from ₹1 online).

Gold vs Silver in 2026: the real differences (not the hype)

1) Volatility: silver swings harder (good and bad)

Silver is famous for “sudden moves.” It can outperform gold in bull runs – but it can also correct sharply when risk appetite drops.

“From 1969 to June 2025, the standard deviation of annual gold price changes was 23.2%, whereas for silver, it was 29.9%.” – Kitco

What it means for you:

-

If you panic-sell easily, gold is easier to hold.

-

If you want extra upside and can stay calm during dips, silver can work.

2) Inflation hedge: gold is the classic “anti-inflation” asset

Gold’s reputation isn’t marketing – it’s behavior across decades. It tends to attract money when inflation rises, currencies weaken, or geopolitics gets messy.

“During years when inflation ranged between 2% and 5%, gold’s price increased by an average of 8% per year.” – World Gold Council

Silver also hedges inflation, but because it’s tied more to industrial demand, it can sometimes behave more like a “growth commodity” than a pure safe haven.

3) Demand drivers: gold is mostly “money.” silver is “money + industry.”

Gold is driven heavily by:

-

global rates and USD strength

-

central bank buying

-

risk-off flows (fear, war, recession)

-

jewellery demand (strong in India)

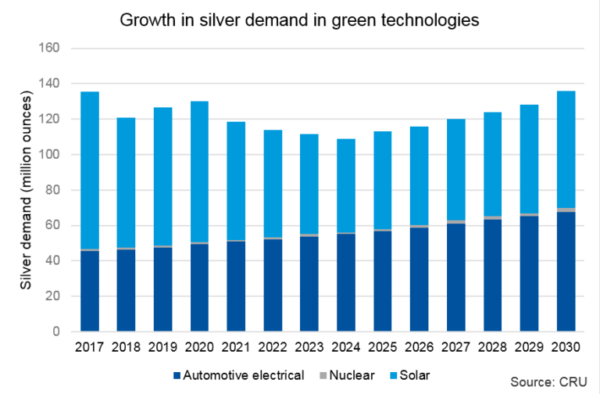

Silver is driven by:

-

investment demand

-

industrial demand (electronics, solar, EVs, medical)

-

manufacturing cycles (which can turn quickly)

Practical takeaway:

If you believe the next few years are about energy transition + electronics + electrification, silver has a structural narrative. If you believe the next few years are about uncertainty + currency pressure, gold remains king.

4) Affordability: silver feels “cheap,” but value isn’t the same as price

Per gram, silver is far more affordable – so it’s easier to accumulate larger quantities. That’s why first-time investors often start there.

But affordability has trade-offs:

-

you need more volume to store the same value

-

spreads can matter more for small-ticket buys if your platform pricing isn’t efficient

If you want to go deeper on buying costs, read: digital gold charges in India (spreads, GST, storage, selling fees).

5) Liquidity: both are liquid – gold is typically smoother

In India, gold has the deepest ecosystem (jewellers, banks, digital platforms, global liquidity). Silver is liquid too, but large-value exits can be slightly less frictionless in the physical market.

Digital metal platforms solve much of this by enabling instant buy/sell without worrying about finding a buyer.

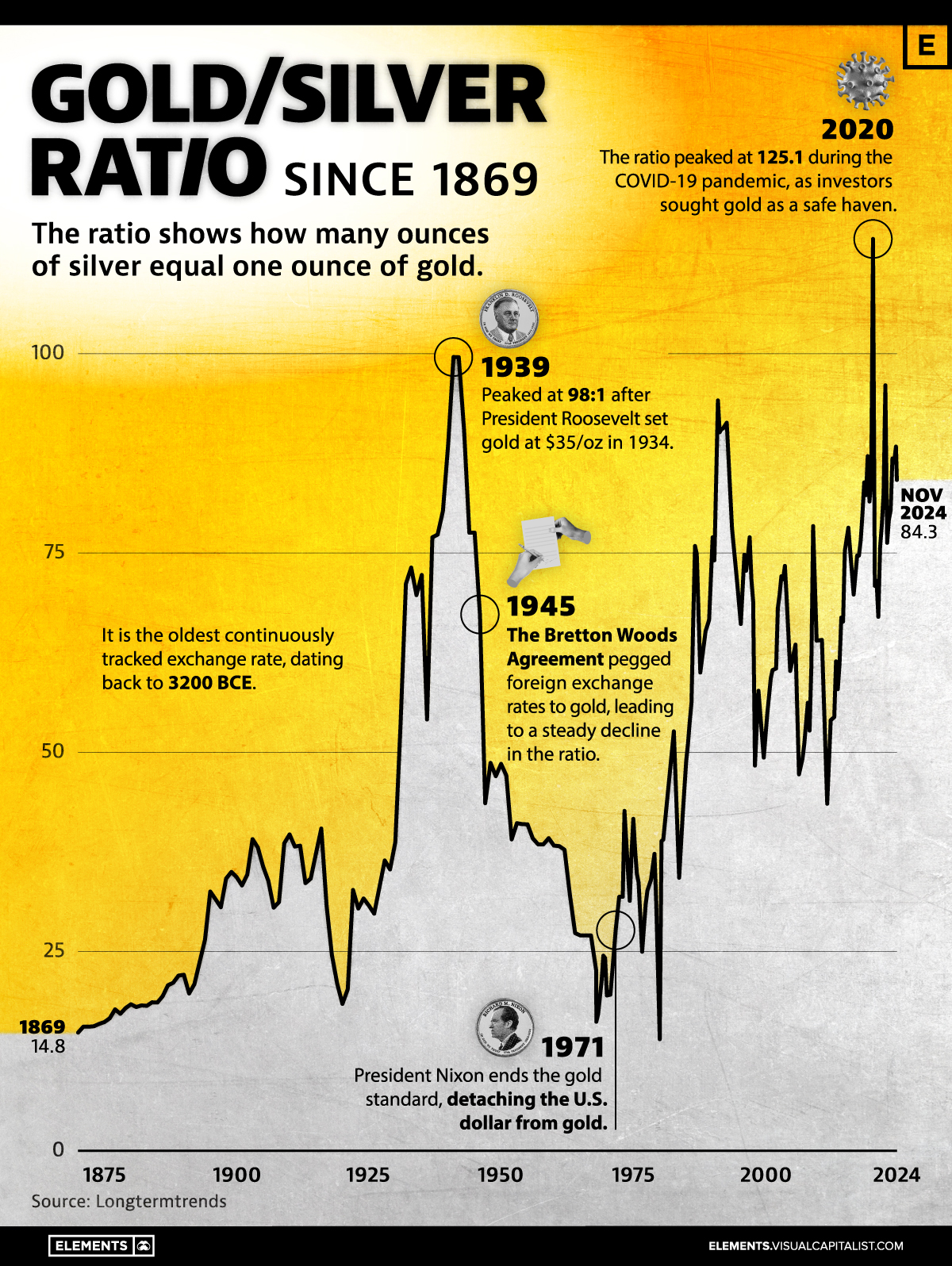

The gold–silver ratio: how investors use it (without overcomplicating)

The gold–silver ratio tells you how many ounces of silver equal one ounce of gold. Investors watch it because it can hint at relative over/undervaluation.

Simple way to use it (retail-friendly):

-

If the ratio is very high, silver may be relatively cheap vs gold.

-

If the ratio is very low, silver may be relatively expensive vs gold.

But don’t bet your full portfolio on this ratio. Use it only to rebalance gradually (example below).

Gold vs Silver: comparison table for Indian investors (2026)

|

Factor |

Gold |

Silver |

What it means |

|---|---|---|---|

|

Price volatility |

Lower |

Higher |

Silver can outperform and crash faster |

|

Inflation hedge |

Strong, consistent |

Good but less “pure” |

Gold usually shines in uncertainty |

|

Demand engine |

Monetary + jewellery |

Monetary + industrial |

Silver benefits from manufacturing booms |

|

Accessibility |

Higher ticket size |

More affordable |

Silver easier to accumulate |

|

Storage (physical) |

Compact |

Bulky |

Digital storage wins for silver |

|

Liquidity |

Excellent |

Strong |

Gold exits typically smoother |

|

Best role |

Core protection |

Satellite growth |

Most portfolios benefit from both |

The biggest content gap competitors miss: your “behavior” matters more than the metal

Most articles stop at features. The real question is:

Can you hold through volatility without selling at the worst time?

-

If you want peace of mind, pick gold-first.

-

If you can stay disciplined and you’re okay with big swings, add silver.

-

If you’re new, the best strategy is usually micro-investing + consistency, not a one-time bet.

That’s why OroPocket is built around habit-building:

-

₹1 entry point (no “I’ll start later” excuses)

-

daily streaks + spin-to-win

-

free Bitcoin rewards on every buy (you’re rewarded for consistency)

Recommended allocation frameworks (beginner-friendly)

These are not “one-size-fits-all,” but they’re practical starting points.

If you want safety-first (most salaried investors)

-

80% gold / 20% silver (within your metals bucket)

If you want balanced growth + protection

-

70% gold / 30% silver

If you’re aggressive and can handle drawdowns

-

60% gold / 40% silver

Important: Many advisors suggest precious metals at 5–15% of a total portfolio. If you’re already heavy in gold due to family jewellery, your “financial gold” allocation may need to be smaller.

Want a structured approach? Use investing in gold and silver together: allocation, rebalancing, and risk control.

How OroPocket makes gold + silver investing smarter in 2026

What you get (and why it matters)

-

Start from ₹1: build the habit before you build the corpus.

-

Instant UPI buys (under 30 seconds): no friction, no delays.

-

100% secure & compliant: fully insured vault storage + authorized bullion partners.

-

Free Bitcoin (Satoshi) on every purchase: two assets for the price of one.

-

Gamified investing: streaks, spin-to-win, tiered rewards – because consistency beats intensity.

-

Referral rewards: both sides earn 100 Satoshi + free spin.

This is the modern investor’s edge: stability (gold) + optionality (Bitcoin rewards).

Conclusion: so… is gold or silver a better investment?

For 2026, gold is the better default for most Indian investors because it’s typically more stable and behaves more like true financial insurance.

But if you want better long-term resilience, don’t choose one metal like a cricket team. Build a system:

-

Gold for protection

-

Silver for cyclical upside

-

Consistency via micro-investing

-

Extra upside via Bitcoin rewards

OroPocket is built exactly for that.

Stop waiting for the “perfect price.” Start a ₹1 gold or silver streak today – and earn free Bitcoin on every buy.