When Is the Best Time to Buy Gold? Indicators, Seasonality, and Mistakes to Avoid

What “Best Time” Really Means (Quick Answer + How Gold Moves)

Quick answer

-

The best time to buy gold is when real interest rates are falling, the INR is stable/strengthening, and before seasonal festival demand spikes. If you’re new or busy, start now with a small SIP and add extra on dips.

-

For India, watch domestic triggers (RBI policy, INR, import duties) as much as global ones (US real yields, USD strength, risk events).

What actually drives gold-in-INR

-

Real yields: When inflation-adjusted rates fall, gold tends to rise.

-

USD strength: A softer dollar supports global gold prices.

-

INR: A weakening INR lifts local gold prices even if global prices are flat.

-

Risk and liquidity: Geopolitical shocks, banking stress, or equity drawdowns push investors to safe havens.

Fast rules of thumb

-

If you’re asking “Should I buy gold now?” and you don’t have exposure yet: start with a SIP today, then layer in buys on 2–5% dips.

-

If you already have exposure: top up when real yields fall, INR firms, or ahead of India’s high-demand festivals – well before the last-minute rush.

“Central banks bought ~1,037 tonnes of gold in 2023 – near record highs.” – World Gold Council

Ready to act instead of overthinking? Start your gold SIP from ₹1 and earn free Bitcoin on every purchase. Download the OroPocket app: https://oropocket.com/app

6 Indicators To Check Before You Click “Buy”

1) Real interest rates (India and US)

-

Falling real rates (nominal – inflation) are bullish for gold.

-

Track India’s real rates via RBI policy rates minus CPI; for the US, watch 10Y TIPS yields. When real yields drift lower or go negative, gold’s opportunity cost falls – historically a tailwind for prices.

2) USD and DXY

-

A weakening USD usually supports gold; a sharp USD rally can cap gains.

-

Keep an eye on the DXY index. Dollar softness often lifts global bullion, while a rapid dollar spike can stall or reverse gold rallies in the short run.

3) INR and USD/INR

-

A weaker INR mechanically lifts domestic gold prices; be tactical about big FX moves.

-

Even if global gold is flat, INR depreciation pushes local prices up. If you’re asking “should I buy gold now?” and INR is sliding fast, consider staggering buys to avoid paying peak FX pass-through.

4) Inflation trend

-

Rising/sticky inflation tends to support gold; disinflation can cool rallies.

-

In India, track CPI and core inflation. Globally, watch US CPI and inflation expectations. Persistent inflation keeps real yields suppressed – typically positive for gold.

5) Rate path and liquidity (RBI/Fed)

-

Cuts or dovish pivots are often supportive; tightening can weigh in the short term.

-

Monitor guidance from RBI MPC and the Fed. Liquidity-additive moves (cuts, QE pauses) often help gold. Hawkish surprises can trigger pullbacks but may create attractive add-on opportunities.

6) Risk-on/off signals

-

Geopolitics, banking stress, credit events, and equity sell-offs often spark safe-haven demand.

-

If risk turns “off” (volatility spikes, equities tumble), gold typically benefits as capital seeks safety and liquidity.

“Gold prices tend to move inversely to U.S. real interest rates.” – World Gold Council

Pro tip: Build a simple watchlist (real yields, DXY, USD/INR, CPI prints, RBI/Fed meetings) and set alerts so buys are rules-based, not emotional. If you’re thinking “when should I buy gold,” use these signals to scale in: start a small SIP, then add on 2–5% dips or into dovish pivots.

Ready to act? Start a gold SIP from ₹1 on OroPocket, pay via UPI in seconds, and earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

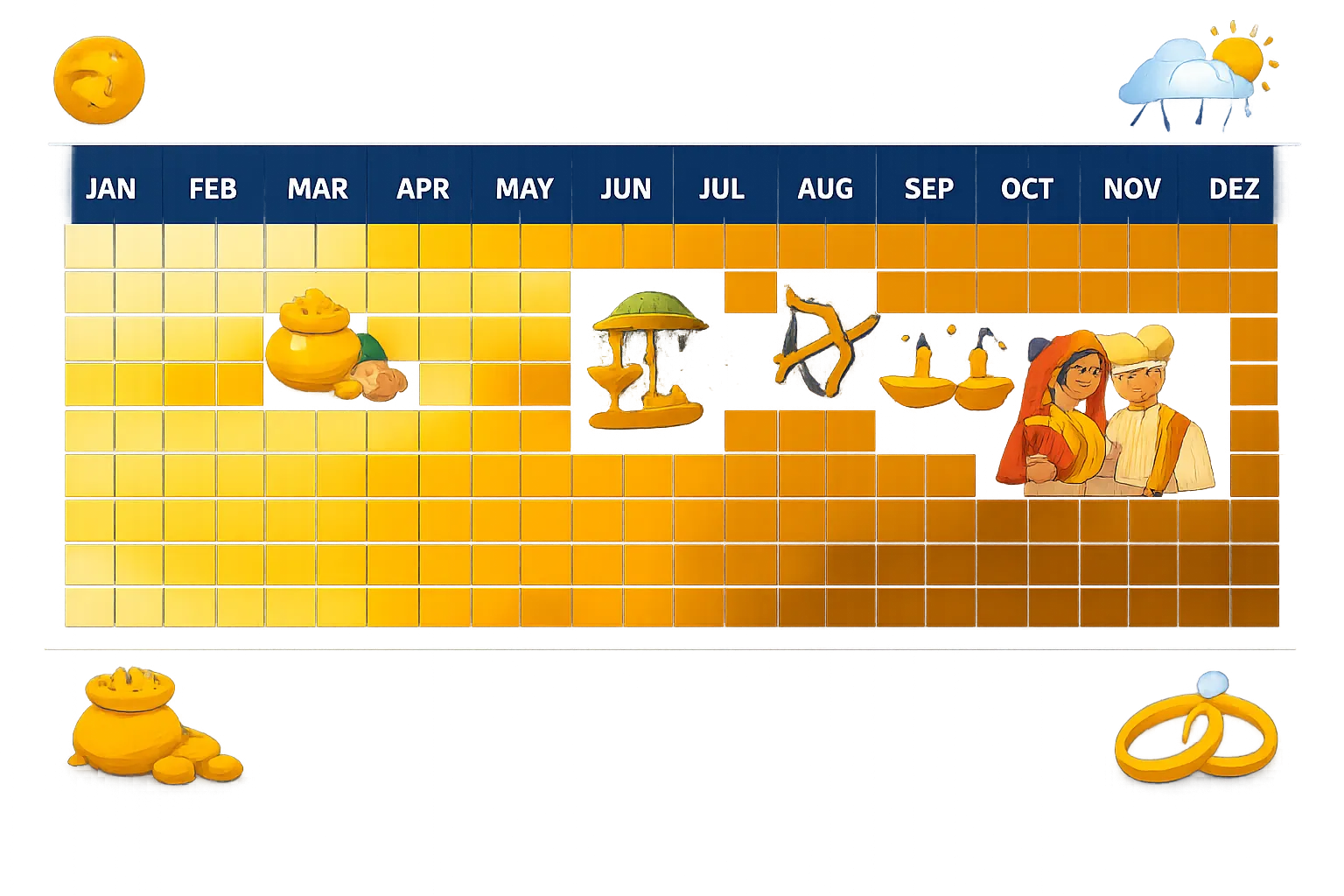

India’s Seasonality: Akshaya Tritiya, Dhanteras/Diwali, Weddings, and Monsoon Incomes

What seasonality looks like (and how to use it)

-

Q2–Q4 bumps: Akshaya Tritiya (Apr/May), Onam (Aug/Sep), Dussehra, Dhanteras/Diwali (Oct/Nov), and the Oct–Mar wedding season.

-

Demand tends to rise into these dates – so consider accumulating earlier rather than buying at the last minute.

Practical playbook

-

Start accumulating 4–8 weeks before major festivals.

-

If prices spike into the event, pause and resume SIP after demand normalizes.

-

Keep a small “dip fund” to add on 2–3% pullbacks.

“Weddings account for around 50% of India’s annual gold demand, creating strong seasonal spikes around festival and wedding calendars.” – Source

India gold seasonality calendar

|

Month |

Key festival/wedding driver |

Typical demand effect (qualitative) |

Suggested approach (accumulate early / pause / buy-the-dip) |

|---|---|---|---|

|

Jan |

Winter wedding season, NRI visits |

Moderate to strong |

accumulate early |

|

Feb |

Peak weddings |

Strong |

accumulate early |

|

Mar |

Late-wedding season taper |

Mild to moderate |

buy-the-dip |

|

Apr |

Build-up to Akshaya Tritiya |

Rising |

accumulate early |

|

May |

Akshaya Tritiya month (some years) |

High |

pause |

|

Jun |

Post-festival lull, pre-monsoon |

Softer |

buy-the-dip |

|

Jul |

Monsoon onset; rural incomes pending |

Softer |

buy-the-dip |

|

Aug |

Onam/Raksha Bandhan build-up |

Rising |

accumulate early |

|

Sep |

Onam, pre-Dussehra/Diwali |

Rising to strong |

accumulate early |

|

Oct |

Dussehra; wedding season starts |

High |

pause |

|

Nov |

Dhanteras/Diwali peak |

Very high |

pause |

|

Dec |

Weddings continue; NRI buying |

Moderate to strong |

buy-the-dip |

When you’re asking “when is the best time to buy gold” in India, seasonality is your edge: accumulate early, pause into peak days, and deploy your dip fund after spikes.

Ready to put this plan on autopilot? Start a gold SIP from ₹1 on OroPocket, earn free Bitcoin on every buy, and pay via UPI in seconds. Download now: https://oropocket.com/app

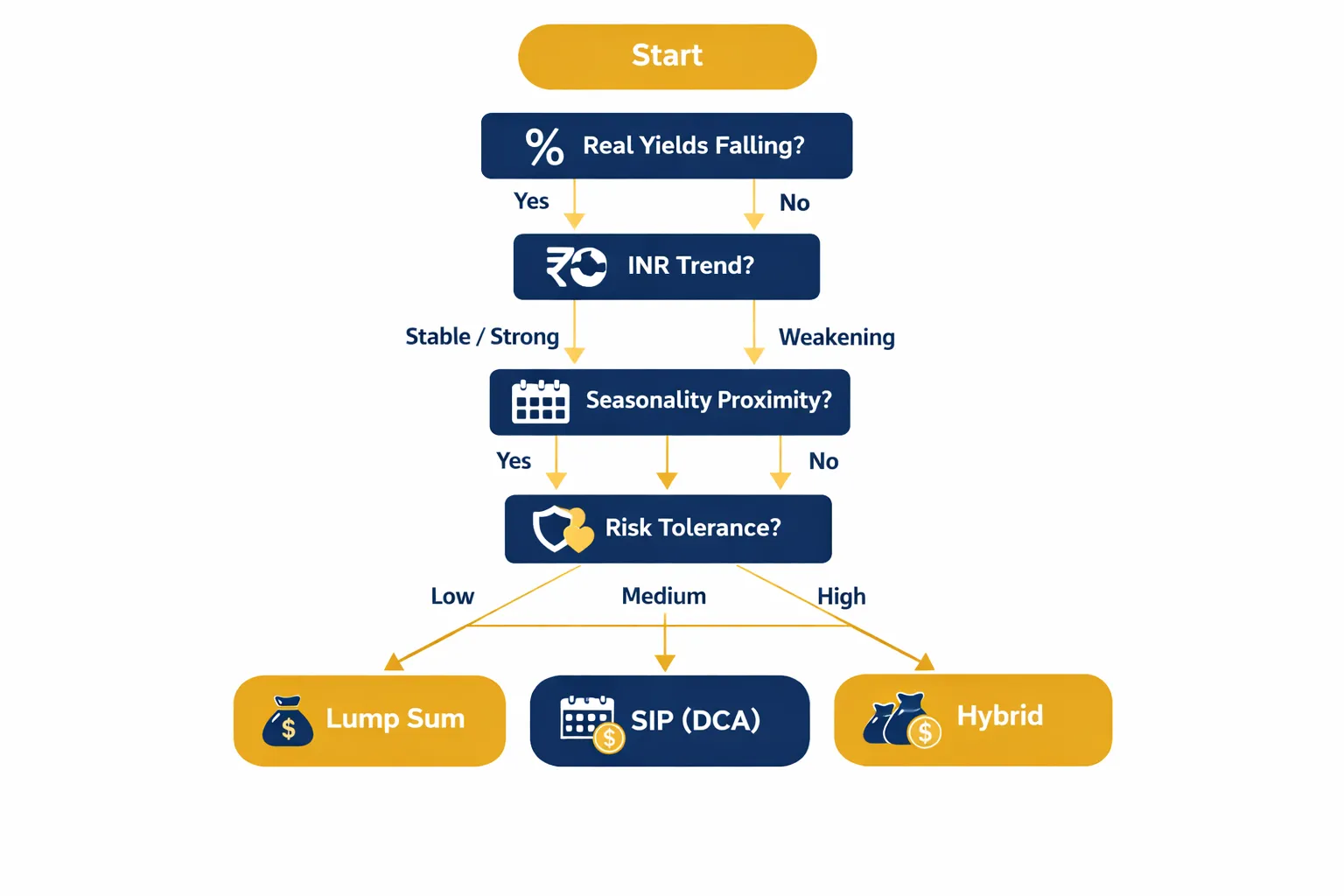

Buy Now or Spread Out? Lump Sum vs SIP (and a Smart Hybrid)

Lump sum

-

Best when macro is clearly supportive (falling real rates, stable INR, rising risk). Higher short-term timing risk.

SIP (DCA)

-

Easiest for beginners. Reduces regret and timing risk. Works well across cycles.

Hybrid approach

-

Run a base SIP + add tactical top-ups on dips (e.g., -3% to -5% from 30-day high) or when your indicator checklist turns green.

How to operationalize

-

Fix a monthly SIP amount (e.g., ₹1,000+). Keep a separate dip fund (e.g., 20–30% of annual target) for opportunistic buys.

Lump Sum vs SIP vs Hybrid

|

Lump Sum |

SIP (DCA) |

Hybrid |

|

|---|---|---|---|

|

Market path (rising, flat, choppy, falling then rising) |

Excels in clear rising trends; can underperform in choppy/flat phases; tough during early drawdowns |

Handles flat/choppy well; smooths falling-then-rising paths; may lag strong uptrends |

Balances most paths; captures upside in rises, cushions choppy/falling-then-rising |

|

Pros |

Immediate full exposure; simple; benefits if macro turns strongly supportive |

Reduces timing risk and regret; habit-forming; easy automation |

Adds discipline + flexibility; can enhance returns with rules-based top-ups |

|

Cons |

High timing risk; emotionally hard if price dips right after |

Slower to gain full exposure in strong rallies |

Requires monitoring and rules; risk of overtrading if undisciplined |

|

Who it suits |

Confident, macro-aware investors with higher risk tolerance |

Beginners and busy professionals who prefer autopilot |

Intermediate investors who can follow signals and set alerts |

|

Behavioral fit |

Suits decisive personalities; can trigger regret if mistimed |

Suits consistency-seekers; minimizes FOMO/FOLE |

Suits balanced mindsets; combines consistency with opportunism |

Whichever path you pick, keep it rules-based. OroPocket makes it simple: start a SIP from ₹1, set alerts, and earn free Bitcoin on every buy. Download now: https://oropocket.com/app

Common Timing Mistakes Indians Make (So You Can Avoid Them)

-

Chasing festival-day FOMO and paying higher premiums/spreads.

-

Fix: Accumulate 4–8 weeks before Akshaya Tritiya/Dhanteras/Diwali, or run a SIP and add on small dips.

-

-

Treating jewellery as investment (making charges 8–25%+ erode value vs 24K investment-grade gold).

-

Fix: Separate “wear” from “wealth.” For investing, choose 24K investment-grade gold with transparent pricing and low spreads.

-

-

Ignoring INR currency risk (domestic prices can rise even when global gold is flat).

-

Fix: Track USD/INR alongside global gold. If INR is weakening quickly, stagger buys instead of going all-in.

-

-

Using unregulated/unknown apps; weak buyback, opaque pricing.

-

Fix: Choose RBI-compliant platforms with authorized bullion partners, insured vaults, and clear buy/sell quotes. OroPocket ticks all three – and adds Bitcoin rewards.

-

-

Going all-in on one day instead of building a plan (SIP + dip buys).

-

Fix: Start a base SIP, then add top-ups on 2–5% pullbacks or when your indicator checklist turns green.

-

-

Forgetting exit planning (goals, target allocation, rebalancing rules, tax).

-

Fix: Define why you’re buying (hedge, goals), your gold allocation, and when you’ll rebalance. Note tax treatment before selling.

-

-

Not checking purity and storage: Prefer 24K investment-grade; ensure secure, insured vaulting when buying digital gold.

-

Fix: Verify purity (24K), vaulting insurance, and custody. OroPocket offers 24K pure gold, 100% insured vaults, and instant UPI buys.

-

If you’re wondering “should I buy gold now” or “when should I buy gold,” avoid these traps and make it rules-based. Start from ₹1, automate a SIP, and earn free Bitcoin on every purchase with OroPocket. Download the app: https://oropocket.com/app

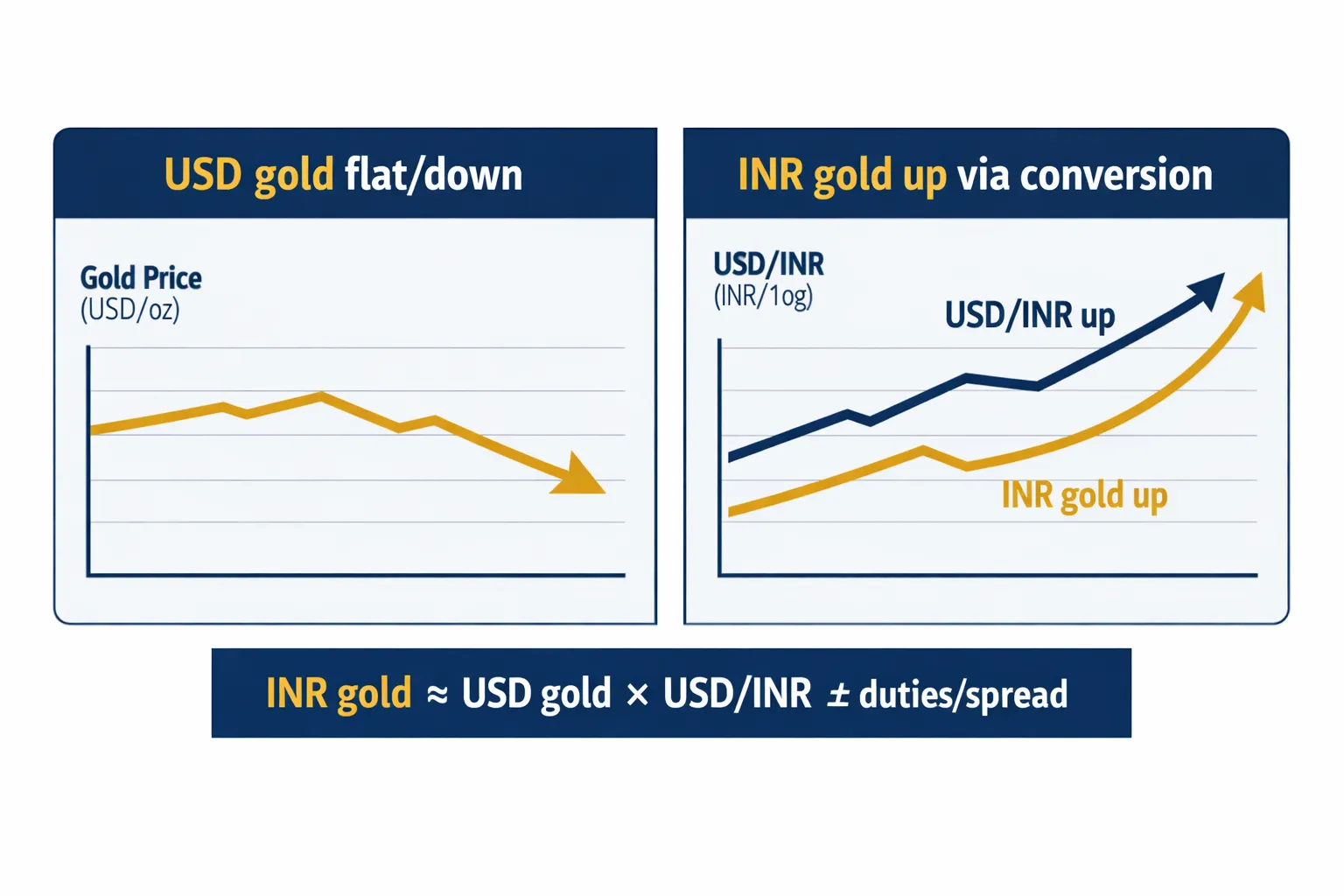

Why INR Matters: Currency, Duties, and Local Pricing

The pricing identity

-

INR gold price ≈ International gold price (USD/oz) × USD/INR ± local duties, taxes, and dealer spread.

What this means for timing

-

Even if global gold is flat, a weaker INR can push Indian gold prices up.

-

Watch import duty and GST changes; they shift local price levels and spreads.

“If the INR depreciates by 1% against the USD, the local INR gold price typically rises by roughly 1%, holding USD gold constant (INR gold ≈ USD gold × USD/INR).” – Source

Practical takeaway

-

Pair global signals (real yields, USD) with USD/INR moves. Avoid chasing spikes caused solely by abrupt INR weakness; let FX volatility cool before large buys.

Ready to buy smart, not emotional? Start a gold SIP from ₹1 on OroPocket, pay instantly via UPI, and earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

Your Pre‑Purchase Checklist (10 Quick Questions)

-

Have I set a target allocation (e.g., 5–10% of portfolio)?

-

Are real yields falling or stable? Is the USD weakening?

-

Is USD/INR calm or strengthening INR? Any duty/tax changes ahead?

-

Am I 4–8 weeks ahead of major festival demand?

-

Do I have a base SIP running and a small dip fund ready?

-

Is my platform RBI-compliant with insured vaulting and clear buyback?

-

Am I buying 24K investment-grade gold (not high-making-charge jewellery) for investment purposes?

-

Have I checked spreads/premiums today versus last week?

-

Do I have an exit or rebalance rule (by time, price, or allocation)?

-

Have I avoided emotional trades and stuck to my plan?

Answer “yes” down the list and you’re ready to buy with confidence. Still thinking “should I buy gold now”? Start small, stay disciplined, and let your rules lead the way.

Start in 30 seconds with OroPocket. Buy from ₹1, pay via UPI, and earn free Bitcoin on every purchase: https://oropocket.com/app

Quick FAQs: Should I Buy Gold Now? Best Months? How Much?

Is it a good time to buy gold now?

-

If you have zero exposure, yes – start with a SIP and add on dips. For tacticians, check real yields, USD/INR, and proximity to festivals.

-

Translation: Don’t wait for the “perfect” bottom. Build exposure now, then layer in buys when the data lines up.

When is the best time to buy gold in India?

-

4–8 weeks before Akshaya Tritiya or Dhanteras, and during calm INR periods. Avoid last‑minute festival rushes when spreads can widen.

-

Also watch RBI/Fed meetings and inflation prints; dovish turns often help gold.

Which months are usually better?

-

Historically, pre‑festival accumulation windows often work better than festival day buys. But indicators and INR matter more than the calendar.

-

If you’re unsure, automate a SIP to average through noise.

How much gold should I hold?

-

Many diversified portfolios allocate 5–10% to gold depending on risk, goals, and other assets.

-

Higher allocation can suit those seeking stronger inflation hedging; lower if equity-heavy and comfortable with volatility.

Lump sum or SIP?

-

SIP for most investors; Hybrid (SIP + dip buys) for those tracking macro.

-

Lump sum can work when real yields are falling, USD/INR is calm, and festival demand is still weeks away.

Make your plan simple and disciplined. Start a gold SIP from ₹1 on OroPocket, pay via UPI, and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

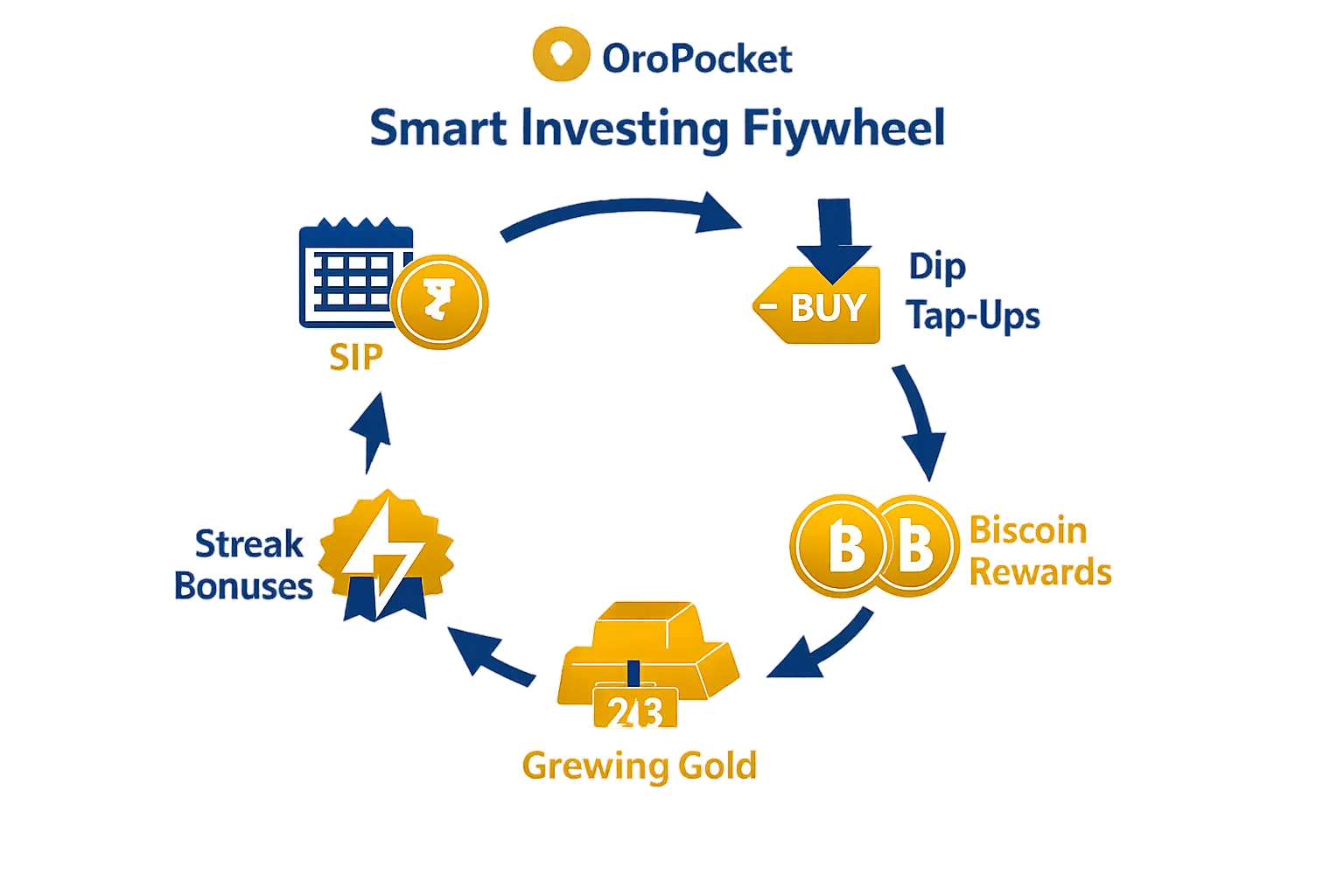

How OroPocket Helps You Time Smarter (and Earn Bitcoin on Every Buy)

Make timing simpler

-

Micro‑investing from ₹1 via UPI: Start your SIP immediately – no waiting for a “perfect” day.

-

Auto‑SIP + dip top‑ups: Build a base position, then add more when prices cool.

Get rewarded while you invest

-

Free Bitcoin (Satoshi) cashback on every gold/silver purchase – unique combo of gold stability + Bitcoin upside.

-

Daily streaks, Spin‑to‑Win, referral bonuses (100 Satoshi + free spin) to keep you consistent.

Trust and security

-

24K pure gold, 100% insured vaults, RBI‑compliant partners, transparent pricing and instant liquidity.

Why this matters for timing

-

You don’t need to time perfectly. Build habits with SIP, capture dips with top‑ups, and let rewards compound your edge.

Ready to start? Download OroPocket and buy gold in 30 seconds. Earn free Bitcoin on every purchase: https://oropocket.com/app

Conclusion: Don’t Overthink The Perfect Day – Start Small Today

-

The best time to buy gold is when your plan says so: base SIP now, add on dips, and accumulate ahead of India’s festival peaks.

-

Use the indicator checklist (real yields, USD, INR, inflation, policy) to guide top‑ups.

-

Keep it simple, stay diversified, and avoid festival‑day FOMO and high making charges.

Ready to act? Download the OroPocket app and start with as little as ₹1. Buy 24K gold in 30 seconds via UPI – and earn free Bitcoin on every purchase.

Call to action: Get the app now – https://oropocket.com/app