SafeGold Review 2026: Features, Fees, Login, and Best Alternatives

Introduction + SafeGold vs top alternatives at a glance

Digital gold matters in 2026 because it fits how India now saves: fractional buys starting from as low as ₹1–₹10, instant UPI payments, and 24/7 liquidity with live market pricing. You skip lockers and paperwork, yet still own 24K gold stored in insured vaults. This SafeGold review covers custody and trustee setup, fees/spreads, SafeGold login and KYC basics, and how redemption works. Then we compare SafeGold head-to-head with MMTC-PAMP, Augmont, and OroPocket so you can decide the best fit for your digital gold purchase online.

Quick takeaway:

- Choose SafeGold if you value wide availability across popular apps, micro-savings, and jewellery redemption via partners.

- Choose MMTC-PAMP if brand trust, 999.9 purity, and coin/bar delivery are your top priorities.

- Choose Augmont if you want a phygital ecosystem and competitive pricing from a large integrated refinery.

- Choose OroPocket if you want ₹1 entry, instant UPI, and unique rewards like free Bitcoin on every buy – ideal for first-time and rewards-driven investors.

“2024 saw the highest-ever total value of gold demand at US$382bn, driven by robust investment and central bank buying.” – Source

Comparison at a glance (fast answers)

| Feature | SafeGold | MMTC-PAMP | Augmont | OroPocket |

|---|---|---|---|---|

| Minimum buy | ~₹10 (varies by partner) | ₹1 (via major partners) | ₹1 (via ecosystem partners) | ₹1 |

| Purity | 24K 99.9% | 24K 999.9 | 24K 99.9% (BIS/NABL hallmarked) | 24K pure, 100% insured |

| Storage fee | Typically none; insured partner vaults | Free storage (often up to 5 years via partners) | Typically none via partners | No storage fees; insured vaults |

| Redemption options | Coins/bars; jewellery via partner jewellers; delivery charges apply | Coins/bars delivery; no jewellery | Coins/bars; select jewellery via Augmont network | Instant sell-back; send/gift gold to contacts (no jewellery redemption) |

| Rewards/USP | Widest partner network; micro-savings and gifting | Government JV credibility; assay-certified coins | “Phygital” gold ecosystem; competitive pricing | Bitcoin rewards on every purchase; UPI-first; gamified streaks & spins |

One-line positioning:

- SafeGold: Ubiquitous access and jewellery redemption through partner networks.

- MMTC-PAMP: Benchmark purity and brand trust with seamless coin/bar delivery.

- Augmont: Phygital ecosystem from refinery to retail with sharp pricing.

- OroPocket: ₹1 entry plus free Bitcoin rewards – gold investing that’s instant and rewarding.

What to look for before you buy

- Custodian/trustee transparency: Who holds the gold, where it’s vaulted, independent audits, and insurance coverage.

- Buy/sell spread and delivery charges: Check live spreads and understand making/delivery fees before redeeming.

- Redemption options and timelines: Coins, bars, jewellery eligibility, minimum grams for conversion, and delivery SLAs.

- App experience and rewards: UPI ease, SIPs/automation, daily savings, and extra benefits like cashback or Bitcoin rewards – crucial for habit-building and better value in a safegold review or any digital gold purchase online.

SafeGold: Company, custody, purity, and partners

SafeGold is a B2B2C digital gold provider that powers gold buying for leading apps across India. Instead of a direct-to-consumer focus, SafeGold integrates into platforms people already use – think large payment apps and jewellers – so users can buy, sell, and redeem gold without switching ecosystems.

What you get is standardized 24K digital gold (typically 99.9% purity) with vaulting handled via secure, fully insured bank-grade facilities under a trustee arrangement. Independent audits and insurance policies are designed to ensure that every gram sold is backed by physical bullion. Because SafeGold distributes through partner apps, KYC, wallet terms, and redemption flows are executed within each partner’s interface – yet the underlying custody remains consistently backed.

Where you can buy SafeGold: widely across major payment apps and savings apps, plus leading jewellers online. This breadth of partners is SafeGold’s superpower – it’s practically everywhere your money already lives.

Who it’s for: first-time investors who want simple buy/sell, micro-purchases, and easy redemption via apps they already trust. If you like the idea of “open your usual app and buy gold in seconds,” SafeGold fits well.

Core features

- 24/7 buy/sell at live market price with fractional investing, so you can start with small ticket sizes and scale up over time.

- Gifting and redemption options: convert to coins/bars with delivery; jewellery redemption is enabled through select partner jewellers.

- SIPs and automation: available on partner apps that support daily savings or monthly SIP flows; features vary by platform.

- Wallet/storage terms: gold is stored in insured, bank-grade vaults; redemption timelines and any making/delivery charges depend on the partner’s policy.

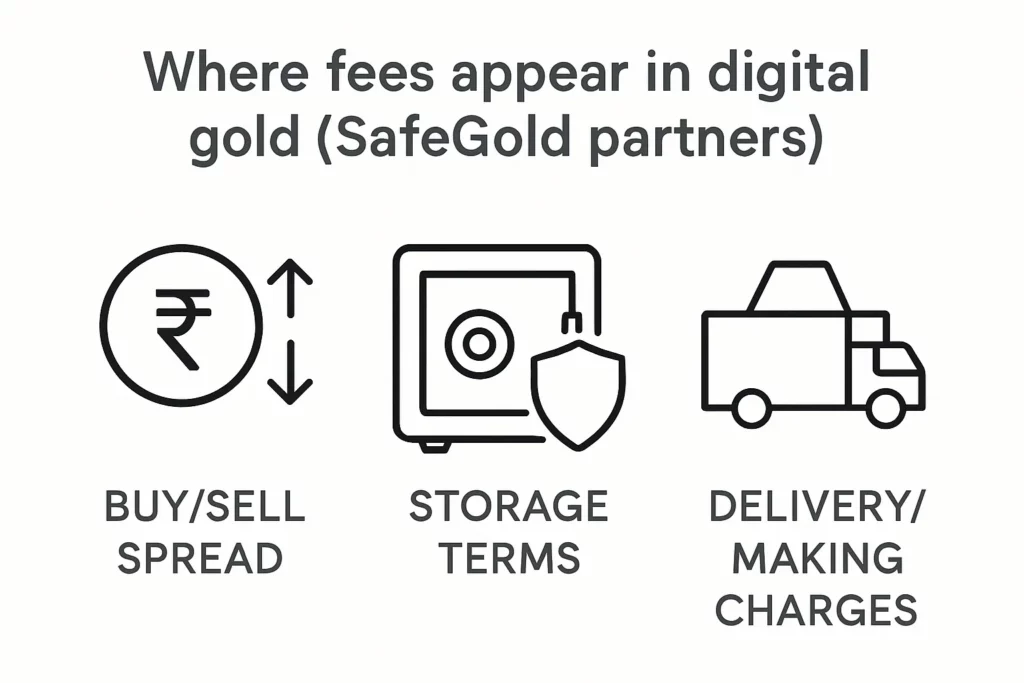

SafeGold fees and pricing

Understanding how pricing works helps you avoid surprises and choose the right partner app for your safegold digital gold journey.

- Buy/sell spread: Every platform shows a live buy price and a live sell price. The difference is the spread, which covers operational costs and can vary by partner app, time of day, and market volatility. Always check both prices before you buy. Smaller, stable spreads mean better value, especially if you plan frequent buys or quick redemptions.

- Storage: Many partner apps offer free, insured vault storage for a defined period (often multiple years). After that, platforms may prompt you to redeem to coins/bars or levy a nominal storage fee. Review the partner’s storage terms in-app so you know when free storage ends.

- Delivery/making charges: Converting digital gold to physical coins/bars (or jewellery through select partners) will involve making and delivery charges. These vary with weight, product design, packaging, and courier insurance. Premium minted coins and jewellery generally carry higher making charges.

- Taxes and limits: Digital gold buys attract 3% GST. PAN/KYC thresholds apply per regulations, and partner apps may cap per-day or per-transaction amounts for risk control. Check your app’s limits and KYC requirements before initiating large purchases or redemptions.

- Practical example (illustrative):

- You buy ₹1,000 of digital gold at the live buy price. GST (3%) is included in the final bill.

- Over time, you sell a portion back at the live sell price – the spread determines your exit value.

- If you redeem to a 1g coin later, expect making and delivery fees to be added at checkout; heavier or designer products may cost more.

- If free storage expires, your app may nudge you to redeem or accept a small storage fee going forward.

- Where to find exact charges: Open your chosen partner app’s gold section and check the Fees/Charges or FAQs area. Review buy/sell prices, any storage timelines, and the making/delivery fee table for each coin/bar before confirming.

SafeGold login and KYC

SafeGold accounts are typically accessed in two ways:

- Via a partner app: Open the gold section inside a supported app (for example, large payment wallets, savings apps, or jeweller apps) and choose the SafeGold-powered option to proceed.

- Via a SafeGold-powered brand page: Some brands host a SafeGold journey on their own domain; you’ll still complete login/KYC within that brand’s flow.

Step-by-step (safegold login basics):

- Enter mobile number and verify with OTP.

- Complete KYC: Provide PAN and basic details (name, DOB, address, PIN code). Some partners may also request an ID proof or address proof if you cross higher limits.

- Create/confirm a security PIN or password if the partner app uses one, and enable alerts.

Security basics:

- One-time passwords (OTP) for critical actions (login, purchase, redemption).

- Device binding and session timeouts in many partner apps.

- Real-time push/SMS/email notifications for every buy/sell/redemption to help you track activity and detect anomalies quickly.

Buying and selling flow

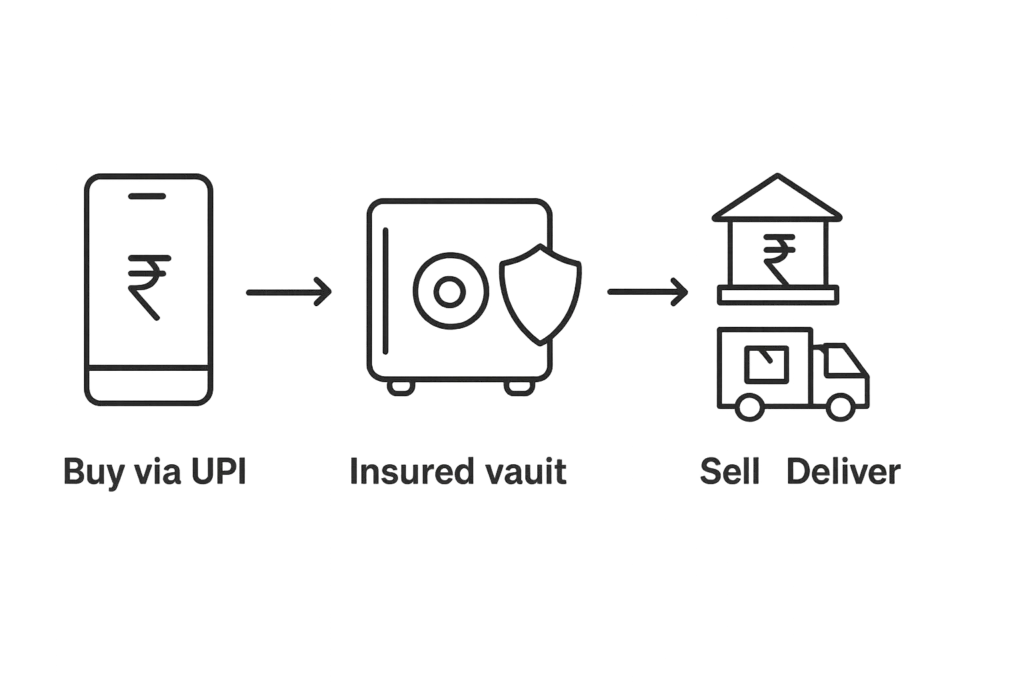

Buying digital gold (digital gold purchase online):

- Choose buy by amount (₹) or grams (g).

- Review the live buy price and applicable GST.

- Pay using UPI, cards, or netbanking – payment rails vary by partner.

- On success, units are reflected in your gold balance; view purity, value, and transaction history inside the partner app.

Selling digital gold:

- Select the quantity to sell; the app will show the live sell price (note the buy/sell spread).

- Choose settlement destination: partner wallet or linked bank account (depends on app policy).

- Settlement timelines are app-dependent – often instant to wallet, and near-instant to same-bank UPI; some partners may complete by T+0/T+1 on bank working days.

Redemption and delivery

Convert to coins/bars:

- Many partners allow conversion to minted coins/bars with minimum thresholds (commonly 0.5g or 1g; varies by product).

- Making and delivery charges are displayed at checkout and depend on weight, design, and packaging.

Jewellery redemption (through supported partners):

- Where enabled (e.g., a jeweller partner), your digital gold can be applied toward jewellery purchases.

- Expect standard jewellery making charges; the flow may involve generating a digital voucher or transferring holdings to the partner’s retail system for in-store/online checkout.

Delivery timelines, packing, and return/refund rules:

- Typical delivery windows range from 2–7 business days, shipped in tamper-evident, insured packages.

- Address accuracy and KYC compliance are required for dispatch.

- Returns/refunds are governed by the partner’s policy – custom or opened packages may not be returnable; damages are usually handled via claims raised promptly with proof.

Tip: Before you buy, review your partner app’s Fees/Charges and FAQs for exact limits (daily/transaction caps), KYC thresholds, storage terms, and redemption timelines – this ensures the safegold digital gold experience matches your expectations for where to buy digital gold and how quickly you can convert or sell.

SafeGold pros and cons (honest take)

Pros

- Ubiquitous access via leading apps (Amazon Pay, PhonePe, Tanishq, Jar): Easy to start, no new account learning curve, and familiar payment flows.

- 24K purity, insured vaulting, trustee model: Transparent backing with audited, bank-grade storage – exactly what first-time investors need.

- Fractional investing + gifting; jewellery redemption via select partners: Start small, gift easily, and convert to coins/bars or jewellery where supported.

Cons

- Pricing spread and charges vary across partner apps (not always transparent upfront): You need to compare live buy/sell rates and delivery/making fees before every purchase/redemption.

- Feature set depends on the app you use (SIP, analytics, alerts may be limited): Experience can range from basic to robust based on the partner’s capabilities.

- No native rewards layer (cashback/points) across the board; depends on partner promotions: Value-adds are inconsistent and often time-bound.

What we compared

- Purity and hallmarking

- Minimum buy and SIP options

- Storage and custody transparency

- Redemption choices (coins, bars, jewellery) and ease

- Payments (UPI speed), app UX, and extras (rewards, streaks)

Feature-by-feature comparison table

| Feature | SafeGold | MMTC-PAMP | Augmont | OroPocket |

|---|---|---|---|---|

| Purity | 24K 99.9% | 24K 999.9 | 24K 99.9% (BIS/NABL hallmarked) | 24K pure, 100% insured |

| Min buy | ~₹10 (varies by partner) | ₹1 (via major partner apps) | ₹1 (via ecosystem partners) | ₹1 |

| SIP | Via partner apps (daily/monthly options vary) | Via partner apps (GAP/SIP-style via partners) | Via partners and Augmont ecosystem | No formal SIP; habit-building via streaks and repeat buys |

| Storage | Insured, trustee model; often free for a defined period via partners | Insured vaults; free storage (often up to 5 years via partners) | Insured vaults; typically no storage fees via partners | Insured vaults; no storage fees |

| Redemption | Coins/bars; jewellery via select partners; min gram thresholds apply | Coins/bars delivery; jewellery not standard | Coins/bars; broad jewellery options through phygital retail network | Instant sell-back; send/gift gold; no jewellery redemption |

| Fees transparency | App-dependent; check partner FAQs (spread, making/delivery fees) | High transparency; live pricing and clear making/delivery fees | Transparent live pricing; product-wise making/delivery fees | In-app live pricing; no storage fees; spreads shown before buy |

| UPI ease | UPI-native via partner apps; instant in many cases | UPI via major payment apps; fast | UPI through partners and Augmont journey | Instant, seamless UPI payments |

| Rewards | No native rewards; depends on partner promos | Typically none | Typically none | Free Bitcoin on every purchase; daily streaks; spin-to-win; referral rewards |

| Gifting | Enabled via select partner apps | Gifting commonly supported via partners | Available via ecosystem partners | Built-in Send Gold to contacts |

| Trustee/custodian | Bank-grade insured vaults; trustee oversight | LBMA-accredited refining; assay-certified packaging; insured vaults | Integrated refinery-to-retail; secure vaulting | Authorized bullion partners; RBI-compliant; insured vaults |

| Partner reach | Very wide (payments, savings, jewellers) | Wide (major payment apps, retailers) | Strong and expanding retail + partner network | Direct app (iOS/Android) |

Key takeaways

- Where SafeGold leads: unmatched distribution and jewellery redemption through partner jewellers – great for users who want to buy anywhere and convert to jewellery later.

- Where MMTC-PAMP shines: brand pedigree, 999.9 purity, and strong physical product range with clear assay-certified delivery.

- Where Augmont wins: a phygital stack from refinery to retail, competitive pricing, and broad jewellery breadth.

- Where OroPocket stands out: true ₹1 entry, UPI-native speed, and unique extras – Bitcoin rewards on every buy, gamified streaks, and spin-to-win – ideal for first-time, rewards-driven investors.

Thanks! Whenever you’re ready, share the next section you want me to write.

Safety, compliance, and what to check before you buy

Stay safe checklist

- Verify purity and custodian/trustee on the product page

- Look for 24K 99.9/999.9 purity, insured vaulting, and an independent trustee structure. In any safegold review or similar provider check, confirm who the vaulting partner is and how audits/insurance work.

- Read fee disclosure: spreads, storage duration, delivery/making

- Check the live buy/sell spread before transacting. Confirm if storage is free for a fixed period and what happens after. Review making and delivery charges for coins/bars/jewellery.

- KYC norms: PAN thresholds, address; avoid transacting across multiple accounts to dodge limits

- Complete PAN-based KYC and provide accurate address details. Limits and documentation needs can step up with higher volumes – don’t split across accounts to bypass limits.

- Tax basics: 3% GST on buys; capital gains on sell/redemption

- Purchases attract 3% GST. Capital gains tax applies on sale/redemption based on holding period and applicable slabs – keep records to simplify filing.

- Redemption hygiene: minimum grams, timelines, packaging

- Check minimum gram thresholds (often 0.5g–1g) for conversion, delivery timelines, tamper-evident packaging, and return/refund rules before confirming.

Pro tip

- Always take screenshots/email confirmations of each buy/sell; reconcile grams and INR value

- Maintain a simple sheet with date, grams, price, fees, and settlement details – especially useful if you use multiple apps.

“Customer gold is stored in secure, fully insured vaults and overseen by an independent security trustee to protect investor interests.” – Source

Example scenarios

- Micro-investor (₹100–₹500 per week): If the buy/sell spread is wider on your chosen partner app, more of your small-ticket buys go to costs. Keep an eye on spreads; batch buys on days when prices are calmer. If you’re tempted to redeem a tiny coin early, making+delivery fees can outweigh benefits – consider selling digitally instead.

- Festival-time buyer (coin/bar): For physical redemption, compare SKUs by weight and design. Premium motifs and gift packaging raise making charges. Delivery insurance is worth it, but costs vary – check before checkout. Sometimes a 2g coin is more fee-efficient than two 1g coins.

- Habit-builder (SIP): Automation helps you accumulate grams through volatility; rupee-cost averaging smooths entry points. Even with spreads, consistent SIPs can build meaningful holdings over time. Review your partner’s free storage duration and plan redemptions before any storage fee kicks in.

Tips to minimise friction

- Compare buy spreads across partner apps before purchase

- Redeem only when you cross fee-efficient gram thresholds

- Use UPI for speed and trackability; set alerts for dips

Which one should you choose? (Final verdict + CTA)

If you want maximum reach and easy jewellery redemption

- Pick SafeGold via your preferred partner app. It’s everywhere, works with the apps you already use, and makes jewellery redemption straightforward through partner jewellers – ideal if you want convenience plus physical conversion options.

If you value brand pedigree and physical products

- Consider MMTC-PAMP. You get 24K 999.9 purity, a deep catalog of coins/bars, and strong delivery assurance. Great for buyers who prioritise trust and want a clear path from digital gold to premium minted products.

If you want phygital breadth and jewellery-first options

- Consider Augmont. Its integrated refinery-to-retail model and wide jewellery range make it compelling for users who plan to convert into ornaments and want many SKU choices.

If you want ₹1 entry, UPI-native speed, and rewards on every buy

- Choose OroPocket: gold’s stability + free Bitcoin rewards, daily streaks, and referral perks. Start from ₹1, pay via UPI in seconds, and build a habit with gamified streaks and spin-to-win – perfect for first-time and rewards-driven investors exploring digital gold purchase online.

Bottom line

- Match platform to your goal: convenience, credibility, redemption style, or rewards.

- Start small, build a habit, and focus on transparent fees and clear redemption rules. If you’re still wondering where to buy digital gold, map your needs – jewellery outcomes vs. pure investing – and choose accordingly. For a safegold review angle, remember pricing and features vary by partner app; always check spreads and timelines before you proceed with a safegold login or any platform login.

Ready to try a reward-first gold app? Download OroPocket for iOS/Android and start with ₹1