Where to Invest in Silver in India: Best Platforms, Charges, and Safety Checklist

Introduction: Where to Invest in Silver in India (Best Platforms, Charges, Safety)

Why this guide matters

-

Bank returns are still below inflation; silver is a practical hedge and a real, scarce asset you can understand.

-

Digital-first options let you start small (even ₹1), pay via UPI, and keep your silver in insured vaults – no locker stress.

What we’ll compare

-

Best places where to invest in silver in India: digital silver apps, SEBI-regulated Silver ETFs, and one ultra-trusted physical mint option.

-

Charges you actually pay: platform spreads, 3% GST at buy, storage, brokerage for ETFs, and making/delivery if you redeem to coins/bars.

-

Safety checklist: vault partners, insurance, independent audits, clear ownership models, regulation and KYC/PAN norms.

How to use this list

-

Pick your path based on comfort: instant UPI micro-buys on a silver investment app (digital silver), or invest in silver online via demat with Silver ETFs – or mix both for flexibility and transparency.

-

Scan each product’s mini table for fee model, minimums, liquidity (sell-back vs market), and key safety signals before you trade silver online.

60-second safety checklist (apply to every platform)

-

Insured third‑party vaults with independent audit reports (or AMC-grade custody/audits for ETFs).

-

Upfront disclosures on buy/sell spreads, 3% GST at purchase, storage terms, and physical redemption charges.

-

Transparent KYC/PAN thresholds, clear dispute‑redressal process, and a downloadable transaction/holding statement.

Quick explainer (video)

A simple 2–3 minute overview of digital silver vs Silver ETFs in India, fees, and safety.

Ready to start with tiny amounts, UPI speed, and insured vaulting – plus Bitcoin rewards on every silver buy? Download the OroPocket app: https://oropocket.com/app

1) OroPocket – Digital silver from ₹1 via UPI, with Bitcoin rewards on every purchase

What it is (and why it stands out)

A mobile-first app to buy/sell 99.9%+ silver in seconds. Unique rewards layer: free Satoshi (Bitcoin) cashback on every buy, plus streak bonuses and daily spins.

Key features for silver investors

-

Start at ₹1; instant UPI flows.

-

Bitcoin rewards on every silver purchase; streak bonuses every 5 days.

-

100% insured vaults with authorized bullion partners; RBI-compliant ops.

-

Instant sell-back or redeem to coins/bars (making + delivery charges apply).

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Digital silver app |

|

Minimum buy |

₹1 entry point |

|

Pricing model |

Live price + platform spread + 3% GST at buy; storage often free for a period; nominal thereafter (if applicable) |

|

Storage/Vaulting |

100% insured, third‑party vaults; periodic audits |

|

Redemption/Liquidity |

Instant sell-back; optional physical redemption with making + delivery charges |

|

KYC & Limits |

OTP signup; PAN/KYC required beyond thresholds per AML norms |

Safety & compliance notes

-

RBI‑compliant operations; insured vaulting; independent audits and user-level statements.

Best for

-

First-time, UPI‑native investors who want micro-buys + habit‑forming rewards.

Getting started

-

Download the OroPocket app, complete basic KYC, tap “Buy Silver,” pay via UPI, and track holdings live.

2) DigiGold – Low-friction digital silver with insured Brink’s vaulting

What it is (and why it stands out)

Digital silver platform by Amrapali Gujarat (40+ years’ bullion legacy). Buy, sell, gift, or redeem to coins/bars.

Key features for silver investors

-

Buy fractions, store in insured vaults (Brink’s); NABL/BIS‑linked credentials.

-

Free storage period; SIP-like plans and instant gifting.

-

Physical redemption PAN‑India (making + delivery charges apply).

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Digital silver app |

|

Minimum buy |

Low minimum (micro-purchases supported) |

|

Pricing model |

Live price + platform spread + 3% GST at buy; storage often free for a period; nominal thereafter (if applicable) |

|

Storage/Vaulting |

Insured third‑party vaults (e.g., Brink’s) |

|

Redemption/Liquidity |

Instant sell-back; optional physical redemption with making + delivery charges |

|

KYC & Limits |

PAN/KYC required beyond high-value thresholds |

Safety & compliance notes

-

Third‑party insured vaults; audit trail and online statements.

Best for

-

Users wanting a simple, legacy-backed digital silver experience with physical delivery options.

Getting started

-

Create account, choose grams/₹, pay via UPI/card/netbanking, track holdings.

3) Augmont – Trusted Indian bullion house for digital silver + delivery

What it is (and why it stands out)

A large Indian bullion brand offering digital gold/silver, SIP-like plans, and doorstep delivery of coins/bars.

Key features for silver investors

-

Fractional buys with insured vaulting; SIP/automated accumulation.

-

Doorstep delivery; gifting options available.

-

Widely integrated with partner apps and jewellers.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Digital silver platform |

|

Minimum buy |

Low minimum (micro-purchases supported) |

|

Pricing model |

Live price + platform spread + 3% GST at buy; storage often free for a period; nominal thereafter (if applicable) |

|

Storage/Vaulting |

Insured third‑party vaulting with periodic audits |

|

Redemption/Liquidity |

Instant sell-back; physical coins/bars with making + delivery charges |

|

KYC & Limits |

PAN/KYC required beyond thresholds per AML norms |

Safety & compliance notes

-

Established bullion player; insured vaulting and reconciliation.

Best for

-

Long-term accumulators who want SIP convenience + occasional physical redemption.

Getting started

-

Sign up on the app/site, pick silver, choose grams/₹, pay digitally, monitor holdings.

4) MMTC‑PAMP eStore – Ultra‑trusted coins/bars (physical silver)

What it is (and why it stands out)

India’s most recognized precious metals refiner. Shop government‑mint‑grade silver coins/bars online for maximum purity and brand trust.

Key features for silver investors

-

BIS‑hallmarked, high-purity silver products; commemoratives and bars.

-

Pan‑India delivery; tamper‑evident packaging.

-

Ideal for gifting and long‑term physical keeps.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Physical silver (online retail) |

|

Minimum buy |

By denomination (coins/bars) |

|

Pricing model |

Product premium + 3% GST; shipping/insurance as applicable |

|

Storage/Vaulting |

Self‑storage (no platform vault) |

|

Redemption/Liquidity |

Resale via jewellers/buy‑back channels; not instant in‑app |

|

KYC & Limits |

As per order value and regulations |

Safety & compliance notes

-

Industry‑leading purity and packaging; purchase invoices for records.

Best for

-

Buyers who want tangible silver from a top‑tier mint.

Getting started

-

Choose coin/bar on the eStore, add to cart, pay online, track shipment.

5) SafeGold – Digital bullion provider powering multiple partner apps

What it is (and why it stands out)

B2B2C digital bullion provider that enables digital gold/silver on popular consumer apps; users typically buy via partner platforms.

Key features for silver investors

-

Buy fractional silver on supported apps; insured third‑party vaulting.

-

Option to redeem into coins/bars (charges apply via partner).

-

Regular reconciliations and independent oversight structures.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Digital bullion infrastructure (buy via partner apps) |

|

Minimum buy |

Low minimums via partners |

|

Pricing model |

Live price + spread + 3% GST at buy; storage terms per partner |

|

Storage/Vaulting |

Insured third‑party vaults; independent trustee/oversight frameworks |

|

Redemption/Liquidity |

Partner‑app instant sell-back; physical redemption with charges |

|

KYC & Limits |

As per partner app KYC thresholds |

Safety & compliance notes

-

Third‑party vaults and independent trustee/audit frameworks; view policies on partner app.

Best for

-

Users already active on partner super‑apps who want convenience.

Getting started

-

Open a supported app account, select silver, pay digitally, and view holdings in-app.

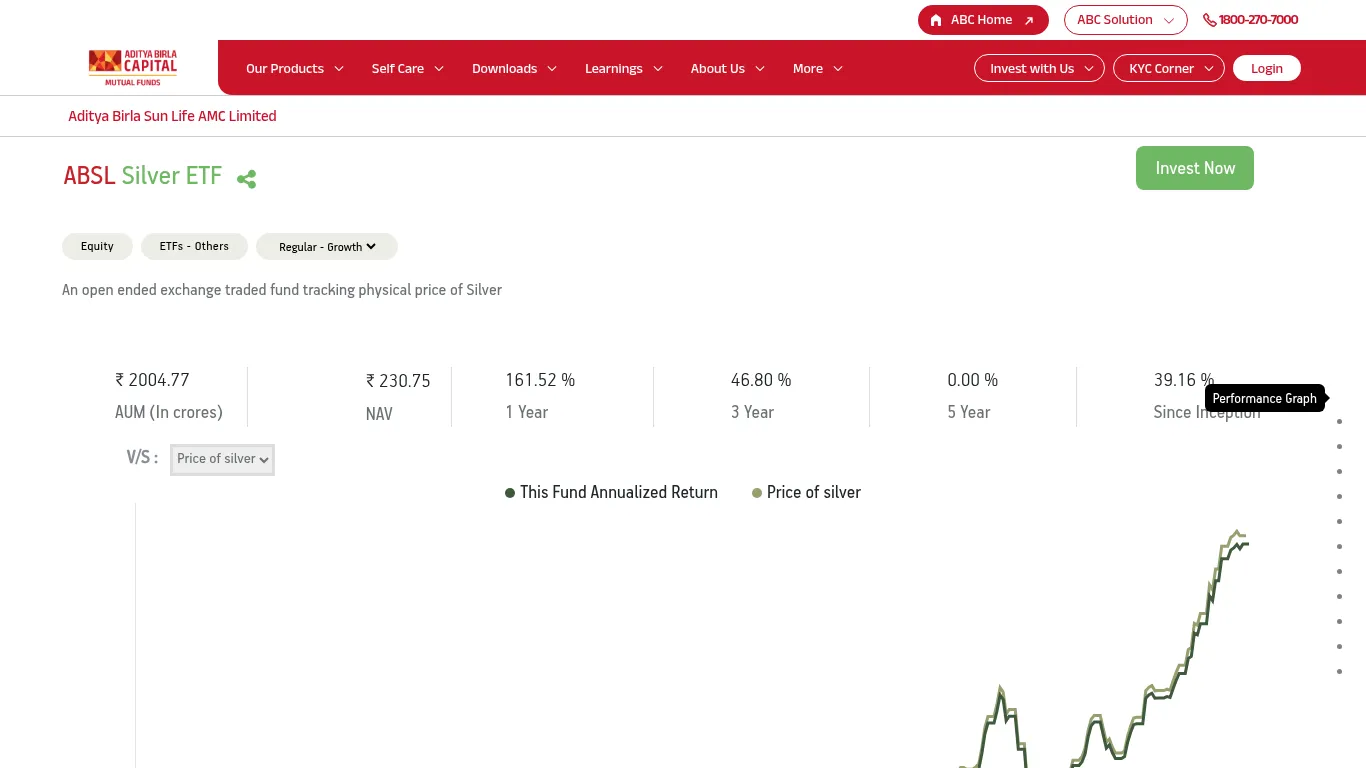

6) Aditya Birla Sun Life Silver ETF – SEBI‑regulated exposure via demat

What it is (and why it stands out)

An exchange‑traded fund that invests in physical silver meeting global good‑delivery standards; buy/sell on NSE/BSE like a stock.

Key features for silver investors

-

High purity standards; daily NAV, transparent disclosures.

-

No GST on unit purchase; pay regular brokerage + exchange charges.

-

No platform vault fee for investors; custody handled by AMC ecosystem.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Silver ETF (SEBI‑regulated) |

|

Minimum buy |

1 unit (via demat) |

|

Pricing model |

Low expense ratio at fund level; investor pays brokerage/exchange charges; no GST on ETF unit purchase |

|

Storage/Vaulting |

AMC‑managed custody of bullion; investor holds demat units |

|

Redemption/Liquidity |

Sell on exchange at market price; T+ settlement |

|

KYC & Limits |

Standard broker KYC with PAN; exchange limits apply |

Safety & compliance notes

-

SEBI‑regulated mutual fund structure; audited holdings and disclosures.

Best for

-

Long‑term investors wanting regulated, low‑friction exposure without physical handling.

Getting started

-

Open demat + trading account, search the ETF ticker, buy units during market hours.

7) HDFC Silver ETF – Blue‑chip AMC credibility, simple exchange liquidity

What it is (and why it stands out)

Large, well‑known AMC offering exchange‑traded exposure to silver prices via demat.

Key features for silver investors

-

Transparent NAV and portfolio disclosures.

-

Buy/sell on NSE/BSE; intraday liquidity subject to market depth.

-

Efficient tracking of domestic silver prices.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Silver ETF (SEBI‑regulated) |

|

Minimum buy |

1 unit (via demat) |

|

Pricing model |

Low expense ratio at fund level; investor pays brokerage/exchange charges; no GST on ETF unit purchase |

|

Storage/Vaulting |

AMC‑managed custody; investor holds demat units |

|

Redemption/Liquidity |

Exchange trading with T+ settlement |

|

KYC & Limits |

Broker KYC + PAN required |

Safety & compliance notes

-

SEBI‑regulated fund, audited holdings, half‑yearly reports.

Best for

-

Investors who prefer established AMCs and exchange liquidity.

Getting started

-

Use any broker app, search the scheme’s ticker, and place buy/sell orders.

8) ICICI Prudential Silver ETF – Broad distribution and tight ops

What it is (and why it stands out)

A widely distributed silver ETF from a large Indian AMC; convenient access across brokerages.

Key features for silver investors

-

Transparent pricing and daily NAV.

-

Exchange‑based buy/sell; no GST on ETF unit purchase.

-

AMC custody of bullion; investor holds units in demat.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Silver ETF (SEBI‑regulated) |

|

Minimum buy |

1 unit (via demat) |

|

Pricing model |

Low expense ratio at fund level; investor pays brokerage/exchange charges |

|

Storage/Vaulting |

AMC custody; demat holding for investors |

|

Redemption/Liquidity |

Exchange trading (subject to market depth) |

|

KYC & Limits |

Broker KYC + PAN |

Safety & compliance notes

-

SEBI‑regulated; audited bullion and disclosures per regulations.

Best for

-

Investors who want broad availability across many brokers and apps.

Getting started

-

Open broker app, search ticker, place order during market hours.

9) SBI Silver ETF – PSU trust factor with exchange trading

What it is (and why it stands out)

Silver ETF from SBI Mutual Fund, combining PSU brand trust with regulated exposure to silver prices.

Key features for silver investors

-

Exchange liquidity via NSE/BSE.

-

Daily NAV and disclosures; efficient tracking.

-

No handling of physical metal by the investor.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Silver ETF (SEBI‑regulated) |

|

Minimum buy |

1 unit (via demat) |

|

Pricing model |

Low expense ratio at fund level; investor pays brokerage/exchange charges |

|

Storage/Vaulting |

AMC custody; investor holds demat units |

|

Redemption/Liquidity |

Sell units on exchange; T+ settlement |

|

KYC & Limits |

Broker KYC + PAN |

Safety & compliance notes

-

SEBI‑regulated structure with audited holdings.

Best for

-

Investors who prefer PSU‑backed brands for core allocations.

Getting started

-

Use your broker app to trade the ETF like a stock.

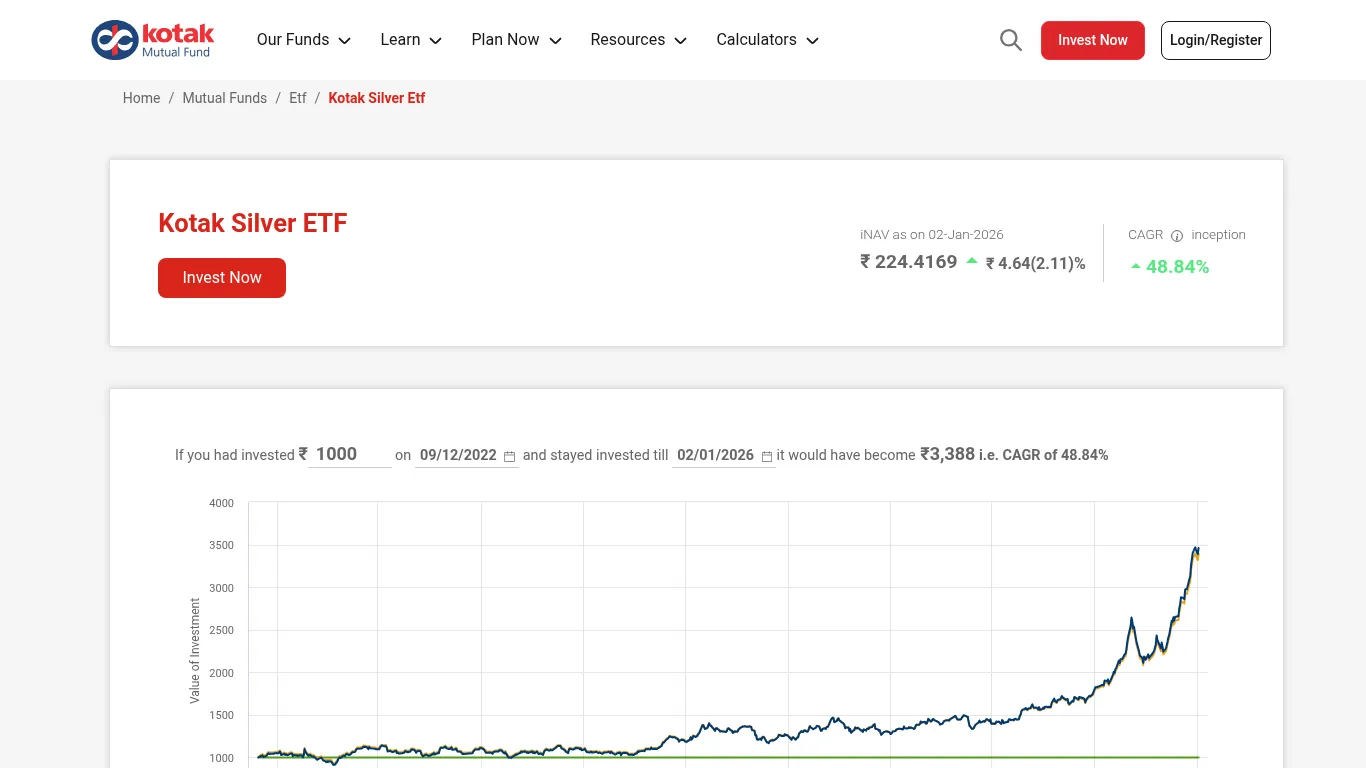

10) Kotak Silver ETF – Clean, low‑touch silver exposure via demat

What it is (and why it stands out)

Kotak AMC’s exchange‑traded silver exposure with the simplicity of stock‑like trading.

Key features for silver investors

-

Daily NAV and transparent reporting.

-

Buy/sell through any major broker; no GST on ETF unit purchase.

-

Efficient way to diversify without physical custody.

Fees and charges at a glance

|

Item |

Typical treatment |

|---|---|

|

Type |

Silver ETF (SEBI‑regulated) |

|

Minimum buy |

1 unit (via demat) |

|

Pricing model |

Low expense ratio at fund level; investor pays brokerage/exchange charges |

|

Storage/Vaulting |

AMC custody; demat units for investors |

|

Redemption/Liquidity |

Exchange trading with normal settlement |

|

KYC & Limits |

Broker KYC + PAN |

Safety & compliance notes

-

SEBI‑regulated mutual fund structure; audited bullion.

Best for

-

Fee‑aware investors who want diversified exposure without platform spreads.

Getting started

-

Open your broker app, find the ETF ticker, and place the order.

Overall Comparison: Best Places to Invest in Silver in India

|

Product |

Type |

Minimum Buy |

Fees Model (high level) |

Liquidity/Redemption |

Safety Highlights |

|---|---|---|---|---|---|

|

OroPocket |

Digital silver app |

₹1 |

Live price + spread + 3% GST; storage often free initially |

Instant sell-back; physical redemption (charges apply) |

Insured vaults, audits, RBI‑compliant ops |

|

DigiGold |

Digital silver app |

Low |

Live price + spread + 3% GST; storage terms apply |

Instant sell-back; physical delivery |

Insured vaults (Brink’s), legacy bullion brand |

|

Augmont |

Digital silver platform |

Low |

Live price + spread + 3% GST; storage terms apply |

Instant sell-back; coins/bars delivery |

Established bullion house; insured vaults |

|

MMTC‑PAMP eStore |

Physical coins/bars |

By product |

Product premium + GST; shipping |

Physical delivery; resale via jewellers |

Mint‑grade purity; tamper‑evident packs |

|

SafeGold (via partners) |

Digital bullion infra |

Low |

Live price + spread + 3% GST; partner terms |

Partner‑app sell-back; physical redemption |

Insured vaults; independent oversight |

|

ABSL Silver ETF |

Silver ETF |

1 unit |

Fund expense ratio + brokerage; no GST on unit buy |

Exchange trading (NSE/BSE) |

SEBI‑regulated AMC custody |

|

HDFC Silver ETF |

Silver ETF |

1 unit |

Fund expense ratio + brokerage |

Exchange trading |

SEBI‑regulated AMC custody |

|

ICICI Pru Silver ETF |

Silver ETF |

1 unit |

Fund expense ratio + brokerage |

Exchange trading |

SEBI‑regulated AMC custody |

|

SBI Silver ETF |

Silver ETF |

1 unit |

Fund expense ratio + brokerage |

Exchange trading |

SEBI‑regulated AMC custody |

|

Kotak Silver ETF |

Silver ETF |

1 unit |

Fund expense ratio + brokerage |

Exchange trading |

SEBI‑regulated AMC custody |

How to choose quickly

-

Want instant UPI micro-buys + rewards? Pick OroPocket.

-

Want regulated, demat-based exposure? Pick a Silver ETF via your broker.

-

Want a physical keepsake from a top mint? Use MMTC-PAMP eStore.

Conclusion: Start small, stay safe, and be fee‑aware

-

Silver is a smart diversifier – pick the route that matches your style: UPI micro‑buys (digital) or demat ETFs (regulated).

-

Apply the safety checklist every time: insured vaults/AMC custody, independent audits, transparent fees, clean KYC.

-

Keep paperwork: invoices, statements, audit-backed confirmations – helps with taxes and performance tracking.

Ready to buy digital silver online in under 30 seconds and earn Bitcoin on every purchase? Download OroPocket now.

Call to Action: https://oropocket.com/app