Is Physical Gold a Good Investment in India? Jewellery vs Investment-Grade

Is Physical Gold a Good Investment in India in 2025? Start Here

“In India, 24K gold prices roughly doubled (~100% total return) between 2019 and 2024.” – Source

If you’re wondering is physical gold a good investment in 2025, you’re not alone. Gold has protected Indian families through inflation, market shocks, and life’s big milestones. But not all gold is equal for wealth building. This guide cuts the noise and shows when buying gold as investment makes sense – and the best way to buy gold in India based on your goal.

Why Indians buy gold: safety, status, and inflation hedge

-

Safety you can hold: In uncertain times, gold is a “no-default” asset – no CEO risk, no balance-sheet risk.

-

Social currency: Weddings, festivals, family wealth – gold signals status and security.

-

Inflation hedge: Everyday costs rise; gold historically keeps up. It’s why parents still tell you to hold some “sona”.

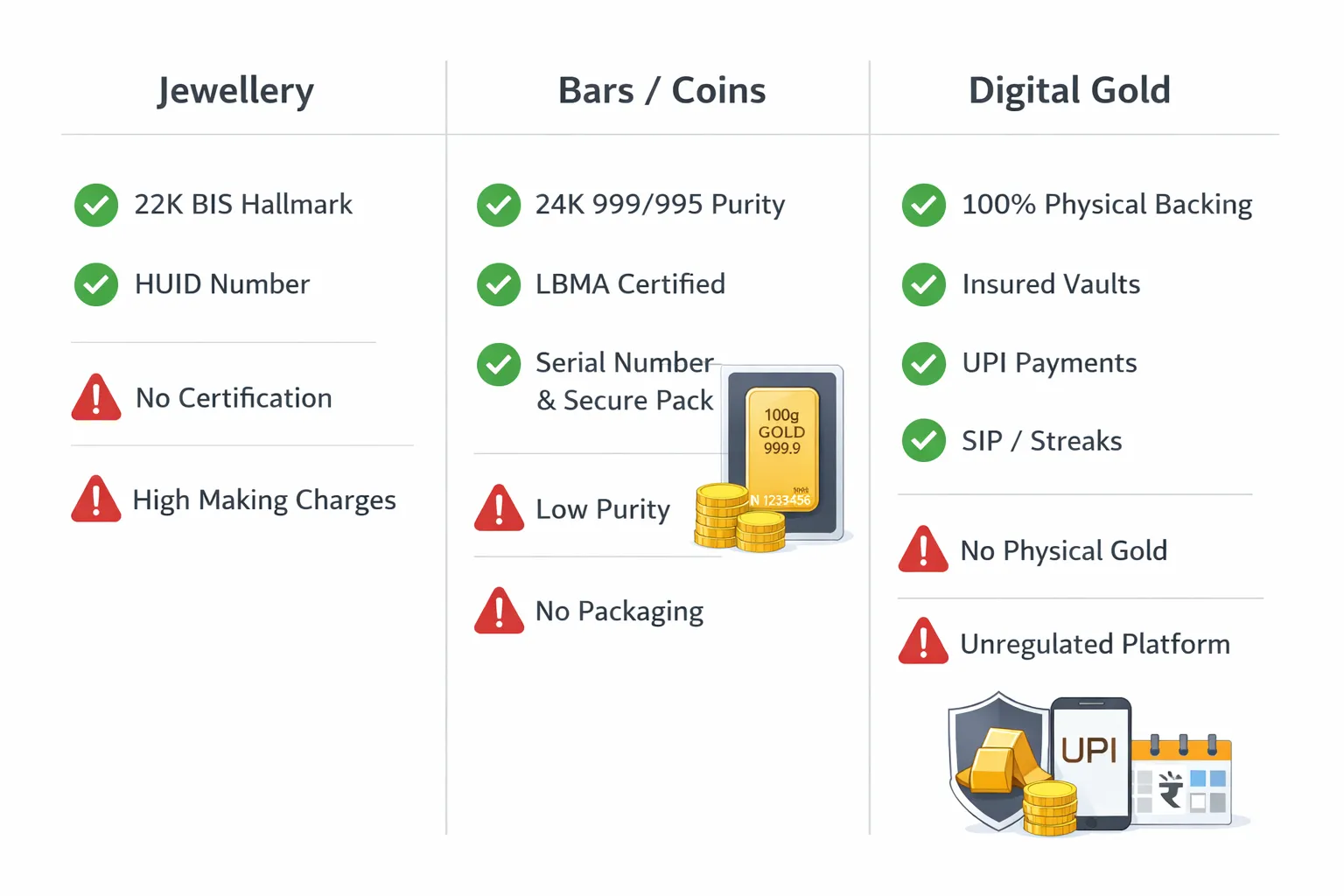

Investment vs adornment: jewellery vs investment-grade (coins/bars)

-

Jewellery (usually 22K): Great for wearing and gifting, but you pay design and making charges and get hit by deductions at resale. Purity can vary, and resale often requires testing.

-

Investment-grade (24K coins/bars): Higher purity, no design premiums, transparent pricing by weight and purity, and easier to liquidate near spot rates. Ideal when buying gold as investment.

Quick answer: when jewellery makes sense and when coins/bars win

-

Choose jewellery if:

-

You want something to wear for weddings/festivals and don’t mind paying for design.

-

Emotional/cultural value matters more than absolute financial returns.

-

-

Choose coins/bars if:

-

You want the most gold for your money (24K), minimal premiums, and better resale transparency.

-

Your goal is wealth preservation and liquidity, not adornment.

-

In short: For pure returns, coins/bars typically beat jewellery. For tradition and style, jewellery wins. If you’re asking the best way to buy gold in India for investment, go investment-grade.

How this guide helps: simple comparisons, costs, storage, liquidity, and a modern alternative (digital gold)

Across this article, we’ll:

-

Compare jewellery vs coins/bars in plain language: purity, pricing, making charges, and resale.

-

Show true costs: how premiums, GST, and spread impact your returns.

-

Cover practicals: storage, safety, and liquidity in real Indian scenarios.

-

Introduce a modern alternative: digital gold on OroPocket – buy 24K gold from ₹1 via UPI, get 100% insured vaulting, and earn free Bitcoin (Satoshi) on every purchase. It’s the easiest on-ramp for first-time investors who want gold’s stability plus rewards – without the hassles of storage or making charges.

Ready to start smart? Download OroPocket and buy 24K gold in 30 seconds – with Bitcoin rewards on every purchase: https://oropocket.com/app

What Is Physical Gold? 22K Jewellery vs 24K Investment-Grade Coins/Bars

“Gold has historically acted as a long-term store of value and an effective portfolio diversifier.” – Source

What is physical gold (definition): tangible gold you can hold

Physical gold is the real metal you can touch – bars, coins, and jewellery. It’s universally accepted, doesn’t depend on any company or government, and has clear value based on weight and purity.

Understanding purity: karat (K) vs fineness (e.g., 22K = 91.6%; 24K = 99.9%)

-

Karat (K) measures the proportion of gold out of 24 parts.

-

24K = 24/24 parts gold ≈ 99.9% fineness (often stamped 999/999.9).

-

22K = 22/24 parts gold ≈ 91.6% fineness (stamped 916).

-

-

Fineness is the purity in parts per thousand (e.g., 999 = 99.9% pure gold).

Jewellery (usually 22K): aesthetics + making charges + cultural value

-

Designed to be worn; typically 22K for durability.

-

Price includes gold value + making charges + sometimes wastage/brand premium.

-

Strong cultural/emotional value in India, but resale often faces deductions and purity testing.

Investment-grade bars/coins (24K): purity, standardization, easy valuation

-

Typically 24K (999/999.9), with weight and serial number.

-

Standardized pieces from reputed mints are easy to value and sell near spot rates.

-

Best for investors focused on purity, transparency, and liquidity.

Certification to look for: BIS hallmark, HUID, reputed refinery/mint (LBMA Good Delivery)

-

BIS Hallmark and HUID (unique ID) on jewellery verify purity and traceability.

-

For bars/coins, check mint/refiner credentials – LBMA Good Delivery–accredited refiners signal global standards.

-

Always keep invoices/certificates for smooth resale or collateral use.

The Real Cost of Buying Gold in India: Jewellery vs Coins/Bars (TCO)

Understanding the total cost of ownership (TCO) is the difference between a smart purchase and overpaying. If you’re buying gold as investment, you need to look beyond the sticker price – especially with jewellery.

Price components for jewellery: base gold value, making charges, wastage, GST, buy-sell spread

-

Base gold value: The underlying 22K gold content (typically 91.6% purity)

-

Making charges: Labour/design premium, often 8–25%+

-

Wastage: 0–7% depending on design/complexity

-

GST: 3% on invoice value (for simplicity here)

-

Buy-sell spread: Typically higher than bars/coins (often 5–12% on resale)

Price components for coins/bars: base gold value, small minting premium, GST, tighter spreads

-

Base gold value: 24K (999/999.9) investment-grade

-

Minting premium: Generally 1–3%

-

GST: 3%

-

Buy-sell spread: Tight, often 1–3% with reputed dealers

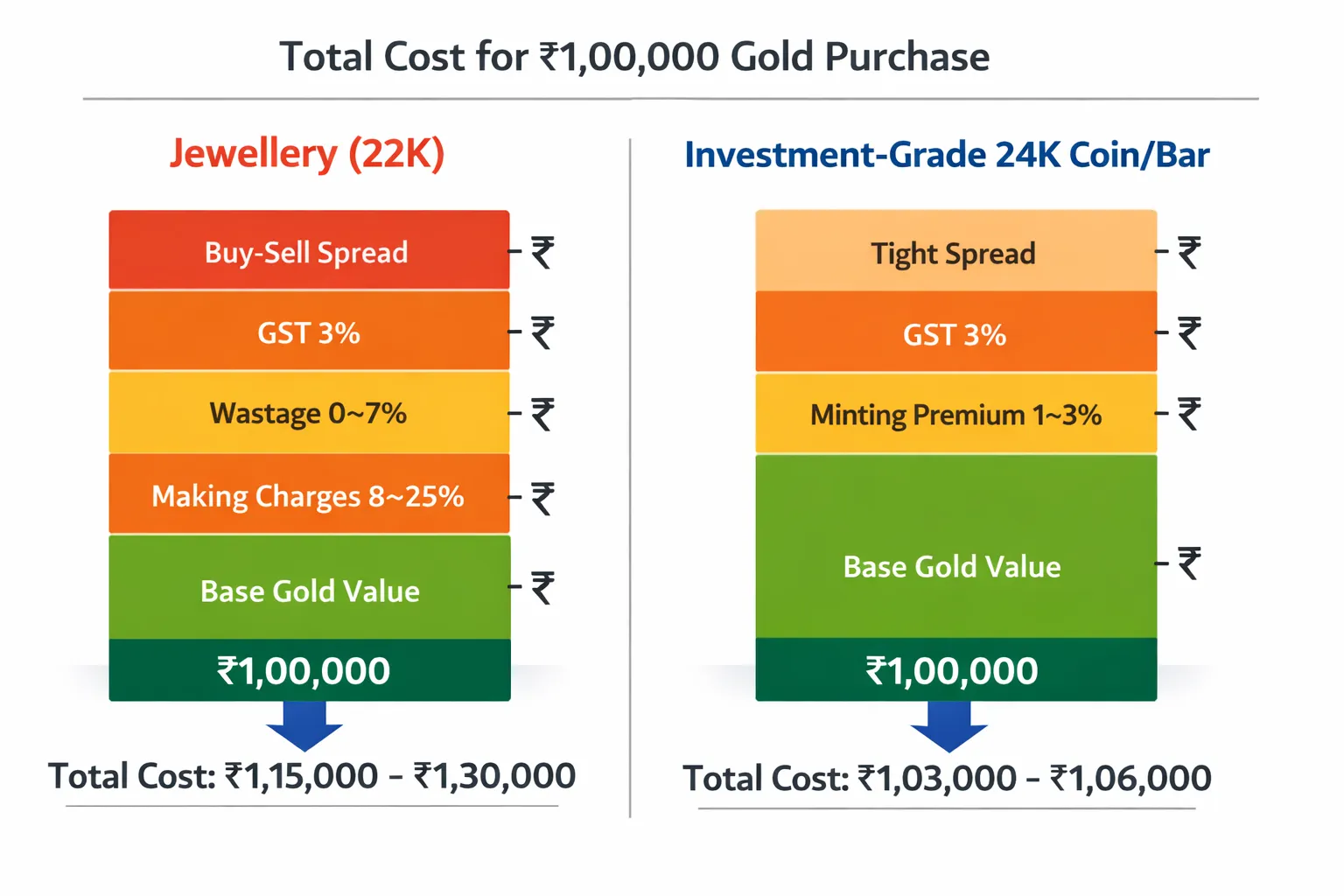

Total Cost of Ownership (TCO) – Jewellery vs Investment-Grade Coins/Bars on ₹1,00,000

Note: Illustrative ranges only, not quotes. Actual pricing varies by city, brand, and market spreads.

|

Cost component |

Jewellery (typical) |

Coins/Bars (typical) |

|---|---|---|

|

Base gold value |

Lower share due to higher add-ons |

Higher share of invoice |

|

Making charges (range) |

8–25% |

N/A |

|

Wastage (range) |

0–7% |

N/A |

|

GST (3%) |

Applied on invoice |

Applied on invoice |

|

Minting premium/spread |

N/A |

1–3% |

|

Net grams of pure gold acquired |

Lower (22K basis + premiums reduce grams) |

Higher (24K basis, minimal premiums) |

|

Estimated buyback spread |

5–12% |

1–3% |

|

Break-even % rise needed |

≈25–35% |

≈4–8% |

Worked example: ₹1,00,000 purchase – how much pure gold you actually get

Assumptions for illustration:

-

24K benchmark price: ₹7,000/gram

-

Jewellery: making 12% + wastage 3%, GST 3%, 22K purity (91.6%)

-

Coins/Bars: minting premium 1.5%, GST 3%, 24K purity

Result:

-

Jewellery (22K): About ₹84,450 goes to base gold value; ≈12.06 grams of pure gold

-

Coins/Bars (24K): About ₹95,650 goes to base gold value; ≈13.66 grams of pure gold

That’s roughly 13% more pure gold for the same ₹1,00,000 when you choose 24K coins/bars over typical 22K jewellery.

Break-even analysis: how much gold price must rise to recover premiums

Using the same assumptions and mid-range buyback spreads:

-

Jewellery: Needs approximately a 29% price rise to break even (due to making/wastage + wider sell spread)

-

Coins/Bars: Needs approximately a 6% price rise to break even (lower minting premium + tighter sell spread)

Bottom line: If your goal is returns, the best way to buy gold in India is usually 24K investment-grade coins/bars, not jewellery. If you’re asking “is physical gold a good investment?” – it can be, but only when you minimize premiums and spreads.

Ready to buy 24K gold without making charges or storage headaches? Download OroPocket to invest from ₹1 via UPI and earn free Bitcoin on every purchase: https://oropocket.com/app

Liquidity and Resale Value in India: Jewellery vs Coins vs Bars

Where you sell and how quickly you get paid depends heavily on the format you hold. Here’s what most sellers experience on the ground.

Where you sell and what you face: jeweller buyback, bullion dealers, online platforms

-

Jewellers: Common for 22K jewellery; expect purity testing, deductions, and negotiations. Some accept only their own bills.

-

Bullion dealers: Best for 24K bars/coins; faster quotes, tighter spreads, standard process.

-

Online platforms: Offer buyback for coins/bars with digital KYC and bank payout; some marketplaces also accept jewellery via partner stores.

Purity testing, deductions, and documentation – what changes by format

-

22K jewellery: XRF/acid test, HUID/BIS check, deductions for making/wastage; higher variability across stores.

-

24K coins: Visual/magnet check + assay card/packaging; serial verification; near-spot buyback with reputed dealers.

-

24K bars: Serial/assay verification; best pricing when packaging intact and from reputed LBMA Good Delivery refiners.

Typical resale experience: fast cash vs negotiation vs certification requirements

-

Jewellery: More negotiation, higher deductions, potentially slower if re-testing or melting is required.

-

Coins/Bars: Faster quotes and payouts; tighter spreads; smoother if you have original invoice and intact packaging.

Resale Reality Check

Indicative ranges only. Actuals vary by city, store policy, and market volatility.

|

Format |

Typical purity |

Who buys it |

Typical deduction range |

Time to liquidate |

Paperwork/certification needed |

|---|---|---|---|---|---|

|

22K jewellery |

91.6% (22K) |

Local jewellers; some online partners |

10–15%+ (making/wastage, testing) |

30–120 minutes (store visit, testing, negotiation) |

Invoice, BIS hallmark/HUID; ID for high-value |

|

24K coins |

99.9% (24K) |

Bullion dealers, banks (limited), online platforms |

1–3% (spread) |

15–60 minutes (verification + payout) |

Original bill, sealed/assay card helpful |

|

24K bars |

99.9% (24K) |

Bullion dealers, specialized buyers, online platforms |

1–3% (spread; may widen if pack damaged) |

15–60 minutes (serial/assay check) |

Invoice, intact packaging/serial; ID for large amounts |

Pro tip: If your primary goal is liquidity and fair resale, 24K coins/bars from reputed mints with intact packaging typically beat jewellery on speed and deductions. For those who want instant, app-native liquidity without carrying metal, consider building your gold on OroPocket – buy/sell 24K in seconds via UPI and earn free Bitcoin on every purchase: https://oropocket.com/app

Storage, Safety, and Insurance: Home, Bank Locker, or Vault?

Physical risks and costs: theft, damage, locker rental, insurance coverage gaps

-

Theft and damage: Home storage risks include burglary, fire, and water damage. Locks help, but they aren’t insurance.

-

Locker rental: Bank lockers reduce theft risk but come with annual rent and limited access hours. Banks typically disclaim liability; separate insurance may be needed.

-

Insurance gaps: Home policies may cap jewellery coverage unless you declare values and pay extra. Read clauses on “mysterious disappearance,” off-premise coverage, and proof-of-ownership.

-

Opportunity cost: Large physical holdings tie up capital in safes/lockers, and you still face resale spreads.

How coins/bars are typically stored (tamper-proof packaging, serial numbers)

-

Bars and some coins come sealed in tamper-evident packs with a unique serial number and assay card.

-

Keep packs intact; damaging or opening packaging can widen buyback spreads.

-

Store invoices and certificates together; photograph serials and HUID numbers for records.

Compliance basics to know: hallmarking regime and why certification matters at resale

-

BIS hallmarking with HUID is mandatory for jewellery – this speeds up resale and reduces testing disputes.

-

For 24K coins/bars, look for LBMA Good Delivery–accredited refiners and keep assay cards intact.

-

Proper documentation (invoice, hallmark/HUID, serials) improves liquidity and pricing at sale or when using gold as collateral.

Quick decision guide: when each storage option makes sense

-

Home safe: Small amounts you may need occasionally; invest in a high-grade safe and discrete placement.

-

Bank locker: Medium-to-large holdings you access infrequently; cost-effective but limited access and separate insurance advisable.

-

Professional vault: Large or high-value holdings; offers 24/7 monitored facilities, itemized insurance, and audit trails – best for investors prioritizing security and documentation.

Prefer not to worry about safes, lockers, or insurance paperwork? Build gold the modern way on OroPocket – 24K gold from ₹1, 100% insured vaulting, instant UPI buy/sell, and free Bitcoin rewards on every purchase: https://oropocket.com/app

Loans and Collateral: Using Gold to Unlock Cash

Gold is one of the simplest assets to pledge for quick liquidity in India. Lenders understand it, valuation is standardized, and disbursal is fast – often same day. If you’re buying gold as investment and wondering how to tap it for emergencies or opportunities, here’s what to expect.

LTV norms in India and what lenders look for

-

LTV (Loan-to-Value): Most regulated lenders offer up to ~75% of the assessed gold value, depending on purity, form, and internal policy.

-

What lenders evaluate:

-

Purity and weight (tested via XRF/karat meters; gemstones aren’t counted)

-

Form and packaging (sealed 24K bars/coins are easier to value)

-

Documentation (invoice, BIS hallmark/HUID for jewellery)

-

KYC compliance (PAN, ID/address proof), repayment capacity, and lien/pledge process

-

-

Tenure options: From a few days to 12–24 months; many lenders allow bullet repayment or flexible EMIs.

Does 24K bar/coin fetch better terms than jewellery? (purity, documentation, standardized valuation)

-

24K bars/coins:

-

Pros: Higher purity (999/999.9), standardized weights, serial numbers, and assay cards; easier, more transparent valuation.

-

Typical outcome: Tighter spreads, quicker appraisal, and, in many cases, better effective LTV due to confidence in purity.

-

-

22K jewellery:

-

Pros: Widely accepted.

-

Trade-offs: Purity can vary, deduction for stones/attachments, and higher testing time. Lenders may haircut value for intricate designs or unknown alloys.

-

-

Best practice: For funding needs, 24K investment-grade coins/bars from reputed refiners/mints with intact packaging usually unlock smoother terms.

What to expect on fees, appraisal, and disbursement timelines

-

Appraisal/valuation: On-the-spot purity testing (XRF/karat meter), weight verification; 15–45 minutes depending on volume/design.

-

Processing/other fees: Vary by lender – may include processing fee, valuation fee, stamp duty, and locker/handling charges. Ask for an all-in APR comparison.

-

Interest rate: Risk-based and market-driven; compare quotes from at least 2–3 lenders.

-

Disbursement: Often within 30–120 minutes after appraisal and KYC. Low amounts can be cash (subject to legal limits), higher amounts typically via UPI/NEFT/RTGS.

-

Storage/insurance: While pledged, the lender stores and insures the gold. Confirm the insurance coverage, custody location, and security protocols in writing.

Do’s & don’ts when pledging gold (avoid damage, keep invoices/certifications)

-

Do

-

Keep invoices, BIS hallmark/HUID (for jewellery), and assay cards/serials (for bars/coins).

-

Photograph items and serial numbers before handing over.

-

Maintain intact packaging for bars/coins – breaking seals can lower valuation.

-

Read foreclosure, part-prepayment, and auction policies carefully.

-

Borrow only what you need; choose the shortest workable tenure.

-

Compare effective APR, not just headline rates; check hidden charges.

-

-

Don’t

-

Don’t mix jewellery with stones/pearls if you expect pure-gold valuation – non-gold parts won’t count.

-

Don’t pledge sentimental heirlooms if default risk exists.

-

Don’t ignore reminders – top-up or part-pay if gold prices fall and the lender asks to maintain LTV.

-

Don’t discard documentation – lack of proof can slow valuation or reduce LTV.

-

Prefer liquidity without visiting a branch? With OroPocket, you can build 24K gold from ₹1, store it in 100% insured vaults, and access instant in-app buy/sell via UPI. Select partners also enable loans against your digital gold holdings – keeping things paperless and fast. Download now: https://oropocket.com/app

Digital Gold vs Physical Gold in 2025: Best Way to Buy Gold in India

Who should pick physical gold (bars/coins) and who should pick digital gold

-

Pick physical (24K coins/bars) if:

-

You want tangible assets to store long-term with minimal counterparty risk.

-

You prefer standardized, globally recognized pieces for inheritance or collateral.

-

You’re comfortable with storage logistics and don’t need instant liquidity.

-

-

Pick digital gold if:

-

You want to start with very small amounts (₹1, ₹100, ₹500) and scale gradually.

-

You value 24/7 buy/sell, transparent pricing, and no making charges.

-

You prefer insured vaulting, paperless KYC, and instant UPI checkout.

-

Fees and convenience: small-ticket investing, UPI payments, 24/7 liquidity

-

Physical: One-time purchase with minting premium (1–3%) and selling spread (1–3% if intact); needs storage and documentation.

-

Digital: No making charges; platform spread applies; buy and sell anytime; funds settle instantly to your bank/UPI. Perfect for SIP-style micro-investing and frequent top-ups.

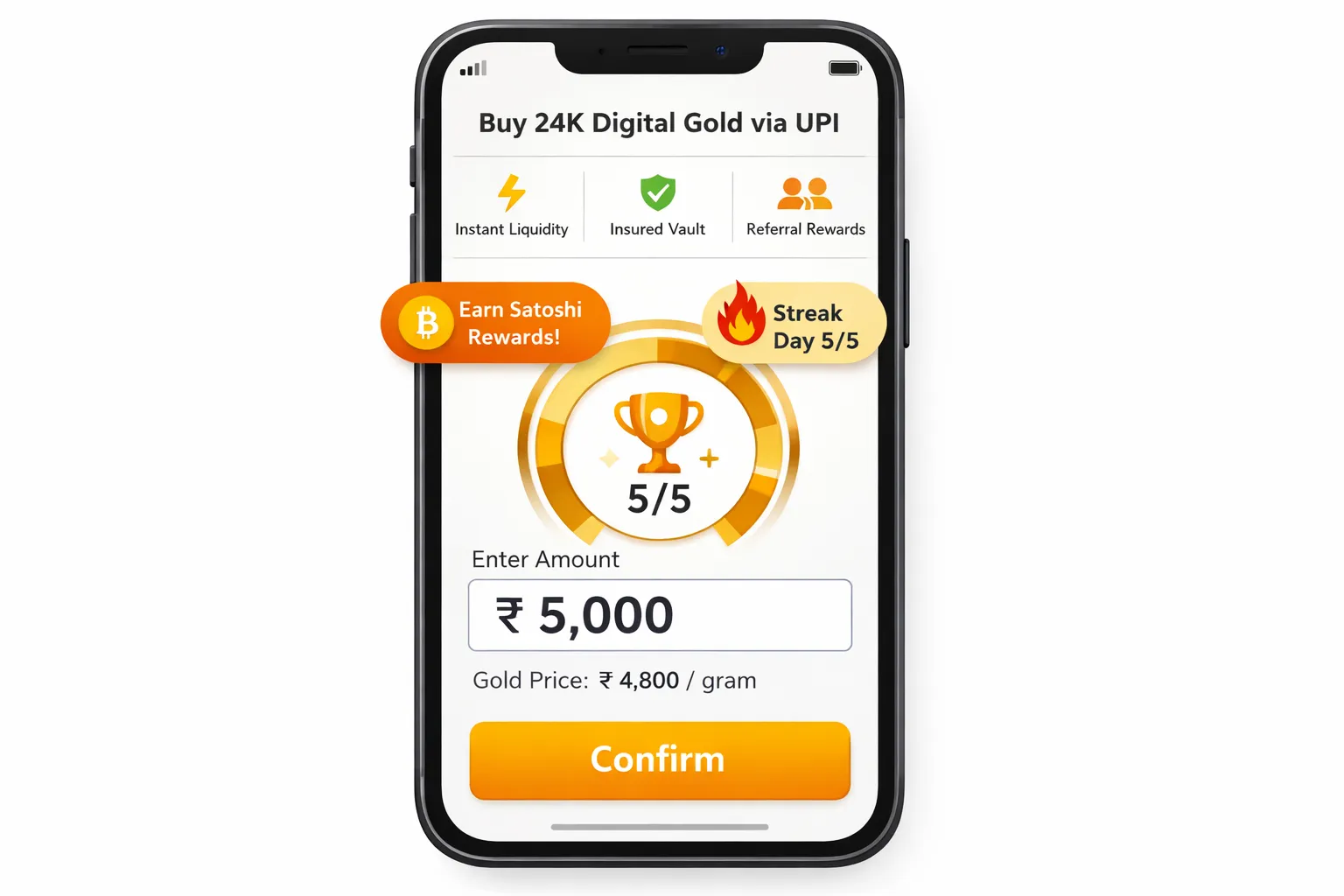

OroPocket advantage: ₹1 entry, 24K vaulted gold, UPI checkout, and free Bitcoin rewards

-

Start from ₹1 with UPI – no thresholds.

-

Own 24K pure gold securely vaulted and 100% insured.

-

Get free Satoshi on every purchase; tiered reward system for higher cashback.

-

Send gold to friends/family instantly; perfect for gifting.

-

Fully compliant, working with authorized bullion partners.

Habit-building: SIP-style micro-investing with gamified streaks and referral rewards

-

Daily streaks: Buy for 5 consecutive days, unlock bonus rewards.

-

Spin to win: Free daily spins to win extra Satoshi or gold.

-

Referral: Earn 100 Satoshi + a free spin when friends join.

-

Real habit formation: Small, frequent purchases build a meaningful position over time.

Blended strategy: keep heirloom jewellery minimal; build wealth with investment-grade gold + digital for flexibility

-

Use jewellery for tradition and occasions – don’t over-allocate.

-

Build core allocation with investment-grade 24K (digital and/or coins/bars).

-

Keep a digital layer for flexibility, liquidity, and rewards; consider converting to physical later if needed.

Buy 24K gold in 30 seconds with UPI and earn free Bitcoin on every purchase. Download OroPocket now: https://oropocket.com/app

How to Buy Smart: Checklists for Jewellery, Bars/Coins, and Digital Gold

Jewellery (if you must buy):

-

Aim for 22K BIS-hallmarked pieces with low making charges (target single digits); avoid heavy gemstone add-ons that don’t count in resale.

-

Insist on BIS hallmark + HUID on each piece and a detailed invoice (weight, purity, making, wastage).

-

Confirm buyback terms in writing: eligible %, deduction policy, and whether only their-store purchases qualify.

-

Keep packaging, tags, and bill; photograph items for records.

Investment-grade bars/coins:

-

Prefer 24K 999/995 purity from reputed mints/refiners (LBMA Good Delivery–linked), with clear branding.

-

Verify tamper-proof packaging, unique serial numbers, and assay cards; don’t break seals.

-

Compare buy-sell spreads across 2–3 dealers; confirm repurchase policy and acceptable condition.

-

Store invoices/certificates securely; note serials and mint.

Digital gold and regulated proxies:

-

Choose platforms with 100% physical backing, insured vaults, third-party audits, and transparent T&Cs.

-

Understand fees/spreads and test with a small UPI buy/sell for speed and settlement.

-

Set a weekly/monthly SIP; automate reminders and track streaks or rewards to build consistency.

-

Consider exit flexibility: ability to redeem to physical, instant sell to bank/UPI, and loan/collateral options.

Ready to put this checklist into action? Buy 24K gold from ₹1 on OroPocket with instant UPI checkout, insured vaulting, and free Bitcoin rewards on every purchase. Download now: https://oropocket.com/app

Conclusion: The Bottom Line – Jewellery vs Investment-Grade, Plus a Smarter Alternative

Key takeaway:

-

Jewellery: Cultural and emotional value, but higher costs (making/wastage) and lower resale efficiency. Good for occasions – not ideal if you’re buying gold as investment.

-

Investment-grade coins/bars: 24K purity, standardized, easy to value, and better liquidity. If you’re asking “is physical gold a good investment?” – this is the efficient route for wealth-building.

-

Digital gold: The best way to buy gold in India in small amounts with instant liquidity. No making charges, 24/7 UPI buy/sell, insured vaulting, and transparent pricing.

Next step: Start small, stay consistent, and stack smarter with OroPocket

-

Begin with ₹1 and build a habit.

-

Keep heirloom jewellery minimal; allocate more to 24K investment-grade and digital gold for flexibility.

-

Automate weekly/monthly investments and track progress.