Will silver touch 5 lac?

Will Silver Touch ₹5 Lakh per Kg? A Reality Check for Indian Investors (2026)

Silver has been on a tear – record highs, violent dips, and headlines that make every saver wonder the same thing: “Will silver touch ₹5 lakh per kg?”

If you’re a student, salaried professional, or first-time investor, the real problem isn’t predicting a number – it’s not getting trapped by hype, buying at the top, and then panic-selling on the next crash.

This guide breaks down what the best market coverage is saying, what they missed, and what you can do right now to build silver exposure smartly – starting from ₹1, via UPI, with rewards – without needing to become a trader.

What the market is really asking when it asks “₹5 lakh?”

Competitors typically focus on:

-

Record highs (₹4 lakh/kg+ moments)

-

Macro triggers (Fed rates, dollar weakness, geopolitics)

-

Industrial demand story (solar, electronics, EVs)

-

Volatility warning (“be careful at elevated levels”)

What they often don’t do:

-

Translate ₹5 lakh into clear conditions that must happen

-

Give a retail-friendly plan (SIP vs lumpsum vs rebalancing)

-

Compare ways to invest (physical vs ETF vs digital) with real-world friction

-

Address the biggest behavioral risk: FOMO + leverage + over-allocation

That’s what we’ll fix.

Where silver is coming from (and why it can still surprise)

Silver isn’t just a “precious metal.” It’s a hybrid asset:

-

Safe-haven demand (fear trade: geopolitics, currency risk)

-

Industrial demand (energy transition, electronics, AI/data centers)

-

Supply constraints (mine supply doesn’t respond fast)

That mix creates a unique outcome: silver can rally like a commodity and trade like a sentiment asset – meaning faster upside, but also sharper drawdowns.

The ₹5 lakh question: what needs to happen (and what can stop it)

A realistic “YES” path to ₹5 lakh/kg

Silver can push towards ₹5 lakh/kg if multiple drivers align for long enough:

-

Sustained industrial demand surge (solar + EV + electronics stays hot)

-

Persistent supply deficit (tight physical market continues)

-

Global risk-off cycles (safe-haven buying returns repeatedly)

-

Weaker dollar / lower yields trend (boosts bullion appetite)

-

India retail + ETF flows remain elevated (local demand fuels spikes)

A realistic “NO / NOT YET” path

Silver may fail to reach ₹5 lakh in the near term if:

-

Global growth slows sharply and industrial demand cools

-

Rates stay higher for longer (reducing speculative appetite)

-

Big profit-booking hits after parabolic moves

-

INR strengthens meaningfully (reduces imported inflation impact)

Bottom line: ₹5 lakh is possible – but silver usually doesn’t move in a straight line. The bigger question is: can you survive the volatility while staying invested?

Proof that retail participation is already aggressive (and why that matters)

When inflows rise this fast, momentum gets stronger – but so does “hot money” risk.

“In January 2026, Silver ETFs in India saw inflows jump 139% month-on-month to ₹9,463 crore; AUM rose to ₹1.16 lakh crore.” – Economic Times

That kind of flow can push prices up quickly – and reverse quickly if sentiment flips.

The smarter way to invest in silver: stop predicting, start building

If you’re investing (not trading), your edge is not forecasting – your edge is process:

-

Small, consistent buys

-

Risk limits

-

Rebalancing rules

-

Low friction (easy entry/exit)

If you want the complete “how”, use this deeper guide: how to invest in silver in India (online and offline).

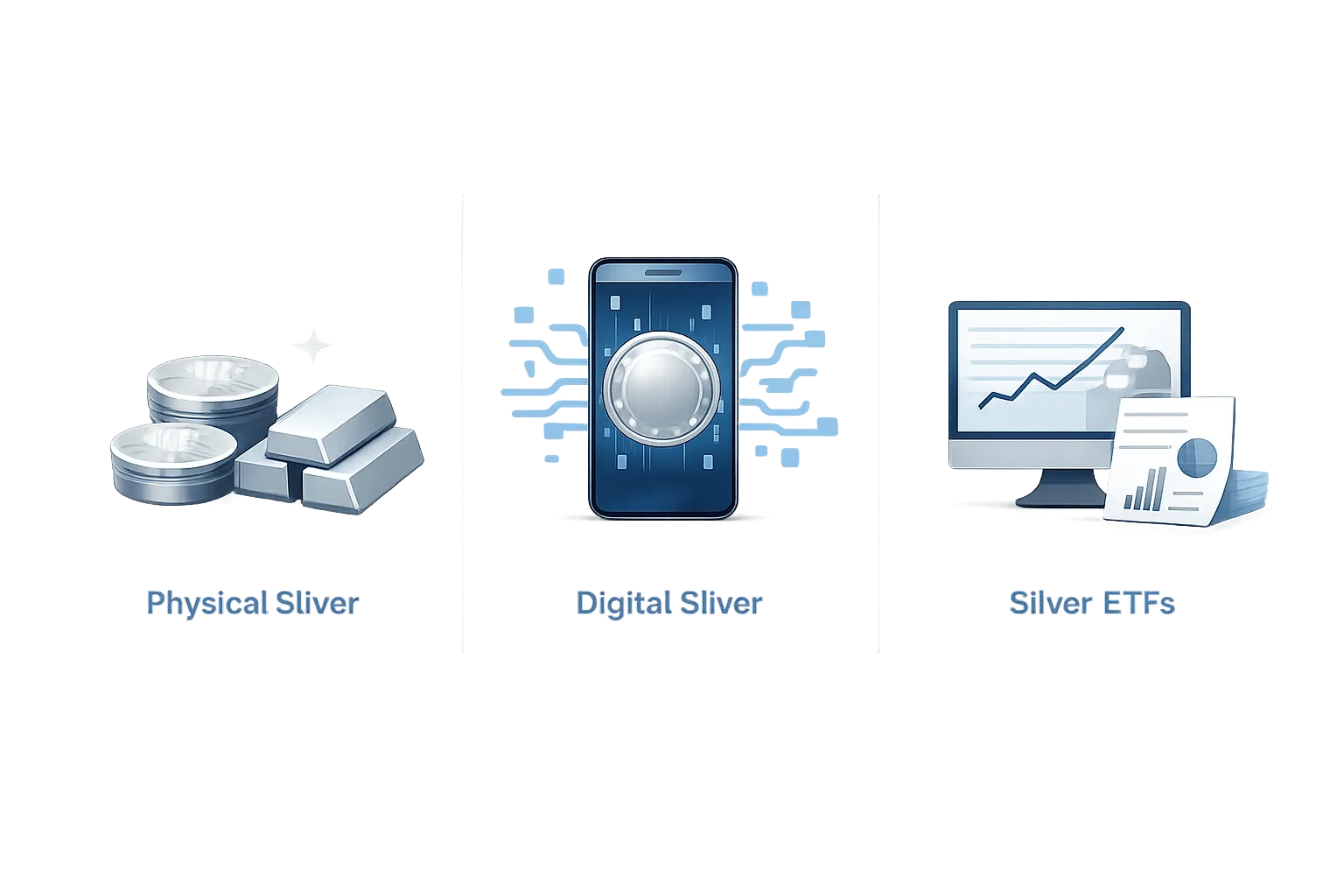

Physical silver vs Digital silver vs Silver ETF (what competitors don’t explain clearly)

Here’s the simple comparison most investors actually need:

|

Option |

Best for |

Hidden friction |

Who should avoid |

|---|---|---|---|

|

Physical silver (coins/bars) |

Gifting, long-term holding, “I want it in hand” |

Making charges, storage, purity checks, resale spread |

Anyone who wants quick liquidity |

|

Silver ETF |

Demat-based investors, tracking market price |

Demat setup, market hours, tracking error |

People who want ₹1-level micro buys |

|

Digital silver (app-based) |

Micro-investing, quick buy/sell, habit-building |

Platform spreads/fees vary |

Those who don’t trust digital custody |

If your goal is convenience + habit + small-ticket investing, digital can be powerful – as long as the platform is transparent and secure. Start here: digital silver in India – how to buy, store, and sell safely.

A retail risk plan for silver (so volatility doesn’t break you)

Use this simple framework:

1) Allocate like an adult (not like a headline)

A practical range for most retail portfolios: 5–15% in precious metals (gold + silver combined), depending on risk tolerance.

2) Buy in slices, not in ego

Don’t “all in” after a viral ₹5 lakh prediction.

-

Use a SIP-style approach

-

Add more on meaningful dips

-

Reduce buys after parabolic spikes

3) Rebalance, don’t regret

If silver runs too far and becomes overweight, trim some profits into gold or cash. (Yes, boring works.)

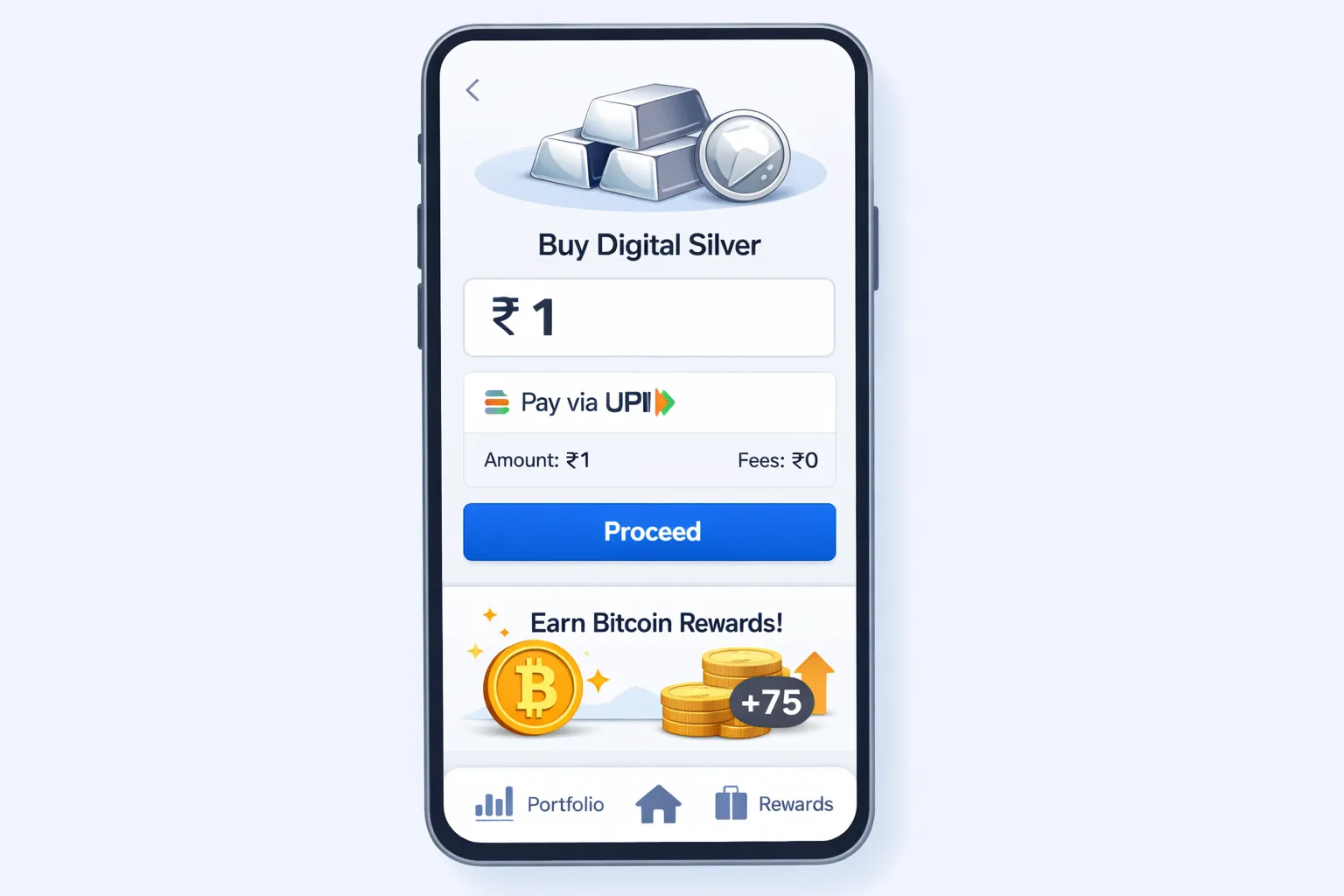

Why OroPocket is built for this exact moment (silver volatility + retail FOMO)

You don’t need more predictions. You need a platform that makes disciplined investing effortless.

With OroPocket, you get:

-

₹1 entry point: start instantly, no “minimum amount” excuses

-

Instant UPI payments: buy in under 30 seconds

-

Gold + Silver micro-investing: build exposure gradually

-

Free Bitcoin (Satoshi) cashback on every purchase: two assets for the price of one

-

Gamified investing: streaks, spin-to-win, tiered rewards – so you actually stay consistent

-

100% secure & compliant: RBI-compliant, insured vaulting, authorized partners

-

Referral rewards: both earn 100 Satoshi + free spin

This isn’t “buy silver and pray.” This is build wealth daily, with a system.

“Between 2021 and 2026, gold in India delivered ~183% absolute return (CAGR ~23.1%).” – myjar.app

That’s the inflation-hedge lesson most Indians learn too late: cash alone is not a plan. If you want a structured approach across both metals, read: investing in gold and silver together: allocation, rebalancing, and risk control.

Final verdict: Will silver touch ₹5 lakh?

Possible? Yes. Guaranteed? No. Predictable? Not really.

Silver can absolutely spike to ₹5 lakh/kg in a strong macro + industrial alignment – but it will test your patience (and emotions) on the way.

The winning move is to stop watching charts like entertainment and start building exposure like an investor.

Stop watching. Start growing.

Start a silver (and gold) habit on OroPocket from ₹1, pay via UPI, and earn free Bitcoin cashback while you do it.