Is it a good time to buy gold in India today? 2025 data-led guide

2025 snapshot: Is it a good time to buy gold in India today?

“Indian domestic spot gold prices rose ~23% YTD to ~₹93,217 per 10g as of 11 April 2025.” – Source

Short answer upfront

- If your goal is wealth protection and diversification, starting a SIP now is sensible. If you’re waiting for a dip for a lump-sum, use the premium/discount and USD/INR triggers in this guide. In plain English: is it a good time to buy gold? For SIPs – yes. For lump-sum – wait for better entry signals.

Why prices are elevated right now

- Global record highs: Gold broke fresh highs this year on safe-haven demand.

- USD weakness and geopolitical risk: A softer dollar and uncertainty have boosted bullion.

- Strong central bank demand: Persistent buying supports prices on dips.

- INR effect: Even if global prices pause, rupee depreciation makes domestic gold costlier.

- Net-net: If you’re asking “is it good to buy gold now” purely for timing, expect ongoing volatility with a positive long-term trend.

Who should buy now vs wait

- SIP buyers: If you’re building long-term exposure, start now and average through volatility. Automate via UPI so you don’t miss days when prices dip intraday.

- Lump-sum buyers: Be patient. Prefer entries when:

- Domestic premium flips to a noticeable discount to landed price.

- USD/INR strengthens (rupee gains) to offset USD-gold moves.

- US real yields pull back, historically supportive for gold. These are your practical “should we buy gold now” triggers.

What this 2025 data-led guide covers

- Drivers to watch: USD/INR, real yields, RBI purchases, ETF flows, and demand seasonality.

- A today-checklist: Quick signals to decide if this is a good time to buy gold.

- Jewellery vs investment gold: When adornment makes sense vs pure investment exposure.

- How to start with ₹1 on OroPocket – and earn Bitcoin rewards:

- Buy 24K insured digital gold from ₹1 via instant UPI.

- Earn free Satoshis on every purchase, with daily streaks and spin-to-win boosts.

- Send/gift gold anytime. RBI-compliant, fully insured vaults.

Keywords to guide your decision: is it a good time to buy gold, is it good to buy gold now, should we buy gold now, when should you buy gold, is this a good time to buy gold.

What’s moving gold right now (2025): USD–INR, real yields, RBI, ETFs, and demand

Currency and rates

- USD/INR: A weaker rupee raises India’s landed gold price even if the global USD price is flat. When INR strengthens, it can soften domestic prices – use this as a timing signal.

- Real yields: Gold typically moves inversely to US real yields. When real yields fall or pause, gold gets support; when they rise sharply, gold can consolidate.

RBI’s role and central bank buying

- The RBI has steadily increased the share of gold in forex reserves over the past year. Pace moderated in early 2025, but the strategic allocation trend remains intact – this underpins dips.

- Globally, central bank purchases have been a key pillar for gold’s uptrend. Persistent buying reduces the depth of corrections.

ETFs and investor flows

“Gold ETFs in India saw a modest ₹0.8 bn net outflow in March 2025 after 10 months of inflows, yet AUM hit a record ~₹589 bn.” – Source

- Why the outflow? Profit-taking and portfolio rebalancing after a sharp rally. This doesn’t negate the broader trend – rising AUM at record prices signals growing investor participation.

Jewellery demand realignment

- High prices have shifted behavior. More customers are exchanging old gold to manage budgets; wedding and festival purchases dominate, while discretionary buys slow.

- Investment bars/coins remain resilient even at higher price points – reflecting gold’s store-of-value appeal.

Domestic premium/discount vs landed price

- What it means: Domestic gold sometimes trades at a premium or discount to the “landed price” (international price adjusted for taxes and USD/INR).

- How to use it:

- Wider discount = better entry for lump-sum buyers (local supply > demand).

- Premium shrinking or flipping to discount after a rally can indicate cooling demand – watch for entries.

- Practical tip: Pair this with USD/INR and real-yield moves. Ideal entries often coincide with a domestic discount, a firmer INR, and softening real yields.

Should you buy gold now or wait? SIP vs lump‑sum playbook

“Average domestic gold price discount to landed price widened from ~US$12/oz (mid‑Mar) to >US$30/oz (11 Apr 2025).” – Source

The simple decision rule

- SIP if you want discipline and risk averaging; lump-sum only on signals (discounts, yield moves).

When SIP wins

- Volatile, rising markets; small budgets; first-time investors building habits.

- Automate via UPI on OroPocket, start from ₹1, and earn Satoshis on every buy.

When lump‑sum makes sense

- Local discounts widen; USD/INR stabilizes or appreciates; real yields dip; off-peak festival windows when jewellers clear inventory.

- Use alerts for USD/INR and real-yield moves; combine with domestic discount data for higher-conviction entries.

Use domestic premium/discount as a timing tool

- What it is: The difference between India’s market price and the “landed price” (international price adjusted for import duty + GST + USD/INR).

- How to check: Track MCX/spot versus landed benchmarks reported by exchanges/market updates.

- How to read it (plain English):

- Discount wide and stable: Buyers have pricing power – better for lump-sum.

- Premium shrinking or flipping to discount: Demand cooling – watch for entries.

- Persistent premium: Demand is hot – prefer SIP to average costs.

Example scenarios for 2025

- Case 1: Buyer in July pre-festive season

- Market context: Seasonal demand starts building; prices elevated but choppy.

- Play: Start/continue SIP. Only consider a small lump-sum if INR strengthens and discount widens that week.

- Case 2: Buyer during a brief price pullback

- Market context: 2–4% dip after a global rally; real yields pause lower.

- Play: Deploy a staged lump-sum (e.g., 40/30/30 over 10–14 days) plus keep SIP running.

- Case 3: Wedding purchase vs investment allocation

- Jewellery: Buy during regional off-peak days or retailer promos; exchange old gold to reduce outlay.

- Investment gold: Separate from jewellery budget; use SIP for the core, add lump-sum only on discount + INR + yield signals.

SIP vs Lump‑sum cheat sheet

| Investor profile | Market condition | Why it fits | Risk | Action today |

|---|---|---|---|---|

| First‑time investor | Uptrend with volatility | Builds habit, averages cost, tiny ticket sizes via UPI | Opportunity cost if market falls sharply | Start SIP from ₹1 on OroPocket; keep it running |

| Volatility spike | Large intraday swings, news-driven | SIP removes timing stress; lump-sum only on discount signal | Buying into whipsaws | Maintain SIP; consider 20–30% tactical buy if discount widens |

| Festival month | Strong jewellery demand, premiums possible | Prices can be sticky; focus on discipline | Paying premium on peak days | SIP as base; schedule buys on quieter weekdays or off-peak |

| INR strengthening | Rupee gains vs USD | Softens domestic price even if USD gold is flat | Move can reverse quickly | Add a partial lump-sum; keep SIP |

| Post‑rally consolidation | Sideways after big run; real yields ease | Dips more likely; better entries | False breaks higher | Staggered lump-sum (in tranches) + ongoing SIP |

Keywords: should we buy gold now, is it a good time to buy gold, is it good to buy gold now, when should you buy gold, is this a good time to buy gold.

Signals to check before you buy today (5‑minute checklist)

Note: Seasonality is a tendency, not a guarantee.

1) USD/INR trend

- Rising USD/INR = costlier gold domestically; falling = relief.

2) US real yields (10Y TIPS)

- Lower real yields usually support gold; watch weekly moves.

3) Domestic premium/discount vs landed price

- Discount widening often indicates softer local demand – can aid entries.

4) ETF flows and RBI activity

- Persistent local inflows = strong investor bid; RBI accumulation = long‑term support.

5) Seasonality and wedding calendar

- Akshaya Tritiya, Dhanteras, Diwali; monsoon income effects; exam bonus/salary cycles.

What to do with these signals

- Map each signal to a concrete buy action (SIP continue, add on dips, or hold lump‑sum).

| Signal | Threshold | What it means | Action |

|---|---|---|---|

| USD/INR breaks below prior month’s average | Easing domestic prices | Advance lump‑sum by 25% and keep SIP running | |

| Domestic discount > US$20/oz | Soft local demand | Stagger buys in 2–3 tranches over 7–14 days | |

| Real yields drop 20–30 bps in a month | Momentum support for gold | Add 10–20% to SIP for the month | |

| ETF inflows persist for 3+ weeks | Strong investor bid | Continue SIP; avoid chasing with large lump‑sum | |

| RBI adds to reserves for 2 consecutive months | Long‑term floor under prices | Maintain SIP; deploy only small tactical lump‑sum on dips | |

| Pre-festival week premiums shrink | Demand cooling into event | Schedule 1 tranche before event; rest after | |

| INR strengthens 1–2% in 2 weeks | FX tailwind for domestic price | Execute 30–40% of planned lump‑sum, keep SIP steady |

Buying jewellery vs investing in gold: costs, liquidity, and purpose

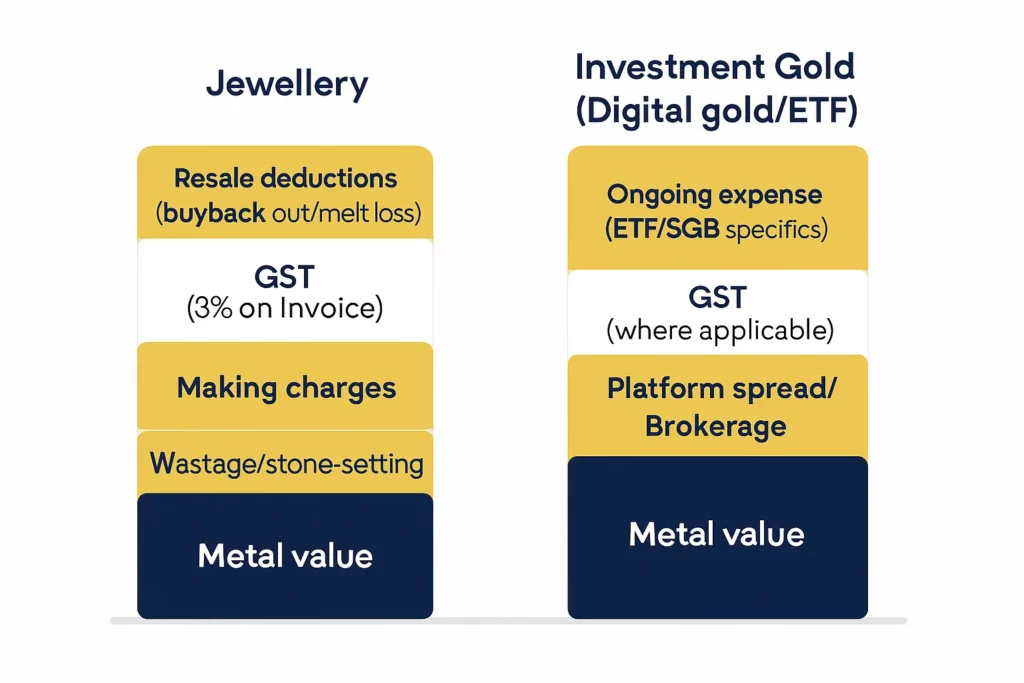

Cost stack comparison (jewellery vs investment gold)

- Jewellery

- Metal value (24K equivalent)

- Making charges and wastage/stone-setting

- GST (3% on final invoice)

- Resale deductions (stone removal, melt loss, buyback cuts)

- Investment gold (digital gold/ETF/SGB)

- Metal value linked to live benchmarks

- Platform spread or brokerage; low ongoing ETF expense ratio

- GST applicability varies by product; SGBs have no GST at purchase and tax-free redemption on maturity

Liquidity and pricing transparency

- Jewellery resale: Negotiated; often below live gold value due to making charges/wastage not being recovered. Liquidity depends on jeweller’s buyback policy.

- Digital gold/ETFs/SGBs: Live quotes during market hours; instant or T+ settlement; transparent pricing. SGBs have fixed tenor but tradable on exchanges; redemption at market-linked price.

Purpose matters

- Jewellery: Cultural, wedding, gifting – emotional value first, financial second.

- Investment gold: For compounding, diversification, and liquidity. Ideal for SIPs, tactical lump-sums, and portfolio ballast.

What should you pick today?

- Split approach:

- Jewellery for occasions you’ll actually wear/use (opt for hallmarking; consider exchanging old gold to reduce cost).

- SIP in investment-grade gold on OroPocket for long-term wealth. Start from ₹1 via UPI, earn free Satoshis on every purchase, and keep liquidity intact.

How to start with ₹1 and earn Bitcoin on gold: the OroPocket way

Why micro‑investing now works

- Start small, average in through volatility, and build a daily habit that compounds over time.

- Rewards keep you consistent – each buy earns Satoshis, nudging you to stay on track.

5 quick steps (under 10 minutes)

- Download OroPocket (iOS/Android)

- Add UPI and complete a quick in‑app KYC

- Buy 24K gold from just ₹1

- Set a daily/weekly SIP (enable reminders)

- Track your holdings and rewards in real time

Rewards that boost your stack

- Free Satoshi cashback on every purchase (tiered)

- Daily streak bonuses for 5 consecutive days and beyond

- Spin‑to‑win for bonus gold/Bitcoin rewards

- Referral: 100 Satoshi + a free spin when your friend joins

Safety and compliance

- 24K pure gold, 100% insured, securely vaulted

- RBI‑compliant with authorized bullion partners

- Transparent, live pricing; instant UPI payments

Example plan

- ₹100/day SIP + maintain your streak + refer 3 friends = growing gold balance + Bitcoin rewards over 90 days.

- Illustrative, not guaranteed. Focus on consistency; the rewards are the boost.

Taxes, safety, and compliance you should know in 2025

“GST on gold jewellery is 3% on gold value; making charges attract 5% GST.” – Source

Tax basics (high‑level overview)

- GST at purchase:

- Jewellery retail invoices typically levy 3% GST on the value of the jewellery (metal + making on invoice).

- Job-work/making services provided to a jeweller attract 5% GST at the service level.

- Capital gains on sale/redemption (indicative, subject to change and your facts):

- Physical/digital gold: Held < 3 years = gains taxed as per slab; ≥ 3 years = typically 20% with indexation.

- Gold ETFs (units acquired on/after 1 Apr 2023): Debt‑style taxation – gains generally taxed as per slab (no indexation). Check your fund’s tax note.

- Sovereign Gold Bonds (SGBs): 2.5% annual interest is taxable; capital gains on redemption at maturity are exempt. If sold on exchange before maturity, capital gains tax applies as per holding period rules.

Product nuances

- Digital gold: Live, transparent pricing; easy buy/sell; treated like physical gold for capital gains.

- Gold ETFs: Exchange‑listed; intraday liquidity; post‑Apr 2023 units generally taxed at slab rates (verify with your AMC).

- SGBs: Government‑issued; no GST at purchase; interest income taxed; maturity redemption CG exempt; secondary‑market liquidity can vary and prices may deviate from gold.

Security & compliance

- Prefer platforms with 24K purity, insured professional vaulting, and authorized bullion partners.

- RBI‑aligned processes, proper KYC, and transparent price discovery are non‑negotiable.

- Avoid unregulated sellers, vague buyback promises, or unclear storage/audit policies.

Plain‑English disclaimer

- No guarantees: Gold can be volatile in the short run. Use asset allocation, not all‑in bets.

- Tax rules change: Always verify the latest GST rates and capital‑gains treatment at purchase time and consult a tax professional for your situation.

- Check purity, charges, and liquidity before you buy; document invoices and redemption terms.

FAQs: Is this a good time to buy gold now?

Is it a good time to buy gold in India today?

- For most investors, yes – start a SIP to average costs through volatility. If you’re eyeing a lump‑sum, wait for better entries: a domestic price discount to landed price, a firmer INR, or softer US real yields. That’s your higher‑conviction window.

Should we buy gold now or wait for a correction?

- Don’t pause wealth building. Keep a SIP running.

- For timing a lump‑sum, wait for 1–2 of these signals: wider domestic discount, INR strengthening 1–2% over 1–2 weeks, or a 20–30 bps drop in real yields over a month. If none show up, stick to SIP.

When should you buy gold in 2025 – festival season or off‑season?

- Festival season can carry premiums. If you must buy jewellery, shop early on quieter weekdays or after the peak day.

- For investing, off‑season or brief dips are typically better. If you don’t want to time it, SIP smooths out festival premiums.

Is it a good time to buy gold jewellery vs investment gold?

- Jewellery: Buy for culture, weddings, gifting – expect making charges and lower resale recovery. Exchange old gold to cut costs.

- Investment gold: Choose digital gold/ETFs/SGBs for transparent pricing and liquidity. Use SIP for core allocation; add lump‑sums only on signals.

Is digital gold on apps safe and compliant?

- Choose platforms with 24K purity, insured vaults, authorized bullion partners, and RBI‑aligned processes. OroPocket is mobile‑first, KYC‑compliant, offers instant UPI buys, and lets you send/gift gold – plus free Bitcoin (Satoshi) rewards on every purchase.

How much gold should I allocate (and in SIP vs lump‑sum)?

- Many diversified portfolios hold 5–15% in gold. Your number depends on risk, horizon, and other assets. Not advice – use as a starting point.

- Split method: Run a base SIP (e.g., weekly/daily). Keep a separate lump‑sum bucket to deploy in 2–3 tranches when discount/INR/real‑yield signals line up.

Is this a good time to buy gold if I want to gift it?

- Jewellery: Buy around personal dates or off‑peak windows; verify buyback and hallmarking.

- Digital gold: Gift instantly at live prices via OroPocket – no making charges, high liquidity, and the recipient can hold/sell anytime.

Action plan for today: from zero to your first gram in 10 minutes

Step‑by‑step

- Check today’s MCX price and USD/INR

- Quick read: higher USD/INR = costlier domestic gold; a firmer INR can be your window.

- Glance at real yields (10Y TIPS) and local premium/discount

- Lower real yields and a wider domestic discount to landed price = better entry odds.

- Decide SIP vs lump‑sum using the table

- If signals are mixed or you’re new, default to SIP. If discount widens and INR firms, deploy a staged lump‑sum.

- Open OroPocket; fund via UPI; buy from ₹1

- 24K gold, live pricing, instant settlement – no paperwork.

- Set SIP; enable streak reminders; invite a friend for referral bonus

- Daily/weekly SIP builds discipline. Streaks and spin‑to‑win boost rewards. Referral: 100 Satoshi + a free spin when your friend joins.

- Calendar a monthly 10‑minute review

- Recheck USD/INR, real yields, and domestic premium/discount. Top up lump‑sum only when signals align; keep the SIP running regardless.

Done. You’ve taken control in under 10 minutes – your first gram is now in progress.

Conclusion: Start small, stay consistent – build gold the modern way with OroPocket

The bottom line

- If you’re asking “is it a good time to buy gold now?”, the smartest move is to start a SIP today. Keep building through volatility and add lump‑sums only when signals align (domestic discount widens, INR firms, real yields dip).

- You don’t need perfect timing to win. Consistency beats FOMO. Use the checklist in this guide to decide when to deploy extra.

Why OroPocket fits

- ₹1 entry point, instant UPI payments, and 24K insured gold in secure vaults.

- Free Bitcoin (Satoshi) rewards on every purchase, plus daily streaks, spin‑to‑win, and referrals (100 Satoshi + free spin).

- RBI‑aligned processes, transparent pricing, and mobile‑first convenience – ideal for SIPs and tactical top‑ups.

Call to action

- Download OroPocket, set your first ₹100 SIP, enable streak reminders, and invite a friend. Let data – not FOMO – drive your journey. When you wonder “should we buy gold now” or “is this a good time to buy gold,” check the signals, then act with confidence.