What are the disadvantages of paper gold?

Introduction: Paper gold vs physical gold – and why the “paper” route has hidden downsides

Gold is the default safety net for most Indians. But the moment you try to invest, you hit a fork: paper gold (ETFs, SGBs, “digital gold”) or physical gold (coins, bars, jewellery). Paper gold looks easier on the surface – no lockers, no making charges – but it also comes with hidden trade-offs: counterparty risk, tax quirks post-2023, liquidity traps in SGBs, and platform-level differences in digital gold. This guide helps you cut through the noise.

Who this guide is for

-

First-time investors weighing convenience (paper gold) vs control (physical)

-

Indian investors confused by ETFs, SGBs, digital gold, and taxes post-2023

What you’ll learn

-

The real disadvantages of paper gold products in India

-

Where physical gold still wins (and where it doesn’t)

-

A quick decision framework to choose the right mix

At-a-glance comparison (read this first)

|

Feature |

Paper Gold (ETFs, SGBs, Digital Gold) |

Physical Gold (Coins, Bars, Jewellery) |

|---|---|---|

|

Ownership |

Indirect: ETF/MF units, SGB claim on cash equivalent of gold, or platform-allocated vaulted gold |

Direct, tangible metal you control |

|

Counterparty risk |

Present: AMC/custodian (ETF/MF), sovereign issuer (SGB), platform/vault partner (digital gold) |

Minimal: no issuer risk; risks are storage, theft, and assay/purity at resale |

|

Liquidity |

ETFs: high intraday; SGBs: tradable but often thin; early redemption only from year 5; Digital gold: typically instant on platform |

Moderate: jeweller/buyer dependent; may face buy–sell spreads and purity checks |

|

Trading costs/spreads |

ETFs: expense ratio + brokerage + bid–ask; SGBs: no making charge; potential secondary market discount/premium; Digital: platform spreads |

Jewellery: making/wastage 3–25%; coins/bars lower spreads; potential assay fee at sale |

|

Taxes |

ETFs/digital gold: capital gains as per current non-equity rules; STCG at slab, LTCG per latest norms; SGBs: 2.5% interest taxable; capital gains on redemption at maturity exempt |

STCG at slab (<3 years); LTCG with indexation benefits (>3 years), as per Income Tax rules |

|

Lock-ins |

ETFs/digital: none; SGB: 8-year tenor with exit windows from year 5 |

None |

|

Collateral/loan access |

SGBs eligible as collateral with banks/NBFCs; ETFs may be pledgeable with brokers; digital gold acceptance limited |

Widely accepted for gold loans across banks/NBFCs/jewellers |

|

Regulatory oversight |

ETFs/MFs: SEBI; SGBs: RBI/Govt. of India; Digital gold: not directly regulated by SEBI/RBI – relies on vaulting partners and industry standards |

No capital markets regulator; BIS hallmarking standards, jeweller practices |

|

Minimum investment |

ETFs: cost of 1 unit + demat; SGBs: 1 gram; Digital gold: as low as ₹1 on some apps |

Typically ≥0.5–1g coin; higher effective minimum due to making charges |

Quick context

-

India’s demand for gold stays structurally strong thanks to weddings, festivals, and its role as an inflation hedge – yet the way we buy is changing fast with UPI and mobile apps.

-

OroPocket fits right into this shift: a modern, mobile-first way to buy/sell 24K digital gold and silver from just ₹1 via UPI – plus Bitcoin rewards on every purchase. We’ll cover how that stacks up in the verdict later.

“India’s gold demand rose 5% year-on-year to 802.8 tonnes in 2024.” – Source

“India purchased 611 tonnes of gold jewellery in 2021, the second-largest globally after China.” – Source

What actually counts as paper gold in India? (ETFs, SGBs, Digital Gold, Gold FoFs)

Gold ETFs

-

What they are: Units of a mutual fund that track domestic gold prices through underlying physical gold and/or derivatives.

-

How they work: Market makers create/redeem units against baskets of physical gold; NAV reflects underlying holdings minus expense ratio; performance may differ slightly due to tracking error.

-

Where they trade: Listed on stock exchanges; you need a demat account and a broker to buy/sell intraday like any other ETF.

Sovereign Gold Bonds (SGBs)

-

What they are: Government-backed bonds with value linked to gold and an 8-year maturity.

-

Returns: Semi-annual interest (coupon) plus gold-price-linked redemption; special tax treatment if held to maturity.

-

Liquidity: Available in RBI/Government primary tranches; tradable on exchanges in demat form, but secondary liquidity can be patchy; early exit windows from year 5 on coupon dates.

Digital Gold

-

What it is: Fractional 24K gold purchased from private providers and vaulted on your behalf with authorized partners.

-

Experience: App-based KYC, seamless UPI payments, instant buy/sell; optional doorstep delivery (fees apply), gifting features.

-

Oversight: Not an RBI/SEBI-regulated security; investor protection depends on provider’s custody model, vault insurance, and transparency.

Gold Mutual Funds/FoFs

-

What they are: Fund-of-funds that primarily invest in gold ETFs; convenient for SIPs and investors without demat.

-

Costs and structure: Adds an extra expense layer over the underlying ETF; check total expense ratio and tracking impact.

-

Tax note: Post Apr 1, 2023, taxation aligns with current non-equity debt-like rules for many gold funds – verify latest norms before investing.

The big disadvantages of paper gold (that most ads gloss over)

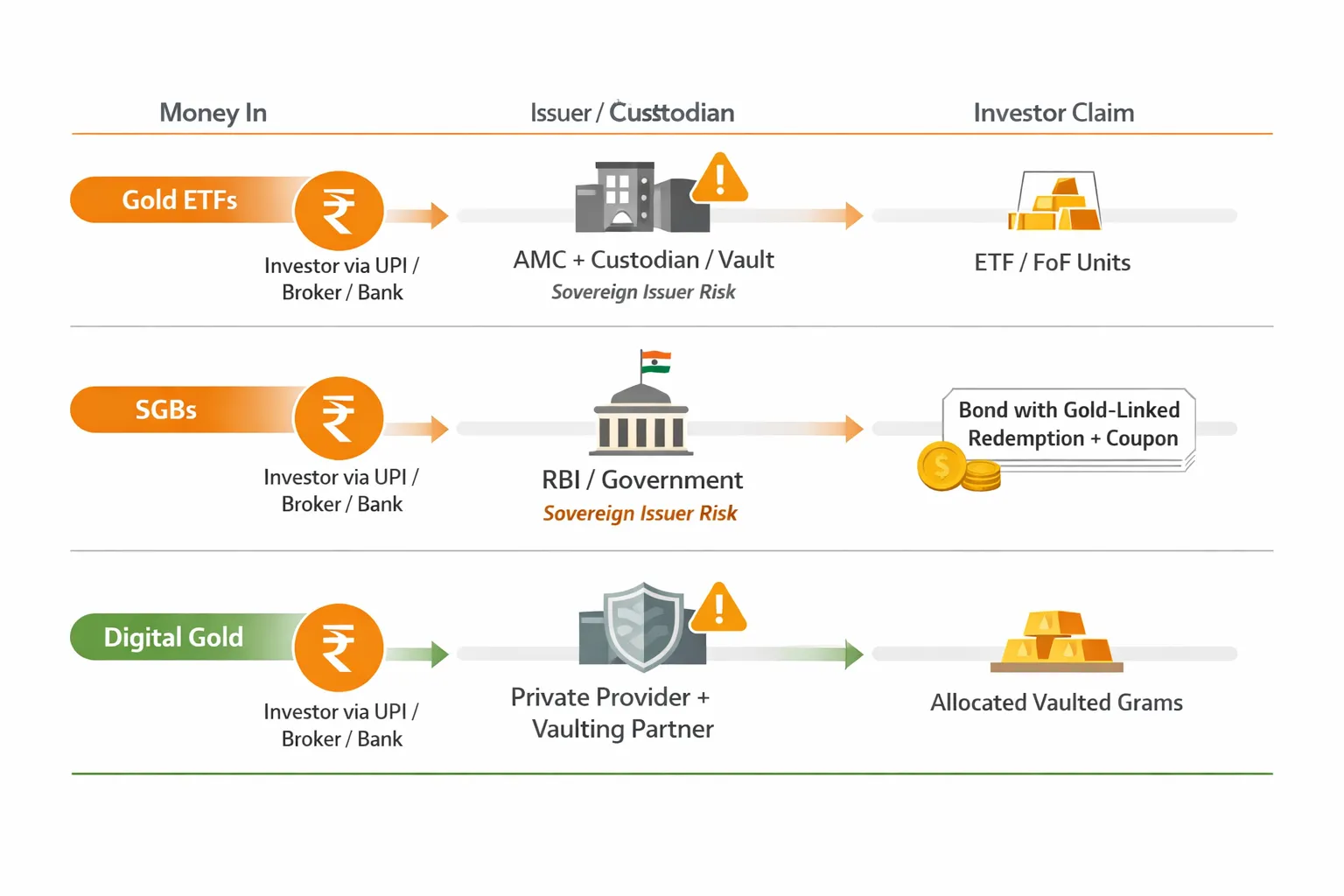

1) Counterparty and issuer risk (varies by product)

Paper gold always introduces an intermediary. That’s the trade-off for convenience.

-

ETFs/FoFs: You rely on the fund house, trustee, custodian, and authorized participants/market makers. Operational lapses, custody failures, or persistent tracking gaps are not your fault – but they affect your outcome.

-

Digital gold: Your claim is on a private provider’s vaulted metal. You’re trusting their custody chain (vault partner, insurer, auditor) and their operational discipline. If the provider changes partners, halts operations, or faces disputes, your access could be temporarily affected.

-

SGBs: Backed by the Government of India (lowest sovereign risk in India), but it’s still an issuer instrument. Your redemption is in INR based on the gold price; you never take possession of metal.

Practical takeaway: With paper gold, your risk isn’t just the gold price – it’s also the platform and the product structure.

2) Tracking error and cost drag

Even when paper gold tracks gold, frictions accumulate.

-

ETFs/FoFs: Expense ratios, creation/redemption frictions, and cash/derivatives buffers create tracking error versus the domestic gold price. Over years, that gap compounds.

-

Digital gold: While many platforms quote live prices, buy–sell spreads and exit fees can eat into returns – especially if you transact frequently or in small tickets. Delivery, if you opt for it, adds making/shipping/insurance costs and may attract GST on making/delivery.

Practical takeaway: “Gold price up 10%” doesn’t guarantee your paper position is up 10%.

3) Liquidity that disappears when you need it most

The promise of “instant liquidity” can be conditional.

-

ETFs: In stressed markets, bid–ask spreads widen and market depth thins. You can exit – but at a worse price. Low-AUM or niche gold FoFs can be even stickier.

-

SGBs: Secondary market liquidity is patchy. Traded prices can deviate from theoretical value (premium/discount), and getting large quantities offloaded without price impact can be hard.

Practical takeaway: Liquidity is market- and product-dependent, not guaranteed at your ideal price.

4) Tax surprises after 2023

Rules changed – and many investors missed the memo.

-

Gold FoFs/ETFs purchased on/after Apr 1, 2023 generally fall under the newer non-equity mutual fund tax regime, which can remove earlier long-term indexation benefits and lead to slab-rate treatment for many investors. Always confirm the latest rules with a tax advisor.

-

Digital gold taxation follows capital gains on sale/redemption per prevailing rules; verify specifics with your provider and CA.

-

SGBs: Semi-annual interest is taxable. Capital gains on redemption at maturity are exempt for individuals – unique to SGBs.

-

Physical gold: Retains the traditional STCG/LTCG framework (indexation after 3 years), subject to current tax laws.

Practical takeaway: Two “gold” products can have very different after-tax outcomes. Don’t assume parity.

5) Redemption and delivery constraints

Convenience can hit hard limits at exit.

-

SGBs: 8-year maturity. Premature redemption is allowed only from year 5 and typically on coupon dates. Secondary sales are possible but depend on market demand/price.

-

Digital gold: Physical delivery, if you want it, usually incurs making/shipping/insurance charges and may involve purity verification when converted to bars/coins. Timelines can vary.

Practical takeaway: Check exit routes before you enter – especially for larger allocations.

6) Limited acceptance as collateral

Paper isn’t always welcome at the lending desk.

-

Many lenders prefer physical jewellery/coins for gold loans due to straightforward valuation and possession. Paper instruments (ETFs, FoFs, digital gold) may be excluded, discounted, or accepted only by select brokers/lenders under tighter terms.

-

SGBs are eligible collateral with banks/NBFCs, but loan terms vary and aren’t guaranteed.

Practical takeaway: If you value emergency liquidity via gold loans, physical gold often works better.

7) Platform and operational dependency

Your access is only as good as the system you’re on.

-

Demat/broker outages, app downtimes, KYC re-verification holds, or settlement holidays can delay trades and redemptions.

-

Corporate actions or provider back-end changes can create temporary freezes or revised processes, especially in digital gold ecosystems.

Practical takeaway: Operational friction is invisible – until it isn’t. Build a buffer for timing and access risks.

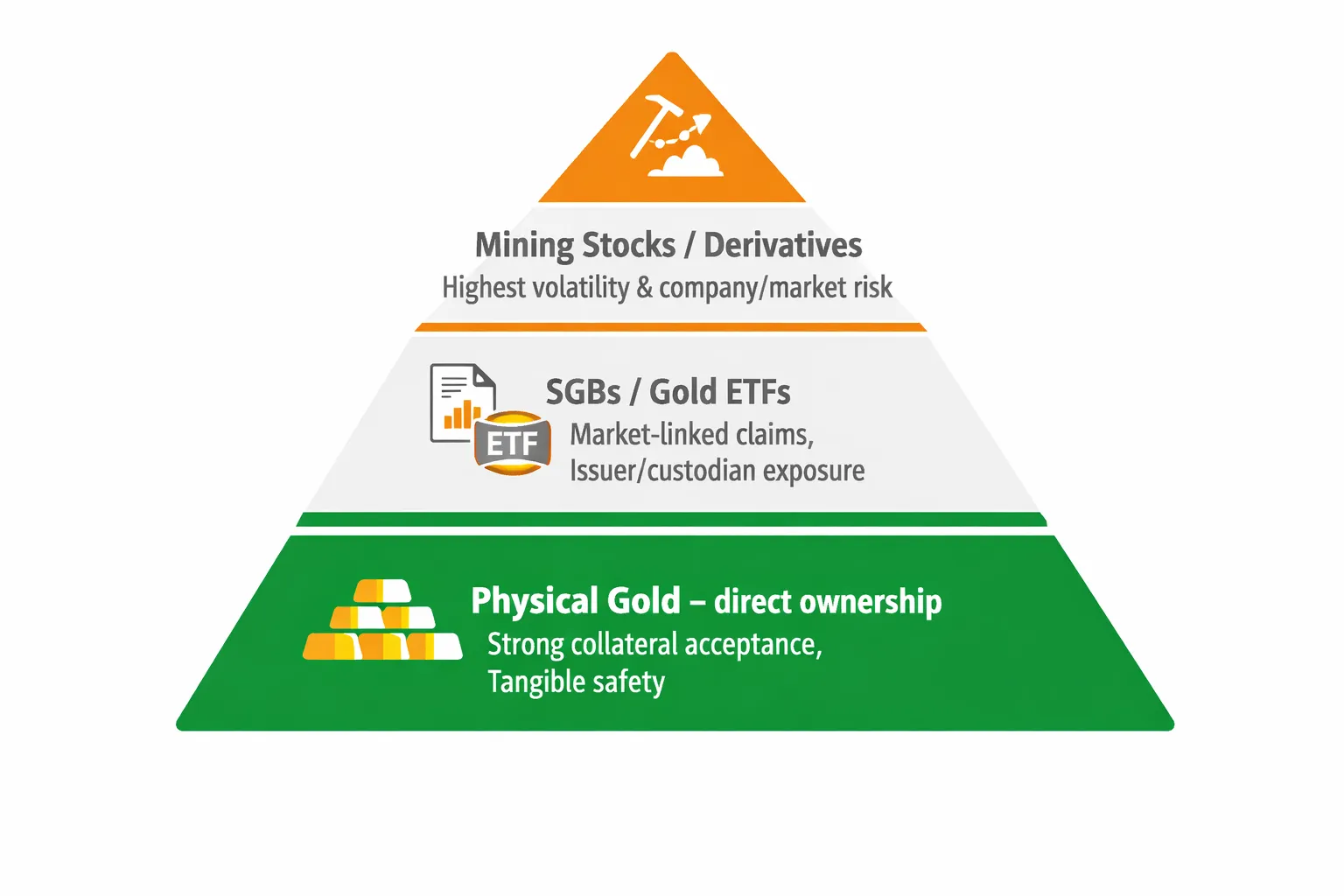

Where physical gold still wins (and where it doesn’t)

Clear wins for physical

-

True, tangible ownership with zero financial intermediary risk

-

Universal acceptability; easier collateral for mainstream gold loans

-

Long-term wealth preservation and cultural utility (gifting, rituals)

The trade-offs you must accept

-

Storage and insurance costs (bank locker/home safe)

-

Making charges on jewellery; premiums on small bars/coins

-

Selling friction vs a click-to-sell ETF

Practical takeaway

-

Physical is your ultimate safety layer; paper is your convenience layer. Most investors want a blend.

Paper gold pitfalls by product: Gold ETFs and Gold FoFs

Key disadvantages to watch

-

Expense ratios + tracking error reduce returns vs spot gold over time

-

Requires Demat + broker; subject to market hours and outages

-

Post-2023 taxation: non-equity mutual fund rules reduce long-hold tax efficiency

-

Creation/redemption can be halted in rare stress events; NAV vs market price gaps

Due diligence checklist

-

Look at 1/3/5-year tracking difference and expense ratio

-

Check average daily turnover and bid-ask spreads

-

Prefer larger AUM and longer track record

Who should avoid

-

Anyone needing assured tax efficiency like SGBs at maturity

-

Those who can’t tolerate occasional discount/premium to NAV

|

Disadvantage |

ETFs/FoFs |

SGBs |

Digital Gold |

|---|---|---|---|

|

Issuer/counterparty risk |

AMC, trustee, custodian, authorized participants; operational and tracking risks |

Sovereign issuer risk (lowest in India), but still an issuer instrument |

Provider, vault partner, insurer; operational continuity and custody chain risk |

|

Liquidity consistency |

Generally good but spreads can widen in stress; FoFs depend on fund flows |

Patchy secondary liquidity; prices may trade at discounts/premiums |

Usually instant on-platform; depends on provider uptime and buyback policy |

|

Tax treatment |

Post-2023 non-equity mutual fund regime; reduced long-hold tax efficiency |

Coupon taxable; capital gains on redemption at maturity exempt for individuals; indexation on transfer |

Capital gains as per prevailing rules; no special maturity exemption |

|

Lock-in |

None |

8-year tenor; early exit from year 5 on coupon dates |

None |

|

Delivery/exit fees |

Brokerage + bid-ask spreads; potential premium/discount to NAV |

No making/delivery; brokerage/spread if sold on exchange |

Buy–sell spread; delivery/making/shipping/insurance charges if opting for physical |

|

Platform dependency |

Demat + broker; market hours; possible outages |

Primary via banks/post offices; secondary via demat/exchanges |

Full reliance on app/provider infrastructure and vaulting partners |

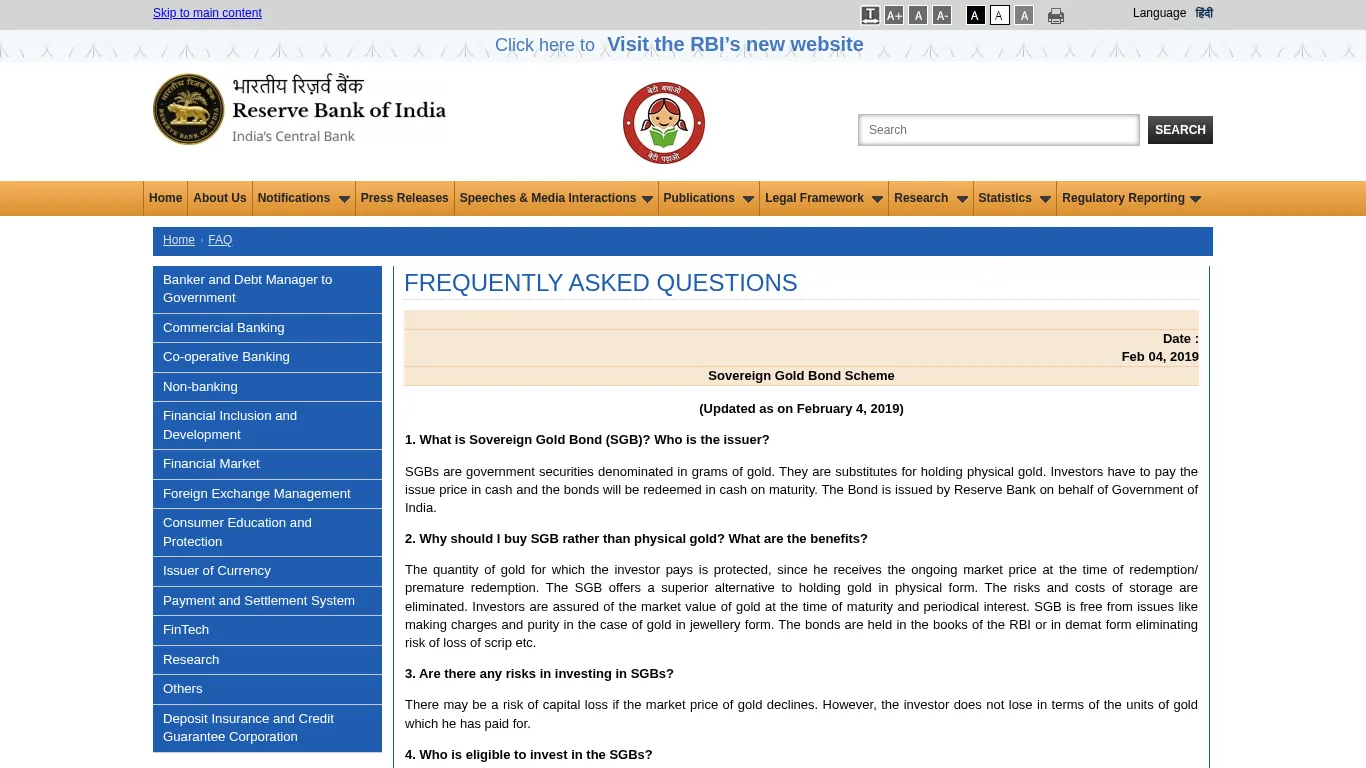

Paper gold pitfalls by product: Sovereign Gold Bonds (SGBs)

Key disadvantages to watch

-

8-year maturity; early exits limited (RBI premature redemption windows) or via thin secondary market

-

Interest (2.5% p.a.) is taxable at slab; cashflows not inflation-indexed

-

Market price on exchange can trade at discount/premium to intrinsic value

-

Purchase windows are periodic; annual individual holding limits apply

Liquidity reality check

-

Spreads widen on some series; selling large amounts quickly can move price

-

Brokerage + Demat needed for secondary sales

Who should avoid

-

Short-horizon investors or those needing instant liquidity

-

Anyone unwilling to hold to maturity to get capital gains exemption

“SGBs carry an 8-year tenure and pay 2.50% annual interest; interest is taxable, while capital gains on redemption at maturity are exempt for individuals.” – Source

“SGBs pay 2.5% per annum interest (credited semi-annually).” – Source

Paper gold pitfalls by product: Digital Gold

Key disadvantages to watch

-

Not an RBI/SEBI regulated security; relies on private providers and vault partners

-

Buy/sell spreads; delivery, making and shipping charges if you want metal

-

Holding limits or provider caps; KYC/AML holds

-

Operational risk: app downtime, redemption windows, customer support delays

Best practices if you still choose it

-

Choose providers with LBMA-accredited vault partners and clear audit/reconciliation reports

-

Read fee schedules (spreads, storage if any, delivery charges, GST on delivery)

-

Diversify provider risk; avoid very large single-provider balances

Where modern apps add value

-

Micro-investing from ₹1 via UPI; gifting and bill-like recurring buys; rewards layers

-

OroPocket note: combines 24K digital gold/silver with Bitcoin rewards, streaks, referrals – useful for habit-building; still consider the risks above

Taxes in India: paper gold vs physical gold (what changed after 2023)

ETFs and Gold FoFs (non-equity mutual funds)

-

Investments made on/after Apr 1, 2023: Most gold ETFs/FoFs fall under the non-equity mutual fund category. Capital gains are generally taxed at your income slab without indexation, regardless of holding period.

-

Pre-2023 holdings: Older units may retain grandfathered benefits (including indexation for long-term gains). Check your fund statements and confirm with your CA.

SGBs

-

Interest: 2.5% per annum, paid semi-annually, taxed at your slab.

-

Maturity: Redemption capital gains are exempt for individual investors if held to maturity.

-

Early sale: If sold on the exchange before maturity, capital gains tax applies as per holding period rules; long-term treatment can be eligible for indexation benefits under current provisions.

Physical and Digital Gold

-

Capital asset treatment:

-

Short-term (<3 years): Gains taxed at slab rates.

-

Long-term (>3 years): Typically 20% with indexation benefits under current rules.

-

-

GST: Applicable on jewellery and making charges; also applicable on physical delivery from digital gold providers (including making/shipping where relevant). Exact rates and components vary – review the invoice breakdown.

Action step

-

Tax rules evolve. Before investing – or exiting – confirm current treatment with a qualified tax advisor and review your provider’s tax disclosures.

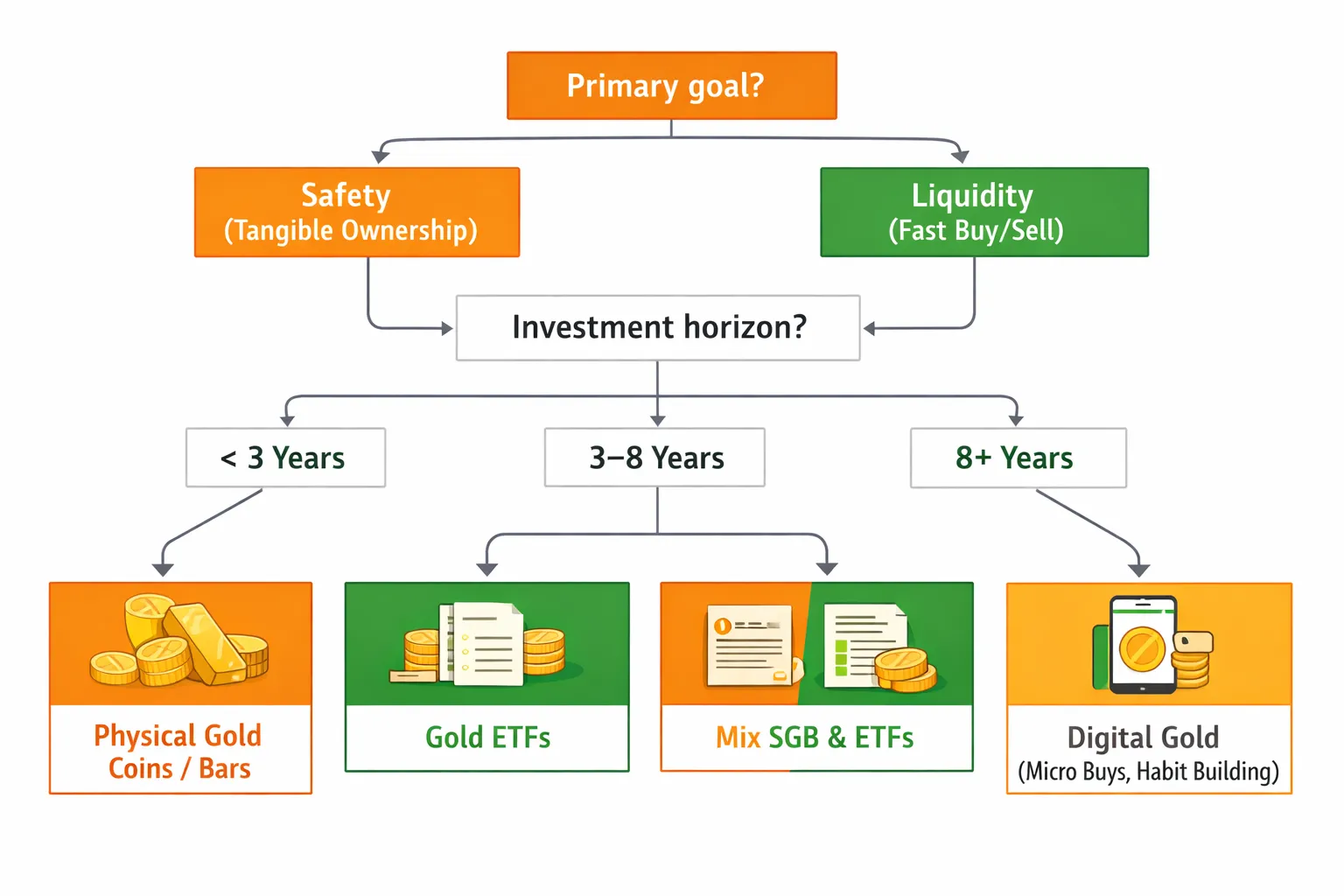

Decision framework: When to avoid paper gold – and when it’s fine

Avoid paper gold (or keep it minimal) if you

-

Need zero counterparty risk and collateral-ready assets → choose physical coins/bars

-

Want guaranteed capital-gain tax exemption at exit → SGBs only if you can hold full term

-

Don’t want platform dependencies or market-hour constraints

Paper gold can make sense if you

-

Want frictionless, small-ticket, frequent buys (SIPs) and quick sells

-

Can tolerate tracking errors, spreads, or lock-ins

-

Understand the exact tax treatment for your product and purchase date

Building a practical mix

-

Emergency layer: Physical coins/bars you can pledge or sell locally

-

Growth/convenience layer: SGBs (long horizon) or select ETFs (short/moderate horizon)

-

Habit layer: Digital gold apps for ₹1 micro-buys via UPI, with rewards to build consistency (e.g., Bitcoin cashback, streaks)

Final verdict (and a smarter way to start)

The bottom line on disadvantages of paper gold

-

Paper gold adds issuer/counterparty risk, possible tracking error, spreads, and product-specific tax quirks.

-

SGBs solve taxes at maturity but require patience; ETFs trade easily but face post-2023 tax changes; digital gold is ultra-convenient yet provider-dependent.

What to do next

-

If safety and collateral matter most: keep a physical core.

-

If you can lock 8 years for tax-free exit: allocate to SGBs.

-

If you prioritise flexibility: selectively use ETFs and small digital-gold balances.

Why many beginners start with OroPocket

-

Start from ₹1 via UPI; buy 24K digital gold/silver in under 30 seconds.

-

Earn free Bitcoin on every purchase, plus streak and spin rewards to build the habit.

-

RBI-compliant partners and 100% insured vaulting; send gold to family in a tap.

Call to action

-

Ready to build a gold habit the modern way? Download the OroPocket app: https://oropocket.com/app

Appendix: Pros/cons checklist you can screenshot

Physical gold

-

Pros: Tangible, collateral-ready, no counterparty risk

-

Cons: Storage, making premiums, resale friction

SGBs

-

Pros: Govt-backed, interest income, tax-free gains at maturity

-

Cons: 8-year maturity, taxable interest, secondary-market liquidity varies

ETFs/FoFs

-

Pros: Easy to trade, SIP-friendly, no storage hassles

-

Cons: Expense ratio/tracking error, slab taxation post-2023 (for new buys), market-hour limits

Digital gold

-

Pros: ₹1 entry via UPI, instant buy/sell, gifting, app-based simplicity

-

Cons: Not a regulated security, provider/vault dependency, spreads and delivery fees