What are the rules for buying gold in India?

Rules for buying gold in India (2026): What’s changed and what hasn’t

India has tightened how gold is bought and sold – without changing the basic freedoms to own it. If you’re buying jewellery, bars/coins, digital gold, ETFs, or SGBs in 2026, you’ll face clearer hallmarking norms, stricter KYC and cash rules, and product-specific tax treatment. This guide distills the rules so you can buy gold confidently – and compliantly.

Why this matters now

-

Hallmarking with HUID is mandatory, KYC is tighter, and cash rules are stricter.

-

Different tax rules apply depending on whether you buy jewellery, coins/bars, digital gold, ETFs, or SGBs.

“Centre notifies the third phase of mandatory hallmarking from 8 September 2023 – expanding HUID hallmarking coverage to 343 districts.” – Source

Source note: Editors may replace with the latest BIS/Department of Consumer Affairs order or press release if updated.

Quick snapshot

-

ID needed: PAN/Aadhaar typically required for large purchases (₹2 lakh+).

-

Cash cap: Cash payments of ₹2 lakh or more aren’t allowed in a single transaction.

-

Purity: Buy only BIS-hallmarked jewellery with a 6-digit HUID on the invoice.

-

Holding limits: No official cap on owning gold if the source is explained; tolerance limits apply during searches.

-

Taxes: 3% GST on gold value + 5% on jewellery making charges; capital gains differ by product and holding period.

What this guide covers

-

KYC, payment and hallmarking rules.

-

GST and price breakdown you’ll actually see on your bill.

-

Legal holding limits at home and how CBDT rules work.

-

Capital gains on selling various gold products in FY 2025–26.

-

Practical checklists, mistakes to avoid, and a modern, compliant way to buy gold digitally.

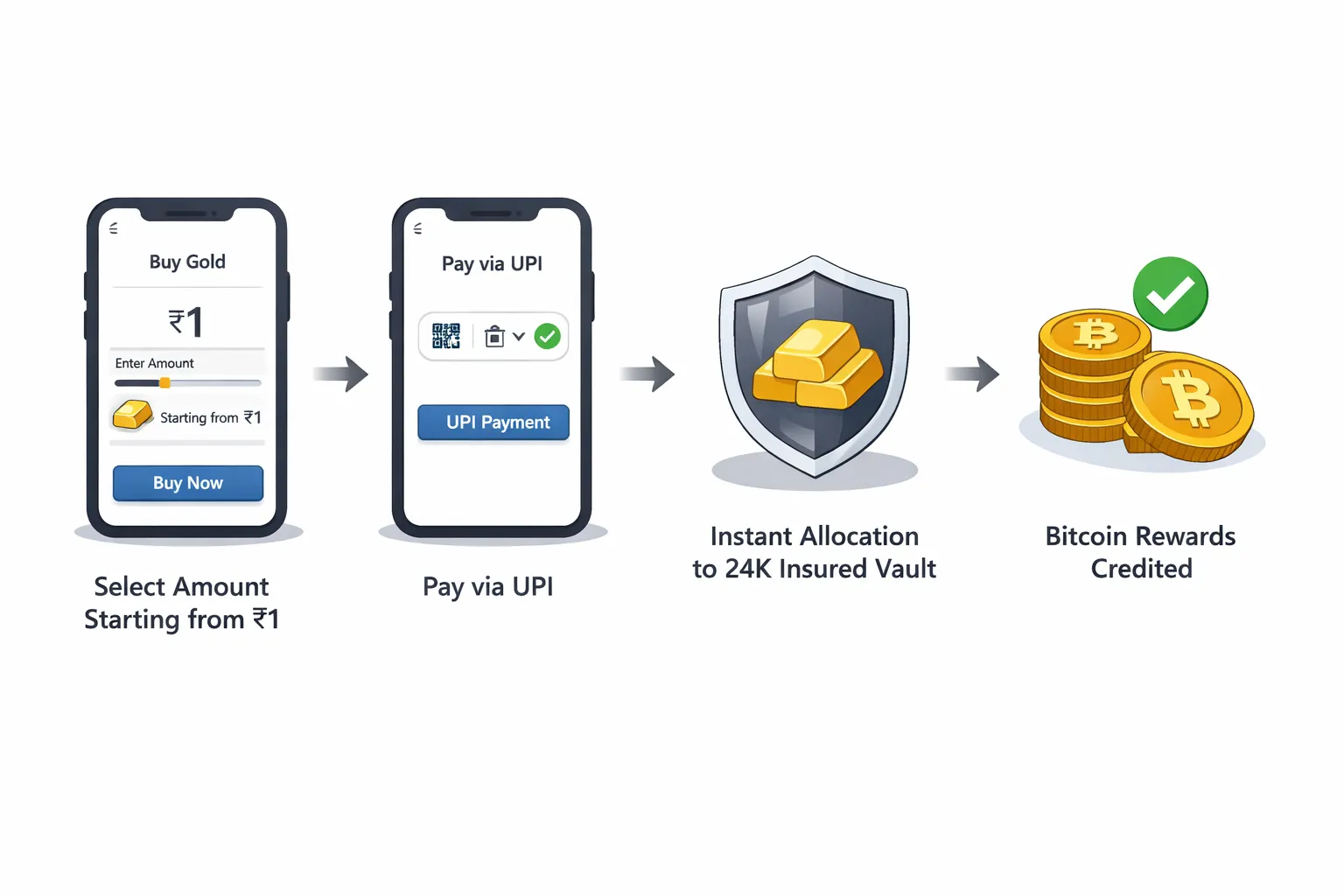

Buying gold the modern way is simple: with OroPocket you clear KYC once, pay instantly via UPI, own 24K insured gold from authorized partners, and even earn Bitcoin rewards on every purchase. It’s compliant, fast, and built for 2026.

Ready to buy gold the smart, compliant way? Download the OroPocket app: https://oropocket.com/app

KYC, payment and hallmarking: The rules to follow before you buy

KYC you’ll likely need

-

PAN or Aadhaar typically required for high-value purchases (commonly ₹2 lakh+).

-

Jewellers must maintain KYC/transaction records; splitting bills to dodge limits can attract scrutiny.

Payment rules

-

No cash payment of ₹2 lakh or more in a single transaction.

-

Use UPI, cards, net-banking for seamless, compliant payments.

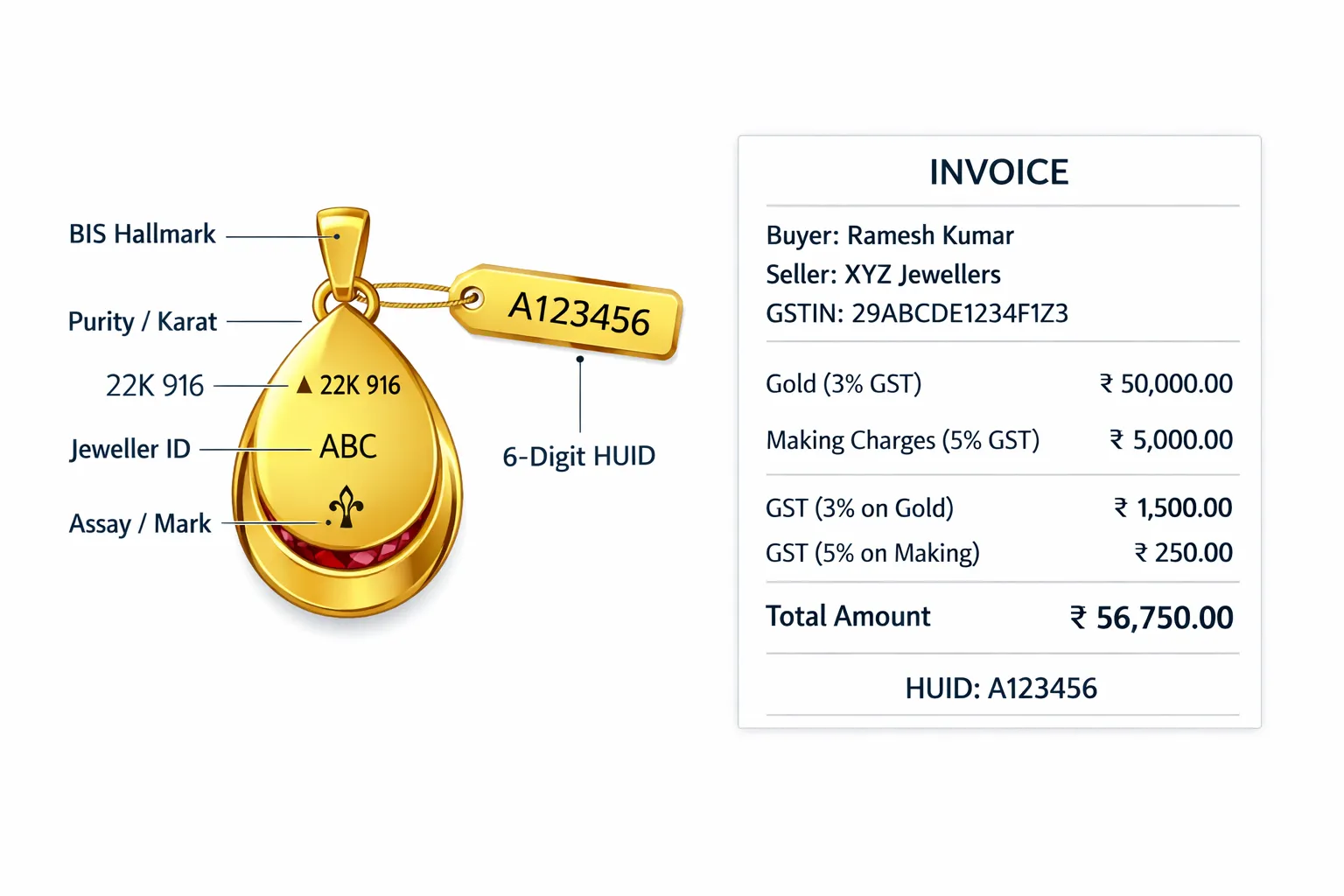

Hallmarking and HUID

-

Buy only BIS-hallmarked jewellery.

-

Ensure the 6-digit alphanumeric HUID appears on the bill and matches the piece.

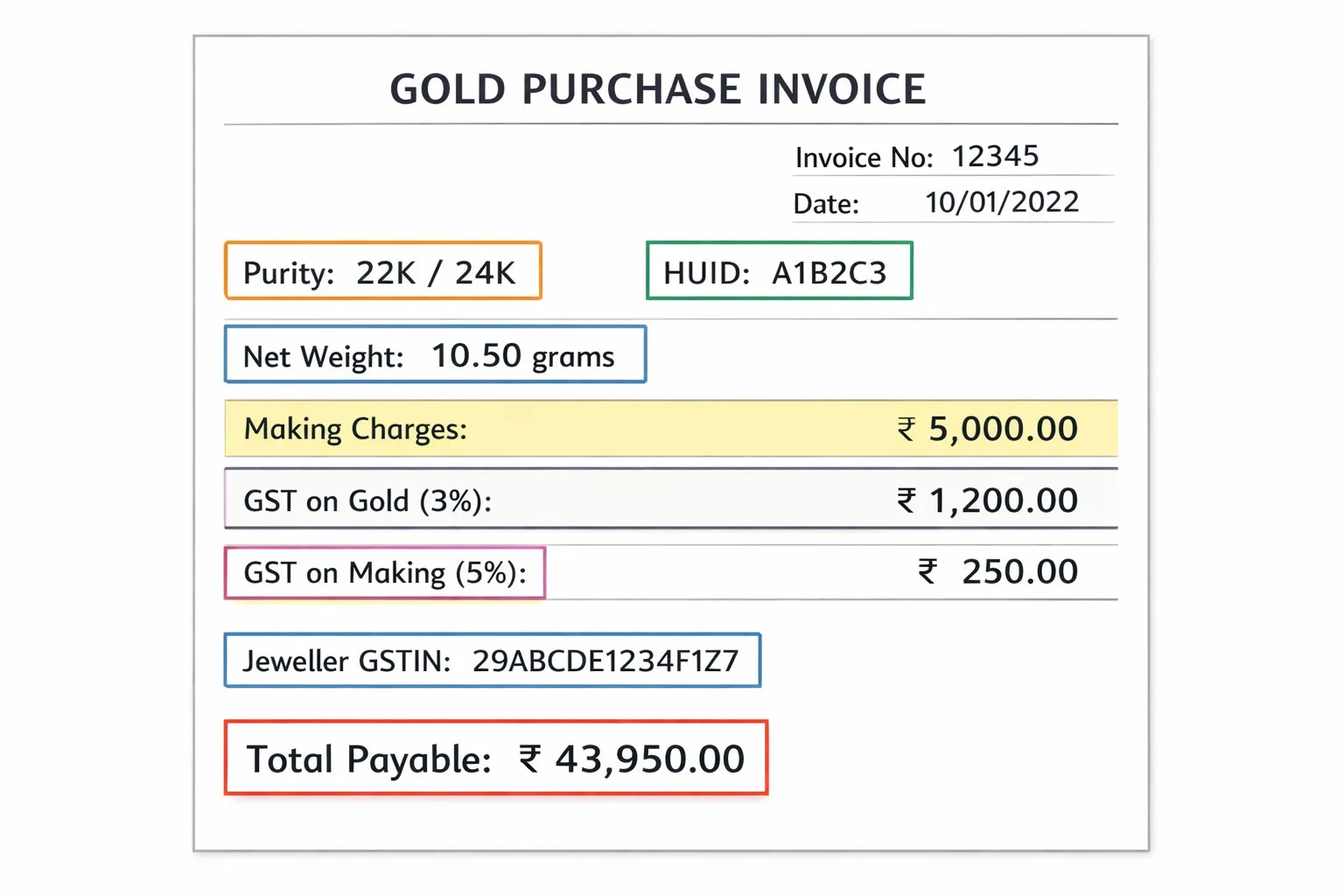

Your safe-buying checklist

-

Verify purity (22K/18K) + hallmark + HUID.

-

Ask for a tax invoice with GST breakdown and jeweller’s GSTIN.

-

Avoid cash above limits; don’t split invoices.

-

Keep all documents (invoice, certificate/warranty).

“India is consistently among the world’s top gold consumers – WGC reports show India’s annual demand in the hundreds of tonnes every year.” – Source

GST and the price you pay: Jewellery vs coins/bars vs digital gold

GST basics

-

3% GST on the value of gold (jewellery, coins, bars, digital gold purchases).

-

Additional 5% GST on jewellery making charges (if charged separately).

What’s in your final price

-

Base gold value (linked to live bullion rates + jeweller margin).

-

Making charges (jewellery only; vary by design/karat/brand).

-

GST: 3% on gold value + 5% on making charges.

-

Import duties and other levies are embedded in market prices (change via govt notifications).

Tip

-

For coins/bars with negligible making: total tax impact is usually lower than ornate jewellery.

-

Digital gold buys attract 3% GST on acquisition; no GST on selling back (capital gains rules apply instead).

Sample on-bill price breakup (illustrative)

Jewellery purchase example:

|

Component |

Rate/Assumption |

Amount (₹) |

|---|---|---|

|

Base gold value |

Example: ₹50,000 |

50,000 |

|

Making charges (%) |

10% of base value |

5,000 |

|

GST 3% on gold value |

3% of ₹50,000 |

1,500 |

|

GST 5% on making charges |

5% of ₹5,000 |

250 |

|

Final payable |

Sum total |

56,750 |

Coins/bars example (lower making):

|

Component |

Rate/Assumption |

Amount (₹) |

|---|---|---|

|

Base gold value |

Example: ₹50,000 |

50,000 |

|

Making charges (%) |

1% of base value |

500 |

|

GST 3% on gold value |

3% of ₹50,000 |

1,500 |

|

GST 5% on making charges |

5% of ₹500 |

25 |

|

Final payable |

Sum total |

52,025 |

How much gold can you keep at home? Legal holding limits and search tolerance

The two truths most people miss

-

There is no statutory cap on the total gold you can own if the source is explained and documented.

-

During searches, CBDT-prescribed tolerance limits guide officers on what not to seize even without documents.

CBDT tolerance limits during searches (guidance)

-

Married woman: up to 500 g

-

Unmarried woman: up to 250 g

-

Men (married or unmarried): up to 100 g

Gold beyond these limits is NOT automatically illegal or seized – you may simply be asked to explain the source (income, gift, inheritance) and show documents.

Documentation that helps

-

Purchase invoices with your name and payment mode.

-

Gift deed or invoice in donor’s name; inheritance papers (will/family settlement).

If you can’t explain the excess

-

Unexplained gold can be taxed at high rates with surcharge/cess and penalties.

“CBDT Instruction No. 1916 (11 May 1994) prescribes non-seizure tolerance limits during searches; CBDT’s 2016 press note reiterates there is no limit on holding jewellery if sources are explained.” – Source

Income tax on selling gold in FY 2025–26: Physical, digital, ETFs and SGBs

Physical gold (jewellery/coins/bars) and digital gold (vaulted)

-

Treated as capital assets. Short-term gains: added to income and taxed per slab if sold within the short-term window.

-

Long-term gains: taxed per prevailing rules (historically 20% with indexation after 36 months for physical/digital gold). Check latest Finance Act/CBDT updates before filing.

Gold ETFs and gold mutual funds

-

Tax rules updated recently. As of FY 2024–25 reforms, many listed non-equity financial assets moved to a 12.5% LTCG without indexation beyond 12 months; STCG taxed per slab. Confirm the latest CBDT circulars for the current year’s treatment of gold ETFs/MFs you hold.

Sovereign Gold Bonds (SGBs)

-

Interest (2.5% p.a. currently) is taxed per slab.

-

Redemption by RBI at maturity (8 years) is exempt from capital gains for individuals.

-

If sold before maturity (secondary market or early redemption windows), capital gains tax may apply as per period/listing rules.

Gifts and inheritance

-

Receiving gold is tax-free if from specified relatives, on marriage, or via will/succession. If later sold, capital gains apply using original owner’s holding period for LTCG/STCG classification.

Tax snapshot by product (FY 2025–26 – indicative)

|

Product Type |

STCG Rule |

LTCG Rule/Rate & Holding Period |

Special Notes |

|---|---|---|---|

|

Physical/Digital Gold (vaulted) |

Added to total income; taxed per slab when sold within short-term window (historically <36 months) |

Historically 20% with indexation after 36 months; verify latest rules before filing |

Keep invoices and transaction history to establish cost and holding period |

|

Gold ETF/MF (listed, non-equity) |

Taxed per slab if sold within 12 months (verify classification of your fund) |

Indicatively 12.5% without indexation beyond 12 months as per FY 2024–25 rationalisation; confirm current-year status |

Post-2024 reforms changed treatment for several non-equity funds – check your AMC’s tax note |

|

Sovereign Gold Bonds (SGBs) |

If sold before maturity, gains taxed per period/listing rules; short-term gains taxed per slab |

Redemption by RBI at 8-year maturity is exempt for individuals |

2.5% annual interest is always taxed per slab; early exits may attract capital gains |

|

Disclaimer |

– |

– |

Always verify the latest Finance Act, CBDT circulars, and your broker/AMC tax notes before filing returns |

Bringing gold into India: Customs rules at a glance

Duty-free allowances (indicative; verify latest CBIC notifications)

-

Duty-free jewellery allowances differ by gender, value and duration of stay abroad (e.g., longer stays abroad typically allow a higher jewellery value limit).

-

Allowances generally apply to jewellery for personal use carried in baggage; quantities must be “reasonable.”

-

Coins/bars typically don’t qualify for duty-free allowance; they must be declared and applicable duty paid.

-

If you exceed allowances, you must declare the gold at Red Channel and pay duty as per current CBIC rates. Non-declaration can lead to confiscation and penalties.

Practical tips at the airport

-

Carry purchase receipts/invoices with metal purity, weight and value, and keep them handy at customs.

-

Declare proactively if you exceed allowances; voluntary disclosure reduces hassle and risk.

-

Prefer jewellery over bullion if you wish to utilise duty-free limits; bullion is usually dutiable.

-

Match invoices to the traveler’s name; keep items accessible for inspection (avoid hiding/“muling” for others).

-

Pack carefully (hand baggage preferred) and avoid removing purity tags/seals that help verification.

Note

-

CBIC revises duty rates, cess/surcharges and baggage allowances from time to time. Always check current rules and airline/admissible carriage policies before you fly.

Want zero customs hassle? Skip carrying physical gold – buy 24K insured digital gold in India via UPI on OroPocket, starting at ₹1, and earn free Bitcoin rewards on every purchase. Download the app: https://oropocket.com/app

Documentation and fraud-proofing: Invoices, HUID and what to check

Your invoice must include

-

Buyer and seller details, seller GSTIN.

-

Karat/purity, net weight, making charges.

-

GST breakdown (3% on gold, 5% on making charges for jewellery).

-

HUID (6-digit) and hallmark stamp details.

How to verify the hallmark

-

Match the HUID on-piece with the invoice.

-

Use the BIS Care app/site to verify hallmark/HUID.

Avoid these pitfalls

-

Unhallmarked jewellery marketed as ‘discounted’.

-

Cash demands over limits; split bills.

-

Vague invoices without HUID or GST breakdown.

Digital gold rules done right: Why OroPocket is the compliant, modern way

Stay fully compliant

-

KYC flows and RBI-compliant, authorized bullion partners.

-

100% insured vaulting; auditable, transparent holdings.

Pay the modern way

-

Instant UPI purchases; no cash-limit worries.

-

Start from ₹1 – perfect for micro-investing and habit building.

Rewards you won’t get at jewellers

-

Free Bitcoin (Satoshi) rewards on every gold/silver purchase.

-

Daily streak bonuses, Spin-to-Win, and referral rewards (100 Satoshi + free spin).

Real 24K, real benefits

-

Buy/sell anytime, track live prices, send gold to friends, and gift instantly.

-

Combine gold’s stability with Bitcoin rewards – two assets for the price of one.

Ready to make your first compliant digital gold purchase and earn free Bitcoin rewards? Download OroPocket now: https://oropocket.com/app

Common mistakes that get buyers in trouble (and how to avoid them)

The big five

-

Paying ₹2 lakh or more in cash or splitting invoices to bypass limits.

-

Cash caps are strict. Splitting bills is tracked and can invite scrutiny and penalties.

-

-

Buying unhallmarked jewellery without HUID and a proper invoice.

-

If there’s no BIS hallmark and 6-digit HUID on both piece and bill, walk away.

-

-

Not keeping proofs for gifted/inherited gold.

-

Missing gift deeds, old invoices or inheritance papers makes explaining sources hard during checks.

-

-

Assuming you can’t own more than the CBDT tolerance limits.

-

Those are search “non-seizure” thresholds – not a legal ownership cap. You can own more if the source is explained.

-

-

Ignoring capital gains rules when selling or switching products.

-

STCG vs LTCG, indexation, and special SGB rules can change your tax outgo meaningfully.

-

Quick fixes

-

Go digital (UPI) for payments; keep invoices safe (cloud + physical).

-

Verify hallmark/HUID every time; walk away if it doesn’t check out.

-

Log gifts/inheritance with simple deeds and retain old invoices.

-

Before selling, check holding period and current tax rules.

Want a compliant, paper-light way to build gold savings? Buy 24K digital gold on OroPocket via UPI from ₹1 and earn free Bitcoin rewards – no cash-limit headaches, full KYC, and secure vaulting. Download the app: https://oropocket.com/app

Conclusion: Buy gold the right way – then make it work harder with OroPocket

Buying gold in India is simple when you follow the rules: verify hallmarking and HUID, pay digitally, keep invoices, respect cash/KYC thresholds, and plan for taxes before you sell. If you want a compliant, convenient, and modern experience, switch to digital gold on OroPocket.

-

Start from ₹1, pay via UPI in seconds

-

Get free Bitcoin rewards on every purchase

-

24K pure gold, 100% insured vaults, fully compliant partners

Ready to invest the smart way? Download the OroPocket app now: https://oropocket.com/app