Paytm Gold review and alternatives

Introduction: Paytm Gold review and the smartest alternatives (2025)

If you’re hunting for a clear, no-nonsense Paytm Gold review and the best alternatives for 2025, you’re in the right place. We break down how Paytm Gold (powered by MMTC-PAMP) actually works, the real costs you’ll pay, and which apps are smarter if you want better rewards, automation, or a simpler habit-building experience.

“Digital gold purchases in India rose by nearly 70% after the pandemic.” – Source

What you’ll learn

-

How Paytm Gold works via MMTC-PAMP: buying flow, limits, storage, and delivery/making charges.

-

The top 3 alternatives for 2025:

-

OroPocket – best for low-cost micro-investing with Bitcoin rewards and habit-building.

-

Google Pay Gold (MMTC-PAMP) – best for pure convenience in an app you already use, with lifetime free storage.

-

Jar – best for “save-the-change” automation and building a daily investing habit.

-

-

Exactly how these options differ on costs, security/custody, ease of use, rewards, and habit-building features.

Quick snapshot: How Paytm Gold (MMTC-PAMP) works

-

Backed by MMTC-PAMP 24K 999.9 purity gold, stored in insured vaults.

-

Start from as low as ₹1; typical upper buy limit per transaction can apply.

-

Buy/sell 24/7 at live prices; storage is free for up to 5 years.

-

Physical delivery (coins/bars) available any time after 24 hours by paying making and delivery charges.

The 3 best alternatives for 2025 (and who they’re best for)

-

OroPocket: Start with ₹1, earn free Bitcoin (Satoshi) on every gold/silver buy, UPI-native, and gamified streaks/spins to build consistent habits. Best for beginners who want rewards plus micro-investing.

-

Google Pay Gold (MMTC-PAMP): Clean, familiar flow with no storage fees; invest inside an app you already use. Best for pure convenience.

-

Jar: Round-ups and daily savings make investing effortless; ideal if you want the simplest automation to build a daily habit.

How these options differ

-

Costs and fees: All charge 3% GST on buys; spreads and delivery/making charges vary. Google Pay typically has no storage fees; Paytm storage is free up to 5 years. OroPocket offsets costs with Bitcoin rewards on every purchase.

-

Security/custody: All use reputable custodians/insured vaults.

-

Ease of use: Paytm and Google Pay are ultra-familiar; OroPocket is built for micro-investing speed with instant UPI; Jar shines at automation.

-

Rewards and habit-building: OroPocket leads with Bitcoin rewards, streaks, spin-to-win, and referrals; Jar leads on round-ups/daily savings; Paytm/Google Pay are straightforward but light on rewards.

Comparison at a glance

|

Platform |

Starting amount |

Fees you’ll actually pay |

Storage policy |

Delivery/making charges |

SIP/automation |

Rewards/bonuses |

UPI flow speed |

Who it’s best for |

|---|---|---|---|---|---|---|---|---|

|

Paytm Gold (MMTC-PAMP) |

₹1 |

3% GST on buys + spread |

Free storage up to 5 years in insured vaults |

Pay making + delivery; allowed after 24 hours |

Gold Accumulation Plan; basic recurring options |

Typically none |

Instant within app |

Paytm loyalists who want one-app convenience |

|

OroPocket |

₹1 |

3% GST on buys; rewards can offset costs |

100% insured vaults; RBI-compliant partners |

Digital-first; physical redemption options vary by availability |

Micro-investing focus; habit streaks |

Free Bitcoin (Satoshi) on every purchase; streak and spin bonuses; referral rewards |

Instant UPI checkout |

Beginners who want low-cost, high-frequency investing + rewards |

|

Google Pay Gold (MMTC-PAMP) |

1 gram minimum |

3% GST on buys + spread |

No storage fees; insured vaults |

Making + delivery charges on conversion |

Manual buys (no dedicated SIP) |

None |

Instant |

Users wanting maximum convenience inside Google Pay |

|

Jar |

₹10 |

3% GST on buys + spread |

Insured vaults; storage included |

Making/delivery charges on physical conversion/jewellery |

Round-ups, daily savings automation |

Habit-focused; occasional offers |

Instant |

The simplest save-the-change habit builder |

Why this matters now

-

Inflation is eating fixed savings: your 3–4% savings rate often loses to 6–7% inflation. Gold has historically held its value, making it a smart hedge.

-

Young investors are moving to micro-investing: start with ₹1–₹10, invest daily, and build habits that stick.

-

Digital gold is tailor-made for first-time investors: small, simple, 24/7, UPI-native, and stored safely in insured vaults.

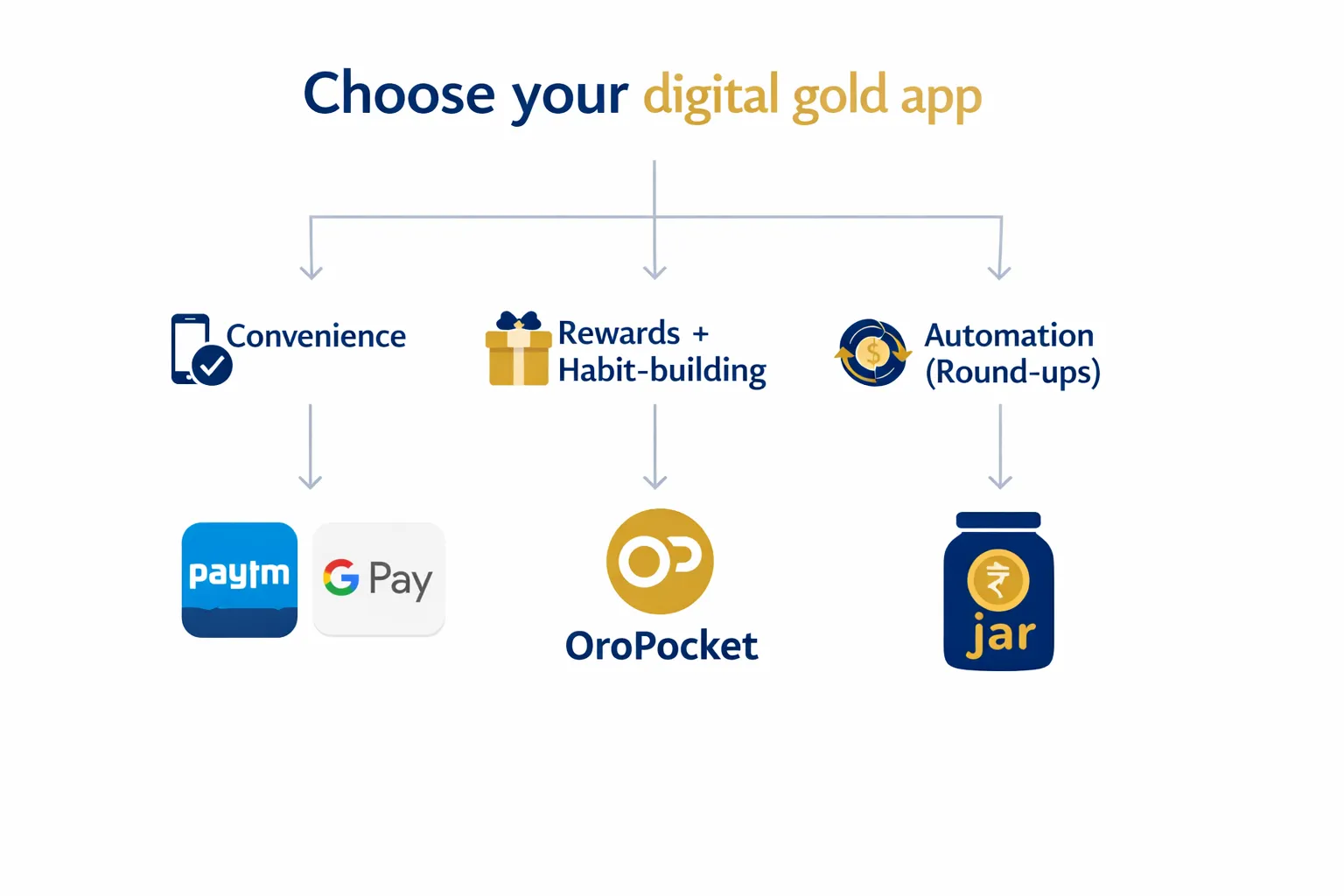

How to use this guide

-

If you want pure convenience in an app you already use: choose Google Pay Gold.

-

If you want low-cost, high-frequency micro-investing + rewards: choose OroPocket.

-

If you want the simplest save-the-change habit builder: choose Jar.

Paytm Gold: What works, what doesn’t (full review)

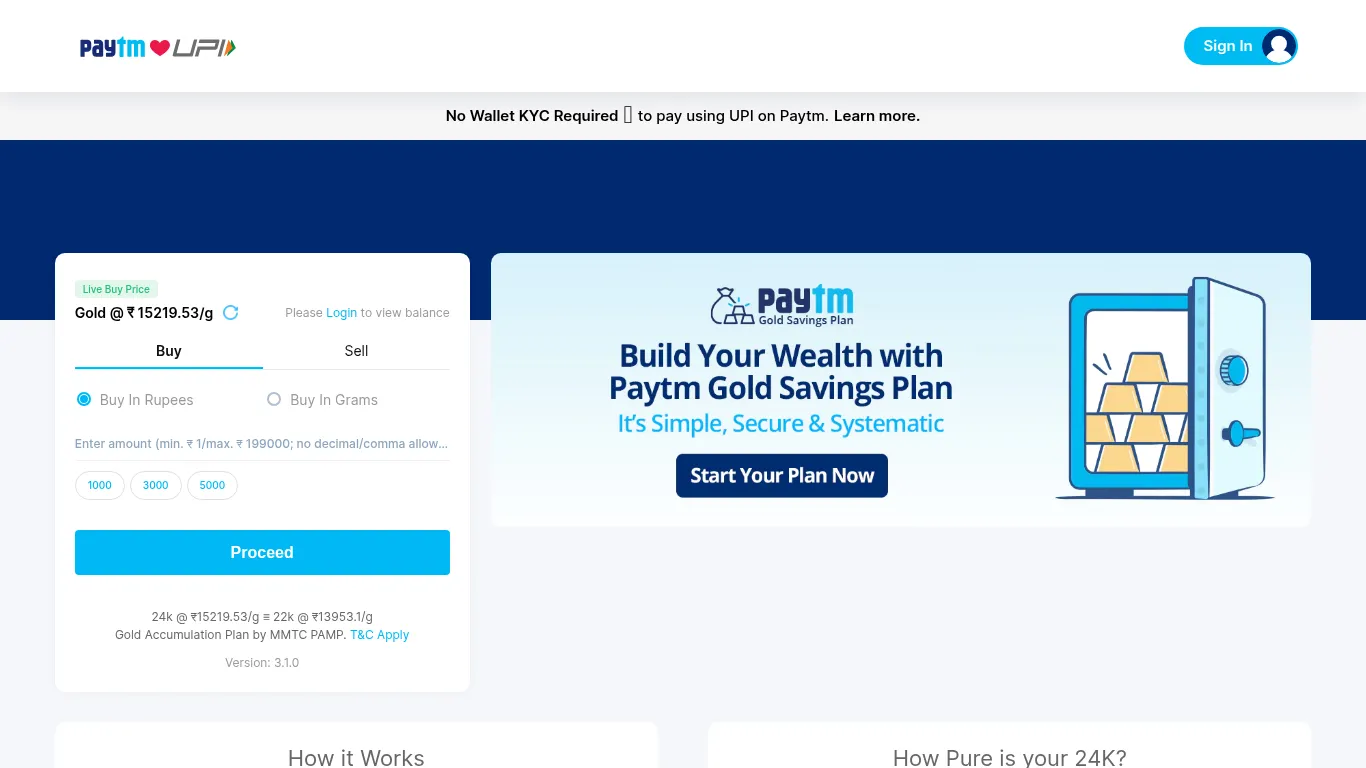

How Paytm Gold works

Paytm Gold runs on MMTC-PAMP at the backend. You buy/sell 24K 999.9 purity gold at live prices directly inside the Paytm app with a simple UPI or Paytm Wallet flow. Orders can be placed 24/7, and you can buy by rupee amount or by grams.

Key features

-

Gold Accumulation Plan to build holdings over time.

-

Vaulting in 100% insured, secure facilities.

-

On-demand delivery of coins/bars (post 24 hours) to your address.

-

Gifting options and a clean, familiar interface embedded within Paytm.

Fees, limits, and policies to note

-

Purchases include a spread over the live price, plus 3% GST on buys.

-

Storage is typically free for a defined period (commonly up to 5 years) in insured vaults; check your Paytm Gold section for any post-window fees.

-

Physical redemption includes making and delivery charges. Delivery usually requires meeting a minimum gram threshold and follows typical T+ processing timelines.

-

Limits: Minimum purchase can be as low as ₹1; maximum per transaction caps may apply. PAN/KYC thresholds kick in for higher cumulative values per regulations.

Pros

-

Seamless for existing Paytm users with fast UPI checkout.

-

Backed by a trusted refinery partner (MMTC-PAMP) and insured custody.

Cons

-

Making and delivery charges can reduce returns if you convert to coins/bars.

-

Limited habit-building and reward mechanics compared to newer micro-investing apps.

Best for

-

Paytm power users who want occasional gold buys without downloading another app.

Things users often ask

-

Where can I see exact making/delivery charges before redeeming? Check the redemption/convert-to-coin flow inside Paytm Gold before confirming; charges and weight thresholds are shown there.

-

How long can I store and what happens at the end of the free storage window? Storage is free for a defined period in insured vaults; after that window, platform-specific storage fees or required actions (redeem/sell) may apply – review the Paytm Gold policy page inside your app.

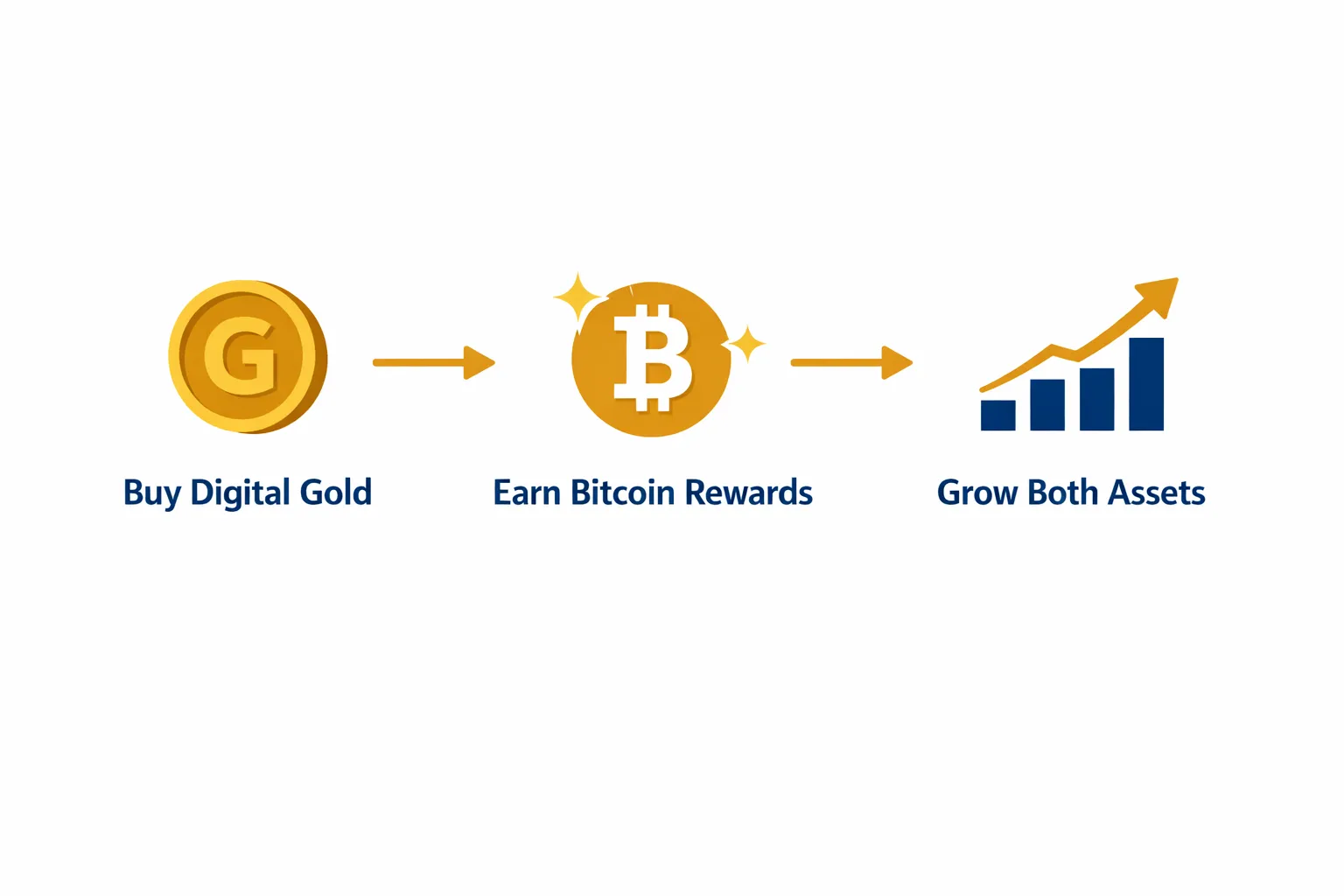

OroPocket: Micro-investing + Bitcoin rewards (the modern alternative)

What makes OroPocket different

-

Start investing from ₹1 with instant UPI. Own 24K digital gold and silver stored in 100% insured vaults.

-

Earn Bitcoin rewards on every gold/silver purchase – Satoshis back on each buy.

-

Gamified wealth building with daily streaks, spin-to-win rewards, and referral bonuses for inviting friends.

Core features

-

Auto-invest options for consistent micro-purchases; send/gift gold instantly.

-

Easy redemption: sell for cash at live prices or explore delivery options as available.

-

RBI-compliant, works with authorized bullion partners, and offers transparent in-app pricing.

Costs and policies

-

Live pricing + 3% GST on buys (industry standard) with a clear view of spreads and any storage/delivery charges inside the app.

-

No hidden fees; quick KYC and instant onboarding so you can start in minutes.

Pros

-

₹1 entry point plus a rewards layer that adds value vs plain gold apps.

-

Habit-forming UX (streaks, spins, referrals) that helps new investors stay consistent.

Cons

-

The rewards + gamification approach may not appeal to purists who prefer a bare-bones interface.

Best for

-

First-time and young investors who want small, frequent purchases – and to be rewarded for good habits.

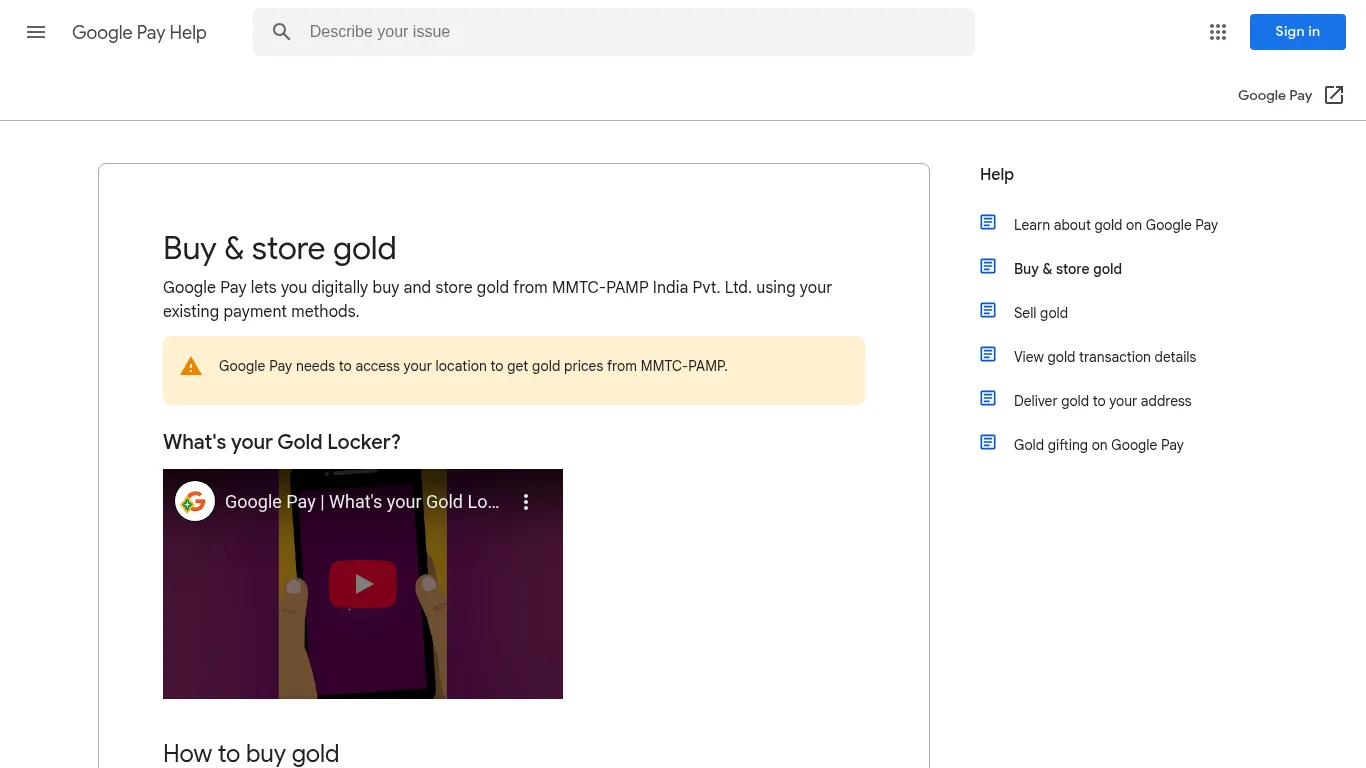

Google Pay Gold (MMTC-PAMP): Simple and familiar

How it works

-

Buy/sell 24K gold at live prices directly inside Google Pay; custody is handled by MMTC-PAMP in insured vaults.

-

View holdings in your Gold Locker; convert to coins/bars with applicable making and delivery charges.

Highlights

-

Zero storage fees for long durations (as per current policy) and an extremely simple in-app experience.

-

Trust and familiarity of Google Pay plus MMTC-PAMP’s international-grade purity.

Fees and limits

-

Purchase spread over live price + 3% GST on buys; making and delivery charges apply for physical conversions.

-

Minimum buy thresholds apply; KYC requirements kick in at regulatory limits.

Pros

-

Extremely simple, no-frills flow embedded in a payment app millions already use.

Cons

-

Limited investing features beyond buy/sell; no rewards, SIP automation, or gamification.

Best for

-

Users who want a minimal way to hold small amounts of digital gold without leaving the app they already use daily.

Jar: Save-the-change style gold for habit builders

How Jar works

-

Jar rounds up your everyday spends and automatically invests the spare change into digital gold.

-

You can set daily savings and SIP-like automation to accumulate steadily; custody and vaulting are handled through partner refineries and insured vaults.

Features

-

24/7 buy/sell at live-linked prices, true micro-investing from small amounts.

-

Optional value-adds like gold leasing may be available as per app updates and eligibility.

Fees, limits, and policies

-

Purchase spread over live price plus 3% GST on buys; any storage, delivery, and making charges are disclosed in-app before you confirm.

-

KYC thresholds apply per regulations; minimum grams/amount required for physical delivery.

Pros

-

Excellent for hands-off habit building – automation turns spare change into gold without extra effort.

-

Enables tiny, frequent investments that fit any budget.

Cons

-

Fewer advanced investing features; rewards and offers depend on occasional app promotions.

Best for

-

Users who want automation and a set-and-forget path to accumulate gold from tiny amounts.

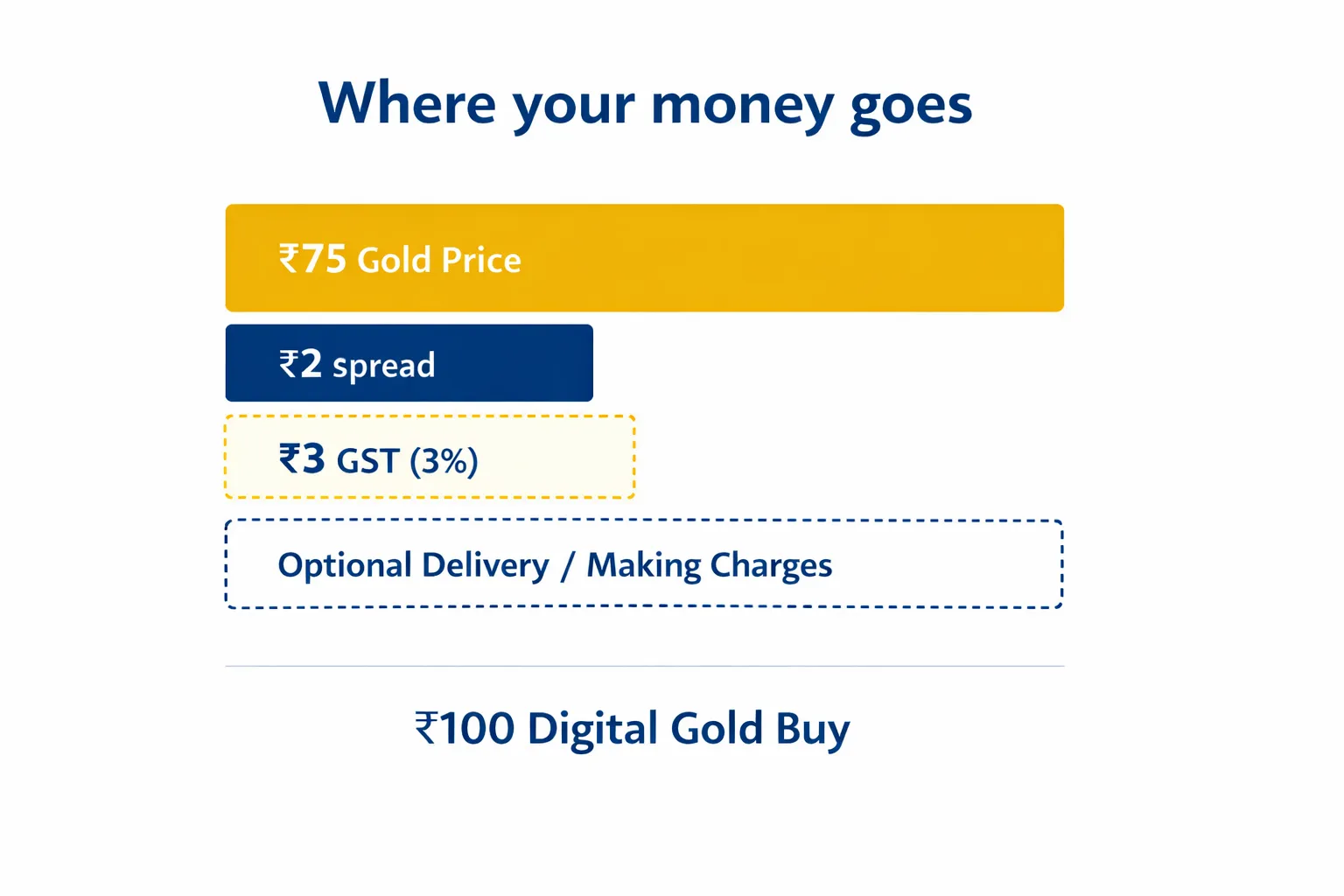

What you really pay: fees, spreads, storage, and delivery (no surprises)

Fee stack explained

-

Universal GST: All digital and physical gold purchases in India attract 3% GST.

-

Purchase spread over live price: Platforms add a small spread to cover sourcing, custody, insurance, and ops. Compare effective price per gram (inclusive of spread) at checkout.

-

Storage policies: Many platforms offer free vaulting for a defined period (some up to 5 years or lifetime), after which nominal storage fees may kick in.

-

Delivery costs: Converting to coins/bars adds making + shipping charges and usually requires a minimum gram threshold. Staying digital avoids these costs.

“GST on gold purchases in India is 3% (applies to both digital and physical gold).” – Source

Table: cost and policy comparison

|

Aspect |

Paytm Gold |

OroPocket |

Google Pay Gold |

Jar |

|---|---|---|---|---|

|

Purchase spread (indicative) |

Platform-dependent; shown at checkout |

Transparent in-app; rewards help offset |

Platform-dependent; shown at checkout |

Platform-dependent; shown at checkout |

|

GST |

3% on buys |

3% on buys |

3% on buys |

3% on buys |

|

Storage policy |

Free up to a defined period (often 5 years) |

Insured vaults; clear in-app disclosure |

No storage fees (as per current policy) |

Insured vaults; policy disclosed in-app |

|

Min delivery quantity |

Applies; check coin/bar catalog |

Applies; shown in redemption flow |

Applies; shown before conversion |

Applies; shown before conversion |

|

Delivery/making charges |

Yes, displayed pre-checkout |

Yes if opting for delivery |

Yes if opting for delivery |

Yes if opting for delivery |

|

Min/max buy |

From ₹1; per-transaction caps may apply |

From ₹1; friendly to micro-buys |

Min thresholds (often 1g) |

From small amounts (e.g., ₹10) |

|

KYC thresholds |

PAN/KYC at regulatory limits |

PAN/KYC as per rules |

KYC at limits |

KYC at limits |

Tips to minimize costs

-

Stick to digital form unless you truly need coins/bars – avoid making and delivery charges.

-

Use micro-investing to average your entry price and watch for low-spread windows before buying.

-

Check storage timelines and plan ahead to avoid post-period storage fees or rushed redemptions.

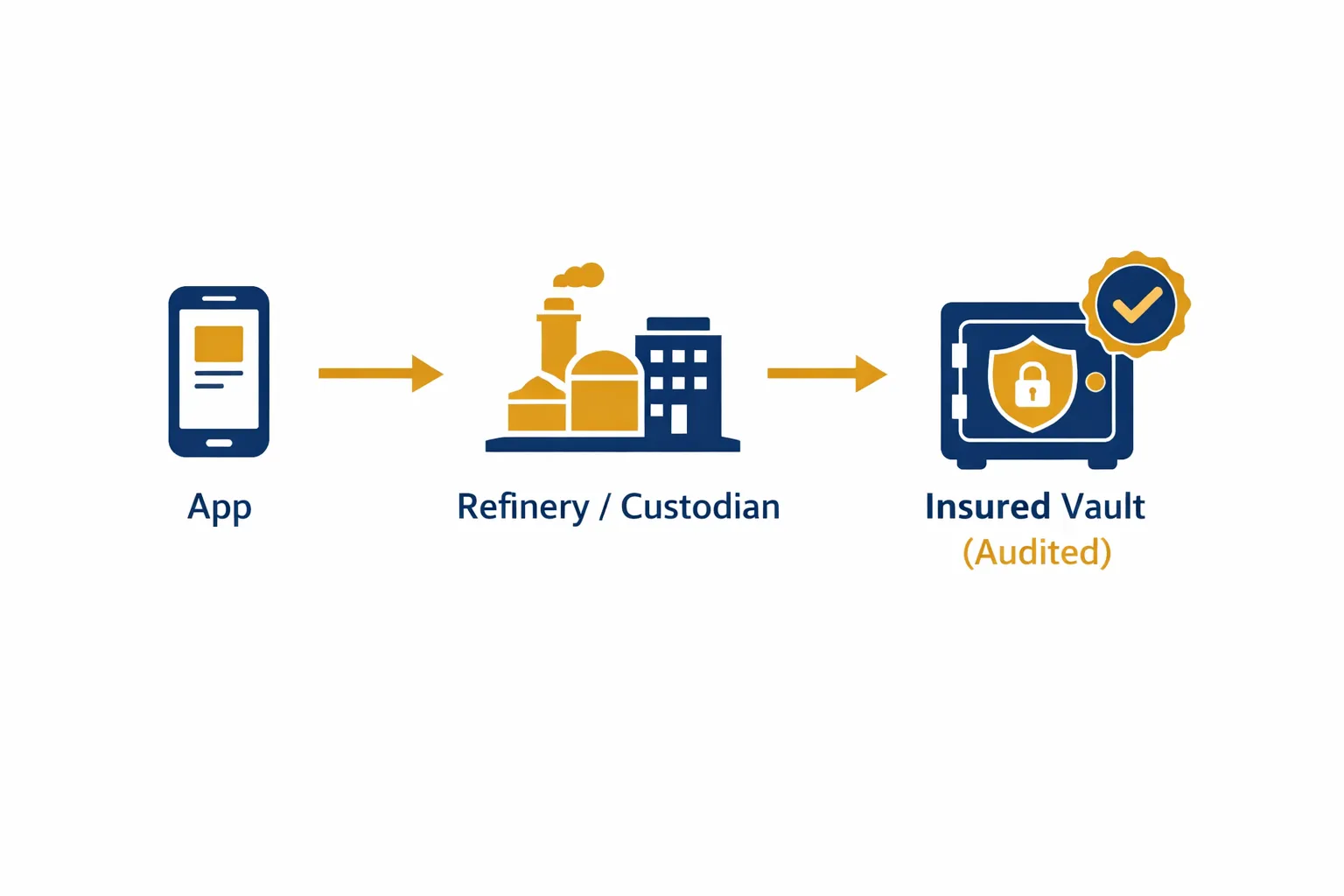

Security, purity, and compliance: who actually holds your gold?

Custody 101

-

Most consumer apps don’t hold the metal themselves. Paytm, Google Pay, and Jar typically route your orders to refinery/custodian partners such as MMTC-PAMP, SafeGold, or Augmont.

-

Vaulting and insurance: Your gold is stored in professional, insured vaults with third‑party security. Independent custodians and periodic audits verify that customer balances match the physical bars in storage.

Purity

-

Digital gold is backed by 24K gold, typically 99.9%–99.99% purity. Bars are assayed, hallmarked, and traceable to refinery lots, ensuring provenance and quality.

Regulation reality

-

Digital gold is not directly regulated by SEBI/RBI like mutual funds or ETFs. Providers follow strict KYC, audit, and insurance practices to protect consumers, but it’s important to review each provider’s disclosures and audit reports.

“Retail gold investment providers should commission regular, independent audits of customers’ vaulted gold holdings.” – Source

OroPocket’s stance

-

RBI‑compliant operations with authorized bullion partners.

-

100% insured vaults and a transparent audit posture so you always know how and where your assets are held.

What to check before you buy

-

Named custodian/refiner (e.g., MMTC-PAMP, SafeGold, Augmont).

-

Audit cadence and who performs it (independent auditor).

-

Delivery policy (minimum grams, charges, timelines).

-

Dispute redressal and support response times.

Everyday use: UPI flow, SIPs, rewards, and habit-building

Onboarding and payments

-

UPI-native across the board. From first tap to completed buy typically takes under a minute once KYC is done.

-

OroPocket is optimized for micro-buys via instant UPI – open app, pick ₹ amount (even ₹1), swipe to confirm, done. The experience is built for frequent, tiny purchases that don’t interrupt your day.

-

Paytm/Google Pay/Jar are similarly quick inside their payment flows; however, OroPocket’s focus on low-friction repeat investing makes the journey feel faster when you’re buying often.

Investing features

-

SIP/auto-invest:

-

OroPocket supports flexible micro-SIPs so you can stack small amounts daily/weekly/monthly. Great for rupee-cost averaging without thinking.

-

Jar emphasizes automation via round-ups and daily savings; it’s excellent if you prefer set-and-forget.

-

Paytm/Google Pay offer straightforward buy/sell; scheduled investing varies by product flow and is typically more basic.

-

-

Micro-investing triggers:

-

Round-ups (Jar) passively convert spare change into gold.

-

Streaks (OroPocket) reward you for showing up – tiny daily wins that build consistency.

-

Why they work: Automation or habit cues remove willpower from the equation. You invest “by default,” not “by decision,” which improves follow-through and smooths entry prices over time.

-

Rewards and engagement

-

OroPocket leads on ongoing rewards:

-

Satoshi cashback on every gold/silver purchase (Bitcoin rewards that compound your upside).

-

Streak bonuses every 5-day run, plus spin-to-win for extra gold/Bitcoin rewards.

-

Referral rewards: invite friends, both earn 100 Satoshi + a free spin.

-

-

Others:

-

Paytm/Google Pay: generally no ongoing rewards – occasionally short promos.

-

Jar: occasional offers exist, but rewards aren’t the core design like OroPocket’s.

-

Tracking and transparency

-

Real-time valuation: All platforms show live-linked prices; OroPocket keeps your total value and asset mix (gold/silver + earned Bitcoin rewards) front and center.

-

Price alerts: Handy for buying dips and pacing your SIPs; OroPocket emphasizes timely nudges without spam.

-

Portfolio history: Clear logs of buys/sells, SIP runs, and rewards earned – so you always know what’s working and where your money went.

Delivery, making charges, and redemption: the fine print (including Paytm)

Physical conversion

-

Converting to coins/bars makes sense for gifting, weddings, festivals, or rituals where physical metal is meaningful.

-

For pure investing, staying digital usually keeps costs lower (no making or delivery charges, instant liquidity, and no minimum grams to move in/out).

Paytm Gold specifics to check in-app

-

Making + delivery charges: Review in the Paytm Gold “Delivery/Convert to coin” flow before you confirm. The app shows charges by denomination (e.g., 1g, 2g, 5g, 10g).

-

Minimum grams for redemption: Each coin/bar has a set weight; you’ll need at least that many grams available to convert.

-

Timelines: Once requested, delivery typically follows a T+ processing window (varies by location and courier). Track status inside your Paytm orders.

Alternatives

-

OroPocket: Digital-first with transparent delivery options (where available). Any making and delivery charges are shown before you confirm; staying digital lets you avoid these costs altogether. You can also redeem to cash at live rates for instant liquidity.

-

Google Pay Gold (MMTC-PAMP): Similar to Paytm – choose coin/bar denominations, see making + delivery charges upfront, and place a delivery request from your Gold Locker.

-

Jar: Delivery is supported via partners; minimum gram thresholds and costs are shown in-app. If you’re using round-ups/daily savings, consider staying digital for efficiency and only converting when needed for a specific occasion.

Best practices

-

Plan ahead of festivals: Demand spikes can extend delivery timelines – place requests early and pick standard denominations to keep making charges competitive.

-

Compare denominations: Per-gram making charges can vary across 1g, 2g, 5g, and 10g coins/bars – larger units sometimes work out cheaper per gram.

-

For investing, stay digital: If your goal is returns and flexibility, avoid making/delivery costs and redeem to cash instead of converting to physical.

Which one should you choose? (final verdict)

If you want maximum convenience in an app you already use

-

Choose: Paytm Gold or Google Pay Gold

If you want to build wealth with tiny, daily steps – and get rewarded for it

-

Choose: OroPocket (₹1 entry, Satoshi rewards, streaks, spins, referrals)

If you love automation via round‑ups

-

Choose: Jar

Our take

-

For most first‑time investors in 2025, OroPocket provides the best mix of low entry, habit formation, and extra value via Bitcoin rewards – without compromising on security or purity.

Next steps

-

Download OroPocket, start with ₹1, set a daily/weekly auto‑invest, and claim your Bitcoin rewards on every purchase.

-

Diversify later with ETFs/SGBs as your ticket size and horizon grow.

CTA: Download the OroPocket app – https://oropocket.com/app