Which is better, digital silver or silver ETF in 2026?

Intro: Digital Silver vs Silver ETF in 2026 (What’s better for you?)

Why this comparison now

After silver’s explosive run in 2025, more Indians want exposure without the headaches of physical storage or making charges.

“Silver on MCX surged about 167% in 2025, its strongest annual performance on record.” – Source

-

Digital Silver: App-based buying/selling of silver units backed by vaulted metal; no Demat required.

-

Silver ETF: SEBI-regulated fund holding 99.9% physical silver, traded on NSE/BSE via Demat.

Where OroPocket fits: We’re a mobile-first way to invest in digital silver starting at ₹1 – instant UPI payments, 100% insured vaults, and you earn free Bitcoin (Satoshis) on every purchase. Build a habit with streaks, spins, and rewards – right from your phone.

At-a-glance comparison (quick answer)

|

Factor |

Digital Silver (apps like OroPocket) |

Silver ETF (SEBI-regulated) |

|---|---|---|

|

Costs |

Platform spread/fees; no brokerage; no Demat charges |

Lower TER (~0.40%–0.56%) + brokerage/exchange fees |

|

Taxes |

Non-equity taxation; LTCG at 12.5% after 24 months (plus surcharge & cess) |

Non-equity taxation; LTCG at 12.5% after 12 months (plus surcharge & cess) |

|

Liquidity |

24×7 buy/sell within the app; instant UPI |

Market hours only; exchange liquidity and bid-ask spreads apply |

|

Minimums |

Start from ₹1 |

Price of 1 unit (often ~₹70–₹100) |

|

Regulation |

Not SEBI-regulated; platform-level compliance, insured vaulting |

SEBI-regulated mutual fund structure |

|

Access/Requirements |

No Demat; UPI-native; mobile-first |

Demat + trading account required |

|

Ideal user |

First-time/micro investors, UPI-first, rewards-motivated |

Cost/tax optimizers with Demat, comfortable with markets |

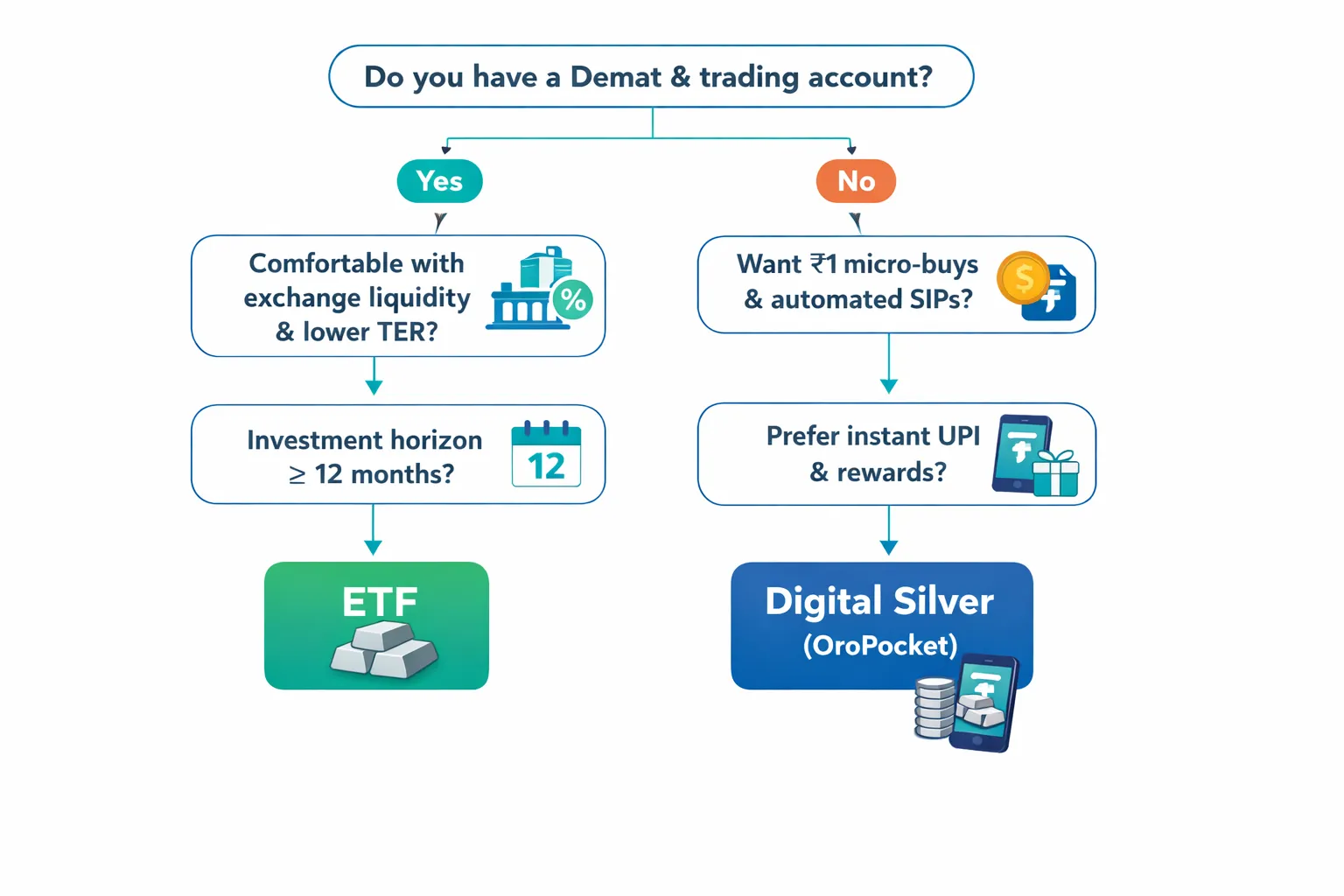

When to prefer each

-

Choose a Silver ETF if you have a Demat account, want lower TER, real-time trading, and 12-month LTCG qualification.

-

Choose Digital Silver if you want ₹1 micro-investing, instant UPI, 24×7 access, and habit-building rewards like daily streaks and free Bitcoin on every purchase.

What exactly are you buying? Asset, custody, and regulation

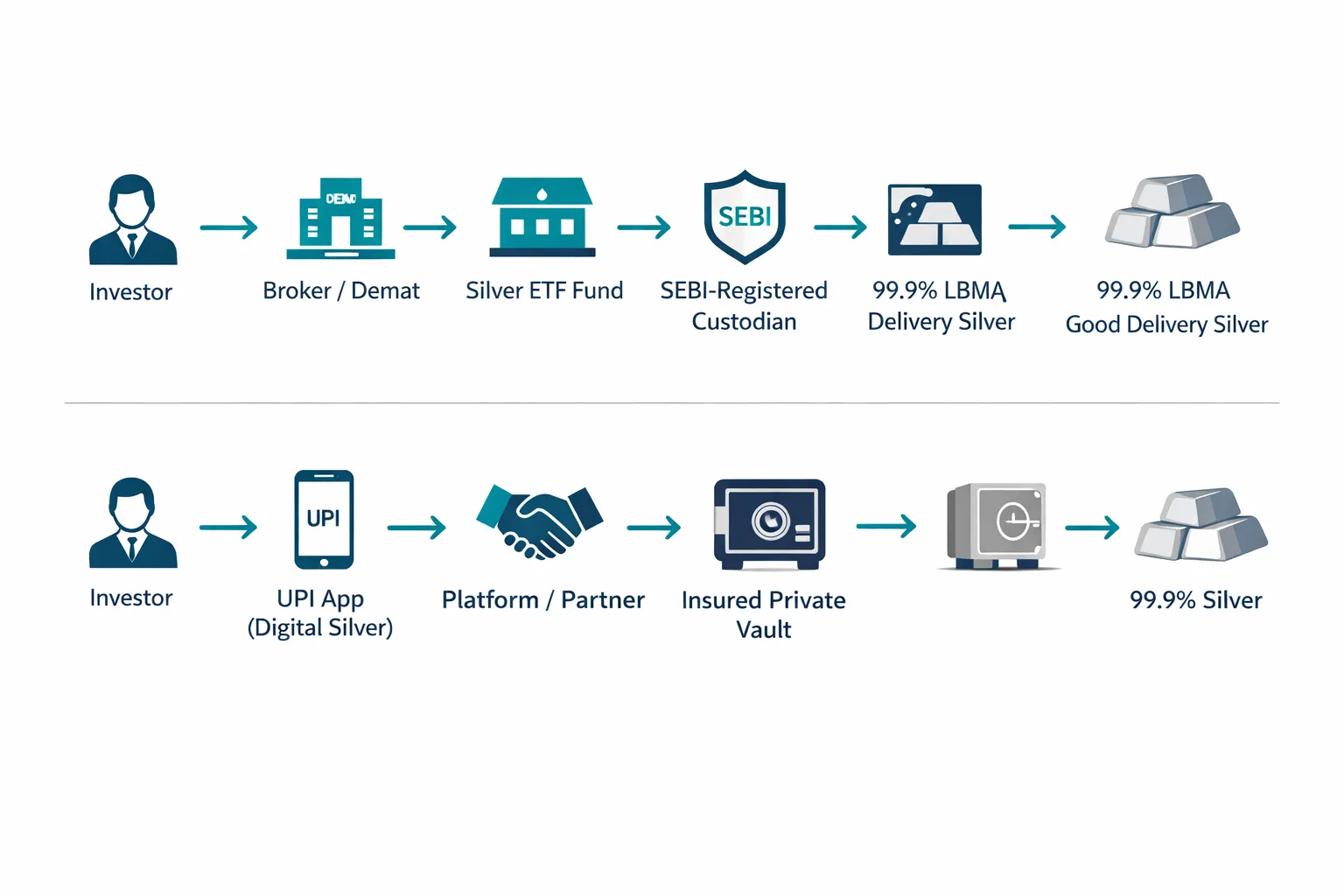

Silver ETF (SEBI-regulated fund)

-

Structure: A listed mutual fund that holds physical silver of 99.9% purity and silver-related instruments; aims to mirror domestic silver prices.

-

Custody: Silver is stored with SEBI-registered custodians; funds publish daily NAVs, mandated disclosures, and undergo regular audits.

-

Price tracking: ETFs track spot prices but can have tracking error due to expenses, cash holdings, and market frictions.

Digital Silver (platform-based bullion)

-

Structure: Fractional ownership claims on 99.9% vaulted silver via partner vaults; you buy/sell units digitally without a Demat.

-

Custody: Stored in insured private vaults; evaluate platform counterparty risk, vaulting partners, and insurance coverage.

-

Proofs and redemption: Look for GST invoices, transaction receipts, and certificates of purity/ownership; some platforms offer sell-back or doorstep delivery of coins/bars.

Purity, verification, and transparency

-

Standards: Preference for LBMA Good Delivery bars (serialized), 99.9% purity.

-

Verification: Independent audits with reconciliation to fund/platform records; frequency should be disclosed.

-

Documents to check: Invoice with GST details, bar/lot numbers where applicable, and a certificate of purity/ownership from the platform/fund.

“SEBI mandates Silver ETFs to invest at least 95% of assets in 99.9% pure silver and related instruments, stored with SEBI-registered custodians, with regular audits.” – Source

Costs you actually pay: TER, spreads, GST, brokerage, and hidden drags

Silver ETF cost stack vs Digital Silver cost stack

|

Cost Component |

Silver ETF (exchange-traded) |

Digital Silver (platform-based) |

Notes |

|---|---|---|---|

|

Upfront price basis |

Market price near NAV; no GST |

Spot-linked price + 3% GST on purchase |

GST applies to silver purchases outside mutual funds |

|

Expense Ratio (TER) |

~0.40%–0.56% annually |

Often embedded in spread; some platforms charge 0%–0.50% storage |

ETFs disclose TER; platforms may bundle custody into pricing |

|

Brokerage/Trading Fees |

Applicable per broker (e.g., 0.03%–0.10%) |

None |

ETFs incur broker + exchange/clearing fees |

|

Exchange/Clearing Charges |

Applicable (small) |

Not applicable |

Exchange levies vary by broker |

|

Bid–Ask Spread |

~0.05%–0.50% depending on liquidity |

Platform buy/sell spread ~0.50%–2.00% |

Wider in volatile markets or low-liquidity ETFs |

|

Premium/Discount to NAV |

Possible ±0.5%–2% in volatile sessions |

Not applicable (provider quotes may widen spreads) |

ETF market price can deviate from NAV intraday |

|

GST |

Not applicable on units |

3% on purchase value |

Major upfront cost item for Digital Silver |

|

Redemption/Delivery |

Not applicable |

Delivery courier + minting/making charges if coins/bars |

Applies only if opting for physical conversion |

|

Exit Costs |

Brokerage + spread on sale |

Sell spread (~0.50%–2.00%) |

ETFs also have statutory charges on sale as per broker |

|

Ongoing Holding Cost |

TER deducted within NAV |

Usually bundled; some platforms charge nominal storage |

Verify storage/audit terms with provider |

|

Liquidity Window |

Market hours (subject to volumes) |

24×7 app liquidity (subject to platform terms) |

ETFs depend on market depth; platforms on provider inventory |

|

Operational Requirements |

Demat + trading account |

UPI/mobile app; no Demat |

Convenience vs market connectivity trade-off |

|

Transparency |

Daily NAV, disclosures, audits |

Invoices, ownership/purity certificates, audit summaries |

ETFs offer standardized disclosures; platforms vary |

Real-world examples (Illustrative ₹10,000 purchase)

|

Item |

Silver ETF |

Digital Silver |

|---|---|---|

|

Purchase amount |

₹10,000 |

₹10,000 |

|

Upfront taxes |

₹0 |

₹300 GST (3% of ₹10,000) |

|

Brokerage/Exchange |

~₹5–₹15 (broker + exchange/clearing) |

₹0 |

|

Bid–Ask/Spread at Entry |

~₹10–₹30 (0.10%–0.30%) |

~₹50–₹200 (0.50%–2.00%) |

|

Net invested after entry costs |

~₹9,955–₹9,975 |

~₹9,500–₹9,850 |

|

Ongoing holding cost (annual) |

TER ~₹40–₹56 (0.40%–0.56%) |

Often ₹0 if bundled; some charge ~₹0–₹50 |

|

Exit costs (when selling) |

Brokerage + spread ~₹10–₹40 |

Sell spread ~₹50–₹200 (delivery fees only if you chose physical earlier) |

|

Key takeaway |

Lower ongoing TER; no GST; needs Demat and market liquidity |

Higher upfront (GST + spread); UPI-native, micro-friendly; simple 24×7 access |

|

Assumptions |

Ranges are illustrative; actuals vary by broker, fund liquidity, and market conditions |

Ranges are illustrative; actuals vary by platform, product choice, and volatility |

Taxes in 2026: Holding period rules and what changes your post-tax return

Silver ETF

-

STCG: If held for 12 months or less, gains are taxed at your income-tax slab rate.

-

LTCG: If held for more than 12 months, gains are taxed at 12.5% plus applicable surcharge and cess.

-

Indexation: Not available under current rules.

Digital Silver

-

Treatment: Typically treated like physical bullion.

-

STCG: If held for 24 months or less, gains are taxed at your income-tax slab rate.

-

LTCG: If held for more than 24 months, gains are taxed at 12.5% plus applicable surcharge and cess.

-

Indexation: Not available.

Planning tips

-

The 12 vs 24 months difference matters: ETFs reach LTCG in half the time, which can materially improve medium-term (12–24 month) post-tax returns versus Digital Silver.

-

Time your exits: If you’re close to 12 months (ETF) or 24 months (Digital Silver), waiting to cross the LTCG threshold could reduce your tax outgo significantly.

-

Harvest gains strategically: Consider partial profit-taking just after crossing the LTCG threshold to lock in favorable tax rates, while letting the rest compound.

-

Use volatility wisely: If you must rebalance early, be aware that selling before 12/24 months may push gains into slab taxation – plan staggered exits.

-

Keep records clean: Maintain purchase dates, amounts, and platform/fund statements to accurately compute holding periods and apply the correct tax rate.

Liquidity, execution, and settlement: How fast you can get in and out

Silver ETF

-

Intraday trading on NSE/BSE (9:15 AM–3:30 PM) with execution quality tied to volumes and bid–ask spread.

-

During high volatility, prices can dislocate from NAV; use limit orders to avoid overpaying.

-

Settlement typically T+1 to your demat; broker withdrawal to bank follows your broker’s payout cycle.

Digital Silver

-

24×7 buy/sell within the app – no exchange hours or market closures.

-

Instant UPI for purchases; sell proceeds timeline depends on platform SLA (often same day to T+1/T+2).

-

No reliance on exchange depth; execution depends on platform inventory and quoted spreads.

Practical safeguards

-

For ETFs: Prefer liquid funds, check bid–ask before placing orders, and use limits over market orders in thin volumes.

-

For Digital Silver: Review platform SLAs, sell-back policies, withdrawal timelines, and any limits on large redemptions.

Risks you must price in: Market, counterparty, and operational

Common risk: Price volatility

Silver can swing hard – much more than gold. Plan your allocation, stagger your entries (SIP or tranches), and avoid chasing spikes.

“Silver’s annualized volatility has been reported near 27% versus ~16% for gold – roughly 1.7x higher.” – Source

ETF-specific risks

-

Tracking error: Fund returns can deviate from spot due to TER, cash positions, and operational frictions.

-

Premium/discount vs NAV: In turbulent sessions, exchange prices may diverge from NAV.

-

Liquidity gaps: Thin volumes widen bid–ask spreads; large orders can impact execution.

Digital silver–specific risks

-

Platform/counterparty risk: You rely on the platform’s governance, partners, and segregation of assets.

-

Vaulting/insurance reliance: Confirm insured storage, audit frequency, and bar serialization standards.

-

Regulatory clarity: Not SEBI-regulated; ensure robust documentation and transparent policies.

How to de-risk

-

Diversify providers and don’t over-concentrate in a single platform/fund.

-

Verify audit trails: Look for third-party audit summaries, bar lists, and insurance certificates.

-

Understand redemption/transferability: Know sellback, delivery options, and settlement timelines.

-

Use position sizing and disciplined rebalancing to manage volatility.

Minimums, SIPs, and habit-building: Start small and stay consistent

Silver ETF

-

Minimum equals the price of one unit, which fluctuates with market price.

-

SIP automation depends on your broker’s “stock SIP” features; often less flexible than mutual fund SIPs.

-

Works well for larger, less frequent allocations where you want lower TER and exchange execution.

Digital Silver

-

Start from ₹1 with seamless UPI and instant execution – no Demat required.

-

Micro-buys any day: perfect for daily/weekly investing, goal tagging, and nudges to build consistency.

-

24×7 access means you’re not limited by market hours, helping you keep your streaks alive.

Why OroPocket stands out (fair, transparent)

-

₹1 entry with gamified streaks and spin-to-win to keep you consistent.

-

Free Bitcoin rewards (Satoshi) on every silver purchase, plus referral bonuses for you and friends.

-

RBI-compliant partners, 100% insured vaults, and a mobile-first experience designed for habit-building.

-

Ready to try? Download the OroPocket app: https://oropocket.com/app

Which one is better for whom? Clear scenarios and portfolio fit

If you prioritise lowest ongoing cost and 12-month LTCG

-

Prefer a Silver ETF – provided you pick funds with healthy trading volumes and tight bid–ask spreads.

-

Use limit orders and avoid chasing spikes during volatile sessions.

If you prioritise convenience, ₹1 micro-investing, and habit formation

-

Prefer Digital Silver. OroPocket adds real-world habit builders: daily streaks, spin-to-win, and free Bitcoin rewards (Satoshis) on every purchase – making consistency easier.

Sample allocations (not financial advice)

-

Conservative: 5–7% silver within total portfolio; rest across equity, debt, and gold.

-

Balanced: 8–12% silver; mix ETFs and Digital Silver depending on Demat access and SIP needs.

-

Aggressive: 12–18% silver; stagger entries to manage volatility and rebalance quarterly.

Red flags to watch (for both)

-

FOMO buying after sharp rallies.

-

Ignoring tax holding periods (12 months for ETF vs 24 months for Digital Silver).

-

Not checking ETF liquidity or platform sellback/withdrawal policies before investing.

How to start in 10 minutes (step-by-step)

If you pick a Silver ETF

-

Step 1: Choose a liquid ETF; verify expense ratio and average daily volumes. Check bid–ask spreads during market hours.

-

Step 2: Open/Use your Demat + broker account; enable an ETF SIP if your broker supports it or set calendar reminders to buy monthly.

-

Step 3: Place your first buy using a limit order (especially in volatile sessions) and note the execution price versus indicative NAV.

If you pick Digital Silver (with OroPocket)

-

Step 1: Download the OroPocket app and complete a quick KYC.

-

Step 2: Add money via UPI and buy from ₹1 – no Demat needed.

-

Step 3: Turn on streaks, set auto-buys (daily/weekly), track Bitcoin rewards on each purchase, and learn the sell/withdraw flows in the app.

-

Ready to start? Download the OroPocket app: https://oropocket.com/app

Good hygiene

-

Keep invoices/contract notes and platform statements in one folder.

-

Track your holding period (12 months for ETF LTCG; 24 months for Digital Silver LTCG).

-

Review allocation quarterly; rebalance if silver grows beyond your target.

Final verdict: Digital Silver vs Silver ETF in 2026

The short answer

-

ETF wins on regulation (SEBI oversight), lower ongoing costs (TER), and faster tax efficiency (12-month LTCG).

-

Digital Silver wins on access (₹1 entry), 24×7 convenience, UPI-native flow, and habit-building with rewards and gamification.

Our recommendation by use-case

-

First-time investors and SIP/micro-investors: Choose Digital Silver. OroPocket’s ₹1 entry, daily streaks, and Bitcoin rewards make consistency easy without a Demat.

-

Demat-savvy, larger-ticket investors with a 12+ month horizon: Choose a Silver ETF for lower TERs, exchange pricing, and 12-month LTCG qualification.

Next step

-

Start with an allocation you can stick to. If convenience matters, download OroPocket and begin with ₹1 today.

-

Keep a balanced, transparent approach – review your allocation and tax position every quarter and adjust as your goals evolve.

Ready to begin? Download the OroPocket app: https://oropocket.com/app