SafeGold Review (2026): Fees, Purity, Safety & Pros/Cons

SafeGold Review (2026): Fees, Purity, Safety & Pros/Cons

Digital gold is one of the easiest ways to start investing in India in 2026: buy ₹10–₹100 worth in seconds, store it safely (without lockers), and sell anytime. But the real question behind every SafeGold review is simple:

Is SafeGold actually safe, fairly priced, and worth using – or should you choose an alternative like Gold ETFs, SGBs, or a rewards-first app like OroPocket?

This guide breaks down SafeGold’s purity/custody model, real-world costs (spread + GST + delivery), redemption experience, hidden risks, and the best alternatives – so you can stop guessing and start building wealth confidently.

“In 2024, global gold demand reached a record high of 4,974 tonnes, valued at $382 billion.” – Source

SafeGold in one minute (fast verdict)

SafeGold is generally credible as a digital gold infrastructure provider (B2B2C), because it typically sells 24K gold (usually 99.9%) stored in insured vaults with an audit/trustee setup.

But here’s the catch: your experience depends heavily on the partner app you use (PhonePe, Amazon Pay, jeweller apps, etc.). Pricing spreads, features, and redemption charges can vary.

Choose SafeGold if:

-

You want wide availability across popular apps

-

You want small, frequent buys

-

You may want jewellery redemption through partner jewellers

Skip/think twice if:

-

You care about the tightest buy–sell spread

-

You want the most regulated format (Gold ETFs / SGBs)

-

You want consistent rewards for investing (SafeGold itself doesn’t offer a native rewards layer)

If you want the bigger picture on safety across apps/providers, read our breakdown: is digital gold safe in India.

What competitors get right (and what they miss)

Across top-ranking competitor articles, the common “winning” points are:

-

Digital gold = real 24K gold in a vault

-

Safety depends on custody + insurance + audits

-

Costs are mostly in the buy–sell spread, not an explicit fee

-

Digital gold isn’t as regulated as Gold ETFs

Content gaps we fix in this review

Most competitor posts gloss over:

-

Where the real cost sits: spread vs GST vs delivery vs making charges

-

Partner-app variability: why the same SafeGold gram can cost more on one app than another

-

Regulatory reality: what “grey area” means practically for retail investors

-

A decision framework: when to pick SafeGold vs Gold ETF vs SGB vs a rewards-first app

What is SafeGold (and how it works in 2026)?

SafeGold is primarily a B2B2C digital gold provider. Instead of pushing one single consumer app, it powers digital gold inside other platforms you already use.

What you’re buying

When you buy SafeGold-powered digital gold:

-

You’re purchasing gold in fractions of grams

-

The gold is typically 24K 99.9% purity

-

It’s stored on your behalf in a vaulting/custody setup (with insurance + audits)

SafeGold website snapshot (for reference)

Safety & trust: purity, vaulting, insurance, audits (what to verify)

Digital gold is “safe” when every digital gram is actually backed by physical gold, held with credible custody, plus insurance and audits.

Here’s the verification checklist you should use before buying SafeGold on any partner app.

1) Purity standard

-

SafeGold is generally positioned around 24K (99.9%)

-

Always confirm the purity disclosure inside the partner app

2) Vaulting & insurance

Look for:

-

Insured, bank-grade vaults

-

Clear mention of who stores the gold

-

Evidence of audits (frequency, auditor details)

3) Trustee / segregation of customer assets

Best practice is an independent trustee or structure ensuring customer gold is not mixed with operational inventory.

4) Redemption integrity

A provider’s credibility shows up when you:

-

Convert to coins/bars

-

Receive tamper-evident packaging

-

Get clear delivery SLAs and policies

If you want the “step-by-step buyer checklist” across platforms, use: how to buy digital gold in India via UPI.

SafeGold fees in 2026: the real cost (spread + GST + delivery)

SafeGold usually won’t show you a “platform fee.” Instead, costs show up in 4 places:

1) Buy–sell spread (the biggest hidden cost)

-

You’ll see two prices: Buy price and Sell price

-

The difference = spread

-

Spread varies by partner app and market volatility

2) GST on purchase

-

Digital gold purchases typically include 3% GST

3) Delivery + making charges (if you redeem physically)

-

Coins/bars incur making + shipping + insurance

-

Jewellery redemption (where available) involves standard jewellery charges

4) Storage fees (usually “free until…”)

Many partner apps offer free storage for a defined period. Always check:

-

When free storage ends

-

What happens next (forced redemption vs ongoing fees)

For a full breakdown of charges across digital gold platforms, see: digital gold charges explained (spreads, GST, storage, selling).

Login, KYC, and limits: what to expect with SafeGold

Because SafeGold is integrated into partner apps, the flow is typically:

SafeGold login (typical flow)

-

Enter mobile number

-

Verify OTP

-

Complete KYC (PAN + basic details; more if you cross higher thresholds)

KYC and limits (practical reality)

-

Small buys usually work fast

-

For larger volumes, apps may require additional verification

-

Avoid splitting across accounts – compliance systems flag patterns

Buying, selling, and redemption: how smooth is the experience?

Buying

-

Buy by ₹ amount or grams

-

UPI/card/netbanking depends on partner app

-

Balance reflects as grams + INR value

Selling

-

You sell back at the sell price

-

Settlement can be wallet/bank depending on app

-

Timing often ranges from instant (wallet) to T+0/T+1 (bank working days)

Redeeming to physical gold

Usually:

-

Minimum gram threshold (often 0.5g–1g per SKU)

-

Delivery in 2–7 business days (varies)

-

Fees can be meaningful for small weights – redeem only when it’s fee-efficient

Regulation reality in 2026 (the part most reviews avoid)

Digital gold is convenient – but it hasn’t historically had the same regulatory wrapper as exchange-traded products like Gold ETFs.

“SEBI cautioned that many digital gold products operate outside its regulatory framework, exposing investors to risks.” – Source

What this means for you:

-

You must rely more on platform credibility, disclosures, and custody practices

-

If you want maximum regulatory comfort, consider Gold ETFs/SGBs

-

If you still want digital gold, use a platform that is transparent, insured, and operationally strong

Pros and cons (honest SafeGold review)

Pros

-

Available almost everywhere: easy entry via popular partner apps

-

Fractional investing: good for micro-savings habits

-

Redemption flexibility: coins/bars + jewellery redemption via select partners

-

Vaulting + insurance + audits are typically part of the model

Cons

-

Spreads vary by partner app: you must compare prices before buying

-

User experience depends on partner: SIP features, analytics, and redemption clarity differ

-

No consistent native rewards: any cashback/benefits are usually partner promos, not guaranteed

SafeGold vs Gold ETF vs SGB vs physical gold (what should you pick?)

|

Option |

Best for |

Key advantage |

Key trade-off |

|---|---|---|---|

|

Digital Gold (SafeGold) |

Small, frequent buys + convenience |

Buy/sell anytime, fractional grams |

Spread + partner variability; regulatory comfort lower than ETFs |

|

Gold ETF |

Investors wanting regulation + demat |

SEBI-regulated, transparent NAV |

Needs demat; brokerage/expense ratio |

|

SGB |

Long-term holders |

Sovereign backing + interest (when applicable) |

Lock-in/liquidity constraints; issuance windows |

|

Physical gold |

Gifting/jewellery |

Tangible ownership |

Storage/purity concerns; making charges |

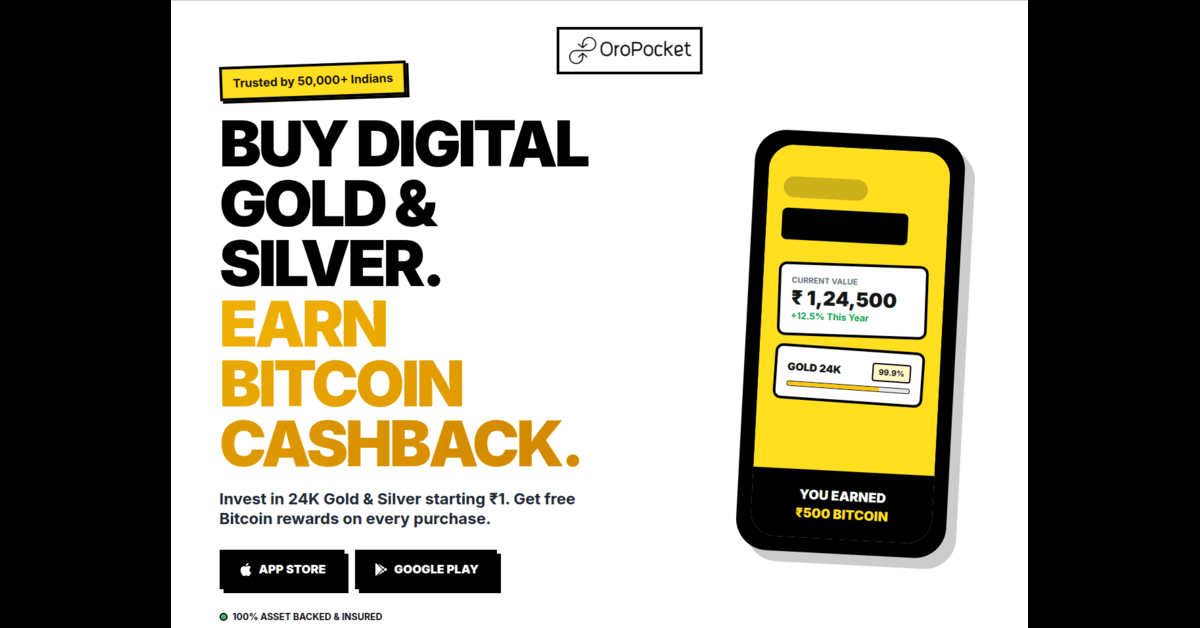

Best SafeGold alternatives in 2026 (quick comparison)

|

Platform |

Why people choose it |

Who it’s best for |

|---|---|---|

|

MMTC-PAMP |

Premium brand + 999.9 purity positioning |

Investors who prioritise pedigree and minted products |

|

Augmont |

Phygital ecosystem + broad retail network |

Users who want variety + jewellery-first options |

|

OroPocket |

₹1 start + free Bitcoin on every buy + streaks/spins |

First-time investors who want habit + rewards + UPI speed |

If you want a deeper side-by-side, see: digital gold providers compared (SafeGold vs MMTC-PAMP vs Augmont).

Why OroPocket is the smarter “2026 upgrade” (if you’re buying for wealth-building)

SafeGold helps you access digital gold. OroPocket helps you build a habit and get more value per rupee invested.

What you get with OroPocket (that most apps don’t offer)

-

Start from ₹1: no minimums, no hesitation, no “I’ll do it later”

-

Free Bitcoin on every purchase: earn Satoshi cashback when you buy gold/silver

-

Gold + Bitcoin combo: stability + growth potential – without crypto trading stress

-

Gamified investing: streaks, spin-to-win, tiered rewards (progress you can feel)

-

Instant UPI: buy in under 30 seconds

-

Send Gold: gift gold to friends/family in-app

-

100% secure & compliant: fully insured vaults + authorized bullion partners

Emotional ROI (the part that keeps you consistent):

-

Control: “I’m taking charge.”

-

Progress: “I can see my wealth grow daily.”

-

Smart: “I’m not letting inflation eat my savings.”

-

Rewarded: “I get Bitcoin just for investing.”

Stop watching. Start growing.

Final verdict: Is SafeGold worth it in 2026?

SafeGold is a solid option if you’re buying via a trusted partner app, you check spreads before each purchase, and you understand redemption charges. It’s convenient, widely available, and suitable for micro-saving.

But if your goal is not just buying gold – it’s building wealth consistently – a rewards-first system wins.

Try OroPocket if you want: ₹1 entry, instant UPI, and free Bitcoin rewards on every gold/silver buy. You don’t just invest – you get rewarded for investing.