Which is better, FD or digital gold?

Intro: FD vs Digital Gold – quick answer and comparison at a glance

What this guide covers in 3 lines

-

Who should pick a bank/NBFC Fixed Deposit (FD)

-

Who should pick digital gold (and when it can beat FD in real returns)

-

When to combine both for stability + growth

TL;DR recommendation

-

Pick FD if you need guaranteed income, zero price swings, and a fixed goal date.

-

Pick digital gold if you want an inflation hedge, long-term growth potential, and anytime liquidity.

-

For most young savers, a 60–80% FD + 20–40% gold split works well; tilt more to gold when horizons are 5+ years.

Comparison at a glance (table)

|

Feature |

Fixed Deposit (FD) |

Digital Gold |

|---|---|---|

|

Returns potential |

Fixed, predictable |

Market-linked; historically higher over long periods |

|

Risk type |

Credit risk of issuer |

Price volatility |

|

Liquidity |

Premature withdrawal penalty |

Redeem anytime |

|

Minimum investment |

Typically lump sum |

Start from ₹1 on OroPocket |

|

Income generation |

Periodic interest payouts |

No periodic income; capital appreciation on sale |

|

Taxes |

Interest taxed at slab rates |

Capital gains tax on sale; rules evolve – check latest |

|

Costs |

Mostly none; penalty if broken |

Spread + 3% GST on buy; no making charges |

|

Safety |

DICGC-insured up to ₹5 lakh per bank |

Vaulted, insured, 24K purity with reputed custodians |

Why this article is better than what you’ve read

-

Uses real Indian context (UPI, DICGC, GST, typical rates)

-

Gives a clear decision framework + sample allocation

-

Shows how OroPocket’s ₹1 entry and Bitcoin rewards can tilt your effective outcomes without extra risk

How they work: what you’re really buying

Fixed Deposit (FD)

-

You lend money to a bank/NBFC for a fixed tenure at a fixed interest rate

-

Payout options: cumulative (reinvest interest) or non-cumulative (monthly/quarterly income)

-

Safety net: DICGC insurance up to ₹5 lakh per depositor per bank (bank FDs only)

-

Corporate/NBFC FDs rely on issuer rating (AAA/AA, etc.) – higher rates can imply higher risk

Digital Gold (via OroPocket and similar vault-backed providers)

-

You buy fractions of 24K gold stored in insured, audited vaults

-

Ownership is digital; buy/sell 24×7 in small amounts; purity and storage managed by the provider

-

No making charges; spreads apply; audited custody with reputed bullion partners

-

On OroPocket: start at ₹1, pay via UPI, gift gold, track holdings in-app

What problem each solves

-

FD: certainty of return, predictable maturity amount, easy planning for fixed dates

-

Digital gold: inflation hedge, portfolio diversifier, simple long-term wealth anchor without storage hassles

Returns vs. inflation: the numbers that matter

Historical performance (directionally)

-

Gold has delivered strong long-term rupee returns over multi-decade periods; best viewed on 5–10+ year horizons

-

Bank/NBFC FDs typically offer 5–8% p.a., varying with rate cycles; real return depends on inflation and tax

“From 1973 to 2023, gold prices in India have grown at a CAGR of roughly 11%.” – Source

“As of Dec 2025, Indian bank and NBFC FDs generally offer between 5% and 8% interest.” – Source

Real return lens (why many savers feel stuck)

-

Real return = Post-tax return – Inflation

-

Example approach: If FD yields 7% and your slab is 20%, post-tax ≈ 5.6%; with 5.5–6.5% inflation, real return can approach zero

-

Gold’s market-linked nature means higher variance year to year but historically better odds of beating inflation long-term

Takeaways for planning

-

Short horizon (≤3 years): FD advantage on certainty

-

Long horizon (≥5 years): gold often narrows or exceeds FD after-tax real returns

-

Stagger entries: SIP in gold; ladder your FDs

Risk, safety, and regulation

FD risks and protections

-

Credit/default risk of the issuer; stick to strong banks/NBFCs with top ratings

-

DICGC insurance covers bank FDs up to ₹5 lakh per depositor per bank (not NBFC FDs)

-

Interest rate reinvestment risk if you need to roll over in a low-rate cycle

Digital gold risks and mitigants

-

Price volatility – NAV moves daily with global gold prices

-

Provider selection: prefer platforms with reputed bullion partners, audited vaults, and full insurance

-

Platform risk: ensure clear title to gold, independent trustees/custodians, and robust redemption processes

Pros/Cons matrix: FD vs Digital Gold

|

Factor |

Fixed Deposit (FD) |

Digital Gold |

|---|---|---|

|

Safety |

High for bank FDs due to DICGC cover; depends on issuer strength for NBFC FDs |

High when vaulted, fully insured, with reputed custodians |

|

Transparency |

Clear interest rate and tenure; known maturity value |

Real-time buy/sell prices; custody audits and purity assurances are key |

|

Counterparty risk |

Bank/NBFC default risk; mitigated by ratings and DICGC for banks |

Platform and custodian risk; mitigated by independent trustees, insured vaults |

|

Volatility |

Very low price volatility |

Market-linked; daily price movements |

“DICGC insures eligible bank deposits up to ₹5,00,000 per depositor per bank, covering principal and interest.” – Source

Liquidity and access: how fast can you get cash?

FD

-

Premature withdrawal allowed but attracts penalty and adjusted interest

-

Loan against FD often available (typically up to ~75–90% of FD value)

-

Best for known goal dates where you won’t need to break the deposit

Digital Gold

-

Buy/sell in seconds; no lock-in; fractional amounts

-

No paperwork; instant UPI payments and cashout to bank via partner policies

-

Gift/send gold to family; great for flexible saving and emergencies

Everyday convenience

-

Track on mobile; automate habits via SIPs and round-ups (where supported)

-

For OroPocket: ₹1 start, daily streaks and spins keep you investing consistently

Taxes and costs (what most comparisons miss)

FD taxation

-

Interest is taxed as per your income slab; TDS may apply above thresholds

-

No GST on investing; penalties if broken early reduce effective yield

Digital gold taxation

-

Treated as a capital asset; tax applies only when you sell

-

Long- vs short-term capital gains rules and rates can change – check latest CBDT guidance for FY 2025–26 before decisions

-

3% GST applies on gold purchases (industry standard), no making charges like jewellery

SGB footnote (if you prefer a government-backed gold route)

-

Capital gains on redemption at maturity are tax-exempt; semi-annual interest is taxable

-

Lock-in of 8 years (with early exit options via exchanges post year 5)

Costs, spreads, and the true ‘all-in’ return

FD

-

Mostly zero explicit fees; watch for premature exit penalties

-

Reinvestment risk if rates fall at maturity

Digital Gold

-

Buy/sell spread (varies by provider); check live quote vs reference price

-

3% GST on buy; no making/assaying/storage hassles

-

Platform benefits can offset costs: OroPocket gives Satoshi (Bitcoin) rewards on each purchase – boosting effective value without changing risk of gold itself

What to check before you choose

-

FD: issuer rating, DICGC cover (for banks), penalty terms, payout option

-

Digital Gold: spread, custody partner, audit/insurance, liquidity, rewards/benefits

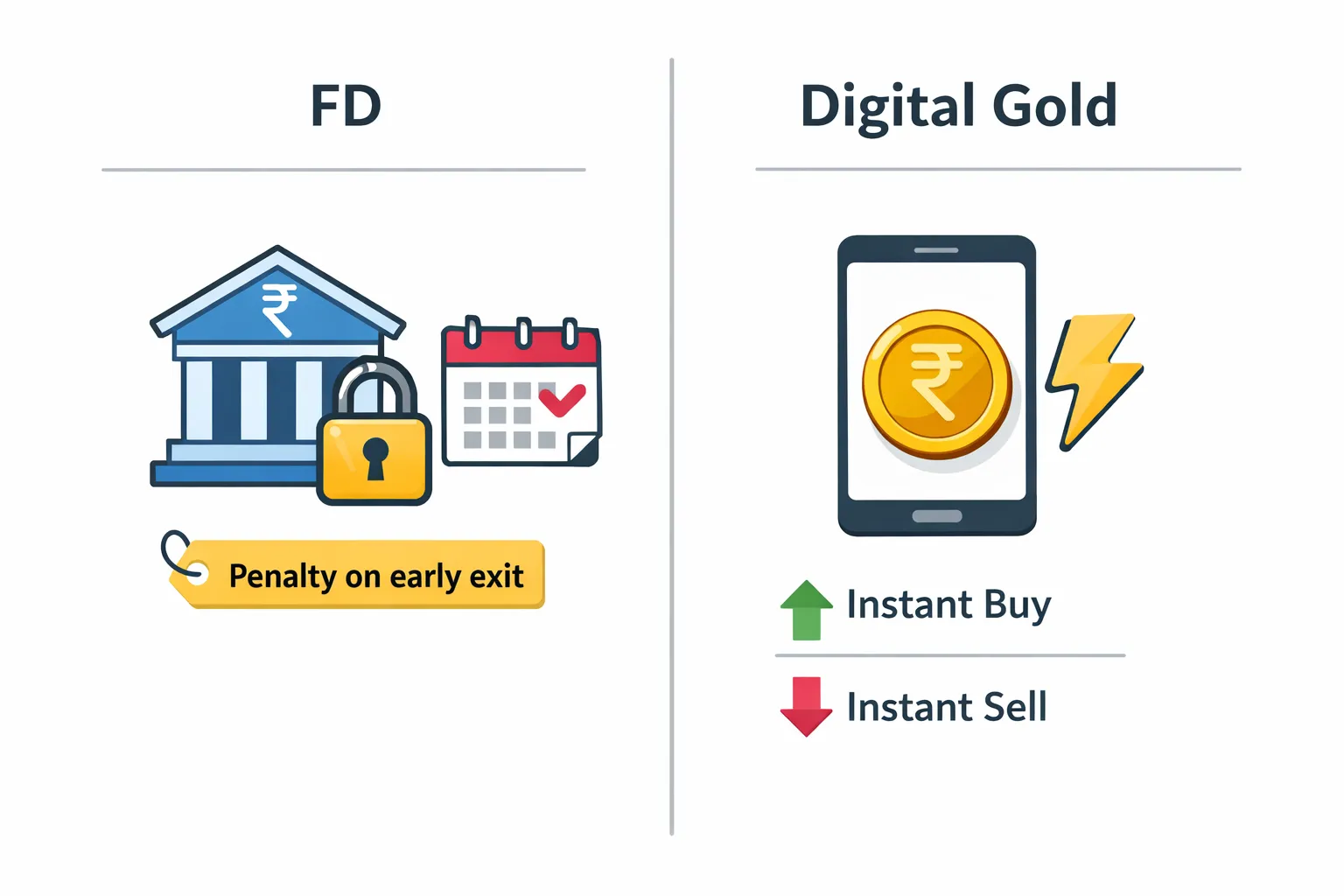

Who should choose what: a simple decision framework

Choose FD if you

-

Need guaranteed returns on a fixed date (fees, rent, education, visa funds)

-

Are in or near retirement and prioritise income stability

-

Will lose sleep over daily price moves

Choose Digital Gold if you

-

Have a 5+ year horizon and want an inflation hedge

-

Value micro-investing (₹1 starts), on-demand liquidity, and zero storage hassle

-

Want to diversify beyond FDs without stock/crypto complexity

Smart middle ground (common for 22–35 age group)

-

60–80% in laddered FDs for stability + 20–40% in digital gold for growth hedge

-

Increase gold tilt as horizon lengthens or inflation rises

-

On OroPocket: automate a gold SIP, earn Bitcoin rewards, and gift gold for milestones

How to combine both: simple, actionable plans

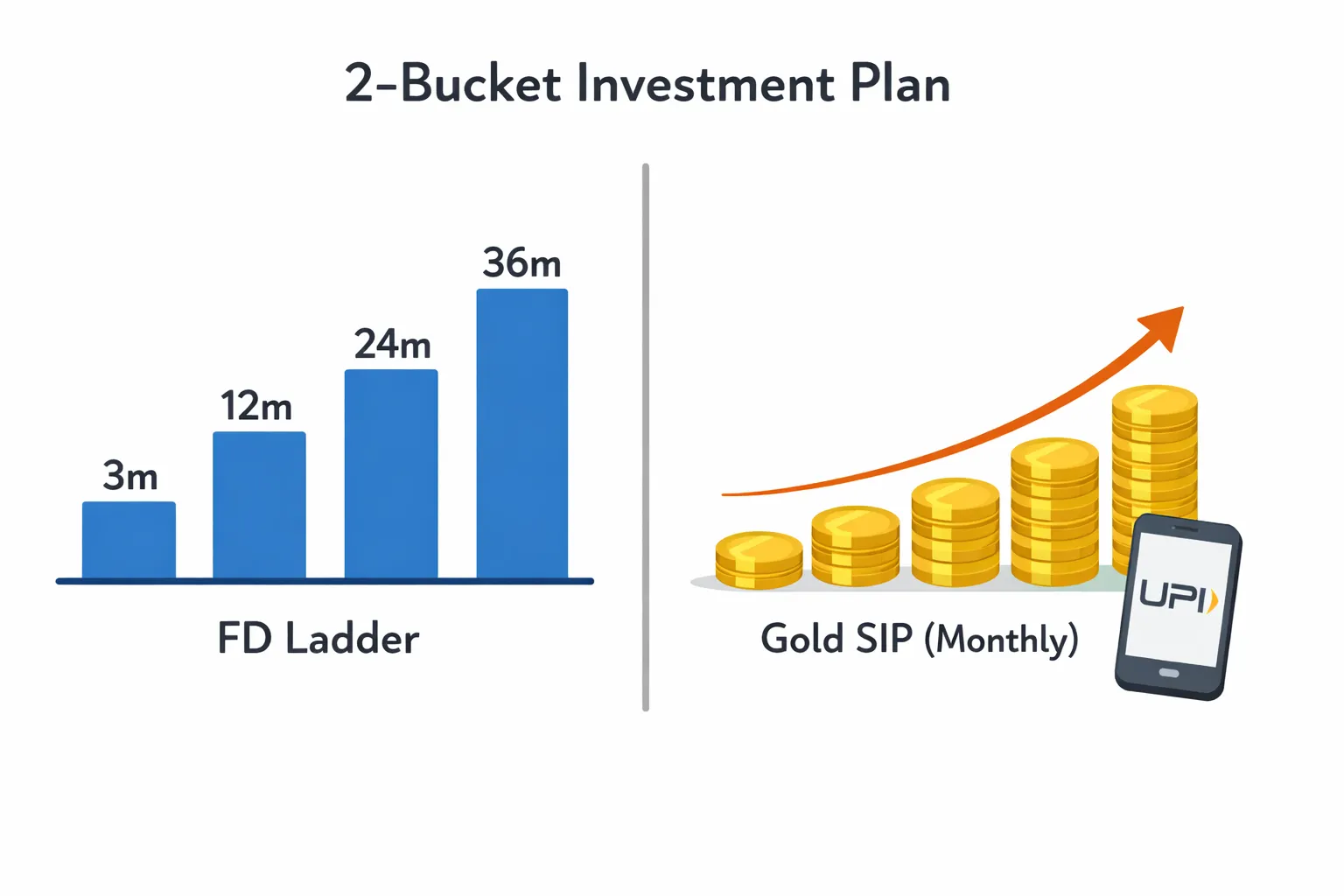

The 2-bucket plan

-

Bucket A (Safety): Ladder 3–12–24–36 month FDs to smooth reinvestment risk

-

Bucket B (Growth Hedge): Monthly digital gold SIP (start with ₹500–₹2,000; even ₹1 works on OroPocket)

Example for ₹5,000/month starter

-

₹3,500 into FD ladder, ₹1,500 into digital gold SIP

-

Review split annually; rebalance back to target if gold rallies sharply

How OroPocket boosts this plan

-

₹1 entry via UPI; daily streaks + spin-to-win build habit

-

Bitcoin rewards on every purchase add extra upside without extra effort

-

Send/gift gold instantly for family goals

Guardrails

-

Keep emergency fund liquid (savings/short FD) before investing

-

Don’t chase short-term gold spikes; stick to SIP discipline

Final verdict: Which should you pick today?

The short answer

-

If you need certainty and dates: go FD.

-

If you want long-term inflation protection and flexibility: go digital gold.

-

If you want both: do a blended plan and rebalance annually.

Why OroPocket stands out for digital gold

-

Start with ₹1 via UPI; 24K pure, fully insured vaults, RBI-compliant operations

-

Earn free Bitcoin (Satoshis) on every gold/silver purchase – unique upside without changing your gold risk

-

Gamified streaks and rewards make consistency easy

Next step

-

Build your 80/20 (or 70/30) plan in 10 minutes: set an FD ladder with your bank/NBFC and start a gold SIP on OroPocket today

-

Download the OroPocket app to begin in under a minute

“In India, gold has historically preserved purchasing power and improved portfolio diversification; when inflation exceeded 6%, gold rose ~12.6% annually on average.” – Source