Is This a Good Time to Invest in Gold? 7 Signals to Watch in 2026

Is This a Good Time to Invest in Gold? 7 Signals to Watch in 2026

Gold isn’t “too expensive.” It’s re-pricing – because inflation, geopolitics, central bank buying, and currency swings are reshaping what “safe” means.

If you’re an Indian retail investor (student, salaried, small business owner, first-time saver), the real question isn’t “Will gold go up?” It’s:

-

Should I buy now or wait for a dip?

-

Should I invest lump sum or monthly (SIP-style)?

-

How do I invest without locking big money or dealing with storage risk?

This guide gives you a practical yes/no framework using 7 signals – and a simple action plan based on your profile.

Early read before you decide: if you want the full macro picture behind gold in 2026, see our breakdown of the gold market in 2026 and what drives prices.

The quick answer: is it a good time to invest in gold in 2026?

For most long-term Indian investors: yes – if you invest the right way.

Gold can be volatile month-to-month, but it’s still one of the cleanest ways to:

-

protect purchasing power,

-

reduce portfolio shocks,

-

and diversify away from INR + equities risk.

The smart move in 2026 is not “timing perfectly.”

It’s starting small, averaging in, and building the habit.

That’s exactly what OroPocket is built for:

-

Start from ₹1

-

Instant UPI buys (under 30 seconds)

-

Real 24K gold, insured and vaulted

-

Free Bitcoin (Satoshi) cashback on every buy

Stop watching. Start growing.

Why most gold “timing” advice fails (and what to do instead)

Competitor-style advice often stops at generic lines like “gold goes up when inflation rises.” True, but incomplete.

What they miss:

-

Gold in India is a two-layer price: global gold + USDINR.

-

“Wait for a dip” often becomes “never start.”

-

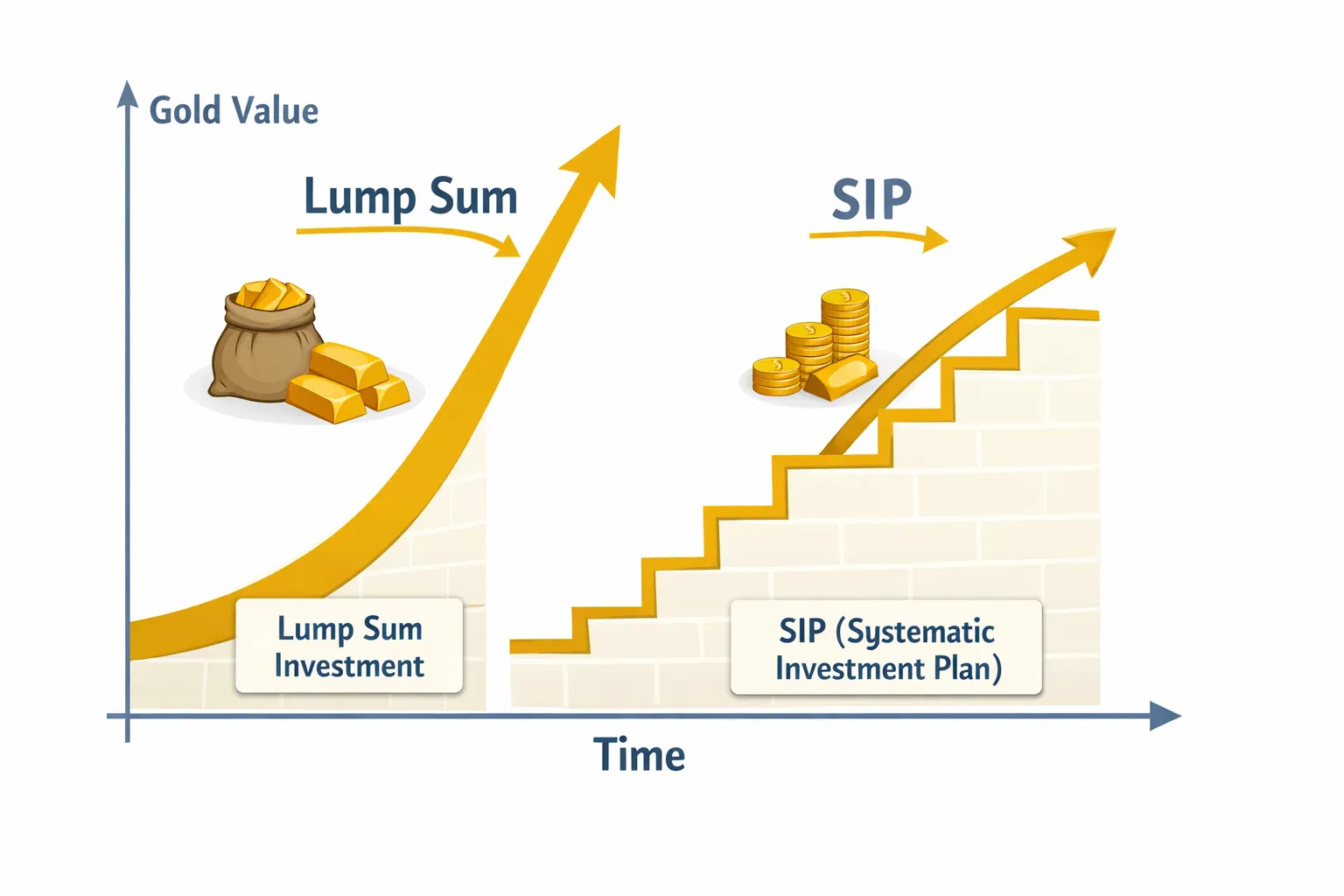

Your outcome depends more on how you buy (SIP vs lump sum) than the perfect entry day.

So here’s the better framework: 7 signals that actually move gold in 2026, and how to react to each.

The 7 signals to watch in 2026 (and what each one means for your decision)

1) Interest rates: are real yields falling or rising?

Why it matters: Gold doesn’t pay interest. So when safe returns (FDs, bonds) look attractive – gold can cool off. When real yields fall – gold tends to get bid.

What to watch (simple):

-

RBI stance (tight vs easing)

-

US Fed expectations (cuts usually help gold)

-

“Real rates” logic: if inflation is sticky while rates soften, gold gets stronger.

How to act:

-

If rate cuts are expected → accumulate gradually (monthly)

-

If rates are rising sharply → don’t panic-sell; consider smaller SIP buys and wait out volatility

2) Inflation trend: is it cooling, sticky, or re-accelerating?

Gold is a savings asset when people fear currency losing value.

Use this mental model:

-

Cooling inflation = gold can pause (not necessarily crash)

-

Sticky inflation = gold stays supported

-

Re-accelerating inflation = gold often breaks higher

Authority check:

“Gold prices in India rose from ₹50,645 (Nov 2020) to ₹1,29,580 per 10g (Oct 2025), an absolute return of ~155.86% over five years.” – Economic Times

How to act:

-

If inflation is sticky: start (or keep) an ongoing buy plan

-

If inflation is cooling: still invest, but use SIP averaging instead of lump sum

3) INR–USD movement: is the rupee weakening?

This is the “India-specific” signal many blogs gloss over.

Even if global gold is flat, a weaker INR can push Indian gold prices up.

Why: India imports most of its gold. USDINR up = gold cost up.

What to watch:

-

USD strength (DXY)

-

India’s current account pressure

-

crude oil spikes (often hurts INR)

How to act:

-

If INR is weakening: buy earlier rather than “waiting for cheaper”

-

If INR is strengthening: you may get better entry points – SIP still wins

4) Stock market volatility: is risk-off increasing?

Gold often shines when equities get shaky.

Simple trigger:

If you feel “the market is too uncertain” and your portfolio is equity-heavy, adding gold is risk control – not fear.

How to act:

-

High volatility or sharp drawdowns → increase gold allocation gradually

-

Euphoric bull runs → keep gold SIP running anyway (discipline beats emotion)

5) Central bank buying: are reserves shifting toward gold?

Central banks buying gold is a major structural tailwind.

Forecast anchor (for global sentiment):

“J.P. Morgan Global Research sees gold averaging $5,055/oz by Q4 2026.” – Investing.com

How to act:

-

This is a long-term signal → supports a “keep accumulating” strategy

-

Don’t trade this weekly – use it to justify your core allocation

6) Geopolitical risk: are global tensions rising?

Wars, trade shocks, sanctions, supply chain disruptions – gold tends to catch bids because it’s portable “financial insurance.”

How to act:

-

If risk rises suddenly: avoid FOMO lump sums

-

Use a “48-hour rule”: start a SIP immediately, then consider adding more after volatility settles

7) Seasonal Indian demand: wedding + festival cycles

In India, gold isn’t just an investment – it’s culture + consumption.

Typical pattern:

-

Demand rises into Akshaya Tritiya, Dhanteras/Diwali, and wedding season

-

Prices can firm up when demand + sentiment align

How to act:

-

If you need gold for a known future event (wedding, gifting): start averaging months earlier

-

If you’re purely investing: seasonality matters, but it shouldn’t stop you from building a long-term habit

The “SIP vs lump sum” decision (the part most people get wrong)

When lump sum makes sense

Choose lump sum if:

-

you have a long horizon (3–7+ years)

-

your allocation to gold is currently zero

-

you’re deploying a planned amount (not emotional buying)

Smart approach: invest 50% now, then SIP the rest over 6–12 months.

When SIP-style averaging is the best move

Choose SIP if:

-

you’re unsure “is this the peak?”

-

you’re a first-time gold investor

-

you’re building discipline and want to reduce regret

If you want a deeper comparison of instruments, read Gold SIP vs Gold ETF vs SGB (what’s best for 2026).

Action plan by investor profile (simple, practical)

Profile A: First-time buyer (starting from ₹1 to a few thousand)

Goal: build habit + inflation protection

Plan:

-

Start a daily/weekly micro-buy

-

Increase slowly after 30 days consistency

-

Don’t overthink entry price – your consistency is the edge

OroPocket advantage: ₹1 entry + UPI + gamified streaks makes habit-building frictionless.

Profile B: Long-term investor (wealth builder)

Goal: diversification + downside protection

Plan:

-

Decide a target allocation (example: 10–20% depending on risk tolerance)

-

Invest 30–50% now, SIP the rest

-

Rebalance once or twice a year

Profile C: Short-term trader (timing-focused)

Goal: benefit from swings

Reality check: gold trading is harder than it looks because currency and policy can flip quickly.

Plan:

-

Use levels + strict risk limits

-

Consider keeping a core long-term position and trading only a small portion

Why OroPocket is built for 2026 gold investing (not 2016 gold buying)

Most platforms help you buy gold. OroPocket helps you build wealth habits.

What you get (the unfair advantage)

-

Start from ₹1: no “I’ll do it later when I have more money”

-

Instant UPI payments: buy in under 30 seconds

-

24K gold, insured + vaulted

-

100% secure & compliant: built for trust, built for scale

-

Gamified investing: streaks, spin-to-win, tiered rewards

-

Free Bitcoin on every purchase: you stack gold and Satoshi – two assets, one action

-

Referral rewards: both users earn 100 Satoshi + a free spin

If you’ve been curious about modern gold investing, but worry about safety, read Is digital gold safe in India? (vaulting, regulation & risks).

Conclusion: so… should you invest in gold now?

If you’re waiting for a perfect dip in 2026, you may wait forever.

The smarter move:

-

Watch the 7 signals

-

But act with SIP-style averaging

-

Build the habit first, optimize later

Gold rewards patience. OroPocket rewards action.

Stop watching. Start growing.

Start with ₹1 today on OroPocket, pay via UPI, and earn free Bitcoin cashback on every gold buy – without trading crypto, without complexity.