Price of Gold Today: What You’re Really Paying (Spot Price vs Local Rate)

Price of Gold Today: What You’re Really Paying (Spot Price vs Local Rate)

You check “gold price today” on three different sites and get three different numbers. Then you walk into a jewellery shop and the quote is even higher. Annoying? Yes. Normal? Also yes.

The truth: there isn’t one single “gold price”. There’s the global spot price (the raw international price), and then there’s India’s local rate (spot + USD/INR + duties + GST + premiums + jeweller costs). Once you understand the stack, you’ll stop overpaying – and start buying smarter.

Spot Price vs Local Rate: The One-Line Difference

What is the gold spot price?

Spot price is the live global market rate for gold for immediate settlement – think of it as the “raw” price used by big markets (LBMA/COMEX) before any India-specific costs.

What is India’s local gold rate?

India’s local rate is what you see on Indian price trackers and what your jeweller roughly anchors to. It’s basically:

Local rate ≈ Global spot price (USD) × USD/INR + import costs + taxes + dealer/jeweller premiums

If you want a deeper primer on the concept itself, see: gold spot price explained (what it means & why it matters).

Why Gold Prices Differ Across Websites, Cities, and Jewellery Stores

1) USD-INR moves your “today’s price” even if gold is unchanged globally

Gold is globally priced in USD. India buys a lot of its gold via imports, so currency conversion is a big lever.

If USD strengthens or INR weakens, gold in INR rises even if the USD spot price is flat.

2) Import duty + other landing costs change the base

Imported gold doesn’t arrive at spot price. There are costs to bring it in (including duties and logistics). That becomes part of the India base rate.

3) GST gets added on top

For most retail gold purchases, GST applies, pushing up the final payable price.

4) Jeweller premium, making charges, wastage, and margins

This is where offline jewellery can diverge the most.

-

Coins/bars: premium + GST

-

Jewellery: premium + GST + making charges + potential wastage + brand markup

This is also why “buy price” and “sell price” are different (spread). It’s standard across the industry.

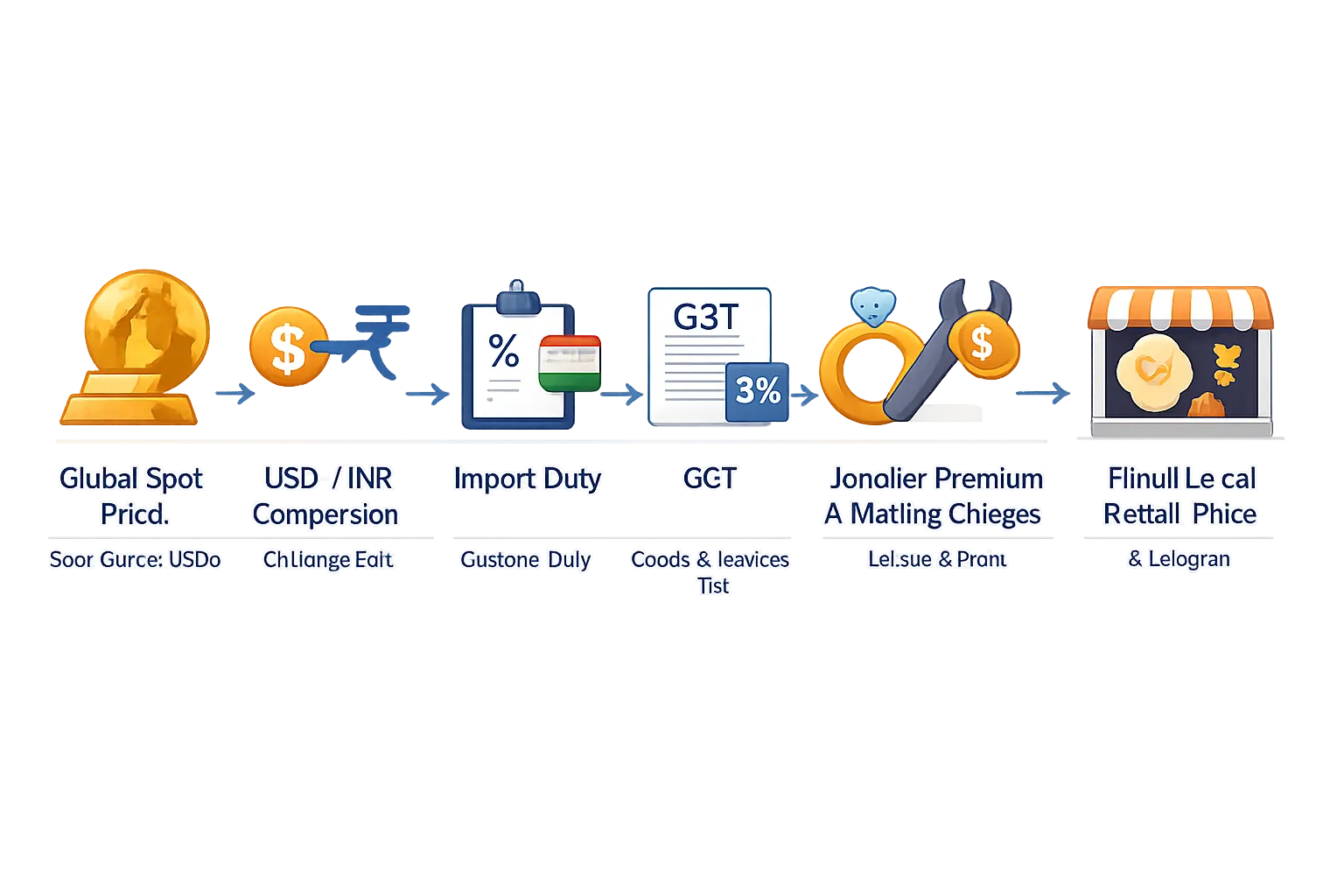

The “Gold Price Stack” (What You’re Actually Paying For)

Here’s a practical breakdown of what sits inside the final number:

|

Layer |

What it means |

Where you feel it most |

|---|---|---|

|

Global spot (USD) |

World reference price |

All formats |

|

USD/INR |

Currency conversion |

Strong impact day-to-day |

|

Import + landing |

Duties/logistics |

India base rate |

|

GST |

Tax on purchase |

Retail invoices |

|

Premium / spread |

Dealer/platform margin |

Digital gold & coins/bars |

|

Making charges |

Craftsmanship cost |

Jewellery (biggest add-on) |

|

Wastage/brand markup |

Extra shop charges |

Jewellery (varies widely) |

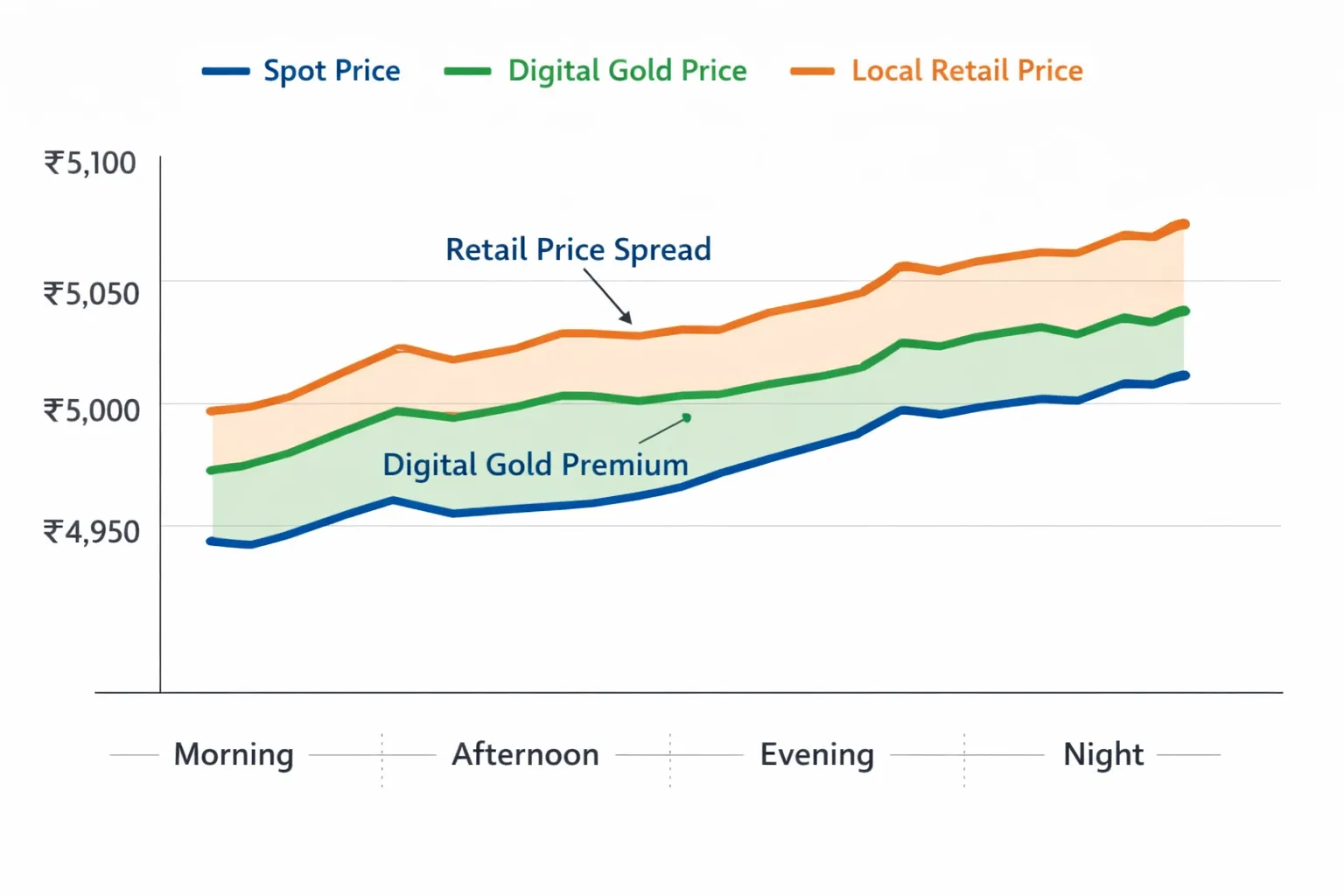

Spot Price vs Local Retail vs Digital Gold: Who tracks what?

Physical jewellery store

-

Anchors to local rate, then adds making + brand markup

-

Best when you value design + craftsmanship, not lowest price

Coins/bars

-

Premium exists, but typically lower add-ons than jewellery

-

Better for investment than jewellery (in most cases)

Digital gold

-

Usually reflects market moves closely, but you’ll see a buy-sell spread

-

You’re paying for convenience, insured vaulting, liquidity, and platform operations

Want to understand those spreads and fees in plain English? Read: digital gold charges explained (spreads, GST, storage, selling).

Two quick reality checks (so you don’t get misled)

“India’s households are estimated to hold approximately 25,000 tonnes of gold, making them the largest private holders of gold globally.” – World Gold Council

“RBI gold reserves have increased from approximately 618 tonnes in 2020 to about 880 tonnes by June 2025.” – Reserve Bank of India

Translation: gold isn’t a fringe asset. India lives on gold – households and even the central bank treat it as strategic.

A Simple Checklist to Compare Prices Before Buying (Coins, Jewellery, or Digital)

If you’re buying 24K coins/bars

-

Compare final payable price (including GST + premium)

-

Check buyback policy and the sell price/spread

-

Prefer hallmarking / assay certification and invoice clarity

If you’re buying jewellery

-

Ask for a split: gold rate + making charges + GST

-

Compare making charges across 2–3 jewellers (it can swing wildly)

-

Confirm wastage policy and buyback deductions

If you’re buying digital gold

-

Check the buy-sell spread (this is your “hidden cost”)

-

Confirm: insured vaulting, partner credibility, redemption rules

-

Ensure instant sell and transparent pricing

If you’re new and want the whole decision framework, see: how to buy gold in India (beginner to confident buyer).

Where OroPocket Fits In (And Why It’s Built for “Real People”, Not Traders)

Most Indians don’t want charts and complexity. They want:

-

to start small

-

buy in seconds via UPI

-

track value without confusion

-

and feel rewarded for building the habit

That’s exactly what OroPocket is designed for:

Why OroPocket makes “today’s gold price” work for you

-

Start from ₹1: zero intimidation, instant entry.

-

Instant UPI payments: buy gold in under 30 seconds.

-

Real 24K gold: securely vaulted, fully insured, compliant setup.

-

Gamified investing: streaks, spins, tiered rewards – habit > hype.

-

Free Bitcoin on every purchase: you don’t just buy gold – you also earn Satoshi cashback. Two assets. One action.

-

Referral rewards: both sides earn 100 Satoshi + a free spin.

You’re not “watching prices”. You’re building wealth – daily.

Final Verdict: Spot Price is the headline. Local rate is the reality. Your strategy is the edge.

If your goal is jewellery, you’ll pay for design and craftsmanship – fair.

If your goal is investment, your job is simpler: minimise unnecessary add-ons, understand spreads, and build a disciplined habit.

Stop guessing what “gold price today” means. Start understanding the stack – and make every rupee work harder.

Stop watching. Start growing.

Download OroPocket, start with ₹1, and earn free Bitcoin as you build your gold stack – one smart buy at a time.