Why did the silver price fall?

Why Did the Silver Price Fall? (And What Smart Indian Investors Should Do Next)

Silver didn’t “randomly crash.” It fell because too many traders piled in too fast, then a few macro triggers (stronger dollar, higher rate expectations, margin hikes) forced leveraged selling – and silver, by nature, exaggerates moves.

If you’re an Indian retail investor (student, salaried, small business owner, first-time investor), here’s the key takeaway:

Silver is not broken. Your strategy might be.

Stop watching. Start growing – with a plan built for volatility, not hype.

The Real Reasons Silver Fell (Explained Simply)

Competitor articles generally agree on the triggers (dollar strength, hawkish Fed vibes, profit booking). But most of them miss the mechanics – how silver falls (liquidity + leverage + margin shocks) and what it means for Indian investors using ETFs, futures, or digital silver.

Here’s the full picture.

1) Silver Ran Ahead of Fundamentals (Speculation + FOMO)

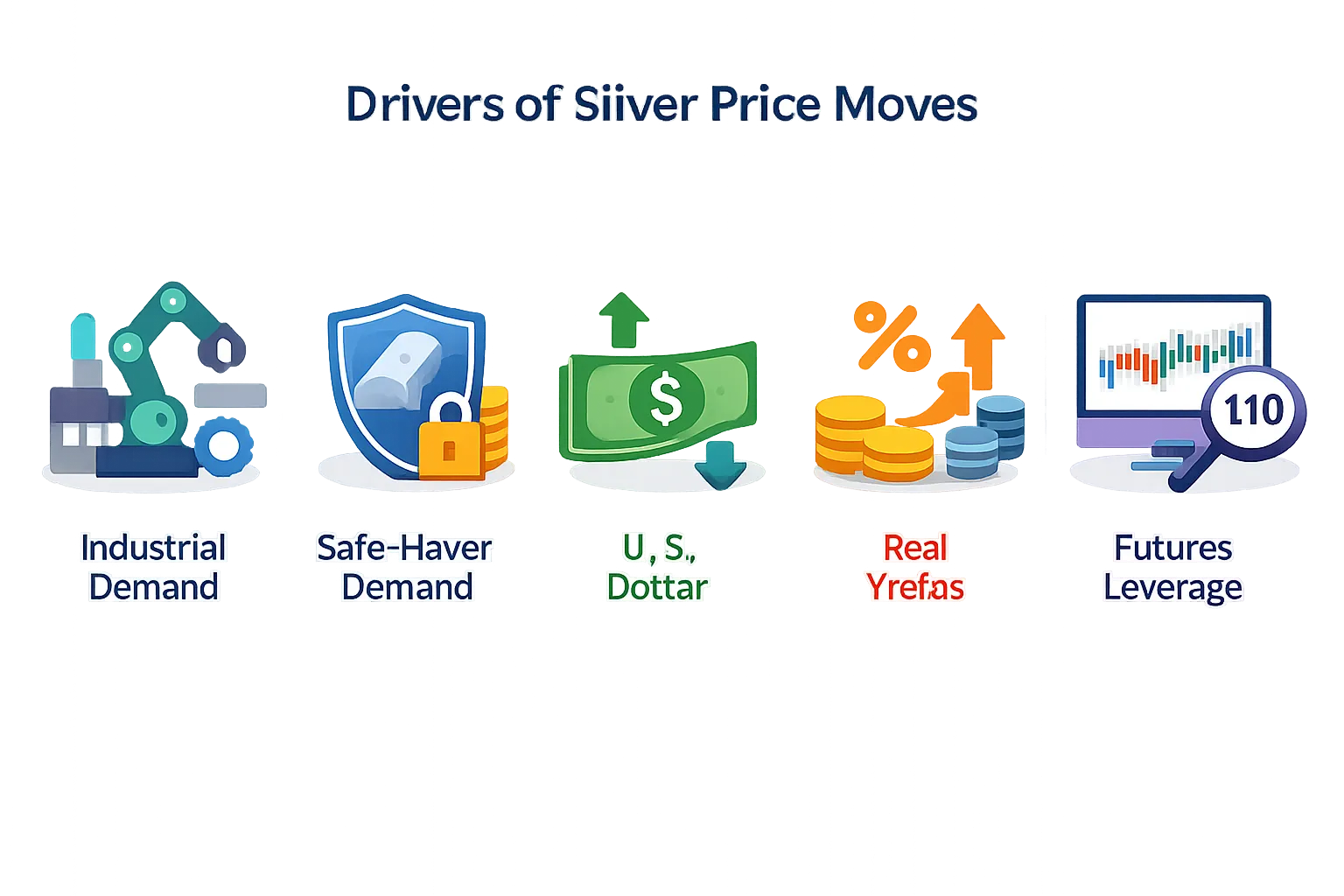

Silver has two personalities:

-

Industrial metal (electronics, solar, EVs)

-

Monetary/safe-haven metal (like gold, but more volatile)

In fast bull runs, the second personality takes over. Prices get pushed by momentum and leverage, not actual end-use demand.

When that happens, the market becomes fragile:

-

small negative news → big selling

-

profit booking → cascade

-

leverage unwinds → panic

2) The US Dollar Strengthened (Silver Is Priced in Dollars)

When the USD rises, silver becomes more expensive for non-US buyers. Demand softens. Prices fall.

In early 2026, silver got hit as the market started pricing:

-

higher-for-longer interest rates

-

a more hawkish Fed path

That combination typically supports the dollar and pressures precious metals.

3) “Hawkish Fed” Expectations Pushed Real Yields Up

Silver (and gold) don’t pay interest. So when interest rates (or real yields) rise, the opportunity cost of holding metals increases.

In the recent cycle, a hawkish-policy narrative intensified after major Fed leadership speculation, which helped trigger a broad commodities selloff.

4) Margin Requirement Hikes Forced Leveraged Traders to Sell

This is a big one that many investor articles mention but don’t explain well.

When exchanges (like CME) raise margins:

-

traders need more cash to hold the same futures position

-

leveraged players either add money or cut positions

-

many cut positions → heavy selling → faster fall

Silver, being thinner than gold, reacts more violently to this “forced selling” mechanic.

5) Risk-Off Sentiment Hit Commodities Together (Silver Fell With Gold, Oil, Copper)

Silver is often treated like a “high beta” version of gold:

-

in rallies: it can outperform

-

in selloffs: it can drop harder

When markets turn cautious:

-

funds reduce exposure

-

liquidity dries up

-

correlated assets slide together

Silver vs Gold: Why Silver Drops Harder

Silver’s volatility is not a bug – it’s a feature of the market.

“From 1990 to Oct 2024, silver’s monthly return volatility (standard deviation) was 26.6% vs gold’s 14.7%, and silver saw a max drawdown of -54% vs gold’s -25.1%.” – Source

Translation: If you buy silver like you buy fixed deposits, it will emotionally wreck you.

But if you buy it with micro-allocation + staggered entries + rebalancing, it can be powerful.

What This Means for Indian Investors (MCX, ETFs, Digital Silver)

Here’s where most competitors stop short: the “right action” depends on how you’re invested.

If you’re in futures (MCX)

-

Volatility + margins can force exits at the worst time.

-

Position sizing and stop discipline matters more than “direction.”

If you’re in silver ETFs

-

ETF prices track spot, but panic days can still feel brutal.

-

Don’t treat ETFs as “safe”; treat them as “market-linked.”

If you’re in digital silver

This is where retail investors get an edge – because you can:

-

buy in tiny amounts (no leverage pressure)

-

average in calmly

-

build a long-term allocation without getting liquidated

If you’re exploring formats, compare options using this guide: digital silver vs silver ETF in 2026.

The “Smart Money” Framework: 5 Checks Before You Buy the Dip

1) Don’t average down blindly – average down with a rule

Example rules:

-

buy in 5–10 tranches

-

buy only after volatility cools

-

buy on fixed dates (SIP style)

2) Keep silver a satellite, not the core

Silver can boost returns, but it shouldn’t dominate your portfolio.

3) Watch the USD and rate expectations

If USD stays strong and yields rise, silver can remain under pressure.

4) Know your reason for owning silver

-

hedge?

-

tactical trade?

-

long-term industrial thesis?

Different purpose = different holding period.

5) Rebalance instead of predicting

This is where the gold-silver ratio becomes useful. If you want to go deeper, use a ratio-based approach: gold-to-silver ratio strategy.

Why OroPocket’s Approach Fits This Moment (Volatility-Proof Investing)

When prices swing violently, the winning move isn’t “timing the bottom.”

It’s building the habit and letting volatility work for you.

With OroPocket:

-

Start from ₹1 (no minimum – no excuses)

-

Instant UPI buys (under 30 seconds)

-

100% secure & compliant (authorized bullion partners, insured vaulting)

-

Gamified investing (streaks, spin-to-win, tiered rewards)

-

Free Bitcoin on every gold/silver purchase (Satoshi cashback)

-

Referral rewards (both earn 100 Satoshi + free spin)

This is how you stay consistent when markets try to scare you out.

And if you’re still deciding whether silver belongs in your portfolio this year, read: is it a good time to buy silver in 2026?

Silver Fell – But the Bigger Problem Is Inflation (Don’t Ignore This)

Most people keep money in savings and feel “safe”… while inflation quietly reduces purchasing power.

Gold’s long-term role as an inflation hedge is why smart portfolios still keep exposure to metals.

“Over the past five years, gold delivered a CAGR of approximately 23.2% in India.” – Source

Silver is more volatile than gold – but both can play a role when fiat purchasing power is under pressure.

Bottom Line: Is the Silver Bull Run Over?

Not necessarily.

What happened looks like a classic “overheated rally → leverage unwind → margin shock → forced selling” cycle.

The real decision is not “will silver bounce tomorrow?”

It’s: Do you want a strategy that survives volatility?

Final Verdict + CTA: Stop Watching. Start Growing.

Silver price falls are scary when you’re all-in, over-leveraged, or chasing highs.

But if you invest like a pro – small allocation, staggered buys, rebalancing – volatility becomes your advantage.

Download OroPocket and start with ₹1 today.

Build your metals stack. Earn free Bitcoin on every buy. Turn investing into a daily habit.

Don’t wait for “the perfect price.”

Start now. Stay consistent. Get rewarded.