What was announced in Budget 2026 for Gold and Silver by Indian Government?

Budget 2026 Gold & Silver Announcements in India: What Changed, What Didn’t, and What It Means for You

Budget days are emotional for Indian savers – because one line can change the price of your jewellery, the returns on your gold ETF, or the tax you pay on an SGB.

In Union Budget 2026, the government largely kept gold and silver taxation stable, but made two big impact moves:

-

Customs duty (import duty) cut on gold & silver to 5% (from 6%)

-

Sovereign Gold Bonds (SGB) capital gains exemption tightened – only for original subscribers who hold till maturity

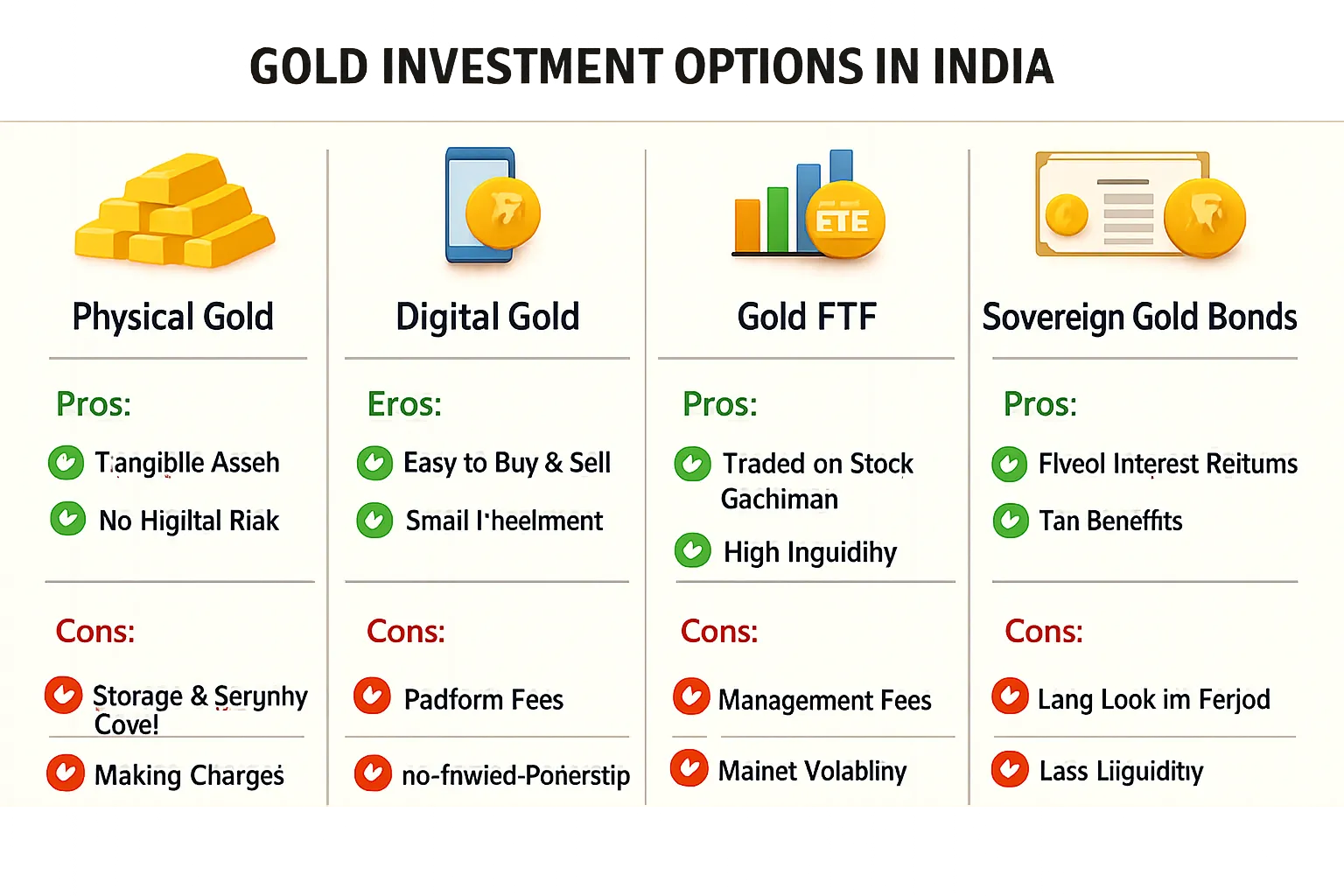

If you own gold in any form (jewellery, coins, digital gold, ETFs, mutual funds, SGBs), this guide breaks down what was announced, how it hits your wallet, and what to do next.

The Two Big Budget 2026 Updates for Gold & Silver

1) Customs duty on gold and silver reduced to 5%

This is an import-side change. India imports most of its gold/silver demand, so even a 1% duty cut can influence domestic prices.

What it means for you (practically):

-

Domestic prices can soften (or rise less) if global prices and USD/INR are stable

-

Jewellery bills can reduce a bit – but making charges still dominate the final bill

-

Legal imports become marginally more attractive, which can help reduce smuggling incentives

Tip: Use price dips to accumulate gradually instead of trying to “time the bottom.” If you’re starting small, you can invest in gold with micro amounts (₹1/₹10/₹100) via digital gold.

2) SGB tax rule tightened: capital gains exemption at maturity only for original subscribers

This is the headline change for investors.

Budget 2026 clarified that capital gains tax exemption on SGB redemption at maturity is available only if:

-

an individual subscribes to the SGB at the time of issue, and

-

holds it till maturity

If you bought SGBs from the secondary market (stock exchange), the maturity exemption does not apply (as per the Budget 2026 change highlighted in reporting).

This is a big deal because many investors buy older SGB series from exchanges at discounts/premiums for liquidity and convenience.

What Did NOT Change (But People Keep Confusing)

Budget 2026 did not overhaul:

-

GST rules on physical/digital metals

-

capital gains framework for ETFs and gold/silver mutual funds

-

STCG/LTCG holding periods for most gold/silver categories (except the SGB maturity exemption condition noted above)

So for most retail investors, your gold/silver taxation playbook remains familiar – with one SGB exception.

Taxes on Gold & Silver After Budget 2026 (By Investment Type)

Quick comparison table (India, FY 2026-27 rules as reported)

|

Investment Type |

GST at Buy |

STCG if sold within |

LTCG if held beyond |

Special Notes |

|---|---|---|---|---|

|

Physical gold/silver (jewellery/coins/bars) |

3% GST (+ 5% GST on making charges for jewellery) |

Up to 24 months: slab rate |

> 24 months:12.5% (no indexation) |

Making charges + spreads are the hidden cost |

|

Digital gold/silver (e.g., OroPocket) |

3% GST |

Up to 24 months: slab rate |

> 24 months:12.5% (no indexation) |

No “making charges” like jewellery |

|

Gold/Silver ETFs |

No GST |

Up to 12 months: slab rate |

> 12 months:12.5% (no indexation) |

Treated as listed securities |

|

Gold/Silver mutual funds |

No GST |

Up to 24 months: slab rate |

> 24 months:12.5% (no indexation) |

Often invest in ETFs |

|

Sovereign Gold Bonds (SGBs) |

No GST |

Up to 12 months: slab rate |

> 12 months (sold before maturity):12.5% (no indexation) |

2.5% interest taxed at slab rate. Maturity exemption only for original subscribers (Budget 2026 change). |

For a deeper practical walkthrough, see: taxes on gold and silver investments in India (FY 2026-27).

Impact Analysis: Who Wins and Who Loses After Budget 2026?

If you buy jewellery (weddings, festivals, gifting)

Net impact: mildly positive.

-

5% import duty can help reduce base gold cost

-

But final jewellery pricing still depends heavily on:

-

making charges

-

wastage

-

brand premium

-

Smart move: If your goal is investment – not wear – consider investment-grade formats (digital gold, coins/bars, ETFs) and buy jewellery for occasions.

If you hold physical gold coins/bars

Net impact: neutral to mildly positive.

-

Slight duty cut helps entry price (depending on market conditions)

-

Taxes unchanged: STCG/LTCG based on 24 months

If you invest in Gold/Silver ETFs

Net impact: mostly neutral.

-

Tax rules unchanged

-

Price impact may occur via broader gold/silver market moves, not because of ETF-specific policy

If you invest in SGBs

This is where the real shift is.

Case A: You subscribed in primary issuance and hold till maturity

You still get the maturity capital gains exemption (as per the Budget 2026 condition).

You continue to get:

-

2.5% annual interest (taxed at slab rate)

-

gold price-linked returns

-

maturity redemption benefit (subject to eligibility)

Case B: You bought SGBs from the secondary market

This is the new pain point.

Budget 2026 indicates the maturity exemption is not available if you weren’t the original subscriber.

Translation: secondary-market SGB buyers may now face capital gains tax on maturity redemption (depending on how rules are finally implemented in detail). That reduces one of the biggest reasons people loved discounted exchange-bought SGBs.

If you invest in digital gold & silver (OroPocket-style)

Net impact: positive for mass-market investors.

-

Taxes are simple and aligned with physical metals (24-month LTCG at 12.5% without indexation)

-

No storage headache

-

Easier to build a habit (small daily buys)

If you want to understand the safety model, read: is digital gold safe in India? vaulting, regulation & risks.

The Big Content Gap Most Articles Miss: “Price Impact” vs “Tax Impact”

Budget 2026 had both, and they affect you differently:

-

Customs duty cut (price lever): impacts entry price and jewellery market sentiment

-

SGB maturity rule (tax lever): impacts net post-tax return depending on how you bought the SGB

Most people only notice price on Budget day. Smart investors track after-tax returns.

Why Gold Still Matters for Indian Retail Investors (Even After Budget Noise)

“Over the past five years, gold has delivered an average annual return of ~10% in INR, outpacing average CPI inflation of 7.3%.” – World Gold Council

Gold isn’t about hype. It’s about not losing purchasing power while you build wealth slowly.

And if you’re building a modern portfolio, the smarter question isn’t “gold or crypto?” – it’s “how do I blend stability + upside without complexity?”

That’s exactly where OroPocket’s model fits.

What OroPocket Recommends After Budget 2026 (Simple, Actionable Plan)

1) Don’t gamble on a one-day Budget dip – build a habit

Stop watching. Start growing.

With OroPocket, you can start from ₹1 and build a daily/weekly accumulation routine.

If you’re new, here’s a step-by-step: how to invest in digital gold online in India (beginner guide 2026).

2) If you’re considering SGBs, know the “how you bought it” risk

Primary issuance SGBs and secondary-market SGBs are no longer identical in tax outcomes (Budget 2026 change).

Re-check your strategy before buying older SGBs on exchange just for the maturity exemption.

3) Get rewarded for doing the right thing

OroPocket is built for real people, not traders:

-

₹1 entry point: start instantly, no intimidation

-

Instant UPI payments: buy in under 30 seconds

-

Free Bitcoin on every purchase: earn Satoshi cashback while stacking gold/silver

-

Gamified investing: streaks, spin-to-win, tiered rewards – habit > motivation

-

100% secure & compliant: RBI-compliant processes, insured vault storage, authorized partners

-

Referral rewards: both sides get 100 Satoshi + free spin

This is the modern combo: gold’s stability + Bitcoin’s upside – without the stress of trading crypto directly.

Final Verdict: What Budget 2026 Means for Your Gold & Silver Strategy

Budget 2026 did two things:

-

made gold/silver imports slightly cheaper (5% customs duty)

-

made SGB maturity exemption more conditional (primary subscriber-only)

For most investors, the best response is not panic – it’s better structure:

-

Use gold/silver as an inflation hedge

-

Prefer low-friction formats for disciplined accumulation

-

Focus on post-tax outcomes, not headlines

Ready to act?

Build your gold + silver stack from ₹1, pay via UPI, and earn free Bitcoin as a bonus – every single time.