Taxes on gold and silver investments in India (FY 2026–27): GST, capital gains, TDS

FY 2026–27 at a glance: how India taxes gold and silver

What this guide covers (GST, customs duty, capital gains, TDS/TCS)

-

Purchases: GST on jewellery, coins/bars, and digital gold/silver; import duty context and how GST is applied on the assessable value at import.

-

Sales: capital gains rules for physical metal, digital gold/silver, ETFs, and SGBs – including holding periods, indexation/benefits, and special SGB redemption treatment.

-

Compliance: TDS/TCS on high‑value transactions, cash‑payment limits, invoices and PAN requirements, and where to report in your ITR.

One‑minute summary (plain‑English)

-

GST: 3% on the value of gold/silver; 5% on jewellery making/repair charges; digital gold/silver also attracts 3% GST on the buy price.

-

Imports: India uses a layered customs duty + cess framework; GST is charged on the import’s assessable value after customs/cess – net effect influences domestic gold buy and sell price.

-

Capital gains: STCG vs LTCG depends on how long you hold; indexation/benefits vary by instrument; SGB redemption at maturity is tax‑exempt on capital gains.

-

TDS/TCS: Mostly kicks in for businesses and high‑value trade; routine personal buys/sells usually don’t face TDS, but cash limits and PAN/invoice rules still apply.

Who this is for

-

First‑time investors and UPI micro‑buyers exploring gold investment in India and digital silver.

-

Jewellery shoppers comparing GST, making charges, and gold buying and selling norms.

-

ETF and SGB investors wanting the latest FY 2026–27 tax rules in clean, actionable English.

-

CA/finance‑curious readers who want a quick, accurate map of gold in finance and tax compliance.

Why it matters now

-

Prices move. Taxes eat into returns. Knowing GST + capital gains rules helps you plan SIPs, festival buys, and exits smarter – so more of your money compounds.

-

If you invest small and often, the right mix (e.g., digital gold/SGBs) can minimize friction and optimize after‑tax returns.

“Gold prices in India roughly doubled (≈100% rise) between 2019 and 2024.” – Source

Tip for OroPocket users: buy digital gold/silver from ₹1 via UPI, get invoices for records, and earn free Bitcoin rewards on every purchase – so your routine buys work harder for you.

Ready to start or optimize your plan? Download the OroPocket app: https://oropocket.com/app

GST on buying gold and silver (jewellery, coins/bars, digital) + import duty

The basics

-

3% GST on the value of gold/silver for jewellery, coins, and bars (applied on the metal value).

-

5% GST on making/repair charges (service component) when billed separately; if the jeweller bundles metal + making together, composite supply rules apply and the principal supply drives tax.

-

Digital gold/silver: 3% GST at purchase; platform spread/fees vary by provider and reflect storage, insurance, and operations.

Imports and duties: what affects domestic prices

-

India levies import duties (basic customs duty plus AIDC/cess) on bullion imports. GST (IGST) is then computed on the assessable value after duty/cess. This layered structure flows into landed cost and ultimately influences domestic gold buy and sell price seen at jewellers and on platforms.

-

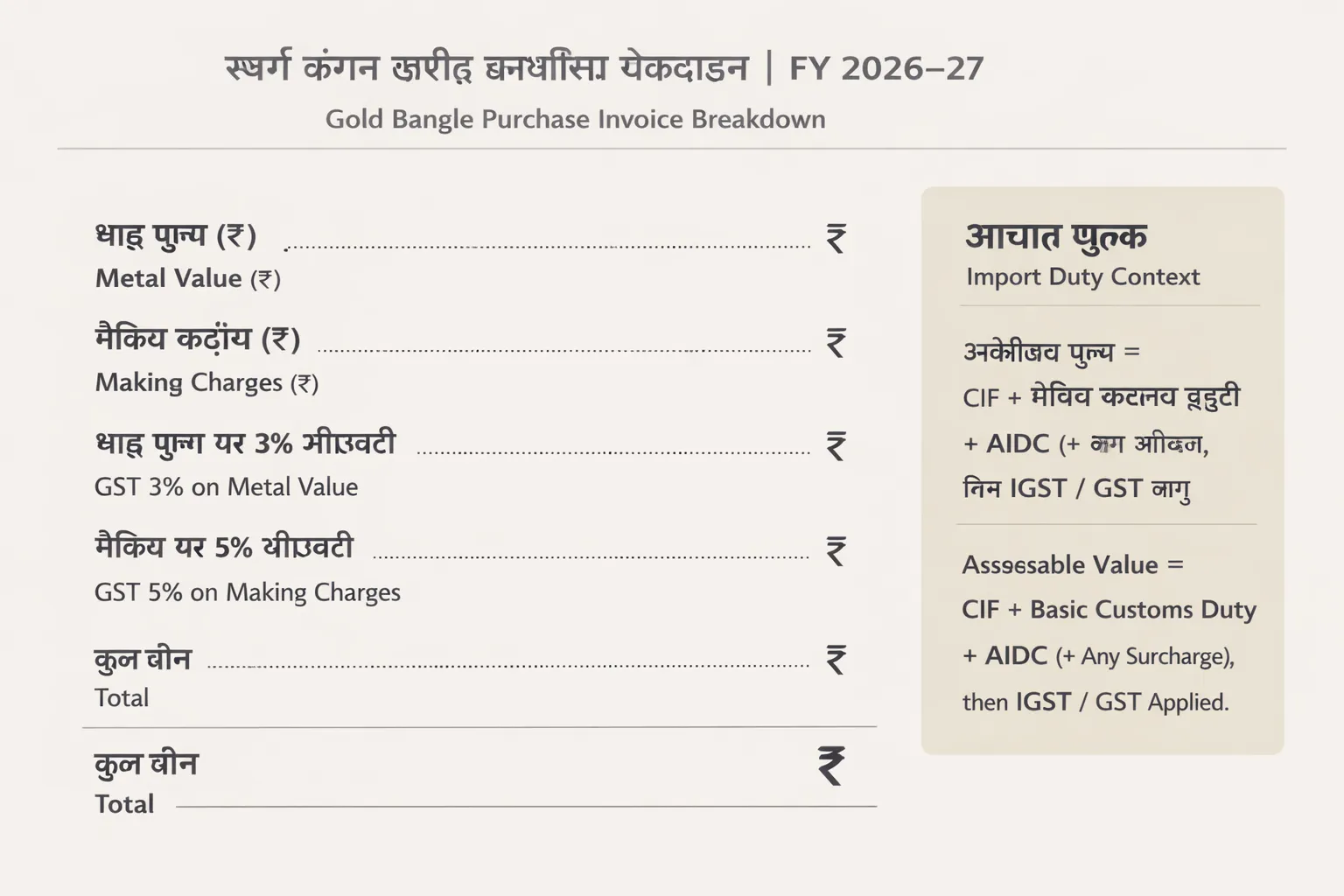

How it reaches your invoice:

-

Importer’s landed cost = CIF value + basic customs duty + AIDC/cess (+ any applicable surcharge) + IGST on the assessable value.

-

Wholesaler/jeweller prices metal to reflect the landed cost plus margin.

-

Your jewellery invoice splits: metal value (3% GST) + making charges (5% GST if billed separately) + hallmarking or other fees if any.

-

Quick GST cheat‑sheet (buy side)

|

Transaction type |

What GST applies |

Typical rate |

Notes |

|---|---|---|---|

|

Jewellery (ready‑made; metal and making itemised) |

3% on metal value; 5% on making charges |

3% (metal), 5% (making) |

Classic split bill; ensures correct gold buying and selling tax treatment. |

|

Jewellery (composite supply; single bundled price) |

GST per composite supply treatment |

Typically 3% on the composite value |

Principal supply is gold; some jewellers still show a split for clarity. |

|

Coins/Bars (physical) |

3% on metal value |

3% |

No making charges unless special finish; premiums vary by mint/brand. |

|

Digital gold/silver |

3% on purchase |

3% |

One‑time GST at buy; spread covers storage/insurance. On OroPocket, you also earn Bitcoin rewards. |

|

Jewellery repair/service |

5% on service charges |

5% |

Separate from any parts replaced; ask for service invoice. |

|

SGB (Sovereign Gold Bonds) |

No GST on units |

0% |

Brokerage/platform fees (if any) may attract 18% GST as a service. |

|

Gold ETFs / Gold FoFs |

No GST on units |

0% |

Fund expenses are embedded; brokerage STT/charges as applicable, not GST on units. |

|

Import of bullion (context) |

IGST on assessable value after customs/AIDC |

IGST typically 3% |

Import duties (basic duty + AIDC/cess) shape landed cost and downstream prices. |

Where buyers go wrong

-

Mixing up taxes: 3% GST applies on the metal value; 5% GST applies only to making/repair charges. If everything is clubbed, ask how they’ve treated composite supply and tax.

-

Ignoring import layers: Duty + AIDC/cess become part of the assessable base on which IGST gets calculated at import – this filters into the final retail price you pay.

When to ask for a breakup bill

-

Request an invoice that clearly shows:

-

Metal value (₹/g and total)

-

Making charges (per gram or fixed)

-

GST split: 3% on metal, 5% on making/repair

-

HUID (Hallmark Unique ID) for hallmarked jewellery

-

Any other fees (e.g., testing, hallmarking, wastage terms)

-

“In Union Budget 2024–25, India cut total import duty on gold and silver by reducing the Basic Customs Duty to 5% and AIDC to 1%, which fed into lower domestic prices.” – Source

Make every rupee work harder:

-

On OroPocket, buy digital gold/silver from ₹1 via UPI, get a clean tax invoice, and earn free Bitcoin rewards on every purchase – so your gold in finance strategy compounds smarter.

Start now: download the OroPocket app at https://oropocket.com/app

Capital gains when you sell gold/silver: holding period, rates, indexation

How capital gains are computed

-

Capital gain = Sale price – Cost of acquisition (indexed where permitted) – Transfer expenses (e.g., brokerage, platform fee, making‑to‑melt conversion fee, demat charges for SGB sale).

-

FIFO is typically used when you’ve made multiple buys (daily/weekly SIPs or UPI micro‑purchases). The earliest units you bought are considered sold first.

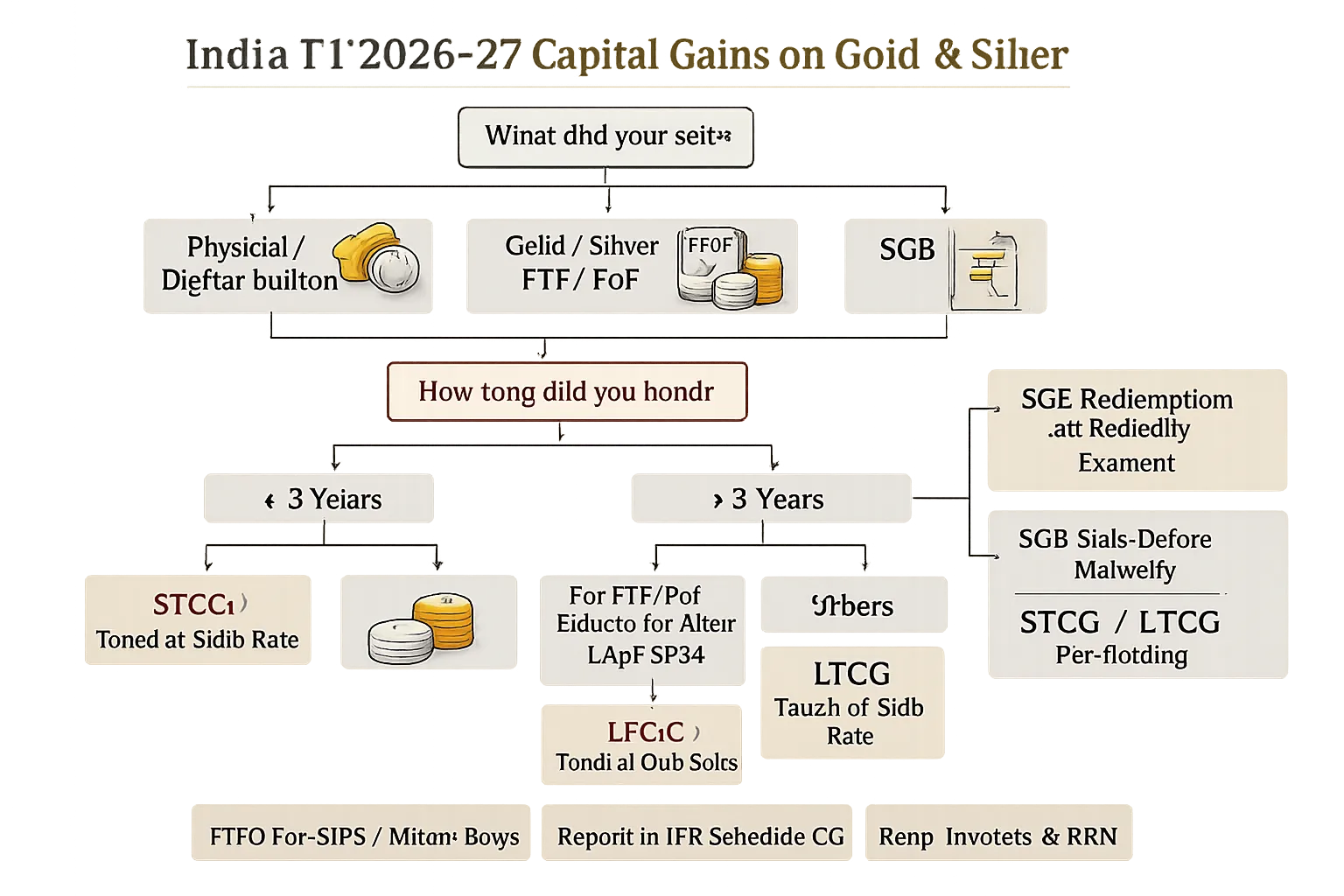

Holding period: when STCG turns into LTCG

-

Physical gold/silver (jewellery, coins/bars): LTCG if held > 36 months; else STCG.

-

Digital gold/silver (vault‑backed): Same as physical – LTCG if held > 36 months; else STCG.

-

Gold/Silver ETFs or Gold/Silver FoFs:

-

Units purchased on/after 1 Apr 2023: Taxed at slab rates regardless of holding period (no indexation).

-

Units purchased before 1 Apr 2023: LTCG if held > 36 months; else STCG.

-

-

Sovereign Gold Bonds (SGBs):

-

Redemption with RBI at maturity: Capital gains fully exempt.

-

Sale on exchange before maturity: Capital gains taxable. If held > 12 months (listed security), treated as LTCG; ≤ 12 months, STCG.

-

Current practice on tax rates (FY 2026–27)

-

Physical/digital bullion:

-

STCG: Taxed at your slab rate.

-

LTCG: 20% with indexation (plus applicable cess/surcharge).

-

-

Gold/Silver ETFs or FoFs:

-

Bought on/after 1 Apr 2023: Slab rate (no indexation) irrespective of holding.

-

Bought before 1 Apr 2023: STCG at slab (≤ 36 months); LTCG 20% with indexation (> 36 months).

-

-

SGBs:

-

Redemption at maturity: Capital gains exempt; the 2.5% coupon interest is taxable at slab.

-

Pre‑maturity transfer/sale: Period‑based capital gains; LTCG on listed bonds often taxed at 10% without indexation (as listed securities), STCG at slab. Check latest CBDT clarifications for your scenario.

-

-

Always verify the latest CBDT/IT Act updates before filing; rules can be rationalised.

Capital gains snapshot across instruments

|

Instrument |

Holding period for LTCG |

STCG tax |

LTCG tax and indexation |

GST on buy |

Special notes |

|---|---|---|---|---|---|

|

Physical gold/silver (jewellery, coins/bars) |

> 36 months |

Slab rate |

20% with indexation |

3% on metal value; 5% on making/repair (service) |

Keep invoices/hallmark HUID; transfer expenses deductible; wastage/assay costs can be part of transfer expenses. |

|

Digital gold/silver (vault‑backed) |

> 36 months |

Slab rate |

20% with indexation |

3% at purchase |

Treated like movable asset; FIFO for SIPs/micro‑buys; spread covers storage/insurance. |

|

Gold/Silver ETF or FoF |

Pre‑1 Apr 2023 buys: > 36 months; Post‑1 Apr 2023: NA |

Pre‑1 Apr 2023: Slab (≤ 36 months); Post‑1 Apr 2023: Slab regardless |

Pre‑1 Apr 2023: 20% with indexation (> 36 months); Post‑1 Apr 2023: NA (slab only) |

0% on units |

Fund expenses embedded; brokerage/transaction charges apply; check grandfathering of pre‑2023 units. |

|

Sovereign Gold Bonds (SGBs) |

Redemption at maturity: Exempt; Exchange sale: > 12 months (listed) |

Slab rate (≤ 12 months on exchange sale) |

Redemption: Exempt; Exchange sale LTCG: commonly 10% without indexation as listed security (verify latest CBDT) |

0% on units (brokerage/service may attract GST) |

2.5% interest is taxable; TDS not deducted on interest for residents but reported in ITR; maintain contract notes for exchange sales. |

Examples at a glance

-

Sold within short holding (slab outcome)

-

You buy digital gold at ₹20,000 and sell 8 months later for ₹23,000. STCG = ₹3,000. If you’re in the 30% slab, tax ≈ ₹900 (+ cess/surcharge).

-

-

Held long‑term (indexation reduces tax)

-

You bought a gold coin for ₹1,00,000 and sell after 4 years for ₹1,45,000. Suppose indexed cost (using CII) = ₹1,20,000. LTCG = ₹25,000; tax at 20% = ₹5,000 (+ cess/surcharge). Without indexation, the gain would have been ₹45,000 – indexation lowers your taxable gain.

-

-

FIFO for mixed‑date lots (SIPs/UPI micro‑buys)

-

You purchased 1 g monthly for 6 months, then sold 3 g. Under FIFO, the first 3 monthly lots are considered sold. If those were ≤ 36 months old, gains are STCG; if older lots cross 36 months, they fall into LTCG.

-

Plan your gold investment in India the smart way: keep invoices, track lot dates, and use FIFO to compute the right tax. Prefer clean splits (metal vs making) when gold buying and selling jewellery to preserve documentation.

Invest small, stay compliant, and earn more on every purchase. Download OroPocket and start building gold in finance from ₹1 – plus get free Bitcoin rewards on every buy: https://oropocket.com/app

SGBs, ETFs and gold/silver mutual funds: specific tax rules

Sovereign Gold Bonds (SGBs)

-

Buy: No GST on units; brokerage/service charges (if any) may attract 18% GST.

-

Holding: Earn 2.5% p.a. interest (paid semi‑annually). This interest is taxable at your slab; for most resident individuals, there is no TDS deduction by the issuer.

-

Exit:

-

Redemption at maturity with RBI: Capital gains are fully exempt for individuals.

-

Secondary‑market sale before maturity: Taxed as capital gains based on holding period (listed security rules; check latest CBDT guidance).

-

“Interest on the Bonds shall be taxable as per the provisions of the Income-tax Act, 1961. The capital gains tax arising on redemption of SGB to an individual has been exempted.” – Source

Gold ETFs/Silver ETFs and gold/silver mutual funds

-

Buy: No GST on units; brokerage/transaction charges may apply; fund expense ratio is embedded in NAV for ETFs/FoFs.

-

Tax on sale:

-

Gold/Silver ETFs/FoFs purchased on/after 1 Apr 2023: Capital gains taxed at your slab rate irrespective of holding period (no indexation).

-

Units purchased before 1 Apr 2023: ≤ 36 months → STCG at slab; > 36 months → LTCG at 20% with indexation (verify grandfathering in your case).

-

What’s best for whom

-

Long‑term wealth builders: SGBs suit buy‑and‑hold investors seeking tax‑free maturity gains plus 2.5% interest (taxable) and no management fees.

-

Tactical allocators/traders: ETFs offer intraday liquidity, live pricing, and ease of rebalancing – best for shorter tactical moves despite slab‑rate taxation for newer units.

-

Micro‑investors and habit builders: Digital gold/silver via OroPocket enables ₹1 UPI purchases, clear GST invoicing, and free Bitcoin rewards – ideal for daily/weekly SIPs, gifting, and goal‑based stacking.

Start compounding smarter with OroPocket: buy gold/silver from ₹1, earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

TDS/TCS, cash limits and PAN rules on high‑value bullion and jewellery

TDS/TCS when businesses trade gold/silver

-

Section 194Q (buyer TDS 0.1%): Applies if your previous FY turnover exceeds ₹10 crore and aggregate purchases from a seller exceed ₹50 lakh in the current FY. Covers “goods,” which includes bullion/jewellery. Not applicable to personal purchases by consumers.

-

Section 206C(1H) (seller TCS 0.1%): Seller collects on receipts exceeding ₹50 lakh from a buyer in a FY. If 194Q applies, 194Q takes precedence and 206C(1H) generally does not apply simultaneously to the same transaction.

-

Practical note: Reconcile PAN‑wise thresholds, exclude GST where law/clarifications prescribe, and ensure one provision applies – not both – on the same leg.

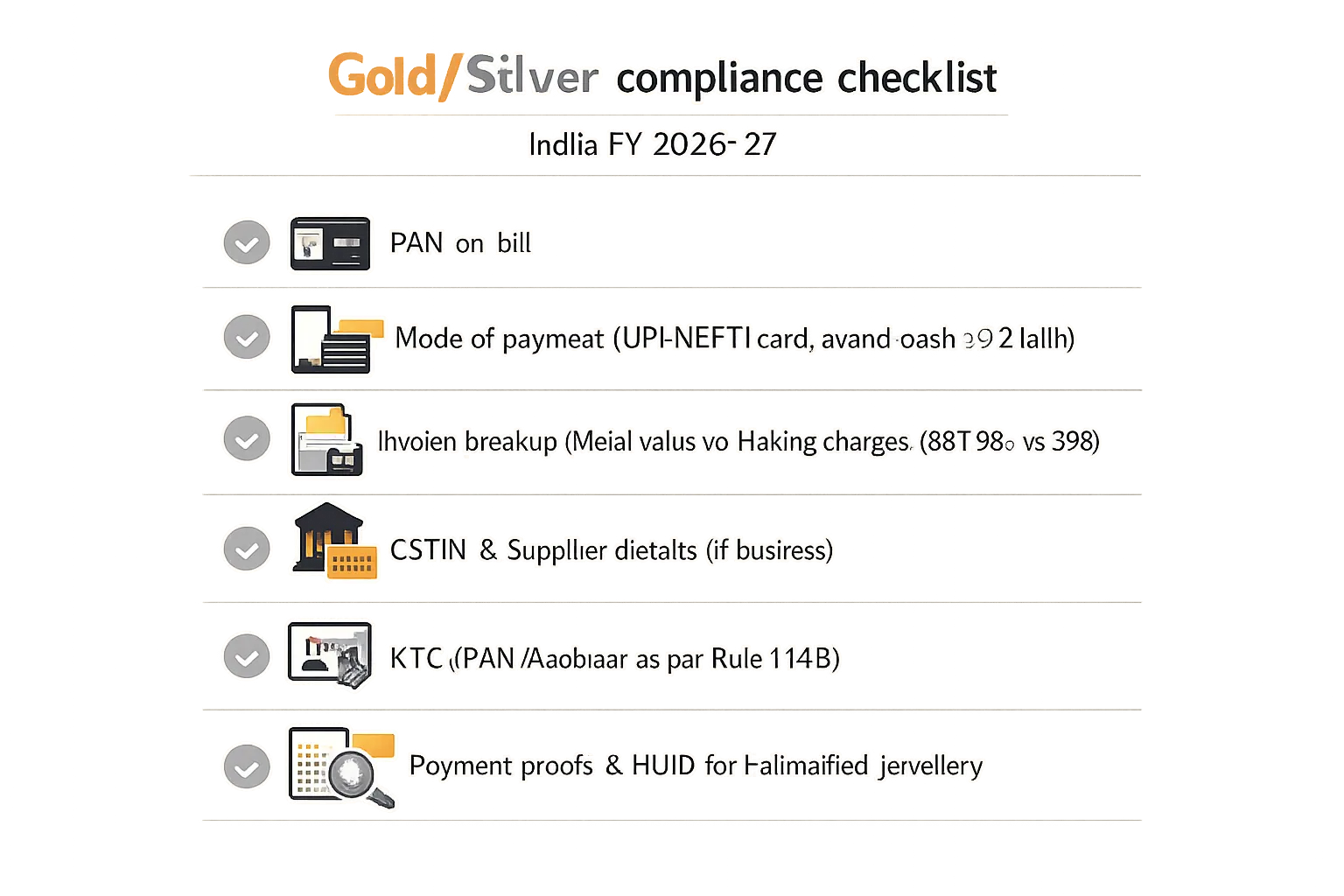

Cash and KYC norms consumers must know

-

Section 269ST: Restricts cash receipts of ₹2,00,000 or more per person, per day/occasion/transaction. High‑value jewellery/bullion buys should be paid via UPI/NEFT/RTGS/card for a clean trail.

-

PAN/Aadhaar quoting (Rule 114B): PAN is mandatory for jewellery/bullion transactions above prescribed thresholds; KYC may require Aadhaar and address proof. Jewelers often request PAN even below thresholds to meet audit and AML norms.

-

Why digital is cleaner: UPI and bank transfers create an audit‑friendly trail, simplify ITR reporting, and avoid penalties tied to cash breaches.

NRI notes in brief

-

TDS may apply on certain redemptions or capital gains payments to non‑residents at rates in force under the Income‑tax Act/tax treaty. Maintain FEMA/RBI documentation and share a valid TRC/Form 10F where applicable to claim treaty benefits.

Practical compliance tips

-

Always capture PAN on the invoice for high‑value buys; verify your name and PAN spelling.

-

Prefer UPI/NEFT/card over cash; retain payment proofs and bank statements.

-

Ask for a breakup bill: metal value, making charges, and GST split (3% on metal, 5% on making/repair); include HUID for hallmarked jewellery.

-

If you run a business: ensure GSTIN, supplier GSTIN, place of supply, HSN codes, and correct TCS/TDS treatment; reconcile PAN‑wise thresholds monthly.

“UPI crossed 10+ billion transactions per month in 2025; in August 2025 alone, it processed over 20 billion transactions.” – Source

Stay compliant, buy smart, and keep your paperwork tight. Use OroPocket to buy gold/silver from ₹1 via UPI with clean invoices and free Bitcoin rewards on every purchase: https://oropocket.com/app

Worked examples you can copy: jewellery, coins/bars, digital SIP, SGB

Example A – Jewellery purchase today, sale within 18 months

-

Buy today:

-

Metal value (10 g): ₹70,000

-

Making charges (10%): ₹7,000

-

GST on metal @3%: ₹2,100

-

GST on making @5%: ₹350

-

Total invoice: ₹79,450

-

Note: For capital gains, the cost of acquisition typically includes everything you paid to acquire (metal + making + GST), provided you have a proper invoice.

-

-

Sell after 18 months (STCG at slab):

-

Assume market price = ₹9,000/g; jeweller pays 2% below = ₹8,820/g

-

Sale proceeds: 10 g × ₹8,820 = ₹88,200

-

Short‑term capital gain (FIFO not needed as single lot): ₹88,200 − ₹79,450 = ₹8,750

-

Tax: STCG taxed at your slab rate (+ cess/surcharge)

-

Tip: Always ask for a breakup invoice (metal vs making) and keep the HUID on record – helps prove cost.

Example B – Digital gold SIP via UPI (₹100/day for 200 days), partial sale at day 400

-

Accumulation (illustrative pricing):

-

Days 1–50: price ₹6,000/g; buy ₹100/day ⇒ 0.016667 g/day ⇒ total ≈ 0.8333 g (cost ≈ ₹5,000)

-

Days 51–200: price ₹6,500/g; buy ₹100/day ⇒ 0.0153846 g/day ⇒ total ≈ 2.3077 g (cost ≈ ₹15,000)

-

Total holding ≈ 3.1410 g; total cost = ₹20,000

-

-

Sell on day 400 (all lots < 36 months ⇒ STCG):

-

Assume sell price = ₹7,200/g; you sell 1.0000 g ⇒ sale proceeds = ₹7,200

-

FIFO cost of 1.0000 g:

-

First 0.8333 g from days 1–50 @ ₹6,000/g ⇒ ₹5,000

-

Next 0.1667 g from days 51–200 @ ₹6,500/g ⇒ ≈ ₹1,083

-

Total FIFO cost ≈ ₹6,083

-

-

STCG ≈ ₹7,200 − ₹6,083 = ₹1,117 (taxed at your slab)

-

-

If you sold after 36 months:

-

Any grams older than 36 months from purchase date would be LTCG (20% with indexation). Younger grams remain STCG – FIFO decides which grams were sold.

-

Pro tip: OroPocket auto‑tracks every micro‑buy, making FIFO and cost reporting easier at tax time.

Example C – Silver bar held 4+ years, then sold (indexation)

-

Buy (FY 2021–22): 1 kg bar for ₹50,000; Sell (FY 2026–27): ₹85,000

-

Indexation (illustrative CII values – use actual CBDT CII for filing):

-

Suppose CII (purchase year) = 317; CII (sale year) = 400

-

Indexed cost = ₹50,000 × (400 ÷ 317) ≈ ₹63,090

-

LTCG = ₹85,000 − ₹63,090 ≈ ₹21,910

-

Tax = 20% of ₹21,910 ≈ ₹4,382 (+ cess/surcharge)

-

-

Notes:

-

Keep invoice, purity, and serial number (for bars) as documentation.

-

Transfer expenses (assay, exchange fees) can reduce taxable gain if directly related to the sale.

-

Example D – SGB held to maturity

-

Buy at primary issue: 10 units (10 g) @ ₹5,800/g = ₹58,000; no GST on units.

-

Interest: 2.5% p.a., paid semi‑annually ⇒ annual interest ≈ ₹1,450 (taxed at slab; generally no TDS for resident individuals).

-

Redeem at maturity (8 years): Suppose redemption price ₹7,800/g ⇒ proceeds = ₹78,000.

-

Tax at exit: Capital gains on redemption for individuals are exempt. Only interest was taxable annually.

Start your habit the smart way: build a daily/weekly OroPocket SIP from ₹1 via UPI, keep clean invoices for taxes, and earn free Bitcoin on every buy. Download now: https://oropocket.com/app

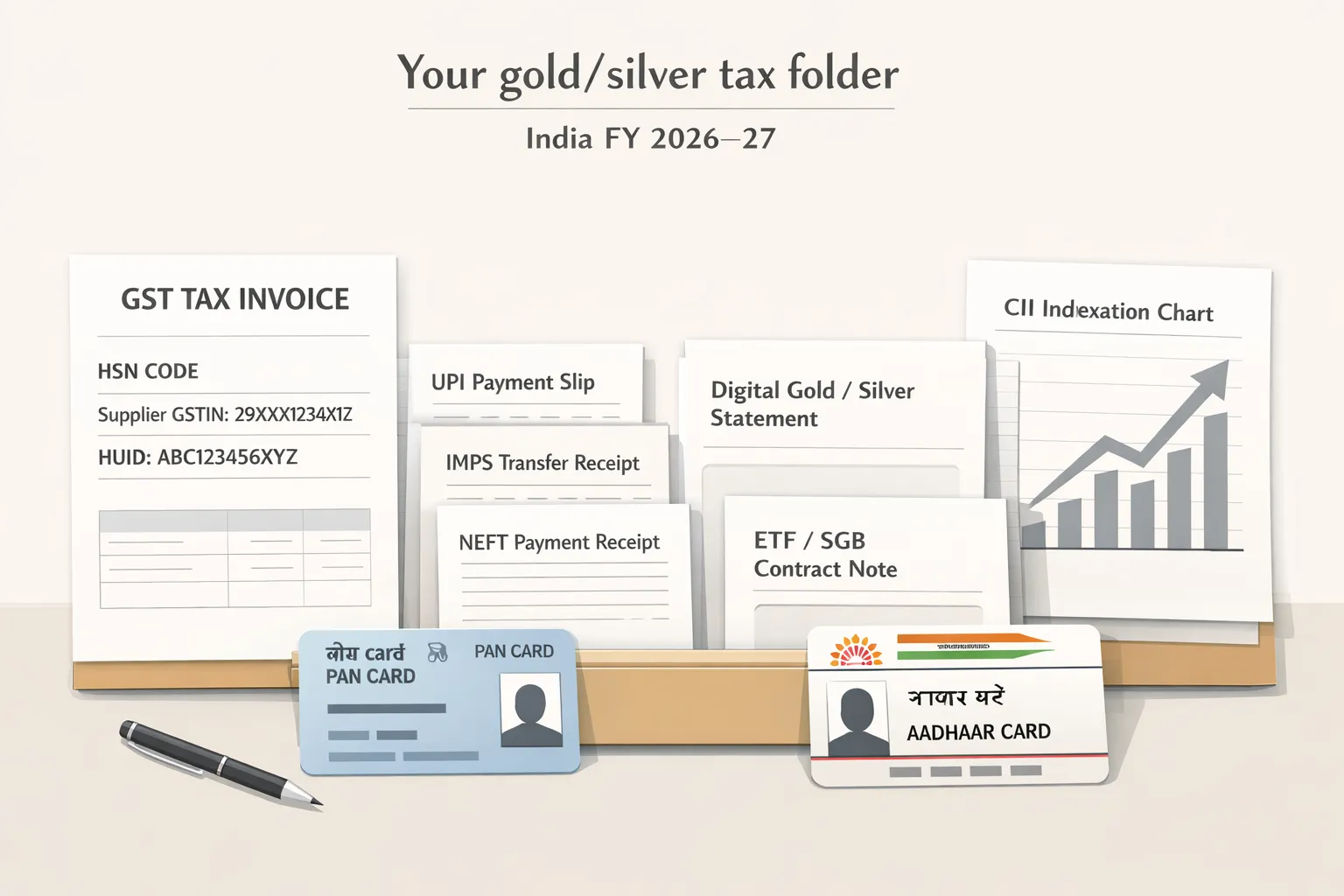

Records you must keep: make tax filing painless

Keep these for every buy/sell

-

GST tax invoice with HSN, HUID (for hallmarked jewellery), supplier GSTIN, place of supply, and invoice number/date.

-

Payment proofs: UPI/IMPS/NEFT/card slips, bank statements, and receipt acknowledgements; PAN/Aadhaar references for high‑value transactions.

-

Platform statements for digital gold/silver, FIFO lot history, and monthly/annual summaries; ETF/SGB contract notes or demat statements.

For capital gains computation

-

Purchase dates, quantities, rates; sale dates, quantities, rates; and transfer expenses (assay, brokerage, platform fees).

-

CII reference for indexation (if applicable) and calculation sheets; scrip‑wise working for ETFs/FoFs; FIFO download for SIPs/micro‑buys.

Reporting in ITR

-

Individuals usually file ITR‑2 for capital gains; use ITR‑3 if treating trades as business income.

-

Fill Schedule CG (capital gains), disclose scrip‑wise where required; include interest on SGBs under “Income from Other Sources.”

-

Reconcile Form 26AS and AIS/TIS with your invoices and statements to avoid mismatch notices.

Make documentation a habit. OroPocket emails in‑app invoices for every ₹1 buy via UPI and keeps a complete FIFO ledger – so your FY 2026–27 filing is click‑simple. Download: https://oropocket.com/app

Planning tips to reduce tax drag (without breaking rules)

Pick the right instrument for the job

-

SGB for long‑term allocation: Maturity redemption gains are exempt for individuals; you also earn 2.5% interest (taxable). Ideal for core, set‑and‑forget gold allocation.

-

ETFs for liquidity and price‑based tactics: Intraday trading, easy rebalancing. Note: Most units bought on/after 1 Apr 2023 are taxed at slab rates on sale (no indexation).

-

Digital gold/silver for habit building and gifting: Start from ₹1 via UPI, automate daily/weekly SIPs, gift small amounts, and keep clean, GST‑compliant invoices. Great for first‑time investors and goal‑based stacking.

-

Coins/bars vs jewellery: For pure investing, coins/bars minimize making charges; jewellery is best for use + sentiment. Always compare the gold buy and sell price and the spread you’re paying.

Timing matters

-

Cross the LTCG threshold: For physical/digital bullion, holding > 36 months may qualify for LTCG with indexation – often a lower effective tax than slab‑rate STCG.

-

SGB exits: If you’re close to maturity, prefer redemption (exempt gains) over secondary‑market sale (taxable capital gains).

-

ETFs/FoFs: If you hold legacy units bought before 1 Apr 2023, consider the > 36‑month window for indexation; newer units are slab‑taxed regardless of period – plan exits accordingly.

-

Harvest losses, offset gains: Short‑term capital loss (STCL) can set off against STCG and LTCG; long‑term capital loss (LTCL) can set off only against LTCG. File your ITR on time to carry forward losses up to 8 years.

Transaction hygiene

-

Use UPI/bank modes; avoid cash to stay clear of Section 269ST issues and to maintain an audit trail.

-

Get clean invoices: Ask for a breakup – metal value (3% GST) vs making/repair charges (5% GST), HSN/HSN code, GSTIN, HUID for hallmarked jewellery.

-

Separate personal vs business: Distinct bank accounts and GSTIN (if applicable). For business purchases, reconcile TDS/TCS (Sections 194Q/206C(1H)) and maintain PAN‑wise thresholds.

Gifting and family planning

-

Know Section 56(2) rules: Gifts from specified relatives (e.g., spouse, parents, siblings, lineal ascendants/descendants) are tax‑exempt for the recipient; gifts from non‑relatives may be taxable if aggregate value exceeds ₹50,000 in a FY.

-

Clubbing check: If you gift to spouse or minor child, subsequent income may be clubbed back to you – plan ownership and timing accordingly.

-

Document gifts: Simple gift deed, PAN/Aadhaar copies, transfer proofs, and updated holding records (FIFO lot history if digital).

Always verify latest circulars

-

Budget changes can tweak holding periods, indexation, and ETF/MF tax categories. Before large sells or switching instruments, review the latest CBDT/CBIC notifications and your broker/platform tax notes.

Smart execution beats timing:

-

Compare platforms for tight spreads and transparent fees in your gold investment in India.

-

Prefer coins/bars for pure investing; keep jewellery making charges in check.

-

SIP with discipline, then wait for your oldest lots to cross 36 months before selling – FIFO will reward your patience.

Build your plan in minutes: buy digital gold/silver from ₹1 via UPI, track FIFO automatically, and earn free Bitcoin on every purchase with OroPocket. Download now: https://oropocket.com/app

FAQs: fast answers for 2026–27

Is GST the same on 22k vs 24k gold? On silver too?

-

Yes. GST is 3% on the metal value regardless of purity (22k/24k gold or silver). Services like making/repair attract 5% GST when billed separately.

Do I pay GST when I buy ETFs/SGBs?

-

No GST on fund units or SGB units. Brokerage/platform service charges (if any) may carry 18% GST. The underlying metal’s taxes are handled at the issuer level.

How are digital gold/silver sales taxed?

-

Exactly like physical metal: capital gains based on your holding period (STCG at slab, LTCG rules where applicable). Use FIFO if you made multiple purchases (SIPs/micro‑buys).

Do individuals face TDS on personal purchases?

-

Typically no. TDS/TCS provisions mainly apply to business‑scale trade or when statutory thresholds are crossed. Routine personal jewellery/coin/digital buys don’t generally attract TDS.

How do I report in ITR?

-

Report gains in the Capital Gains schedules (ITR‑2 for most individuals; ITR‑3 if you treat activity as business). Report SGB interest under “Income from Other Sources.” Keep invoices, platform statements, and reconcile with 26AS/AIS.

Make gold investing simple and compliant: buy from ₹1 via UPI, get clean invoices, and earn free Bitcoin on every purchase with OroPocket. Download now: https://oropocket.com/app

Conclusion: start building tax‑smart gold and silver with OroPocket

-

Buy from ₹1 via UPI; perfect for SIPs and festival top‑ups. No paperwork, no minimums – just instant gold investment in India in under 30 seconds.

-

Earn free Bitcoin (Satoshis) on every gold/silver buy – two assets for the price of one. Build long‑term gold in finance while stacking BTC rewards.

-

Daily streaks and spin‑to‑win keep you consistent; secure 24K gold/silver, 100% insured vaults, authorized partners.

-

Clean invoices and downloadable statements make GST and capital gains filing simple – FIFO‑ready histories, clear gold buying and selling records, and accurate gold buy and sell price snapshots.

-

Ready to modernise your gold and silver plan? Download the OroPocket app: https://oropocket.com/app

What is gold investment in 2026–27? Simple: buy frequently, keep costs low, stay compliant, and hold smart. OroPocket helps you do all four – so your money works harder, every single day.