Is it a good time to buy silver in 2026? Signals, strategy, and FAQs

Quick take: Is it a good time to buy silver in 2026?

The one-minute answer

-

Yes – but buy smart. After a massive 2025 run-up, silver’s 2026 path is elevated and volatile. That calls for staggered buys, SIPs, and clear rebalancing rules rather than all-in bets.

-

Who should consider buying now: long-term savers, first-time investors, and gold holders seeking higher upside with controlled risk.

-

Who should wait for dips: short-term traders without risk buffers and anyone with concentrated equity risk needing cash first.

If you’re asking “is it a good time to buy silver,” “is this a good time to buy silver,” or “is silver good to buy now,” the answer in 2026 is: yes – if you use a rules-based plan. For timing questions like “when to buy silver,” focus on tranches and SIPs instead of trying to nail the bottom.

Why timing matters this year

-

Macro tailwinds (easing rates, softer dollar), structural industrial demand (solar/EVs/electronics), and multi‑year supply tightness keep the long-run case intact.

-

Near term: two-way price action is likely; use rules-based entries.

“The silver market posted a 184.3 million-ounce deficit in 2023, the third consecutive annual shortfall.” – Source

How to use this guide

-

Scan the signals dashboard.

-

Follow the 2026 action plan (tranches + SIPs + rebalancing).

-

Localise decisions with INR/USD, RBI stance, and Indian seasonality.

Build your silver position the modern way on OroPocket: start with ₹1, buy via UPI in 30 seconds, and earn free Bitcoin on every silver purchase. Download the app from https://oropocket.com/app and set up your SIP today.

The 2026 signals dashboard: what to track before you buy

Use this dashboard to answer the big question – “is it a good time to buy silver?” – with data. Track these levers to decide when to buy silver in 2026 and how big each tranche should be.

1) Rates and USD trend

-

Falling real yields and a softer DXY historically aid precious metals; watch the Fed’s path, inflation surprises, and US 10Y TIPS.

-

A dovish pivot and weak dollar = tailwind for silver. Hawkish surprises and a stronger dollar = headwind.

2) Industrial demand pulse

-

Solar, EVs, AI/datacentres, and high‑end electronics drive structural demand.

-

Monitor OEM guidance, PV installation run‑rates, and semiconductor/electronics order books for momentum.

3) Supply stress indicators

-

Exchange inventories (LBMA/COMEX), mining updates (Mexico/Peru/China), refining bottlenecks.

-

Lower visible stocks and constrained mine supply amplify upside moves.

4) Market positioning

-

Track ETF inflows/outflows, futures positioning (CFTC where applicable), and local premiums.

-

Persistent ETF inflows and rising retail premiums signal improving investor demand.

5) India-specific variables

-

INR/USD, RBI stance, import duties/taxes, festive season demand (Dhanteras/Diwali), and wedding cycles.

-

A stronger INR reduces landed cost for Indian buyers; seasonal tailwinds often improve liquidity and demand.

“These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.” – Source

Silver 2026 Signals → Action Map

|

Signal |

What to watch (metric/threshold) |

Bias (Bullish/Neutral/Bearish) |

Action (Aggressive buy/Normal SIP/Hold cash) |

|---|---|---|---|

|

Real yields |

US 10Y TIPS trend: falling and <1.0% |

Bullish |

Aggressive buy |

|

Flat around 1.0–1.5% |

Neutral |

Normal SIP |

|

|

Rising and >1.5% |

Bearish |

Hold cash |

|

|

DXY trend |

DXY falling and <100 |

Bullish |

Aggressive buy |

|

Sideways 100–104 |

Neutral |

Normal SIP |

|

|

Rising and >104 |

Bearish |

Hold cash |

|

|

ETF flows |

4‑week rolling inflows > +10 Moz |

Bullish |

Aggressive buy |

|

~Flat (±2 Moz) |

Neutral |

Normal SIP |

|

|

4‑week outflows < −10 Moz |

Bearish |

Hold cash |

|

|

PV installs |

Global quarterly PV installs YoY > +20% and record run‑rates |

Bullish |

Aggressive buy |

|

YoY +0–10% |

Neutral |

Normal SIP |

|

|

YoY negative/guide‑downs |

Bearish |

Hold cash |

|

|

Exchange inventories |

LBMA/COMEX registered stocks falling to multi‑year lows |

Bullish |

Aggressive buy |

|

Stable |

Neutral |

Normal SIP |

|

|

Rising rapidly |

Bearish |

Hold cash |

|

|

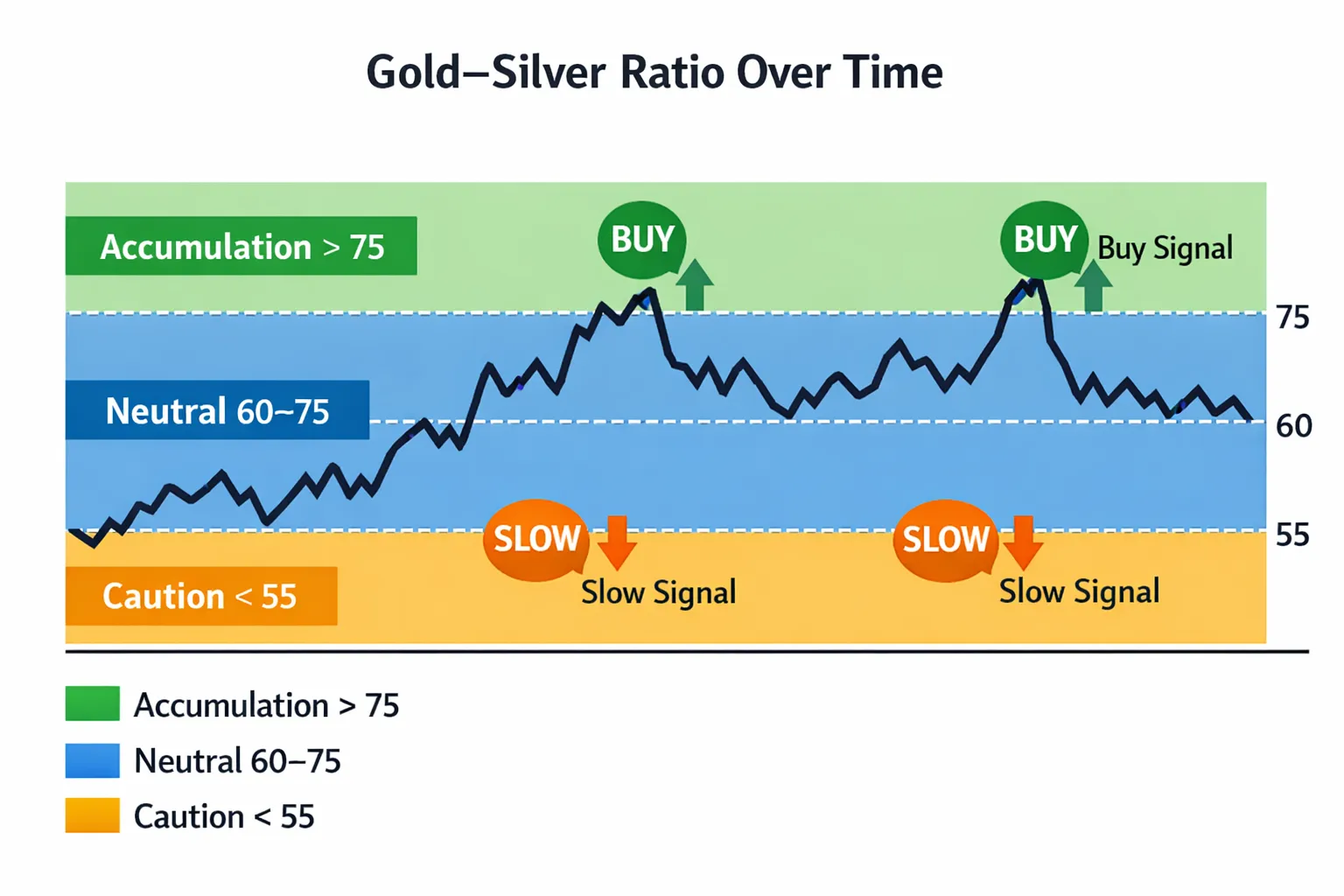

Gold–Silver Ratio |

GSR falling toward ≤60 |

Bullish |

Aggressive buy |

|

60–75 |

Neutral |

Normal SIP |

|

|

Rising >75 |

Bearish |

Hold cash |

|

|

INR/USD |

INR stable/stronger (appreciating vs USD) |

Bullish (for Indian buyers’ costs) |

Aggressive buy |

|

Range‑bound |

Neutral |

Normal SIP |

|

|

INR weakening sharply |

Bearish (higher landed cost) |

Hold cash / SIP only |

How to act on the mix

-

If 3+ bullish signals align, deploy a larger tranche (e.g., 25–30% of your planned 2026 allocation).

-

If signals are mixed, stick to SIPs + buy small dips to average costs.

-

If bearish signals dominate, buy token amounts only and keep dry powder for better entries.

Build your silver stack the smart, India‑first way on OroPocket. Start from ₹1, buy via UPI in 30 seconds, and earn free Bitcoin on every silver purchase. Download now: https://oropocket.com/app

When to buy silver: seasonality, gold–silver ratio, and INR/USD

Seasonality (India context)

-

Festive/wedding demand can tighten local supply; avoid chasing spikes – front‑run with small tranches 2–4 weeks ahead of peaks; add on post‑fest corrections.

-

Dhanteras/Diwali and wedding cycles typically lift retail demand; stagger entries to avoid day‑of price surges.

Gold–Silver Ratio (GSR) rules of thumb

-

GSR > 75: overweight silver adds; 60–75: neutral SAA adds; < 55: slow purchases or rebalance toward gold.

-

Use GSR only alongside macro and supply signals (real yields, DXY, inventories, ETF flows).

“Industrial demand made up 56% of total silver demand in 2024, with PV consumption at a record 232 Moz.” – Source

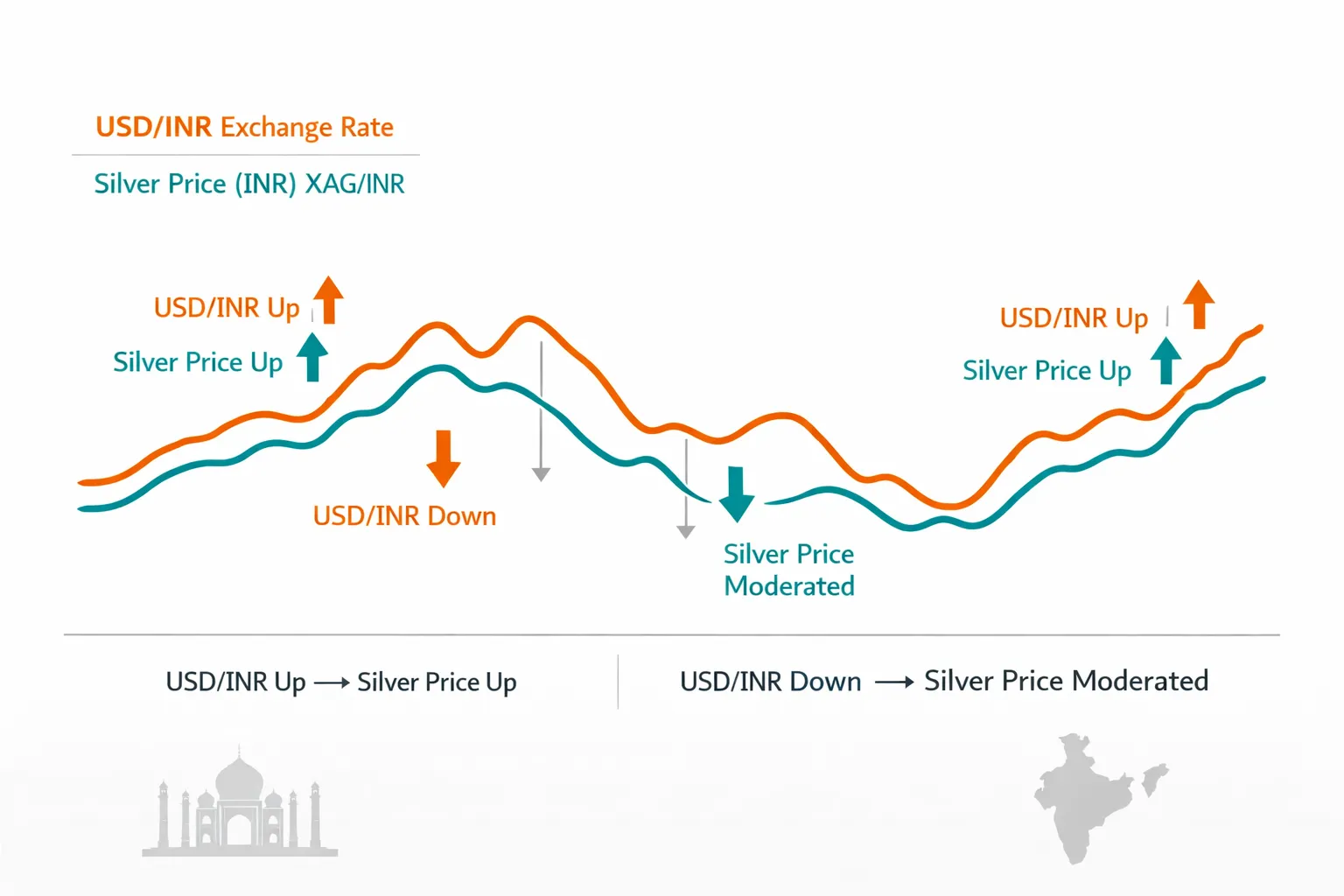

INR/USD pass-through

-

A weakening INR can lift INR silver even if USD silver is flat – plan India-facing entries with currency in mind.

-

Stronger INR lowers landed costs; align larger tranches when INR is steady or appreciating.

Practical entry playbook

-

Tranche buys on 8–12% pullbacks from swing highs.

-

Keep a core SIP regardless of noise; SIP smooths timing risk.

-

Rebalance on GSR and large one‑week moves (e.g., ±10–15%) to lock gains and control risk.

Concise explainer video (GSR basics and timing use-case):

Ready to act on the signals? Build your silver stack on OroPocket – start at ₹1, pay via UPI in 30 seconds, and earn free Bitcoin on every silver purchase. Download now: https://oropocket.com/app

Your 2026 action plan: staggered buys, SIPs, and rebalancing

1) Split your capital

-

Divide your target 2026 silver allocation into 8–12 tranches.

-

Deploy larger tranches when 3+ bullish signals align (from the dashboard: real yields ↓, DXY ↓, ETF inflows ↑, PV installs strong, inventories tightening, INR steady/strong).

2) Set a default SIP

-

Automate a weekly/bi‑weekly/monthly SIP starting from ₹1 to build steadily and reduce regret.

-

Keep SIP running through all market regimes to average costs and build habits.

3) Buy-the-dip rules

-

Add 1 tranche on every 8–12% pullback from a local peak.

-

Add 2 tranches on 15–20% flushes if macro isn’t broken (no spike in real yields, no USD surge, no inventory rebuild).

4) Rebalance rules

-

If GSR < 55 for 2 consecutive weeks, shift 10–20% of new buys to gold.

-

If silver rallies 30%+ in 4–6 weeks, skim 10–15% gains back to cash/gold to de‑risk.

5) Exit discipline

-

Never go all‑out; scale out 10–20% into extreme strength and keep the SIP running.

-

Review monthly, align with your risk budget, and reset tranche sizes as the year evolves.

Ready to execute with precision? Do it on OroPocket – start at ₹1, pay via UPI, and earn free Bitcoin on every silver purchase. Download the app: https://oropocket.com/app

Position sizing and risk controls for a volatile metal

Right-size your exposure

-

Cap silver at 5–15% of total portfolio for first-time investors; advanced investors may scale higher with hedges (gold ballast, cash buffer).

-

Position sizing rule of thumb: risk no more than 0.5–1.0% of total portfolio per dip-add tranche. If hit, pause and review signals.

-

Keep 25–40% of your planned 2026 silver budget as dry powder for volatility events.

-

If you’re asking “is it a good time to buy silver” or “when to buy silver,” remember: sizing beats timing. Small, consistent adds > one big bet.

Volatility-aware entries

-

Use limit orders on dips; avoid chasing breakouts in thin liquidity.

-

Avoid illiquid hours (late-night India time/low-vol sessions) to minimize slippage.

-

If trading, allow wider stop buffers to avoid whipsaws; size smaller to compensate for wider stops.

-

Ladder entries: split into 8–12 tranches and scale only when multiple bullish signals align.

Liquidity and premium checks

-

Compare platform spreads/premiums before buying; elevated premiums can erase a “dip.”

-

Watch for local shortages during festive/wedding peaks; front-run demand 2–4 weeks ahead instead of buying on the day.

-

Prefer platforms with transparent pricing, instant UPI settlement, and easy exit liquidity.

Behavioural guardrails

-

Pre-commit rules (how much, when, what triggers) and stick to them.

-

Don’t abandon SIPs after red weeks; that’s when cost-averaging works.

-

Don’t FOMO after green weeks; trim into strength per your rebalance rules instead.

-

Review monthly: if silver rallies 30%+ in 4–6 weeks, skim 10–15% to cash/gold; if GSR < 55 for two weeks, shift 10–20% of new buys to gold.

Build your silver position with discipline on OroPocket – start at ₹1, pay via UPI in 30 seconds, and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

Indian buyer’s cheat‑sheet: INR/USD, taxes/duties, and RBI stance

The INR effect

-

USDINR ↑ typically lifts INR silver even if USD silver is flat; hedge timing accordingly.

-

When you’re deciding when to buy silver, align larger tranches when INR is stable/strong and DXY is easing.

Taxes/duties (high-level)

-

Factor GST/duties/local premiums into your delivered cost; these can offset a “dip.”

-

Prefer transparent, RBI‑compliant partners for clear pricing and easy exits.

RBI lens for 2026

-

Liquidity stance, inflation path, and FX stability guidance influence INR – and therefore INR silver.

-

A tighter stance or INR weakness can lift XAGINR even if XAGUSD is flat.

“A depreciation in the exchange rate by 1 per cent leads to an increase of around 7 basis points in inflation via an exchange rate pass-through (ERPT) of 7 per cent.” – Source

Quick rules

-

If DXY ↑ and USDINR ↑, stagger smaller tranches (keep SIP, but go light on lump-sum buys).

-

If DXY ↓ and USDINR flat/down, green light for normal SIP + dip adds.

XAGUSD vs. USDINR → Impact on XAGINR

|

USD silver move |

USDINR move |

Likely INR silver move |

Suggested action (Aggressive/Normal/Light) |

|---|---|---|---|

|

+2% |

0% |

≈ +2% |

Normal (or Aggressive if other signals bullish) |

|

0% |

+1.5% |

≈ +1–1.5% |

Light (stagger small tranches/SIP only) |

|

–3% |

–1% |

≈ –4% |

Aggressive (buy the dip if macro intact) |

|

+1% |

+1% |

≈ +2% |

Normal (watch premiums) |

|

–2% |

0% |

≈ –2% |

Normal to Aggressive on rule‑based dips |

|

0% |

–1% |

≈ –1% |

Normal (add tranches if other signals align) |

Make INR‑smart purchases with OroPocket. Start from ₹1, pay via UPI in seconds, and earn free Bitcoin on every silver buy. Download the app: https://oropocket.com/app

Scenario map 2026: bull, base, and bear – what to do

Bull case (breakout + deficits deepen)

-

Triggers: Fed cuts > market pricing; DXY trends down; real yields fall; PV installs beat; ETF inflows accelerate; LBMA/COMEX inventories tighten further; GSR compresses toward 55–60.

-

Actions:

-

Accelerate tranches on smaller 5–8% dips (vs 8–12% in base case).

-

Run SIP at full cadence; add bonus buys during festival dips if INR is stable/strong.

-

Rebalance only after vertical moves: if price jumps 30%+ in 4–6 weeks, skim 10–15% to cash/gold.

-

Keep 20–25% dry powder for sudden pullbacks; avoid chasing intraday spikes.

-

Base case (elevated range)

-

Triggers: Mixed macro; steady industrial demand; inventories broadly stable; DXY range‑bound; real yields flat; GSR in 60–75 band.

-

Actions:

-

Stick to SIP + buy‑the‑dip rules (add 1 tranche on 8–12% pullbacks).

-

Quarterly rebalancing: harvest gains into gold/cash if allocations drift >20% from target.

-

Prioritise INR‑aware entries: larger tranches when USDINR is flat/down.

-

Maintain 30–35% of allocation as dry powder for range edges.

-

Bear case (hawkish pivot or supply relief)

-

Triggers: Real yields jump; USD spikes; CPI upside surprises; mine supply rebounds (Mexico/Peru/China); exchange inventories rebuild; ETF outflows persist; GSR rises >75.

-

Actions:

-

Reduce tranche size by 50%; buy only on 12–18% pullbacks and only if other signals aren’t deteriorating further.

-

Keep SIP minimal (token amounts) to maintain exposure without overcommitting.

-

Rotate some allocation to gold/cash until signals improve; tighten review frequency to weekly.

-

Avoid buying during INR weakness spikes – wait for INR stabilisation before adding.

-

Is it a good time to buy silver? In 2026, let the scenario guide you. If you’re wondering when to buy silver, use SIPs for consistency and tranches for dips – then adjust pace based on this map.

Build your plan on OroPocket: start from ₹1, pay via UPI in 30 seconds, and earn free Bitcoin on every silver purchase. Download now: https://oropocket.com/app

How to execute with OroPocket (and earn free Bitcoin)

Why OroPocket for silver in 2026

-

Start from ₹1 with instant UPI buys; RBI‑compliant, fully insured vaulting.

-

Unique edge: earn free Bitcoin (Satoshi) rewards on every silver/gold purchase.

-

Gamified discipline: Daily Streaks and Spin‑to‑Win nudge consistent investing.

Build your 2026 plan in the app

-

Set a weekly or monthly silver SIP starting from ₹1.

-

Turn on Daily Streaks to build habit; use Spin‑to‑Win for bonus gold/Bitcoin rewards.

-

Refer friends – both get 100 Satoshi + a free spin when they join.

-

Rebalance in‑app between gold and silver as the Gold–Silver Ratio crosses your thresholds (e.g., shift toward gold when GSR < 55 for 2 weeks).

Practical example

-

New investor plan: ₹500 weekly SIP + 4 dip‑buy tranches across the year + rebalance if GSR < 55 for 2 consecutive weeks.

-

Advanced twist: add larger tranches when 3+ bullish signals align (falling real yields, softer DXY, ETF inflows).

Start building your silver stack the smart way – download the OroPocket app now: https://oropocket.com/app

FAQs: is silver good to buy now, when to buy, and how much?

Is it a good time to buy silver now?

-

Short answer: Yes, if you buy in tranches/SIPs and follow risk controls. Avoid lump-sum at highs.

-

Use rule-based entries (signals dashboard) to avoid FOMO and manage volatility.

When to buy silver in 2026?

-

Prefer dips of 8–12%, supportive signals (falling real yields, ETF inflows), and favourable INR conditions.

-

If 3+ bullish signals align, increase tranche size; if mixed, stick to SIP + small dips.

Is silver good to buy now for first-time investors?

-

Start with a ₹1 SIP, then add small tranches on dips.

-

Cap allocation at 5–10% initially; review monthly and rebalance on big moves.

How does the gold–silver ratio help?

-

Use GSR > 75 to lean into silver; 60–75 = neutral adds; < 55 = slow adds and rebalance toward gold.

-

Always combine GSR with macro and supply signals for stronger conviction.

Will a weak rupee always push silver up in India?

-

Often, but not always. A rising USDINR can lift INR silver even if USD silver is flat – use the USD silver vs. USDINR cheat‑sheet to plan entries.

What’s the difference between SIP and lump‑sum here?

-

SIP smooths entries and reduces timing risk – ideal after big rallies.

-

Lump‑sum magnifies timing error; if used, split into 8–12 tranches with clear dip triggers.

Build your plan with OroPocket: start from ₹1, buy via UPI in 30 seconds, and earn free Bitcoin on every silver purchase. Download the app at https://oropocket.com/app

Conclusion: Start small, stay consistent – buy silver the smart way with OroPocket

-

Silver’s 2026 setup is strong but choppy. Win by system: SIP + tranches + rebalancing.

-

Localise your timing with INR/USD and RBI cues; let the Gold–Silver Ratio fine‑tune your gold vs silver split.

-

Is it a good time to buy silver? Yes – if you buy smart. Use staggered buys on 8–12% dips, keep your SIP running, and rebalance on big moves.

Ready to act? Download OroPocket, set your ₹1 silver SIP, and earn free Bitcoin on every purchase.

Get the OroPocket app now: https://oropocket.com/app